"Equally Benjamin Graham advocated avoiding companies with cyclical earnings, the troughs are too deep, the peaks are too high. To paraphrase blogger Cullen Roche, a bet on commodities is a bet against humanity. The whole idea is that we can continue to do more with less, going into the future. For the time being many commodity markets seem oversupplied and reluctant to cut volumes aggressively. We continue to avoid."

To market to market to buy a fat pig. Another day of heavy selling in the commodity stocks, it seems quite close to the capitulation trade. Amplats were down 8 percent, Anglo American themselves were down six and a half percent, Glencore were down nearly six, and this was in Rand terms. I checked the Amplats ADR price, since their ADR program started in January of 1999 the stock is down nearly 12 percent in Dollar terms. That is right, you have nearly 17 years of history and the stock has returned negative 12 percent. The S&P 500 is up 75 percent in that time, and there have been some pretty horrible patches in-between, the tech bubble, the financial crisis, two of the worst market events in the last generation.

I did notice that a couple of brokerage houses changed their recommendations from either sell to hold or hold to buy, anticipating that this might well be the bottom. Whether or not this means that there is going to be earnings momentum to propel the share prices higher from here, well, that remains to be seen. I would still suggest that there is a long road ahead, the share prices in some instances are suggesting a wipe out. And in some cases you have already been wiped out.

In May of 2008 when there was the previous market high, when commodity prices were driving the local market higher, Anglo American was around 540 Rand, in fact that was in June of 2008. The share price closed last evening at 94.18 Rand. That is about the lowest level in half a generation, again that is in Rand terms. In the London market, in Pound Sterling the price is down 45 percent from their listing date in mid June of 1999. That was round about the time that the Super 6's were taking place during the World Cup Cricket, and that (big sigh) tied semi final. We didn't lose, we tied. I don't want to talk about it. Lance Klusener was pretty amazing, winning 4 man of the matches in the 9 matches he took part in.

Notwithstanding the crash in the commodity stocks yesterday, just to show you how they have fallen from grace, the overall market was up two-thirds of a percent, as a collective the resource stocks were down over three and a half percent. It just goes to show you that our market has shifted significantly away from a market owned by the mining companies to one that is certainly not any more, all this has changed in the last ten years. And yet, many asset managers I see cling to the idea that you have to own mining stocks.

Legendary investor Bill Miller of the Legg Mason Value Trust fame, he beat the market regularly over many years, always ignored cyclical stocks including mining stocks. 15 years in fact he beat the market, that is some pretty mean feat if you think about it. Sam Peters has been running that fund since 2012. Equally Benjamin Graham advocated avoiding companies with cyclical earnings, the troughs are too deep, the peaks are too high. To paraphrase blogger Cullen Roche, a bet on commodities is a bet against humanity. The whole idea is that we can continue to do more with less, going into the future. For the time being many commodity markets seem oversupplied and reluctant to cut volumes aggressively. We continue to avoid.

There were excellent results from investment holding company Brait, Byron went to the presentation yesterday, I read through a magnificent analyst book when he got back, a really detailed booklet with all their operations across the globe. Virgin is interesting, their biggest asset is the New Look stores, they will roll that out sharply in France, Poland and China over the coming years. Their food assets are also interesting, I wonder what input Christo Wiese is putting in there, remembering that he is a significant shareholder of both Steinhoff and Brait, as well as Shoprite. We will have a detailed write up on Brait in the coming days.

Over the seas and far away, stocks on Wall Street closed off the session flat. At the beginning of the session in the lead into midday stocks were up sharply, around three quarters of a percent, sadly failing to hold onto the rally into the close. The energy sector sold off, dragging the broader market S&P 500 down with it. There were some bright spots, Walmart numbers were better than anticipated, the outlook less cloudy and the stock rallied hard, up three and a half percent. Year-to-date it has been ugly however, the stock is down 30 percent from the first trading day of the year, the broader market is about flat for the year, it has been horrible. Most of the divergence has come from the beginning of the year.

Don't feel too sorry for the Walton family however, they may have fallen down the ranking tables as the richest folks in the world, Walmart is still up 3308 percent over the last 30 years when compared to the 935 percent return that the S&P 500 has given. Over the last half a decade when compared to Costco, Target and the index, Walmart stock has been a poor investment, woefully underperforming the index and their peers. Also enjoying a rally was Home Depot, also robust sales chasing away the negative chill just starting to build, the "health" of the US consumer has been questioned lately. These strong numbers from major retailers will go some way to setting the scene for a Santa rally. Remembering as we pointed out that stocks in the US have been completely flat this year. Not moved. Unmoved. Going nowhere. Home Depot is up 20 percent, perhaps a whole lot of home improvements going on, you know, a person's home is his castle.

Company corner

The Mediclinic circular has been posted and if you are a shareholder of the stock you will have the opportunity to vote, the Mediclinic shareholders will vote mid December. I hope that you are all still around. The Al Noor shareholders will also vote on this, the NMC Health deal disappeared on Monday, they announced that they would not be pursuing the purchase of their Emirates rival. The Al Noor information does not appear (as we write) on their website yet, I will continue to monitor. Let us presume that all the shareholders on both sides vote yes (they probably will), the new Al Noor shares (that you will own in the ratio of 0.625 per Mediclinic share you currently own) will be listed on the 1st of February, next year. The business will then change its name to Mediclinic International PLC, and will have the main board listing in London, an inward secondary listing here in Jozi.

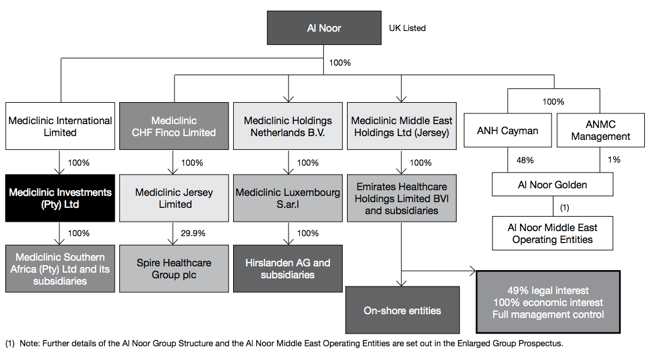

You can download the Scheme Circular from the Mediclinic Investor Relations page, it is 300 pages plus of legal work, investment banking work, company IR work, there are tons of contributors there. RMB and Morgan Stanley for their work on the scheme get 167 million Rand apiece, good work if you can get it. Slaughter and May in the UK get 85 million Rand, the whole scheme will cost 468 million Rand. I would say that it is at the end of the day, well worth it in the long run, if not balking at the price in the very short run. That is your money shareholders. This is an organogram of how the combined entity will look like:

I see Jersey, the Netherlands and the Cayman popping up there, all favourable tax destinations. I guess in this modern world, this is how businesses are structured. The question that private client shareholders are likely to ask is, what must I do with 300 pages of reading material? Nothing, if you are our client, we will elect on your behalf, the shares in the combined entity. Remembering that directors and more importantly, Remgro as the anchor shareholder (over 43 percent) have given irrevocable undertakings to vote in favour of the scheme. The shareholders currently are as follows:

We will watch and continue to advise on the transaction as it unfolds over the course of the next two and a half months, all the way into Valentines Day, when it is expected to be concluded. More or less then. Mediclinic, the combined entity will have access to global capital markets, they will then have access to cheaper funding in order to build what will no doubt be a bigger entity in a fragmented healthcare market. We continue to recommend the stock as a buy.

There was a Woolworths trading update released after the market closed last evening. This was for a 20 week period, the first of the current financial year and the lead into the stronger 6 week trading period to the day after Christmas. Group sales increased by nearly 18 percent, when compared to the comparable period in 2015, excluding David Jones group sales showed a more modest 11.7 percent increase. David Jones sales increased 12.2 percent in Aussie Dollars, Country Road sales down under (Aussie) and in the land of the long white cloud (Aotearoa or New Zealand) grew 14.2 percent. In Aussie Dollar terms. Most of that was as a result of space reallocated from other brands in David Jones stores, out with the old brands and in with the Woolies brands.

Locally food sales were up 11.7 percent, sales in comparable stores increased less than 5 percent. Store space continues to grow, up over 9 percent, that is most pleasing. Woolies food rocks, although you would have noticed serious shortages on the shelves recently, not so? Still, the selection is so grand and there is plenty to choose from. The clothing division grew sales by 12.1 percent with price movement (inflation, higher prices for your Woolies winter woolies) of over 6 percent. The results seem decent at face value if not a huge blow out, ready ahead of the biggest time of the year. Results are expected to be released in the first two weeks of February, we still continue to recommend this company as our number one retail holding for local accounts.

Linkfest, lap it up

This is taking social media to a whole new level! Not sure I would spend millions on a property that I have never seen - Chinese nationals are buying multi-million dollar US homes using the country's most popular instant messaging app. Next we could see people buying things using virtual reality glasses.

Josh Brown talks about being consistent as the best way of achieving long term superior gains. You only have to be slightly better than the average many times over to be way ahead of the average over a 10 year period. The result is that you will miss some flyers but you will also miss some stinkers! One of our main jobs is tear you clear of landmines - To be great, you must first learn to be good

Over the last few years, technology in renewable energy has made huge progress. The result is that it is becoming more cost effective to go green with the consequence that dirty energy is fast becoming a thing of the past. Not great long term prospects for coal prices - In Coal Setback, Rich Nations Agree to End Export Credits

It is always interesting to see how our knowledge base as a species is growing - Researchers just unearthed a lost island in the Aegean

Home again, home again, jiggety-jog. Jonah Lomu has passed away overnight. My favourite Lomu moment has to be running over (and not around) Mike Catt at the semi-final of the RWC in 1995. Catt tried in vain to tackle the human tank and failed -> Jonah Lomu in pictures. As an old varsity friend said, when you were bounced in a tackle, you got "Mike Catt'ed". Lomu changed rugby, whilst he never won a world cup he was the man who appeared on the early EA Rugby software, he was a superstar and apparently a really nice man off the field. He will be missed.

Stocks across Asia are mixed to lower, I suspect that the same will be the case here after the heroic rally on the part of the industrial stocks yesterday. Locally we do have CPI data, if inflation is looking benign for the time being, the Reserve Bank does not need to raise rates. And more to the point, growth rates are so anaemic, there is no need to raise rates. We will see!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment