"The Mediclinic share price sank on Friday, not through any announcement from that company, rather through another business impacting on a pending deal that may, or may not take place."

To market to market to buy a fat pig. The stock market march continues. And it is another reminder that if you are an investor, it is better to be in the market than out. During the last market flush from mid August through ten days to the 25th of that month, the S&P 500 lost around 250 points, around 12 percent from the highs. Yet over the last three months, thanks to the re-rating of stocks again, the S&P 500 is down less than three percent. And it is still down just over 2 percent year to date.

A lot of the initial anxiety of a slow down in China have been allayed, from the People's Bank of China Deputy Governor, Yi Gang, who suggested that the Chinese market correction is nearly over to the IMF chief, Christine Lagarde saying that China slowdown fears are exaggerated. Chinese policy sees the country shifting to a consumption based economy, there is only so much that you can build, in a short period of time. Different consumption means different minerals. In this regard there has been a lot of excitement about what the outlook for different commodities are, each is different of course, from copper to coal, iron ore to crude oil to zinc to precious metals, each has their own different dynamics. In response to a weaker looking zinc market, Glencore announced that they were cutting one-third of their production, that sent the zinc price in London up 12 percent, one of the single biggest days in trading history.

Bloomberg is reporting that It's Glencore Versus Goldman in Metals as Miners Cut Production. Goldman's thesis is simple, what demand will drive metal prices in the long run, most especially against the backdrop of record supply. In essence Glencore are doing the right thing for both themselves and the rest of the industry, reducing supply. With a lot of mining related activity waiting for better prices, and not being as profitable as before, the broader industry possibly needs to "do more", mothball more production. In the end the less marginal production, the more likely the prices will recover. The question remains, who wants to blink first?

Talking of blinking, Glencore stock is suspended currently in Hong Kong, as they discuss a sweeping range of sales of copper assets in Australia and Chile. This is not new news, they had indicated that asset sales would take place as they look to shore up their balance sheet, reducing debt and being more nimble in the long run. Hard truths confront the company, I suppose the only thing that is positive is that they are making the hard decisions. They are doing what is right for them, and their business and their shareholders, of which senior management definitely are a core part of that grouping. On the copper price specifically, Rio Tinto have said that they will not cut back production, suggesting a lot of shorts in markets are related to China a few months ago. So the fundamentals for copper look strong, the company says.

Not helping on the local front is the VW emissions scandal, the so called diesel-gate. With demand for alternative battery operated vehicles set to rise, could diesel vehicles (and their relative cleanliness) be the victim? And that means by extension that platinum group metals could be hurt, as demand falls. We can only wait and see what the implications are likely to be be for Volkswagen, when I see headlines like this (subscription only, sorry) from the FT: Volkswagen's home city enveloped in fear, anger and disbelief, the same applies closer to home on the fringes of mining towns in South Africa.

Company corner

The Mediclinic share price sank on Friday, not through any announcement from that company, rather through another business impacting on a pending deal that may, or may not take place. You will recall from just a few days back that we wrote about a Mediclinic potential tie up with Al Noor, taking a short and concise view of the Al Noor business. What transpired on Friday afternoon was that a rival bid for Al Noor was being considered from suitor NMC Health, another Emirates based business, which also happens to be listed in London.

According to the UK law, and not too dissimilar to the current brewing of the AB InBev bid for SABMiller, NMC Health have until the 6th of November to present a formal bid. The so called put up or shut up rule. According to the Bloomberg article, NMC Health of Abu Dhabi Approaches Al Noor About Counteroffer, Al Noor prefer the Mediclinic offer. If you think about it, for Al Noor shareholders to have access to all the other geographies, Switzerland, the UK and Southern Africa, as well as the Middle Eastern assets, that makes sense. What it does however mean for Mediclinic, and you as the shareholder, either you lose the London listing (not good), with access to cheaper long term funding (a positive if you get it) and/or Mediclinic would have to pay up, which is not great.

Mediclinic is bigger than both the two groups, Al Noor and NMC Health combined. Which means that they possibly have the resources, plus NMC Health have a far higher market rating, that would potentially dilute the Al Noor shareholders with "more expensive" shares, I can see why Al Noor would be attracted to the Mediclinic advances. Rather than throwing a spanner in the works, I suspect this might crystallise the deal making process of Mediclinic. Al Noor have leverage now, that is not great for Mediclinic. The stock was down around 3 percent Friday, against the back of a market up strongly. Mediclinic this morning are up one and one quarter of a percent, perhaps there was an overreaction on Friday.

Linkfest, lap it up

I feel that companies will make a way in spite of what governments do. Another way of looking at it, governments can help make their economies efficient, thus making them stronger but trying to uplift a market when it wants to go down is a fools errand - Preventing the Next Crash?

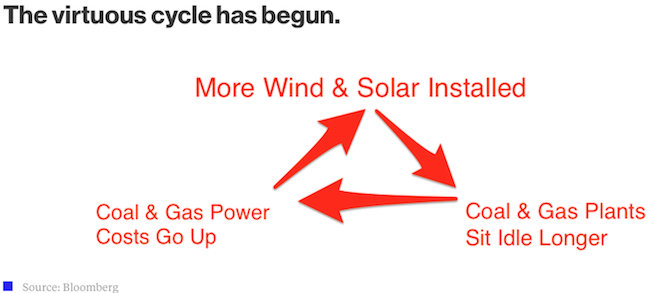

Renewable energy is starting to get to critical mass. Here is one of the main points, "Wind power is now the cheapest electricity to produce in both Germany and the U.K., even without government subsidies". Wow! You would have to say that coal fired power stations (and coal miners) are going to die a slow death - Solar and Wind Just Passed Another Big Turning Point. The below image makes a very important point, the more we use renewable energy sources, the more expensive fossil fuel power becomes on a per unit basis.

Home again, home again, jiggety-jog. The market has started better this morning, up around one quarter of a percent. In three weeks time we will be through most of earnings season and have had a much better time of knowing if the levels are better. Equity markets are set by the current share prices and their reflection of future prospects. SABMiller and AB InBev, that thing is closer and closer, Wednesday is the deadline for that deal.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment