"In China I guess what we have to remember is that participation in the equities market is something that is relatively new, the Chinese stock exchange as we pointed out the other day only restarted in 1991. Before that I am guessing that it was cash, or there was very little savings as the economy has grown 25 fold since back then. By contrast the market has woefully underperformed the broader stock market, over a decade and a half the Chinese stock market is up a little over 200 percent."

To market to market to buy a fat pig. Locally stocks sank ever so slightly, led lower by industrials, resource stocks bounced as the Rand weakened. More specifically, gold shares bounced hard off very depressed levels, some individual stocks up as much as 7 or 8 percent. Wow, if nothing the ride is wild, although it seems more like a B24 riddled with holes rather than a cruise where the pilots are in control.

Construction group Group 5 confirmed how tough it is out there with a poorly received trading statement, sadly for shareholders the stock sank nearly 13 percent. The stock now trades at a 52 week low, as far as I can tell, the government employees pension fund is the largest shareholder here with a little over 15 percent of the shares in issue. The one thing that I will give the company is that they have consistently paid a dividend through the good and bad times, an unbroken streak (on both the final and interim) back to the 1970's. As far as I can tell. To put that into perspective, Murray & Roberts have paid only one dividend since the World Cup was held here in 2010, Wilson Bayly has also managed to pay through the cycle. Ditto Raubex, perhaps it is just a Murrays "problem".

Their share prices have barely budged over ten years, the share price of Group 5 is up 35 percent in that time, Murray & Roberts share price is down nearly 12 percent in that time (and they did a rights issue), Raubex has been listed sine the first half of 2007 and their share price is basically flat over that time (up 2 percent), the surprise is Wilson Bayly, up 205 percent over that time horizon. Stefanutti Stocks also listed in 2007 (I remember that you could not get shares for love or money at the IPO), that share price is down basically two-thirds since then. Only WBHO has managed to deliver their shareholders a decent return over ten years, it does not "feel" like it, with the last five years the stock returning minus ten percent. With the stock at 96 Rand, it is back at levels last seen in 2007.

So surely, being exceptional as a species in pattern recognition (those Impala never learn), now is a "good time to buy"? I think that as investors for retail clients, there are always going to be some sectors that one must avoid and construction businesses are sadly those. Feast or famine, from peak to trough the cycles are higher and deeper than most. Some of the most amazing people work in these industries, yet they tend to have low margins perpetually, project overruns that are costly and unforeseen costs that impact heavily on profitability. Yet, it is one of those highly skilled industries (not too dissimilar to airlines) that attracts talent without the commiserate shareholder returns.

Like a good opening batsman, to use a cricket analogy, to leave a ball and in this case investment alone is an investment decision in itself. My u15 cricket coach (who was also our headmaster) was a huge fan of Geoff Boycott. He himself had represented Eastern Province and Rhodesia as it was known back then at both rugby and cricket, and he used to tell us (the only year I opened the batting) that the best shot sometimes was no shot at all. Following the Geoff Boycott approach, that you could not get out if the ball wasn't hitting the stumps and you left it alone. It made for boring watching I am sure, once I batted for over four hours and didn't even make forty, what a snore. Last out too. Remember that in an investment world where you cannot own everything, and in fact will not own the vast majority of stocks, sometimes it is about the stocks that you avoid (shoulder arms) just as much as the companies that you choose to be in your investment portfolio.

Warren Buffett uses the baseball analogy where he can never strike out and has the luxury of endless pitches. He is quoted as saying: "What's nice about investing is you don't have to swing at pitches. You can watch pitches come in one inch above or one inch below your navel and you don't have to swing. No umpire is going to call you out. You can wait for the pitch you want." Perhaps Buffett, as a man of patience, as you should be as an investor, would enjoy cricket a little more than baseball. There are some industries for retail investors that are way too cyclical to be reliably invested in, be more opening batsman and patient.

Chinese stock markets on the other hand are more of a dasher, a little like Adam Gilchrest. In recent times however, the last couple of months the lookalike resembles an 8 year old dressed up in oversized pads, so much so that the walk to the crease takes five minutes and takes the form of a straight legged shuffle. Awkward stance, poor execution and generally beginner stuff. The Chinese market has somehow captured our imagination as something that is "very important" right now. Yet, as Larry Fink of Blackstone points out, the very nature that they are volatile is a sign of immaturity. He does not mean that in a condescending way, it is merely an observation that the capital markets in China are not well formed, in the US where liquidity, participation and price discovery are amongst older and wiser sets of investors, there is less angst.

In China I guess what we have to remember is that participation in the equities market is something that is relatively new, the Chinese stock exchange as we pointed out the other day only restarted in 1991. Before that I am guessing that it was cash, or there was very little savings as the economy has grown 25 fold since back then. By contrast the market has woefully underperformed the broader stock market, over a decade and a half the Chinese stock market is up a little over 200 percent. And that counts a 70 percent move in equities over the last 12 months. With all these wild moves, you would expect the Chinese market to be trading at 40-50 times earnings, right? Yet the Shanghai Stock Exchange website tells me that stocks trade at less than 19 times earnings. In fact, 18.33 times. Which is not cheap nor is it overvalued, the market itself is worth 30.3 trillion Yuan, which is around 4.88 trillion Dollars. Less than 50 percent of the economy, again, that hardly sounds like something that you should be worried about.

So whilst there exists a culture of betting in China, limited access to assets globally and a large numbers of retail investor accounts are going to have an impact. And a more pronounced one at that, remembering that government holds large parts of the market, so the "free float" is likely to be lower. Yet having said all of that, according to the FT article titled Myth of China's retail investors understates large players' role, from two weeks ago, only 11 percent of households in China have brokerage accounts. In the US, according to a Gallup poll, 55 percent of households in the US have brokerage accounts.

I don't know what to think, personally I do not know a single investor that owns mainland Chinese shares (do you?), let alone how it could lead to a stock market sell off that would be fundamentally driven. i.e. Earnings are markedly lower as a result of it. I suppose if retail investors in China are stung their spending habits could be impacted, as the FT article points out, there are fewer households than you think. And if the balance of the equity market investors are up as much as the market over the last 12 months, surely there could be positive signs from a wealth effect point of view? Again, I do not know the answer to that, what I do think is that this is completely overdone from a news point of view. Stay calm, stay invested.

Lastly, let us add this answer I gave to a client, first, his specific question (amongst others) in an email sent to me:

"Wanted to quickly ask what your position is on Naspers at the moment? Do you still think it is a hold? and how you feel about the Chinese propping up that market?"

And then my answer to him, which I tried to match above:

"We do not have any Chinese stock market exposure, remember that Tencent is listed in Hong Kong, and not Shanghai or Shenzhen, that is where the volatility is. I don't believe that it is a good idea, propping up markets and intervening, those are weak capital markets. Hong Kong is very mature, relatively speaking. Chinese government has a different agenda, to keep people "happy". I think at face value the whole market in Shanghai is not stretched. It does not trade at 100 times, it is closer to 20, actually. So, do nothing with Naspers, if anything, use this as an opportunity to add some more shares."

Does that all make sense to you? right now the Chinese market is down over three percent (not another day like yesterday) whilst Tencent is trading up three quarters of a percent in Hong Kong, that illustrates the point that I am trying to make. Yet ironically, Tencent trades at nearly 30 times forward earnings, much more expensive than the rest of the Chinese market.

Linkfest, lap it up

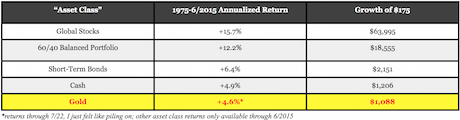

If you read our blog regularly you will know that we are not fans of Gold. Here is why we say so - The Worst "Investment" Ever?. Also remember that the gold price dropped during 2008 like every other asset class. It only picked up when the words QE started to emerge, people bought gold because they thought inflation was coming due to QE not because it is a "safe asset".

This is the way that producing fresh food is going - Chicago is about to get the world's largest rooftop greenhouse, and it's the size of an entire city block. It will still be a very long time until the majority of fresh produce is grown in the same city than the consumers, here is the first step to get there.

This is a long article on one persons in-depth research into the GMO argument - Unhealthy Fixation. Any data can be manipulated to say more or less what you want it to say. I think that GMO foods allow us to produce food at far cheaper prices allowing people to have more disposable income, which is very positive for the poorest of the poor.

Home again, home again, jiggety-jog. Shanghai markets are alight, green, which is not good when you are talking about Chinese markets. Green is down and red is up, perhaps it has something to do with the communist party. Red symbolises good luck in Chinese culture, as well as happiness. Phew, that means that we would have been really happy here lately!

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment