"In terms of territories, China still is growing like gangbusters, sales of 12.5 billion Dollars in mainland China represents a 99 percent increase year on year from the corresponding quarter. Wow. Mainland China is now bigger than Europe as a destination for Apple, European growth has been muted, up 2 percent year on year. The biggest market, the Americas, which counts for 21.773 billion, or 42.2 percent of total sales."

To market to market to buy a fat pig. It was a break from a pretty long rally, stocks as a collective fell 0.7 percent here in Jozi, Jozi, MTN feeling the heat again, that stock was down another 4.2 percent. As long as the uncertainty remains over the quantum of the fine and the small matter of looking to have their licence renewed next year in Nigeria (that is possibly a bigger concern), the share price will display the concerns of the broader investor community. The stock traded 3.64 billion Rand of value, which is around three times more than their average, and that is around 1.2 percent of the total market cap. In a single day! Over the last week the stock is down 14 percent, and this has been a very unwelcome stink for investors.

The question remains, what should one do with the stock if you own it? Obviously the Nigerian renewal remains a serious concern, bearing in mind that it is their biggest territory. We watch it closely, at the moment we are inclined to wait and see, remember that doing nothing is doing something in investing. To use the Warren Buffett baseball analogy, you don't always have to swing at the plate, you have more than three strikes.

Also stinking up the joint was a sharp move lower in Anglo American, down over five and a half percent. The outlook for the commodities complex worsens, worries about the main customer, China, worries about the operating environment locally, worries about cost controls, worries about the rest of the industry supply. Whilst we wait for the bigger picture to see an unwind in inventory levels (specifically for oil), usage patterns to change globally (in light of the VW Diesel-gate scandal, the VW results are soon!) and generally too many projects coming online in one go, our view is to avoid the sector for the time being.

We have no doubt that it will turn, when however is not an answer that we have. It will not be in the short term, perhaps inside of the next 18-24 months we could see more balanced markets in key commodities. In the mean time some countries are experiencing evident pain, the Saudis, Venezuela and the like, all very dependent on export prices being higher. For the global consumer however, this is great news, more money to deploy elsewhere. For the time being, avoid.

Over the seas and far away, in New York, New York with Fed watching back on the radar (the FOMC are expected to deliver their two day meeting statement this evening local time), stocks gave back a little. Both the broader market and blue chips sank around one quarter of a percent, the nerds of NASDAQ almost squeaked into the green for the day, healthcare stocks were the only sector that were comfortably in the green. Energy and basic materials (what we call resources) were down by over a percent and a half, lower commodity prices across the board to blame. Alibaba topped analysts expectations, with the same question asked of the company as with Apple below, Chinese consumers are strong! Year to date the stock is still down 23 percent, loads of heavy lifting left to do.

Company corner

Apple Inc. announced their fourth quarter results post the market last evening, for the quarter to end 26 September 2015. Don't ask why the quarter ends on the 26th of September. By most metrics the results were a beat, a record fourth quarter for the company. Sales of 51.5 billion Dollars were recorded for the quarter, or roughly 560 million Dollars worth of sales a day. That is mind boggling. At the same time of course being the fourth quarter, the company reported full year sales, which were also an annual record at 234 billion Dollars, an increase of 28 percent. Or by the same day measurement, 641 million Dollars of sales per day across the globe, that is pretty crazy.

That growth number for the year is so big that it deserves some quantifying, Tim Cook said on the conference call, via the transcript, courtesy of SeekingAlpha: "To put that into some context, our growth in one year was greater than the full year revenue of almost 90% of the companies in the Fortune 500." For the full year some amazing records were set, 300 million devices sold, that included 231 million iPhones, 55 million iPads and 21 million Macs. And it also included 100 billion cumulative downloads from the app store. And to think that in some categories, the Watch and the TV, they are just getting started.

Profits for the quarter were 11.1 billion Dollars, more amazing was that the company returned 17 billion Dollars back to their shareholders by way of buybacks and dividends during the quarter. At this run rate the 200 billion capital return program should be finished by the end of the third quarter of the current financial year. The dividend for the current quarter is 52 cents, payable 12 November, it all happens rather quickly when you have 205.7 billion Dollars worth of cash on hand, mind you most of it (187 billion Dollars, or 91 percent) is outside of the US.

The company also has 56 billion Dollars of term debt, when your cash position is so pretty and your market capitalisation is 674, the ratios of debt to equity are hardly worrying. The reason for the debt is due to rules that prevents US companies bringing their cash back "home", without incurring extra taxation. So, if you are cash flush like Apple, you can raise money at cheap rates in order to pay dividends and have massive buybacks, you will generate it over time quickly. A better cash utilisation methodology.

To sales of their products we go, the flagship iPhone is still responsible for the lions share, 32.3 billion Dollars of the 51.5 billion Dollars being 48 million units. Marginally ahead of the market, who were darn close, expecting 47.5 percent. iPad sales continue to fall, down 10 percent quarter on quarter and down 20 percent year on year, yet they still managed to sell 9.88 million units that generated 4.2 billion dollars worth of sales.

The Mac continues to take market share, whilst sales were only 3 percent higher year over year, across the whole industry over the same time frame sales have been down 11 percent. So certainly there are more people entering the Apple ecosystem. 5.7 million units of Macs were sold during the quarter, revenues generated from that business were 6.88 billion Dollars. Services revenues grew 10 percent year on year and closed in on ten percent of total revenue, 5.086 billion Dollars in total. Other products, which includes the watch, Beats, Apple TV, heck even the iPod is in there (no product sales breakdown is given any more). That division has experienced breakneck speed, up 61 percent year on year.

In terms of territories, China still is growing like gangbusters, sales of 12.5 billion Dollars in mainland China represents a 99 percent increase year on year from the corresponding quarter. Wow. Mainland China is now bigger than Europe as a destination for Apple, European growth has been muted, up 2 percent year on year. The biggest market, the Americas, which counts for 21.773 billion, or 42.2 percent of total sales.

Prospects? Time Cook is pretty pleased that the company heads into this holiday season with the strongest line up of products ever, the new iPhones, the new TV (that begins shipping this week), the iPad Pro and of course the Apple Watch which comes with more accessories, more wrist bands and cases. The company expects sales of between 75.5 billion Dollars to 77.5 billion Dollars, gross margins to remain about the same or improve marginally, to between 39 to 40 percent. Tim Cook also suggested that two-thirds of current Apple iPhone owners have not upgraded to the new bigger iPhone screens, i.e. own model 5 and lower. There is certainly lots of room to grow.

Back to China for a bit. Apple plan to roll out another 15 stores to their network of 25 existing stores by the middle of next year. Apple Music only launches there this quarter, as well as iTunes, as well as movies and iBooks. That could continue to drive service revenues much higher for Apple in that specific geography, which will no doubt eventually be bigger than the US as a main base for them. Emerging markets, which include China, represents 31 percent of total sales, China accounting for most of that.

Equally in the enterprise space, which grew 40 percent year on year, there are plenty of opportunities there, inside of their existing partnerships with Cisco and IBM, as well as many others. On the conference call the CFO, Luca Maestri said (transcript courtesy of SeekingAlpha) "Inside IBM, Macs are gaining tremendous traction. There are currently over 30,000 Macs deployed within the company with 1,900 more being added each week. IBM tells us that each Mac is saving $270 compared to a traditional PC, thanks to the much reduced support cost and better residual value." Amazing, whilst the products are expensive, you get what you pay for in life. They are so useful and so powerful that there is very little down time.

People want the product, there is no doubt about that. It is expensive, make no mistake. Tim Cook mentioned on the conference call that Android switches last quarter were 30 percent. I presume that means for all buyers of the iPhone. The renew cycle has been shortened for those on the "rental" model, they can have a new phone every 12 months. The Chinese middle class is set to grow ten fold from five years back (i.e. in five years time the middle class would have grown 10 fold over a ten year period). Over 50 percent of people who recently bought the iPhone 6 or 6 plus in China had never owned an Apple product before, that is something to think about for a while. Tim Cook mentioned loads of other territories that they are working hard on, India, Indonesia and Vietnam (populations of 1.28 billion, 255 million and 90.7 million respectively) came to mind.

In conclusion, you should continue to accumulate the biggest company by market capitalisation on the planet, as there are still many growth opportunities for them, in enterprise, in services, in other products that are new, or other products that may be invented at some stage. Apple should earn in the region of 10.50 Dollars for the year, that might even be a conservative number. And whilst the comparable current quarter may be a tough ask to beat, it seems like most have not gone through the renew cycle. Based on those projections, we continue to recommend Apple as a strong buy. The stock has traded marginally higher in after-hours trade, up 0.7 percent, regaining what the stock lost during ordinary trade.

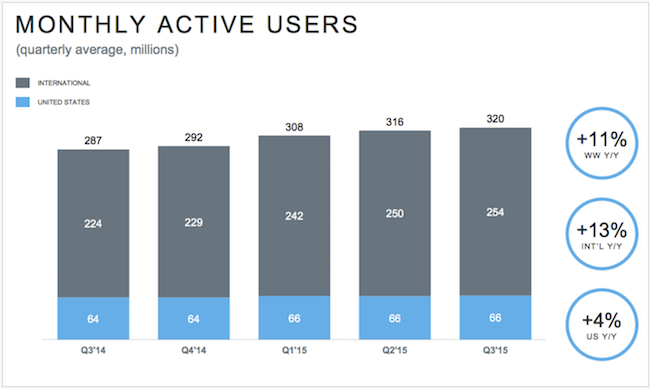

The one tech stock that didn't beat expectations and isn't up after hours is Twitter. Last night Twitter released their Q3 numbers, with 58% growth in revenue to $569 million for the quarter and a smaller loss of $131.6 million compared to last year's quarter were the loss was $175.5 million. The number that is really hurting the stock at the moment is the user growth numbers, which only came in at 8%. Without user growth, the huge growth in revenue will hit a ceiling a lot quicker than analysts are expecting. The bigger problem has been the user growth in the US, their home market and where advertisers are more likely to spend on social media advertising.

Graph courtesy of this article: Twitter Sputters To 320M Monthly Active Users, Stock Drops Over 10% After Hours

It would seem that Twitter at the moment is a very niche social media platform, either you can't live without it (all of us in the office) or you are more than happy to live without it (my wife and many friends). I think that growth will come from their platform, Periscope, which allows you to broadcast video live to world (how will this start affecting live sport games and the likes of SuperSport?).

Jack Dorsey, the returning CEO has some big hurdles to get over and I think we need to give him a few quarters to make a marked impact on the company. He recently gave $200 million worth of stock to employees to help with moral, which is a good indication of how much he wants Twitter to succeed.

Linkfest, lap it up

Before WhatsApp and BBM there was MXIT - Mxit formally shuts down. I think the company could have been huge if they had moved quicker, it worked on 'dumb phones' before Apple even had an iPhone. Sad to see but also is a reminder of how quickly the world of technology changes.

James Bond hype is growing with the world premiere on Monday night. Here are some numbers from the very successful Bond franchise over the years - James Bond in numbers!

Some fun with video - Time-lapse shows construction workers taking apart a bridge piece by piece

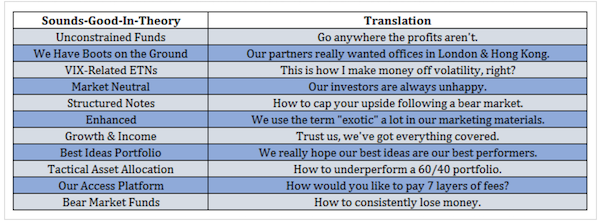

Some humour from A Wealth of Common sense, talking about the different marketing names given to funds and investment ideas. Remember simpler is normally better and definitely cheaper over the long run - The Sounds-Good-In-Theory-Portfolio

Home again, home again, jiggety-jog. Asian markets are mixed, the Japanese market is up, the Chinese markets and Hong Kong are not. I guess today, whether I like it or not will be all about what the Federal Reserve intends doing later this evening and what the impact will be on equity markets. And then we can get back to the business of covering earnings.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment