"The copper price reached a multi year low, back to July of 2009. The gold price was at a five year low, the oil price was zeroing in recent lowest prices in about six years. Copper is often referred to as Dr. Copper, with a Phd. in the health of the global economy. The weaker the copper price, the less the building going on. The less building going on, the less demand for Dr. Copper. Let us just say that we currently looking at Dr. Flopper."

To market to market to buy a fat pig. You were reaching for the barf-bag yesterday if you were deep in resources, those stocks were seeing their Christmas stockings stuffings disappear in a hurry. Emptying out, nothing left, the Grinch came early. The copper price reached a multi year low, back to July of 2009. The gold price was at a five year low, the oil price was zeroing in recent lowest prices in about six years. Copper is often referred to as Dr. Copper, with a Phd. in the health of the global economy. The weaker the copper price, the less the building going on. The less building going on, the less demand for Dr. Copper. Let us just say that we currently looking at Dr. Flopper.

The Bloomberg commodities index, a tracker of 22 commodities (according to this FT article: Fresh wave of selling engulfs oil and metals markets) is at the lowest level since the financial crisis. Whilst iron ore prices are below 50 Dollars a tonne, Twiggy Forrest, the Fortescue metals boss is warning his country, Australia, of darker days for iron ore.

The upshot of it all was unsettling equity prices, Anglo American trading at their lowest ever London price, since they listed in mid 1999. The price locally in Jozi fell below 100 Rand, the last time I remember that happening was in May of 2003, I think. The ten year return for Anglo American (sans dividends) in Rands is minus 51 percent. In London the return over the same period is minus 77 percent. Once the crown jewel of the South African market, the stock is now unfortunately deep in the midst of a continued drawdown in commodity prices not seen for quite some time.

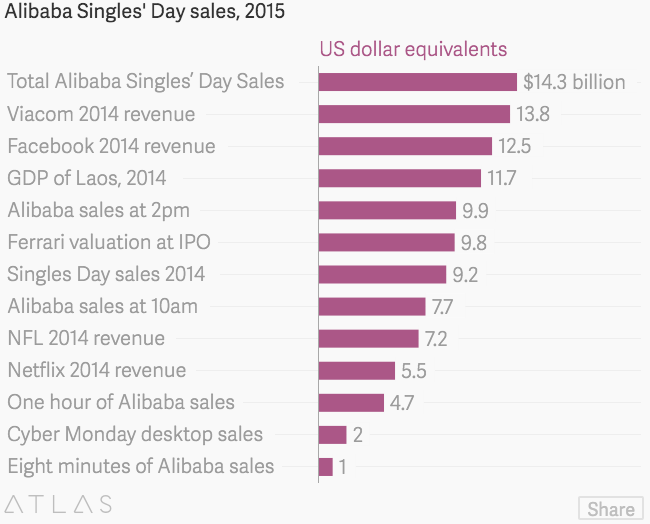

In fact, the Anglo listing in London coincided with the biggest ever industrialisation plan we have seen in our time, Chinese thirst for commodities and their infrastructural roll out was like something we have never seen before on that sort of scale. And now that the country shifts towards a consumption based economy, singles day (four 1's next to each other apparently look like bare branches) was a wonderful reminder of how their economy has morphed into something different. The top items selling on singles day, baby related products, both clothing, items and nutritional, and then one for the singles, Levi's jeans and Nike sneakers. Adding to a massive singles days boost was that October retail sales were 11 percent higher than the year before, beating expectations earlier in the week.

The upshot of a stronger Dollar against most currencies globally and a slowing Chinese economy has translated to a weaker commodities complex. Stocks as a collective in Jozi, Jozi sank over a percent, the stocks at the top of the losers headboard included Anglo, Glencore, South32 and BHP Billiton, all the heavyweights with exposure to most bulk commodities. At the top of the leaderboards and bucking the trend and the only real standout was Naspers, up over a percent as the afterglow of the good Tencent results still continue to leak through. Stock earnings osmosis we can call it.

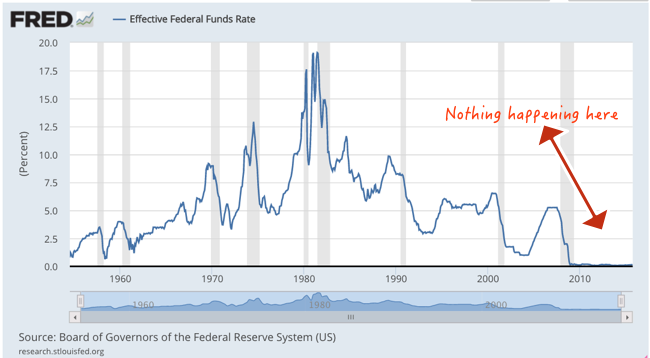

Stocks over the seas and far away, in New York, New York got a solid drubbing, selling off furiously into the close, the S&P 500 down 1.4 percent on the day, the nerds of NASDAQ down nearly a percent and a quarter, the blue chip Dow Jones Industrial Average the worst of the three, down nearly a percent and a half. Why? Anxieties around rising interest rates again. I am afraid that we are all going to just have to live with this, volatility into the Fed December meeting and what is now the inevitability of a rate hike. What makes this rate hike so unique is that the time from the first hike in the Greenspan era to now is a period of ten years. See this graph take from the St. Louis Fed, from 1954 to present.

If you are around 26-27 years old and you have been working in financial markets for your whole, yet short career, you would not have ever seen a rate hike. In fact, Ben Bernanke only ever had to hike rates once during his tenure. Do you see that last hike in September of 2006? That was Ben Bernanke, during his tenure as Fed chair. And from there until now, we have got used to the idea of a near zero rate world. I still maintain that the rate cycle at the top will be a "lower high". What to do with the pending Fed hikes and multiple Fed folks speaking? Nothing. Market participants with diverging time frames will act irrationally in the very short term, stay the course, stocks can fall ten percent in a short period of time as you saw in August/September, markets then recover thereafter.

Company corner

The other day we wrote about Tencent, you will recall this message, Tencent Q3 Numbers. In which I wrote: "... the Hong Kong Dollar market cap by the exchange rate (back to Rand) and you get a smidgen over 907 billion Rand. Ummmm. . . why is the Naspers market cap this morning, on opening just under 880 billion Rand? This implies that the local market gives Naspers a discount relative to the rest of their holdings and the rest of their assets, which includes a growing satellite TV business that is still growing strongly. Perhaps the best and cheapest way to own Tencent is through Naspers.

A reader of the newsletter, from one of the big four accounting firms put me in my place:

I'm not so sure about the logic of your reasoning about the valuation of Naspers with respect to Tencent. Naspers is not just equity funded, so the market cap is not a complete picture. Their latest financial statements (March 2015), indicate that they carried about R47b in debt. R27b of that covers the Tencent valuation shortfall, leaving R20b for the remainder of their businesses. This may be a low valuation (I don't know), but it is certainly not negative.

This is like saying that if you have R100 to invest, then borrow another R100 and invest the R200, you would have a net worth R200. Not really, your debtors would have a claim on half of the holdings. You, the equity holder would still only be worth R100.

Quite right. I replied: "The point I often make is that they have loads of other assets, including Multichoice which could be as much as 200 billion Rand, let us call it 150 billion Rand for comparison sake with their developed market peers. Their ecommerce business is growing revenues by 40 percent per annum, it is not too dissimilar to another global giant (Amazon) which still loses money as they expand their network, does one value this on a revenue only basis, stripping out investment spend (like Amazon)?

Tencent and Naspers are both listed, their share prices and by extension market capitalisation reflect the future earnings prospects, we can agree on that. Both sets of businesses have their respective assets and liabilities, Naspers have interest bearing liabilities of 37 billion Rand as of June 2015.

Surely the rest of the business, knowing what we know is not worth minus, including the liabilities (that are known). Perhaps I should have been more eloquent with my beef with the big discount, I often hear the asset management community tell everyone on the screens how Naspers is way too expensive. Certainly by earnings measurement, perhaps, certainly not in a sum of the parts, and their respective earnings."

To which the same reader replied:

I understand your point about Naspers trading at a discount and I don't disagree with that. I just think it is a bit dishonest to ignore the fact that Naspers is leveraged (albeit not very aggressively) when you make the point. We don't have to consider Tencent's debt, because we are really only interested in the value of Naspers' equity holdings, which the market cap gives us. Tick that. However, Naspers' market cap should reflect the value of it's assets (Tencent holding + all the other goodies) minus the value of its' long term debt and yes, I agree that this should reflect the future earnings prospects for its equity holders. My point is that simply comparing a company's market cap to the value of its assets (Tencent holdings in this particular case), while ignoring its debt, is a bit dodgy.

The point our accountant friend and reader was making is that my simple calculation of saying, hey, Naspers' stake in Tencent is worth more than their entire market cap is not the whole picture. My point is that you get the rest for free, including some sizeable businesses, and that means that Naspers still trades at a significant discount to the sum of the parts. This is what makes a market, two people who own the same stock, both of them, who have a different view on the valuation in its entirety. And sometimes these views are easier to put into context when one person says sell and other says buy. Keep the interactions coming, we love it!

Linkfest, lap it up

The numbers are in for singles day sales for Alibaba and they are huge! - Alibaba's Singles' Day shopping total was bigger than Facebook's revenue last year. This is another reminder of how the Chinese consumer is coming into their own and how online shopping is the way of the future.

Following on from our link yesterday about the really really expensive wine. It turns out that most people can't truly tell what the quality of a wine is. Even the pros gave different ratings to the same wine but in different bottles. It seems that when we think we are drinking expensive wine, our brain becomes more stimulated and voila, it tastes better - Expensive wine is for suckers

A big part of attracting investment and helping business thrive is to create certainty and protect property rights. In this case we are talking about space, where if you start mining an astroid you get property rights to it. I'm not sure anyone reading this message will be alive if/ when we start winning astroids but giving some form of certainty will speed up R&D to make this technology viable - Democrats and Republicans agree: If you can mine it in space, it's yours

Bill Ackman is a very smart man, he also seems to be involved with stocks that cause a stir. At the moment it is his stake in Valeant, who are known for buying drugs and then pushing up their prices - Ackman v. Berkshire: Whose Holdings Are More Immoral?. Here is what he said about Coca-Cola, "Coca-Cola has probably done more to create obesity and diabetes on a global basis than any other company in the world".

Home again, home again, jiggety-jog. Stocks across Asia are all softer, the late sell off on Wall Street means we all have to catch up today, there may be another bout of selling here today. Although, having said that, commodity prices still under pressure. The copper price is at a fresh recent low. Dr. Copper went to Gloucester, in a shower of sellers. He fuddled through a muddle, right up to his middle, And vowed never to own those again. Alas, loads of South Africans are up to their eyeballs in commodity stocks.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment