"A tale of two economies, at the same time we stare at the very possibility of Lonmin not being able to raise the money from their shareholders via a rights issue, Shanduka have said yesterday that they would not be following, reports suggest that the PIC may step into the breach. As we showed yesterday, equity holders have basically all but been wiped out, they do not feel like pouring any more money down a black hole."

To market to market to buy a fat pig. There and back for US markets last evening, Mr. Market is starting to get antsy about the Janet Yellen comments ahead of the non-farm payrolls today. It is not like I don't care about the non-farm payrolls numbers, I do care, we certainly do not let it dictate what companies to own, and which ones to not own. That you must own on the merits of the businesses, they will negotiate the matters of interest rates in their businesses as and when it comes.

I wonder what it does mean for that monster Apple cash pile, when rates go higher? That is another matter entirely. As the bell rang for the close, the S&P 500 closed down just over one-tenth of a percent, stocks had been nearly half a percent lower at the beginning of the session. Tech stocks closed lower, notwithstanding the move higher by Facebook, that stock up 4.6 percent during the session.

Back home the resource stocks were dealt a heavy hand, again sadly. If the Fed raise rates in December as the most powerful woman in the world suggests (That is Janet Yellen, not Oprah Winfrey) they are ready to do, then that equals dollar strength, which in turn equals commodity weakness, which also means to a certain extent, Rand weakness. That meant on the local bourse that Anglo American, BHP Billiton, Amplats and Sasol all injured the wrath of the sellers, down 8.69, 4.15, 3.85 and 3.3 percent respectively.

At the top end of the leaderboard were the retail stocks, a very surprising trading update for 18 weeks from Truworths, including Earthchild and Naartjie, sales for that period leading into the festive season up in the high teens. Buoyed by cash sales, perhaps we are seeing early signs of the personal balance sheet repair cycle. Hopefully. Joe Consumer might colloquially be under pressure at all corners, these numbers from the clothing retailer certainly didn't reflect that, Truworths stock closed up 8.8 percent on the day. Mr. Price (with their new share code, MRP not MPC) rallied, up 3.68 percent on the day. Famous Brands touched a lifetime high yesterday, also in the discretionary spend segment of the economy.

A tale of two economies, at the same time we stare at the very possibility of Lonmin not being able to raise the money from their shareholders via a rights issue, Shanduka have said yesterday that they would not be following, reports suggest that the PIC may step into the breach. As we showed yesterday, equity holders have basically all but been wiped out, they do not feel like pouring any more money down a black hole. Oh dear. It seems like we are around two weeks away from knowing the fate of what is still a sizeable employer and definitely a sizeable producer by global standards. I fear the worst. It doesn't necessarily mean that the mine shuts, it may mean that the new owners get it for very little, they may have to assume the sizeable debt pile.

Company corner

Cerner, the information systems healthcare service provider, reported numbers earlier this week. The company announced Third Quarter 2015 Results, that unfortunately missed the lofty expectations of the market, and more unfortunate was that this was the third quarter in a row that the company has come up shy of expectations.

Notwithstanding the earnings miss, revenues increased 34 percent and more importantly for future business, bookings (for the quarter) increased 44 percent to 1.59 billion Dollars, roughly 1.4 times the last quarter revenue. That is of course future business, the backlog currently stands at 13.9 billion Dollars, an increase of 37 percent from this time last year. Adjusted diluted earnings per share increased by 29 percent to 54 cents for the quarter.

The outlook for the current quarter was a revenue increase of 27 percent, diluted EPS to increase 21 percent to around 56-58 cents, new bookings are expected to again be higher than revenue projections for the quarter, forcing the backlogs even higher. I am sure that many businesses would like to have that problem, ever increasing demand for you product, the ability to meet it is important. That is why the 2016 outlook was probably not well met, revenues for the full year next year are estimated to increase by 13 percent to above five billion Dollars. And why that is disappointing is simple, the company expects current year revenues to increase 30 percent. The market is looking for better, the range of earnings consensus is around 2.52 Dollars a share. And on a share price 61.28 Dollars (the close last evening), that looks a little stretched at 24 times earnings forward.

I really like the company, I really like what they are trying to achieve, paperless hospitals and complete integration of all the services from admission to packing your bags and leaving. Everything in-between from dispensing post operative medication to administration of said medication, making sure that human error is cut to next to zero. In fact, even knowing about you before you get to the hospital, your medical records, to know what medicine may not be right for you, what has worked in the past.

There is not a single person I have ever met who I have explained the business to, who did not think that their business was definitely going to gain traction in the coming years, it is certainly an exciting space. Their software extends beyond the hospitals, into doctors practices, home health including long-term and Hospice caring, research laboratories, even into the workplace to ensure that your workers are healthier. And by extension, more productive, one less thing to worry about. Equally, the company offers complete information technology solutions for medical practices, hospitals, they understand the business of healthcare.

It remains unsettling when a stock you hold is pretty volatile. And whilst the outlook is a little more muted than perhaps hoped, the central thesis remains intact, we continue to accumulate the stock on weakness and still recommend the company as a buy. It certainly is a business that has a very bright future, the market is huge, not only in the US, amongst the rest of the world too. Technology and medicine go hand in hand to improve the experiences of all patients.

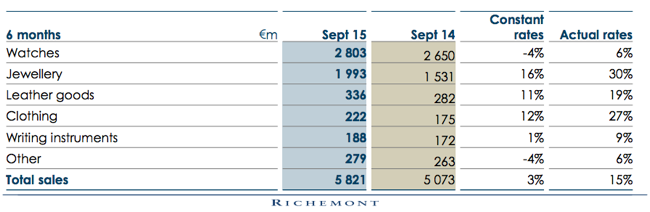

Richemont have released six month results to end September, sales up 15 percent in Euro terms, 3 percent increase at constant exchange rates to 5.821 billion Euros. Such is the weakness of the Euro relative to their selling territories. Gross profits increased 13 percent to 3.786 billion Euros. Operating margins were described by the company as robust, they did sink 200 basis points to 24 percent. Yet, after all of that, profits managed to increase 22 percent a share, equally earnings per share increased by 22 percent to 1.949 Euros.

Now this is the part where you must be careful, whilst the company reports in Euros, the stock is primarily listed in Zurich, and the global depositary receipt that we own down here is one-tenth of a share in Zurich. So essentially divide the Euro earnings by ten and then apply the exchange rate to work back to Rand terms. 19.49 Euro cents equals 2.95 Rand. The stock remember has been reaching and touching new all time Rand highs, last evening the close was over 120 Rand.

As per the presentation of the half year results, strong performances in the old world, Japan and Europe more than offset what is still negative conditions for luxury in Hong Kong and Macau. The latter are destinations for luxury shoppers from mainland China. Jewellery in particular looked good, showing a 16 percent increase in sales at constant rates, 30 percent in actual rates, see table below. What is interesting is that Asia Pacific and Europe in terms of percentage sales are nearly back on an even keel, the weaker Euro has meant stronger tourism and more buying of luxury goods in that part of the world. Mainland China has interestingly showed signs of improvement, we did see that in the five month trading statement.

Everything looks OK, until you get to the point where October sales are reported in these results, and that is the reason for the weakness in the share price this morning, constant currency sales looking weak. We continue to accumulate what is a world class collection of luxury brands, centuries old and only more valuable as time goes on, the quality is undisputed.

Linkfest, lap it up

Friday fun! Even the robots are going to be writing now. Yes, really. Our daily blog is under threat. Mind you, I think that we are more entertaining than the robots. Xinhua News Agency begins computerized writing project. What I find quite fun is that simple stuff like earnings, stock market reporting and football can be reported on. Excellent, now that we have removed the emotion, can the computer tell us whether Chelsea are going to qualify for the Champions League next season and whether "the special one" will still be manager by Christmas?

Whilst we bumble along here and suggest that nuclear is the future, I am still in agreement with Elon Musk, the greatest power source known to mankind comes up each and every day. We just need to find a way to store it better. The two biggest economies on earth are pushing ahead with huge tax breaks, and generally solar is becoming mainstream. The FT (subscription only) has a great article: Sunshine revolution: the age of solar power, that features Elon Musk's cousin, Lyndon Rive, who runs SolarCity. About the stock however, down 44 percent year to date. Ouch.

Home again, home again, jiggety-jog. Stocks are sharply lower here at the get go, don't forget that today is the release of the non-farm payroll numbers, something too hot (i.e. better than the expectations) would mean that the Fed are more than likely to raise rates in December. Sigh, we will continue to monitor the companies we own rather than the Fed and what they are likely to do.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment