' "there's only one word to describe China's wealth accumulation: Relentless. Since 2000, China's per-capita wealth has quadrupled to $22,513, and the country has more than a million millionaires. As of June 2015, the country's total household wealth of $22.8 trillion trailed only that of the U.S." And how much of that in the stock market, a beast that is wild and unpredictable? The answer comes in the next paragraph: "stocks account for just 10 percent of overall household wealth in China, and the country also has a high personal savings rate. In other words, it's not about to fall off the global wealth podium any time soon."'

To market to market to buy a fat pig. A strange end to October for markets in New York, New York Friday, stocks down half a percent in the flick of a switch at the close. At the bell, stocks sold off from about even, down around half a percent for both the broader market and blue chips. Locally stocks rose, the Jozi all share closed around three quarters of a percent higher, at the top of the leaderboard were the volatile stocks of late, Anglo and Glencore at the top of the winners list this time.

Too often we have seen the opposite, year to date Anglo American share price is down nearly 46 percent, Glencore is down 55 percent in Jozi. In London Anglo American is down 58 percent and for Glencore, it is 62 percent. That is in Pound Sterling, it has looked far worse. And with some key commodities for Anglo still looking unbalanced, iron ore specifically, there could still be some pain to come. The suggestion from some quarters is that the iron ore price could fall another 30 odd percent from here. Yowsers.

The MTN fine still knocks around, senior officials of MTN have been engaging with Nigerians authorities and higher powers too, in order to convince them that whilst they may have violated some of the conditions of their licence, a fine of that magnitude is equal to years of profits. Years and years. That analogy still sticks out for me, it is like being imprisoned for 400 years for a traffic violation. It is interesting in civil society the reaction, some suggest that the evil wrongdoers and profiteers should pay the fine, most who have a little better insight believe it to be ridiculous.

Whilst it is easy to company bash, the chattering classes have little insight on how difficult it is to operate in multiple territories across different sets of laws and rules. Added to this is the irritation of the JSE investigating the company on the ties release of their SENS last week. I for one think that they were probably scrambling in order to speak to someone in the know before going public, you do not want to create more uncertainty before you know everything. I am hoping for a conclusion this week.

Talking of bashing people, it is equally easy to bash the wealthy in society and suggest that all of them inherited it. In fact, the opposite is true. A Forbes article from the beginning of October, titled The New Forbes 400 Self-Made Score: From Silver Spooners To Bootstrappers, suggests that today 69 percent of the folks on the Fortune 400 are self made, less than half of the people were self made back in 1984. So over three decades, the number of self made millionaires has increased dramatically at the expense of the folks that inherited it. Too much time is spent bashing rich people and not enough time enabling people to measure their own successes in society, celebrate all successes and then yours will come easier too. In whatever it is that you too. Whilst wealth may not be the measure of success (we dish out academic and sports medals and prizes), it is important to remember that not all socialist economists are correct.

Staying on this topic, I think it is important, the August wobble was largely as a result of falling Chinese stocks, letting their currency weaken a little, concerns of a slowdown in China and generally anxiety associated with the Fed too, when will they raise rates. This led to folks wondering about the health of the global economy. I did however come across a post on the weekend, by Credit Suisse, in their blog called the Financialist: Global Wealth and the Long-Term Investor. It basically leaves you feeling better about the future of the global economy and how richer Chinese people will be more likely to protect capital in the coming years.

Some interesting paragraphs, worth reposting: "there's only one word to describe China's wealth accumulation: Relentless. Since 2000, China's per-capita wealth has quadrupled to $22,513, and the country has more than a million millionaires. As of June 2015, the country's total household wealth of $22.8 trillion trailed only that of the U.S." And how much of that in the stock market, a beast that is wild and unpredictable? The answer comes in the next paragraph: "stocks account for just 10 percent of overall household wealth in China, and the country also has a high personal savings rate. In other words, it's not about to fall off the global wealth podium any time soon."

Based on this evidence, we should not be worried about a) the Chinese stock market representing the majority of peoples savings and b) the health of the future of the Chinese consumer. Continue to accumulate and buy businesses that will directly benefit from Chinese consumers that are richer, Apple, Nike, Richemont are the obvious ones. In the end, whilst you are in the midst of a heavy stock market slide, you are always worrying about one thing or another (survival instinct kicking in), the inevitable recovery leaves you wondering why you worried in the first place.

Company corner

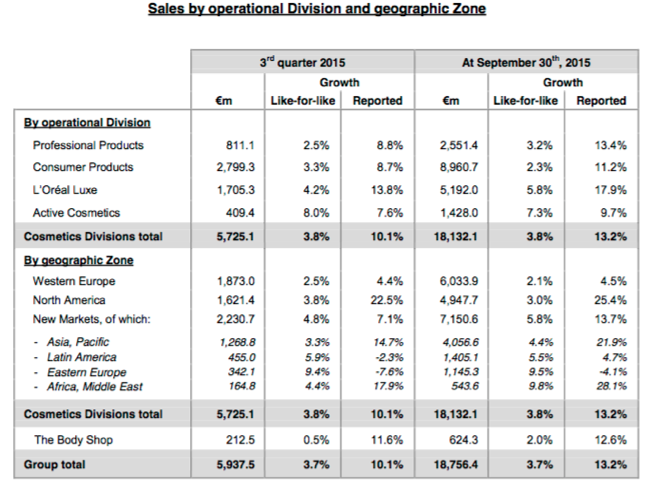

L'Oreal released a 9 month sales update towards the end of last week, this was for the sales period to end at September 30th, 2015. Emerging markets seem to be the biggest issue, a slowdown in China with specifically L'Oreal Luxe and what they term a "difficult Brazilian market", plus general Asia market turbulence. At face value the sales update looks decent, herewith a breakdown of the product and geographic mix:

In Euro terms sales looked excellent, up 13.2 percent when compared to the prior year, at constant exchange rates the growth was a less impressive, showing a 4.9 percent growth over the corresponding 9 month period. For some reason the third and fourth quarter seem to be worse than the first and second, Northern hemisphere summer time maybe, gearing up early? Even if the group have a comparable fourth quarter to the full year, I think that they would have done a great job in a tough market.

Whilst we have very little to work with, for three months now. The market clearly did not like this, the stock was down 4.57 percent in Paris and down 3.37 percent in New York Friday. Clearly the market is expecting greater things, the stock trades on a 30 multiple, they need to deliver the goods. Year to date the stock in New York (where we own them) is up 9.4 percent, relative to a market that is up a single percent. In Euro terms the stock reflects a far greater gain, up 19.2 percent for the year. We continue to accumulate what is a great middle income growth story, across multiple territories. From time to time you are going to have these currency headwinds or tailwinds, know that the longer dated story is intact.

Linkfest, lap it up

Elon Musk may have had a tough few weeks, SolarCity stock was down 25 percent Friday, Tesla has been under pressure (results tomorrow), yet he remains committed to solving the problems that blight us, too much reliance on Earth and fossil fuels. Some pithy quotes: 25 Quotes That Will Take You Inside the Mind of Elon Musk

Having computers understand what we are saying is the next big step in searching for information. It will allow us to find information even if we are missing a few key terms in our search term or it will allow Google to bring up the exact information we are looking for instead of us scrolling through result pages - Google Turning Its Lucrative Web Search Over to AI Machines.

Home again, home again, jiggety-jog. The gesture from Sonny Bill Williams to the 14 year old Charlie Line is the stuff of dreams, and the reason why I guess we all watch sport. Charlie is a British schoolboy from Millfield, where, as per their website: "Millfield is an inspirational school where pupils are celebrated for who they are, and encouraged to reach their personal best". That includes getting a medal from Sonny Bill, at a world cup final. Markets across the globe are less excited than Charlie, Japanese markets are down over two percent, China down three quarters. Futures are set to open lower. Fear not, earnings are set to continue, Visa results post the market today, I am looking forward to that.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment