"Quite simply it means that a listing in London gives the combined larger group access to cheaper funding for any future deals, it gives them a main board presence, which in turn means shareholders with deeper pockets. Although you can argue that Remgro are "just fine" thank you very much as Remgro own nearly 42 percent of the group, the Government Employees Pension Fund own 8.72 percent, that is more than 50 percent right there."

To market to market to buy a fat pig. Sit down and stop Yellen. Wait, that isn't right, Yellen sits down. Who knows? Was the jobs report Friday that bad that the Fed do not have to move ahead with raising rates? Was it the revisions lower, flat wages growth and a shorter work weak, pointing to workers generally stuck in a rut? Perhaps. Mr. Market is suggesting that rates will not go up this year, even if Fed Chair Janet Yellen said that they would. Ben Bernanke was on CNBC yesterday, promoting his new book, he really is amazing.

All the armchair critics of the Fed are no different to the sports critics, who sit in their living room and tell their mates that highly paid hand selected officials and even higher paid individuals who have sacrificed much (born with talent too) are useless, rubbish, pathetic. All of the Federal Reserve members are highly decorated public officials who are the best people for the particular job at that time. The end. Equally, your favourite sporting team is filled with the best and most talented people for the job. Except Brendan Rodgers. Kidding. That is Paul's team, Liverpool, my wife too. Careful now ....

Our market in Jozi, Jozi added over 1000 points yesterday, to close up 2.19 percent and above 52 thousand points, it was certainly an amazing turn of events with rallies across the board. Glencore racked up an amazing 16 percent on the day, the price in London is now at 115 pence, or 10 pence light of where the group did their capital raise that management participated in (to the tune of 22 percent of the 2.5 billion Dollars).

There were only three stocks in the top 40 which were down, one of them, SABMiller released a trading update this morning. It hardly looks mind blowing to me, what do I know however? Volumes for Q2 grew by 2 percent. The two regions for the company that saw volumes decline were North America and Asia Pacific, Africa and Latin America were strong. In total "net producer revenue" was up 6 percent, again, Africa and Latin America leading the charge. North America sliding, down 2 percent. More wine drinking? Just generally less beer drinking? SABMiller is down two percent at the start in London. More important, with just a week to go, what are the 3G Capital guys thinking, having read this?

Over the seas and far away in New York, New York, stocks also rallied hard, up over 1.8 percent on both the Dow Jones and the S&P 500. The nerds of NASDAQ added just over one and a half percent. GE popped 5.34 percent after it was revealed that activist investor Nelson Peltz (through the Trian fund) had taken a 2.5 billion Dollar stake. So what, that is only 1 percent or so, and whilst it puts him in the category of largest 10 shareholders, hardly moves the needle. Peltz wrote a long document, 88 pages in total, suggesting why the group should buy back more shares, engage in more mergers and acquisitions, you read it for yourself and let me know: Transformation Underway...But Nobody Cares

GE has still underperformed the S&P 500 over the last 5 years, even over a period of 10 and 20 years the stock has underperformed the index. Sigh. Trian thinks the stock should be around 40 to 45 Rand, they believe at 14 times earnings the stock is cheap. The stock is trading comfortably below the 2007 stock market highs and is half of what the stock traded at in 2000, the returns have not been good for the longer term money. Mind you, they have nearly quadrupled from the market low in 2009, as ever, it depends where you bought the stock.

Company corner

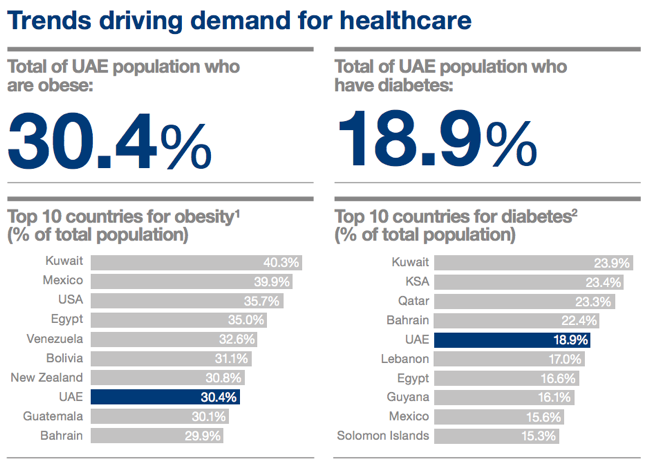

A simple SENS announcement from Mediclinic yesterday that they were trading under cautionary has led to an announcement this morning. Well, the news was known yesterday in London, the share price of Al Noor Hospitals group (listed on the London Stock Exchange) rose 7.6 percent, the release came at 4 pm London time (just as our market closed). The company (Al Noor) has per their website overview segment was founded in 1985 and operates in Abu Dhabi and Dubai. Al Noor operates three hospitals and seventeen medical centres in the Emirates, the main focus is Abu Dhabi. As of the end of last year the company had 218 operational beds, and had nearly two million outpatient visits. There was a couple of graphs that stood out for me, in the annual report (2014) of Al Noor:

There are some obvious countries in there, Mexico, the USA and New Zealand, I didn't realise that the Middle East had such a problem with obesity and by extension diabetes. Almost one in four people in Kuwait (and nearly the same in Saudi) have diabetes. Overeating, junk food and not enough exercise. Changed diets and changed habits. Increased wealth certainly has its benefits for society at large, the trappings of an indoor lifestyle (in very hot climates) and faster and easier calories has meant that the region is now sitting on a medical time bomb. It makes sense how it happened, if you think about it. To change habits, to break the cycle is far harder and requires the collective.

Back to the relative scale. The current market capitalisation of Al Noor is 1.07 billion Pounds, or at the current exchange rate 22.03 billion Rand, Mediclinic at the close last evening (the stock was up 3.26 percent) had a market capitalisation of 114.55 billion Rand. That is roughly 19.2 percent, Al Noor is to Mediclinic, more than just bite size. Bearing in mind that the group just raised 10 billion Rand in order to pay for a 30 percent stake in Spire Healthcare.

So what would this be? How would they (Mediclinic) go about this? It would be a combination of the two groups, let me do a copy and paste (something that had led to the death of many writers not giving credit) of the SENS announcement from this morning: "The Possible Combination, if completed, would be implemented through the issue of new Al Noor shares to the shareholders of Mediclinic and may be classified as a reverse takeover of Al Noor by Mediclinic under the applicable UK listing requirements. Accordingly, the combined business would benefit from a premium listing on the LSE together with a listing on the Johannesburg Stock Exchange. The Board believes that this will provide incremental benefits to Mediclinic through increased liquidity and a reduction in cost of capital. The Possible Combination provides Mediclinic with further diversification of its geographic profile internationally, as well as exposure to additional US Dollar-based, high-growth earnings."

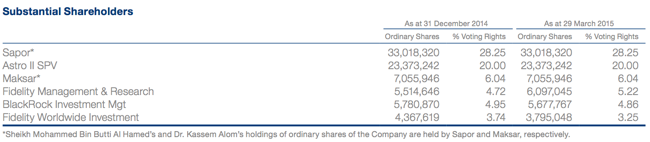

Quite simply it means that a listing in London gives the combined larger group access to cheaper funding for any future deals, it gives them a main board presence, which in turn means shareholders with deeper pockets. Although you can argue that Remgro are "just fine" thank you very much as Remgro own nearly 42 percent of the group, the Government Employees Pension Fund own 8.72 percent, that is more than 50 percent right there. So who are the Al Noor shareholders? Here goes, as per their annual report:

28 percent is held by Sheikh Mohammed Bin Butti Al Hamed (the Sheikh serves as chairman of the Abu Dhabi National Hotels Company and is also an investor in Abu Dhabi motors, a busy man) and 20 percent is held by Ithmar Capital, a private equity crowd in the Middle east. Ithmar is run by Faisal bin Juma Belhoul and Khaldoun Haj Hasan (they are both non-execs at Al Noor), these two both went to Boston and both have engineering qualifications. Lastly, just over 6 percent of the business is owned by a vehicle called Maksar, which is owned by Dr. Kassem Alom, the founder and deputy chairman.

In terms of both company's relative valuations, it is about the same. Al Noor trades at just above 20 times, Mediclinic commands a slightly higher premium at 23 times historic earnings. That is not cheap, neither of them are cheap, they operate in a great space however. The 2014 Al Noor annual report suggested that revenue was growing at 23 percent, earnings per share grew at 23.4 percent. Of course remember that nothing may come out of this, it would seemingly make sense for both parties to be drawn to one another, geographically it makes sense for both. Now, about the price, that is always the trickiest part of the conversation. We wait and see, this is a positive for the hard chargers at Mediclinic, and explains the recent price movement, someone somewhere knew something. That always irritates me.

Linkfest, lap it up

Here is how the functionality of your iPhone has changed with the new operating system - Your phone's home screen is dead. I think as we move more to smart wearables, Siri and your operating system becoming more intuitive will be important.

Due to competition and the consumer wanting to go green, solar panels are getting cheaper and more efficient - SolarCity Creates A 22% Module-Level Efficient Solar Panel. This new solar panel will be the worlds most efficient but I suspect competitors will come up with a more efficient panel in the near future.

Moving away from cash makes things far more efficient and safer for all people involved - Card payments boom across the world, led by Finland. Given this strong trend towards a non-cash society is the reason to be a Visa shareholder and to a lesser extent an Apple shareholder (apple pay). I'm shocked that 5 billion cheques are still written each year.

Home again, home again, jiggety-jog. Mr. Market is giving up some of the fabulous gains from the previous sessions, not altogether surprising. Some German Factory orders that were, how do you say this, not good. Mediclinic is up nearly three percent, that is good news for shareholders, it's been a bumpy ride, with the Spire deal and the rights issue. Having said that, the stock is up nearly 20 percent year to date.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment