"Stocks over the seas and far away, in New York, New York roared ahead again, the S&P 500 turned positive for the year, at the beginning of the session. Year to date the return is now a paltry 0.79 percent, Friday's move was 1.1 percent higher. The sharp movements higher in the Amazon (up 6.23 percent) and Alphabet, Aka Google (5.61 percent up) and Microsoft (up 10 percent!), shunted the nerds of NASDAQ above 5000 points again, the collective up two and one-quarter of a percent."

To market to market to buy a fat pig. It is daylight saving soon in the Northern hemisphere, that means that this time next week the Europeans will be an hour different from us. Which sort of messes up the trading day, we essentially "start" an hour later, waiting for direction from some of the dual listed companies. I guess for us in the area of the market that suggests you are in stocks forever, an hour here or there is hardly noteworthy. South Africa observed daylight savings for three short years during the second world war. If you are in the part of the market that is always looking for minute by minute changes, I can imagine that an extra hour of "dead time" is not the most thrilling prospect. Equally for the Springboks having to contest the bronze medal match Friday, at least we can say that we won our first bilateral tournament in India in ODIs. That is at least good, that line holds true, we left everything on the field. Sigh, my favourite AB is at least the most dynamic batsman in the world.

Rewind to Friday quickly, stocks locally in Jozi, Jozi were lifted by the prior night earnings rally on Wall Street initially, the follow through for stocks was the Peoples Bank of China (PBoC) cutting interest rates again, I think for the 6th time this year in fact. Whilst the interest rate was cut by 25 basis points, the reserve ratio requirement (the amount of funds that banks have to hold for liquidity purposes) was cut by 50 basis points, or half a percent.

There was for the central bank watching junkies another piece of important information, at least in their minds, the PBoC sent the deposit rate ceiling packing. That was supposedly important. All this, coupled with the European Central Bank (ECB) in the prior session hinting of more stimulus, led global markets, ours included higher. We closed up over 1000 points higher, a gain off nearly 1.9 percent to close out at 54298 points on the Jozi all share index. It was pretty much a broad based rally, stocks across the board all up. Like the Proteas scorecard.

Stocks over the seas and far away, in New York, New York roared ahead again, the S&P 500 turned positive for the year, at the beginning of the session. Year to date the return is now a paltry 0.79 percent, Friday's move was 1.1 percent higher. The sharp movements higher in the Amazon (up 6.23 percent) and Alphabet, Aka Google (5.61 percent up) and Microsoft (up 10 percent!), shunted the nerds of NASDAQ above 5000 points again, the collective up two and one-quarter of a percent. As a collective year-to-date the NASDAQ is up 6.25 percent. The Dow Jones, for comparisons sake is down a percent as of the close Friday. That is pretty bizarre, the Dow Jones is supposed to reflect industrial USA, which by most counts has done better than the rest of the developed world, yet the Dow Jones is lower year-to-date. Strange, isn't it?

The world changes and shifts perhaps quicker than the folks who stick constituents in and out of the Dow 30, perhaps the fact that Facebook, which reached a market cap of 250 billion Dollars quicker than any other company is a reflection of that. Michael told me that this morning. Yet Facebook is not mentioned as a possible contender for entering into the Dow. For the record, best performing stock in the Dow 30 is Nike, up 35 percent year-to-date, the worst belongs to Walmart, down an astonishing 32 percent for the year. The second best performer in the Dow 30 is going to surprise you, McDonald's up just over 20 percent, a whisker ahead of Disney (that is also up just over 20 percent). The 2nd and 3rd worst performers in the Dow Jones year-to-date are Caterpillar, down 21 percent and American Express, down nearly 20 percent. Not the oil companies, like I thought initially.

Oh my word, just when you thought it was safe to go outside again and bask in the sunshine of earnings, a Fed meeting returns and strikes back during the middle of this week. Talking of strikes back, have you seen the new Star Wars trailer? Looks epic. I may have to twist the wife's arm to watch it with me. It is however still a big earnings week, with giants both old and new reporting. Apple reports after the market closes tomorrow evening, the expectations are always high. A reminder, if you needed one, the stock trades on a 13.76 multiple (cheaper than the index) but not the best yielder in the world with a pre-tax dividend yield of 1.75 percent.

Other titans weighing in with earnings this week are Exxon Mobil and Chevron Friday, Pfizer and Merck earlier in the week. Of interest (I guess) is Twitter, reporting this week. I keep telling you how big I think periscope is going to be, I saw amid the jostling and violence (luckily nobody was badly hurt) Friday at the Union Buildings that one of the local TV stations used the technology. i.e. Instead of using the usual channels to stream photos, a local TV station broadcast a periscope feed. That is the first time that I have seen that, the quality is of course grainy, it is however "coming". And I am still convinced it will change the way that we consume news. Twitter just has to figure out how to integrate it fully into the application, to make it seamless, to have both sets of followers one and the same. Pretty much like the way Instagram and Facebook work. Like? Periscope for the win!

Company corner

Naspers announced on Friday that they had stepped up their investment in Avito. What is that? As per the release, it explains that the business is the leading online classifieds business in Russia, and that they (Naspers) are increasing their stake from 17.4 percent to a controlling stake of 67.9 percent. The price seems pretty hefty, it is not clear what the purchase price is, how do you interpret this: "a US$1.2bn transaction to become the largest shareholder in Avito"?

Annual revenues of 76.5 million Dollars (a whopping increase of 76 percent from 2013 to 2014) mean that the business is growing quickly, and has strong EBIDTA margins of over 50 percent. From my inter-webs reading it seems indeed that the 50.5 percent that Naspers bought was for 1.2 billion Dollars. Or 2.4 billion Dollars for the whole business. Or 31 times last years revenues. Even if we presume that the business maintains their growth rates of last year into this year, Naspers paid roughly 18 times annual revenue of the current year for an online Russian classifieds business.

For comparisons sake in a listed environment, eBay trades on a nearly 2 times price to sales ratio, Facebook trades on 23 times on the same metrics. Google slash Alphabet on 7.3 times. I guess that if the new business bought outstrips their competitors and morphs into something really big, this would have proven to be a market move (if they can maintain margins). What is less pleasing is that this is taking place in Russia, not the most favourite investment destination currently. Those politicians are crazy. The quantum of the transaction represents just less than 2 percent of the entire market cap of Naspers.

In amongst the excitement of Thursday evenings reporting came that of Stryker, the Third Quarter Highlights looked a little more like the Samoa checklist of their World Cup highlights. Some, not enough to please the pundits. The stock sank over four percent Friday on a day that stocks were on balance going a lot higher. After the move Friday the stock is trading flat for the year. Why the sudden slowdown in revenues, both orthopaedics and the MedSurg divisions were flat? Partly the Dollar, as you can see in constant currencies sales would have in those two divisions been around 5 percent higher year on year. The neurotechnology and spine division area nearly 10 percent in constant currency terms, 5 percent in Dollar terms. That division sadly only represents 20 percent of group revenues, the balance spread almost evening between the two aforementioned ones.

The outlook and guidance for the year (which expected at current exchange rates a negative 4 percent hit from a stronger Dollar, or 25 cents) expects a full year range of 5.07 to 5.12 Dollars per share. Which puts the stock on a current year estimate of 18.4 times earnings. The stock is not overly expensive and not wildly cheap either. We really like the space however, the company operates in a fast growing segment of the market, and as a standalone devices and diagnostics business, we believe it is the best in terms of quality. The older people live as a result of improved therapies globally, the more they will have to have hip, knee, ankle, even spinal therapies. Those will become more commonplace and are in fact more procedural (with risk of course) than life threatening. We maintain our buy rating on the company. Once the currency headwinds are out of the way, we expect that earnings growth will return to a 10 percent per annum trajectory.

Linkfest, lap it up

After 3000 finance posts you would think that Morgan Housel would know a thing or two. He admits that he doesn't and subscribes to the old adage that the more you know, the more you know there is to know. And by extension, the more you know that you don't know. Check out his post: I'm Just Now Realizing How Stupid We Are. I particularly enjoyed: "It is always different this time, as no two recessions, recoveries, or market cycles are alike. What's dangerous is assuming the future will perfectly resemble the past."

In the USA they have a strong tipping culture where tipping your barber is common place and where 20% tip is expected on a meal. That may be changing though, where a service charge will be added automatically to your bill and then spread between cooking and serving staff - Hold the Tip, No gratuities could mean better food.

Two milestone for Facebook on Friday, as mentioned earlier. It is the fastest company to a $250 billion market cap, not bad considering the fiasco around their IPO where the share price fell for a couple months - Facebook Hits $100 a Share. The second milestone is them reaching $100 a share, which is "a 476 percent rally since September 2012".

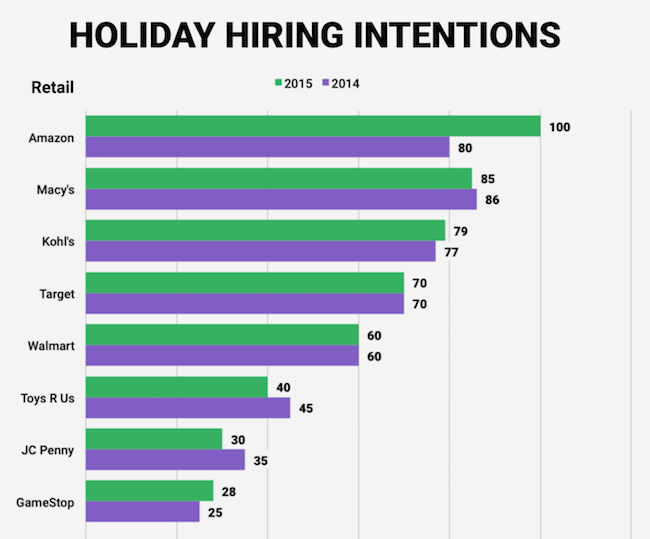

Based on the below graph, which company would you rather own? It is clear where retail sales are heading and which business model is the future - Here's what this year's holiday hiring looks like at America's big retailers

Being able to speak to anyone on the planet in your native tough and have computer translate it for you is another step towards making the planet a smaller place. Skype is working on it but is not quite there yet - How good is Skype's instant translation? We put it to the Chinese stress test

Home again, home again, jiggety-jog. Asian markets are on balance higher, Us futures are lower. It will continue to be a collective efforts of earnings that will see this equity market higher across the globe. Not central banks, earnings and companies make equity markets go around. Pay attention to what matters and leave the focus of others elsewhere.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment