Vestact has a new number. It is a mobile number: 078 533 1063. Please record it and update your records accordingly. You can call us or SMS us, we will get back to you.

"A slowdown in economic activity equals lower tax collections. Which equals less options and not more. The minister was clear: "Without economic growth, revenue will not increase. Without revenue growth, expenditure cannot increase." Debt has piled up, government debt as a percentage to GDP is now 47 percent, having doubled since 2008. And that of course does not include State Owned Enterprises. There are many different methods to reduce debt, the first and most important in the long run is to increase economic activity"

To market to market to buy a fat pig. There was plenty of action happening away from the markets, most especially at the Parliament buildings in Cape Town where not only were the antics from the EFF becoming more predictable than Hashim Amla, rather the finance minister putting on a brave face and delivering a mid term budget speech that was tougher than any before. Outside on the street the police used heavy handed tactics to move students away, the students want to be heard, their grievances to be acknowledged by seemingly unsympathetic politicians. It is not for us to try and decide what is or isn't the right way.

The only question to ask is, as the pie is only so big, where do the students propose raising the necessary funds to make education more affordable? Or where do they propose taking the money from? UNISA fee structure looks more affordable than many other universities, plus you can earn work experience at the same time. Why not have more students here, ensuring that the model is much more scalable than any other, learning via correspondence? Pumping resources into regional studying centres to provide correspondence students with the necessary support? Sounds like a great stop gap measure.

From my very quick look at the fees of UNISA and fees of WITS, is it not a better option? Plus, part time jobs, student jobs can easily pay for the tuition and have some extra left over. These institutions are underfunded as it is, government is stretched and does not have the resources, that was quite clear in the Medium Term Budget Policy Statement delivered by Finance Minister Nhlanhla Nene yesterday.

A slowdown in economic activity equals lower tax collections. Which equals less options and not more. The minister was clear: "Without economic growth, revenue will not increase. Without revenue growth, expenditure cannot increase." Debt has piled up, government debt as a percentage to GDP is now 47 percent, having doubled since 2008. And that of course does not include State Owned Enterprises. There are many different methods to reduce debt, the first and most important in the long run is to increase economic activity to levels that mean collections rise and GDP rises at a much faster rate than debt.

In order to continue to meet our social obligations, there are 16.7 million recipients of government grants in South Africa, in the long run I am very sure all of these people receiving grants would love to be earning a whole lot more than currently. The only way that is going to happen is growing economic activity. Be more friendly to business and strange things start to happen. The best example that still exists for me is North and South Korea. You know the story, the one is rich, the one is dead poor and has an overreaching government and no civil liberties. And they both had the same starting point. All I am saying is that some economic models work, some don't. That ultimately is for the people to decide.

Away from things that are sensitive and away from matters that I don't understand, let us rather focus on Mr. Market, a "beast" that nobody is ever going to understand. Luckily for all of us, we don't need to even understand Mr. Market. We only need to understand the companies that we own. And even then, the recent events at Volkswagen, one of the most reliable manufacturers of any product on the planet has been tainted in ways that we don't quite comprehend. And what it means for the longer term vehicle consumption patterns. What really worries me in our platinum industry is whether people will say, OK, I can completely diminish my emissions by going with an electric vehicle. It may cost more for now, the cost of energy (and alternative energy supply is increasing) is lower over time, the vehicles themselves will get cheaper. That will mean less Platinum Group Metals consumption, no doubt.

After all was said and done the local market lifted off as a result of a weaker currency, perhaps it was the Dollar, I did see that the commodities complex dropped at about the same time. We closed up shop here on the local front up 0.22 percent, a smidgen away from 53 thousand points. Lonmin rose nearly five percent (it had been up over 15 percent at one stage) after the company announced drastic measure to raise capital (it looks like unless you follow your rights you are going to get diluted out of sight) and sweat really hard in order to save costs and survive this tricky period for producers. As we know, this is something that we should continue to follow closely.

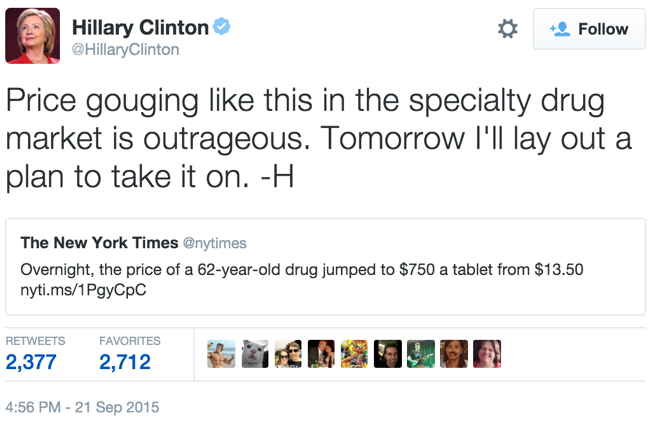

Over the seas and far away, in New York, New York stocks sank in the second half of the session to close out over half a percent lower. Healthcare and energy stocks continued to feel the heat, I saw that Valeant was down another 20% on the session. Ever since "that tweet" from Hillary Clinton, most likely the next president of the US. Here it is:

In one month, Valeant is down nearly 50 percent. That is quite simply astonishing. This time it is a little more worrying for investors and patients alike, read here: Valeant Pharmaceuticals Intl Inc (VRX) Stock Tumbles 40%, Shares Halted After Analyst Report Trumpets 'Enron Part Deux'. All I can say is that there are some big names there, Bill Ackman included. Serious allegations from a short seller led the stock down heavily, a trading halt, Ackman stepped into the breach and said he had bought more shares. Another reminder that there is no such thing as a safe investment, this is a massive business (smaller now at 50 billion Dollars) with speciality drugs in a new part of the market. Citron versus Pershing, the winner takes all the spoils.

Linkfest, lap it up

Watches are one of those things that can be past from one generation to the next, something that can show wealth and can cost an arm and a leg - A Rare Look Inside Patek Philippe's Geneva Headquarters. Here is an inside look at one of the worlds top watch brands and the very fine details that watch makers need to focus on, you get an idea why they cost so much.

Generally when a conversation about how it is better for government to be smaller than bigger, the Scandinavian countries come up as a model society where big government has been good - 7 myths about Scandinavia's social democratic 'paradise'. The basic conclusion is that Scandinavian countries were already doing well socially before government started playing a more central role and the countries statistics seem to have dropped steadily as governments have played a bigger role.

As competition heats up in the retail space, companies brand's matter more than ever. The result is that more needs to be spent on building your brand, your image and do things outside of the retail space to bolster that brand - Apple To Raise China Solar Investment Fivefold with Climate Bid. It is always nice to be able to say that the company who you support, in turn supports the environment and makes the world a better place.

Humans are naturally cautious which can sometimes lead to being negative on the world as our default. The way this plays out is that people who make big statements about how the market is going to crash get far more air time over those who say things are just fine and will get better - Predictions No One Ever Makes. "What if the future is better thank we think?"

Home again, home again, jiggety-jog. European stocks are set to open lower, they are pointing that way, we would possibly follow suit. Asian stocks on balance are lower too, a few stand outs here are there, Aussie up, as is mainland China. China should start participating in rugby, they certainly would have the numbers to draw down on. Or cricket. Talking of which, our chaps are over in India today, trying to secure a series victory, that would be something. We can also look forward to many more results (companies that is) over the coming two weeks, next week being the busiest.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment