"Across their geographies it is evident that the growth engine is going to be in China/Asia Pacific, after the integration of Starbucks Japan during the financial year. And they plan to add 900 stores, half of all the stores this year for the group in the China/Asia Pacific region, 700 in the US and the balance, 200 in the EMEA."

To market to market to buy a fat pig. It was a real mixed bag yesterday, a smorgas board (my publishing package does not allow umlauts and accents, sorry) of sort. Amplats was down an astonishing 7.95 percent, whilst SABMiller was up by nearly three percent. The move higher in "Breweries" represents two things, one, for starters a weakening local currency and secondly the conclusion of the deal. I for one never actually thought it would close, I thought that there were too many hurdles, too many egos. The deal seemingly will be announced before Guy Fawkes Day next week. Strangely, the failed attempt to blow up the house of Lords (the gunpowder never went off) is "celebrated" with fireworks, which almost always go off. At the heart of the plot (the Gunpowder Plot) to destroy one and stick another on the throne was religion and politics (the monarchy). Hence the reason your mum told you never to discuss this topic with family, or strangers for that matter, stand back!

Markets locally in Jozi, Jozi, yesterday closed lower, stocks as a collective were down two-thirds of a percent, the sellers far outnumbers the buyers. Whilst that can never really be true, in markets you need each buyer to be matched with a seller, that is market speak for stocks closed lower and I have very little explanation. It is possibly a broader response to emerging market selling, a weakening of the currency also in response for heightened chances of the US Fed raising rates at the next FOMC meeting in December. Mid December, meetings are held every 45 days (there and there about). And as such, US assets in the fixed income space become more attractive, emerging markets less so. Which is not exactly great news, most emerging markets find themselves having taken on too much debt since the financial crisis, and now having some serious budgetary challenges. "Challenges" is South African for "problems".

That aside, like I told a client yesterday, companies evolve and adapt to the changes around them at a far faster pace than organisations or countries, if you think of the businesses that you own, like Aspen, or Discovery, or Mediclinic, Naspers, those companies have global reach and presences that they did not have a decade ago. The world cannot end at our borders, you need to attract all the customers of the world. Talking of something that may impact on all of us and specifically the Chinese consumption story long term is the change of the one child policy that was announced yesterday, the number is now two. As a result of an ageing population in China, the authorities have u-turned on the idea that Chinese urban population be allowed to only have a single child. What the longer term implications are for consumerism in China will only be felt in the decades to come.

MTN still continues to be in the vacuum of a lack of news, which is bad for the company, and unnerves those who have shaky nerves at the best of times. Vodacom stock has absolutely crushed MTN over the last 12 months on almost all metrics. Most of that is recent though, to be fair to both companies. Paul pointed to a tweet with an interview with Calixthus Okoruwa, who runs a telecoms consulting firm. It is definitely worth a read: NCC's $5.2bn fine is like 400-year sentence for traffic offence. It is full of pithy quotes, including this one: "Investors are not likely to forget that this is one country where a regulator can summarily impose a fine to the tune of billions of dollars on a telecom operation. The entire industry should be worried because this will considerably jeopardize investor confidence for a long time to come."

And of course in the headline: "My only regret and a big one at that, is that this was allowed to happen in the first place. Investor confidence is now badly shaken and will take some time to recover. This was very unnecessary. It is like imposing a sentence of 400 years imprisonment for a traffic offence." Okoruwa points to the fact that damage has been done, it can be somewhat restored by reversing the fine. To put the quantum of the fine into context, it represents over 20 percent of the total Nigerian budget, and one percent of GDP. Which begs the question, why are Nigeria not raising more money across their economy for starters, and are they trying to dip the golden goose into molten lead to store it for posterity? That'll clearly kill the golden goose and chase away any investment. Mission accomplished administrators, guess who indirectly pays your salary, tax collections dummy.

Over the seas and far away in New York, New York, the broader market S&P 500 nearly closed flat on the session, blue chips ended down around one-eighth, whilst the nerds of NASDAQ sank just over four-tenths of a percent, most of the selling coming in basic materials, healthcare and financials. A first look at a US Q3 GDP was ever so slightly lower, inventories were run down during the course of the quarter, perhaps in response to the global anxieties around growth, companies also read the headlines. Allergan gained over 6 percent after they revealed that they were indeed in friendly talks with Pfizer, as Paul pointed out yesterday the seller of botox and the seller of the legendary little blue pill has a fabulous end-to-end business right there. Across to the east, where it is nearly weekend as I write this, stocks are mostly higher, just a little lower in Hong Kong, most other markets are higher there. The Japanese market is up nearly a percent.

Company corner

Starbucks, one of the Vestact recommended stocks, reported numbers post the market close last evening. It was a meet, in terms of what matters for the people who suffer from quarteritis. Quarteritis is a disease whereby you judge a company purely on the metrics of what the market analysts expect the company to earn. And you can make a sweeping statement like, they had an excellent quarter, what a stock, or rubbish quarter, rubbish stock. Eddy Elfenbein captured it perfectly in his Friday morning message, where he quoted the doyen of index investing, Jack Bogle: "The stock market is a giant distraction to the business of investing." We try and stress many times that we own companies, not share prices. The share price represents the prospects at any one given time, whether you are an investor, speculator, stapler, trader, or whatever you call yourself, that is the price and that is what someone is willing to pay. Bogle is right, at times it seems nuts.

Back to the business of roasting beans and serving up a cup of Joe. The origins, like in beans sources in years gone by, are a little lost in time, research suggests that reference to "Joe" means that coffee was the drink of the common man. Coffee smells and tastes delicious, the side effects and positive attributes include heightened heart rate and breathing. Which I guess can be both good and bad. Coffee is used to revive mental and physical fatigue, according to WebMD. And we all know WebMD is always right! These results, luckily enough for us, were not only the for the fourth quarter, by extension they were full year number reporting time too. So let us first whizz through the quarterly numbers. EPS increased 16 percent to 43 cents, which was a Q4 record, revenues jumped 18 percent to 4.9 billion Dollars, operating income was also a record for Q4, up 13 percent to 969 million Dollars.

Full year revenues were 17 percent higher than 2014 revenues to 19.2 billion Dollars, with consolidated operating income up 17 percent to 3.6 billion Dollars. EPS increased 35 percent to 1.82 Dollars. Over the year the company opened 1677 new stores, net, to end out the financial year at a whisker over 23 thousand stores across 68 countries. And of course, here locally, Taste Holdings will be in a position to sell Starbucks coffee across our fine land. Of course hipsters everywhere are outraged, yet their look is the same, chequered shirts, well groomed beards, rolled up jeans, sneakers made up of canes, snappy hat, Vespa and of course organic beer and coffee. I have an idea, if you don't like it, don't drink it, OK?

Across their geographies it is evident that the growth engine is going to be in China/Asia Pacific, after the integration of Starbucks Japan during the financial year. And they plan to add 900 stores, half of all the stores this year for the group in the China/Asia Pacific region, 700 in the US and the balance, 200 in the EMEA. EMEA is Europe, the Middle East and Africa. That area will continue to be the future of the business, and is so far away from matching the presence of Nike and Apple in that region. The truth is that you cannot lie to any customers across the globe on quality, and what you will pay for it. Starbucks checks many boxes, both ethically and of course quality.

The stock is down in the pre market, just a little less than a percent. Again, when you are primed for growth, you must deliver more than the market expects. We are comfortable that the share price represents very much the future, and that future is bright. The company and accordingly the stock price will continue to march onwards, gathering new and loyal customers across the globe, the expansion story remains intact, and it is a growth business with a quality product. We continue to add to Starbucks.

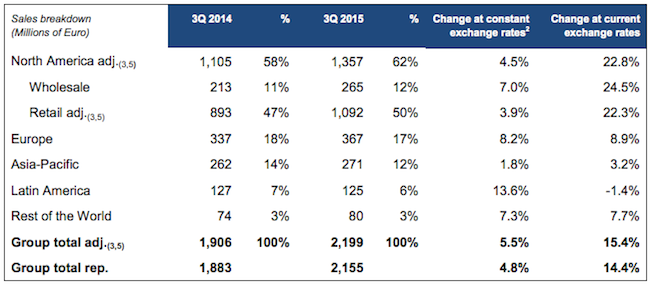

We had numbers from Luxoticca on Wednesday. If you need reminding they are the guys that make sunglass brands Ray Ban, Prada, Oakley and a whole host of other brands. Over the past few months, most of the companies that we have written about talk about strong dollar head winds, Luxoticca is a European company which results in strong dollar tail winds instead. Group sales are up 15.4% compared to the same quarter last year but if we strip out the strong dollar tail wind, sales are only up 5.5%. If we look at EPS, in Euros it is up 19.8% but in US Dollars it is only up 0.5%.

Here is a breakdown of the sales in each region and their respective weighting for the business:

Note the solid growth in North America, which is a good indicator of how things on the ground for the consumer have improved. A key figure to look at though is the Asia-Pacific region which only accounts for 13% of sales and if you drill down further China only accounts for 3% of sales. Given that figures from China have been showing a strong shift to consumption (Apple and Nike both confirming this with their numbers), China is going to be a key growth market for them. Consider that China has 30% more people that both Europe and the US combined, so a region that will grow with in significance.

Then the last number of interest was that they grew their E commerce sales by 50%. Most people I know try on many pairs of glasses before they buy a pair, maybe this is people who are buying glasses they have already tried on in the shops? The stock is not not cheap, trading at a P/E of 30 for next years expected earnings. The reason is due to the huge growth that is expected to come out of China, which at the moment can be considered a blue sky market.

Linkfest, lap it up

The boys at Moneyweb have written a great piece, giving the circumstances of the MTN fine - The background to MTN's fine in Nigeria. Having read the article it highlights how crazy the fine is.

Facebook is putting their employees in their customers shoes so that they create a better product - Facebook will make its employees feel what it's like to have a 2G connection. To keep the platform relevant in the developing world, the site needs to be able to function if you have a very slow internet connection. If the site does not function, selling advertising space won't happen.

The problem with using hindsight in your next decision, is that with hindsight everything looks so simple and obvious to us. "How could the outcome have been anything else than what it was?" - The Insidious Nature Of Investing Hindsight.

Home again, home again, jiggety-jog. Our market is marginally higher this morning at the start. MTN is also marginally up on the news that the group CEO is engaging the Nigerian authorities. Phew, it has been a really tough week for them.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment