"I would choose each and every time the prospects of a hospital group over a tobacco or alcohol company, is it just me that thinks medical care spend is less "optional" than anything else? Mind you, there is one thing that is more addictive than cigarettes as Paul always points out, it is food."

To market to market to buy a fat pig. Whilst it was a mixed bag here in Jozi, stocks ending off a fraction might appear at face value as a failure to ignite, in truth it was almost the best point of the day, the closing. Resource stocks felt an enormous amount of pain, down another three and (nearly) one-third of a percent on the day. Over five years the Resource 10 index, which includes all the majors, is down nearly 49 percent. Wow. Times have changed. And so much so that as far as the ranking tables go, by companies by market capitalisation is that Remgro and Sanlam are, as of this morning, bigger companies than Anglo American. FirstRand is a bigger company than Glencore. Anglo finds itself in 18th place and represents just over 1.1 percent of the overall market. A company that was once synonymous with South Africa has fallen down the ranking tables, in the most dramatic way.

Whilst that slide has been well documented, it is the morbid fascination of humans to focus on negative events (it may happen to you mentality), what is less documented and we have tried to point this out several times, there are always new winners. Businesses like Discovery, that are nearly 100 billion Rand big, from next to zero one quarter of a century ago. Companies like Steinhoff that have pulled off audacious deals, and grown to a business that is more than double Anglo American.

And then one of the biggest metamorphosis shows, Naspers, which clocked a new all time high yesterday. The stock was at the top of the leaderboards, up over three percent on the day to close out at 2233 Rand. This is ahead of results, which I think are on Friday. At the opposite end of the spectrum was Glencore, down 7 percent plus as copper prices plumbed lows last seen near the financial crisis. Equally, South32 was down 5.3 percent, Anglo down 4.2 percent, BHP down over three and one-third of a percent.

Another noticeable loser on the day, bunched in amongst the losers was Netcare, that stock was down 3.81 percent. Year to date the stock is flat, yesterday the company released results for their year to end September. Profits before tax were up 16.4 percent, HEPS rose 12.6 percent to 189 cents, the dividend was hiked by 12.5 percent to 54 cents. Which means by peer comparisons, Netcare is neither expensive nor cheap, Mediclinic, Netcare and Life all trade on low 20 times historic earnings. I read the outlook, it seems just fine to me, prospects although muted in both the UK and here, the company operates in a hugely defensive space. We prefer Mediclinic to Netcare, we are lucky enough to have multiple choices of three quality operators.

I would choose each and every time the prospects of a hospital group over a tobacco or alcohol company, is it just me that thinks medical care spend is less "optional" than anything else? Mind you, there is one thing that is more addictive than cigarettes as Paul always points out, it is food. We have always and will always eat food. If I have to say with certainty that in particular two industries are going to be around in 100 year (for great grandchildren), I would be certain that it is food and healthcare.

Talking food, there were results from Rhodes Foods, who have the best and most peaceful head office in the country on the Pniel Road in the Groot Drakenstein. For those of you who do not know where that is, it is not too far from Franschhoek. Whilst most of you may have heard of that part of the world, how many of you have heard of, what the company refers to as strong brands? The name Rhodes (yes I have), Bull Brand (yes, again), Magpie (maybe), Saint Pie (nope) and Pure Squish (definitely not, perhaps as a result of older children).

Still, the company managed to register sales of 23 percent higher for their full year to end 27 September (weeks and not months in reporting), gross profits increased nearly 29 percent, normalised HEPS showed a monster 136.9 percent increase to 87.4 cents, the maiden dividend of 24.8 cents (raise your bat Rhodes Foods) declared represents a dividend cover of three times. The stock trades on 30 times (nearly) earnings, at that growth rate a PEG of 1 is acceptable, the stock was cheered up 5 percent plus yesterday. The market cap is now a whopping 5.1 billion Rand, bigger than I thought.

Another food company is reporting results this morning, this time Pioneer Foods Sales are up a modest 6 percent to 18.7 billion Rand for the full year, yet the magic of Phil Roux seems to be permeating through the whole business still. Earnings are 17 percent higher to 1.13 billion, diluted HEPS is up 12 percent to 613 cents, the dividend for the full year is much higher, up 52 percent to 332 cents (237 cents in the final dividend). They seem to be focusing on cutting costs, increasing margins, driving returns for shareholders. Whilst we like this business, we prefer Tiger Brands, who have had problems of their own. We are busy compiling a year end results report for our clients.

There are also results from chemicals, agriculture and explosives company Omnia this morning. They do not paint the best outlook for the medium term, in light of a deteriorating mining outlook: "The downturn in the mining sector, which started in the last quarter of the 2014 calendar year continues. In the short-term, the situation is expected to remain weak or to deteriorate further and will probably not turn the corner for another few years."

They are taking it unfortunately on all fronts, the weaker commodity prices equals less demand for explosives, the poor weather means that fertiliser usage has been muted, the weaker economy means chemicals sales growth is unlikely to grow at any pace. Six month sales were flat, profits were nearly 20 percent lower, HEPS dropped 19 percent to 494 cents, dividend marginally lower to 180 cents, that is the only good news. We continue to recommend that you avoid until the outlook improves, judging from their commentary, that might well be a few more years.

Over the seas and far away in New York, New York stocks closed marginally lower, stocks were up sharply at the beginning of the session. Monday merger excitement to begin with, although the stocks in question themselves, Pfizer and Allergan did not gain at all, if anything, both stocks dropped quite a lot. I guess in order to complete the deal and look for the tax inversion in Ireland, and an international footprint for Allergan, this is going to take some doing. The gift that keeps on giving, "the Donald" said that jobs were flying out the window and this was a disgrace. That fellow is a hoot, in fairness to his many critics, myself included, the man has managed to gain a certain amount in the polls. Whether or not this translates to a Republican nomination is debatable, we can only wait. Until then, he gives much amusement to moderate and liberals across the globe.

For an interesting take on what is a HUGE deal and the tax "avoidance", see the Quartz article titled: Pfizer and Allergan just announced the second-largest corporate M&A deal of all time. The article is pretty light on the deal, it does however highlight the tax problem that the US has. And if the mechanism exists to transfer from 35 to 12.5 percent tax rates, then good for the companies involved. Is it a moral issue? I am not too sure, countries attract capital in all the ways that they possibly can. An interesting debate that highlights that the US is not as competitive as they should be.

Staying on Pharma, did you see that Bill Ackman now holds through option structures around 9.9 percent of Valeant, he really is backing that horse in a large way. So much so that it is now the biggest holding in his fund. The stock is down 60 percent in three months, following both the gouging allegations from presidential candidate (and likely next president) Hillary Clinton and the potentially more damaging revenue fudging allegations. And the fact that Charlie Munger does not like their business practices means that Ackman is up against it. He has scored deep on some of his takes before, and equally thrown in the towel on the likes of JC Penney (that went badly). If nothing for us, it provides a little bit of spice.

Linkfest, lap it up

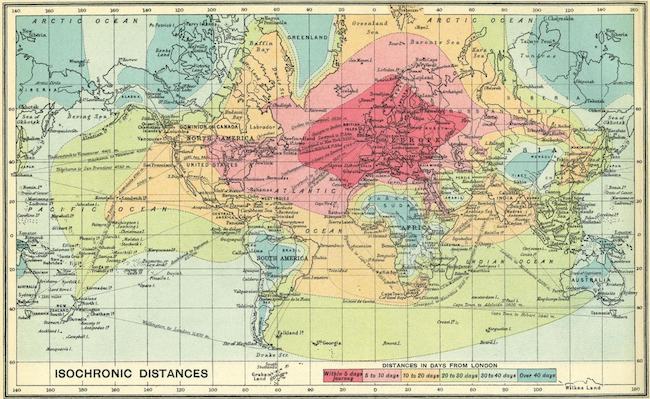

Here is a map of howl long it would take you to travel in 1914 from England. There are many areas on the map that will take you over 40 days to reach! - Time travel.

Moving on to another other form of travel, NASA has placed orders with Space X for crewed rockets. You will remember that Space X is privately owned by Elon Musk, who has the mission to get people to Mars. One of the first steps in doing that is taking people to the International Space Station - NASA orders first crewed mission from SpaceX to the International Space Station.

Josh Brown has a look at the roots of the word risk. He also points out it appears 4 times more in media than the word weather, which I think points to our bias to avoid losses and to avoid pain. The result is we fixate on risk more than we probably should - The Etymology of Risk

There have been many unicorns prancing around Silicon Valley, less so over the last few months though - Tech's big valuation correction means the system is working the way it's supposed to. Sometimes too much money flows in the direction of new technology with the result being that valuations can become too high. In the current environment the money flowing to Silicon Valley is mostly private, which means that when things go bust, the shock wave does not hit the broader market/public. It is great to see huge amounts of money flowing into tech because the new things invented improves all our lives.

Home again, home again, jiggety-jog. Stocks have started mixed here, resource stocks bouncing a little, although it is too hard to tell. There is the small matter of European, US and South African GDP reads today. That should be exciting for the economists out there, established and budding alike. I suspect that we are at a point where we are "waiting for the Fed".

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment