"What is also very important to note is how much money the company is spending in their newer business segments that don't necessarily make money. They spend 37 percent of all development spend (3.5 billion Rand in the last half) on Etail, 31 percent of classifieds and 17 percent on other ecommerce ventures"

To market to market to buy a fat pig. Friday was the slowest day of the year for the US marketers, due to it being Thanksgiving weekend and Friday only being a half day on the the markets. If you went anywhere near a shop on Friday you would have seen chaos ensuing due to the "Black Friday" specials given by local retailers. Never let an opportunity for a good sale slip by. I remember last year there were a couple specials for local retailers and then this year my inbox was full of promotions and Twitter was covered with pictures of throngs of people braving long queues to get their hands on deeply discounted items. In the US, numbers showed that online sales were up 18% this year with 33% of the sales generated from mobile. The numbers are broken down further to show that 71% of those sales happened on iOS (Apple) and only 28% on Android. Given all that data, the consumer who's eyeballs you want are iPhone users.

The shopping is not over though, today is Cyber Monday. According to Wikipedia Cyber Monday originated in 2005 and was an attempt to push sales online. Due to a lack of size and scale, online stores were not able to offer the same specials as brick and mortar stores on Black Friday. Now however the likes of Amazon are bigger than most retail outlets and people tend to spread their shopping over a number of days due to more frequent specials for retailers.

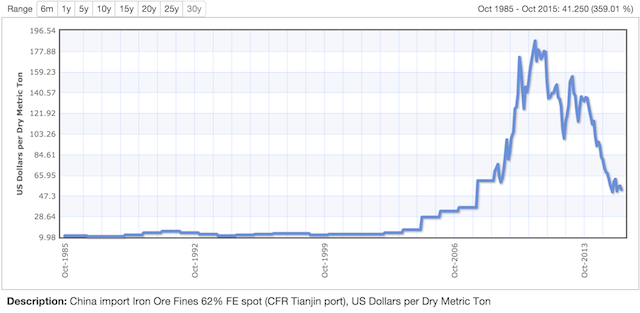

Looking here in Jozi, Jozi we were down on Friday with commodity stocks leading the charge lower. Anglo American down 5.3%, Glencore down 3.8% and BHP Billiton down 3.3%. Having a look at how BHP Billiton is trading in Aus this morning, it is down 3.6% at the moment so expect it to be down at the market open. Bloomberg were reporting this morning that the Iron Ore price was under further pressure this morning, which does not bode well for the likes of Kumba (Anglo American) and BHP Billiton. For a sense of perspective, here is the 30 year price graph for Iron Ore, thanks to Index Mundi. As you can seen, current prices are still much higher than they have been for the bulk of the last 30 years. So if you are buying commodity stocks because you feel they are at the bottom of the cycle, there may be some more pain in the near future.

Company corner

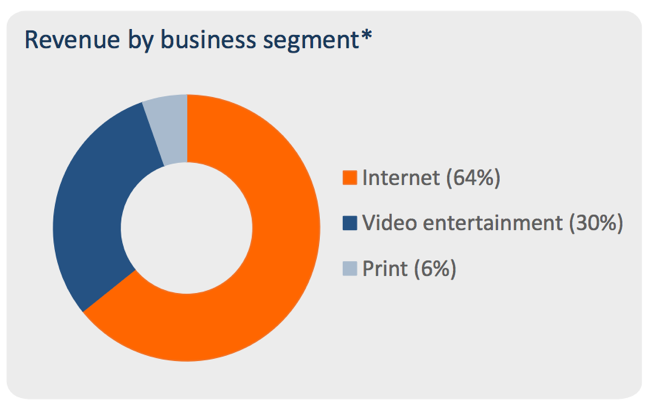

Naspers, one of our most widely and largest holdings across our client base reported their half year numbers on Friday afternoon at 4. Forget Thanksgiving and the half day in the US, forget that we are in festive season, at least for the office and school segment, this is Naspers time. If you were not there to see it, you missed out. Revenues for the half increased 24 percent to 74.29 billion Rand, trading profits increased 34 percent for the half, the metrics at face value look amazing. Core HEPS increased by 40 percent to 21.33 Rand, up from 15.28 Rand this time last year. Revenues have now grown at a compounded annual growth rate of 33 percent for the last four full financial years, it is pretty astonishing. Where are the revenues coming from? Here goes, a series of graphics from the investor presentation all through from segment, geography and then a further breakdown of revenues by type of activity.

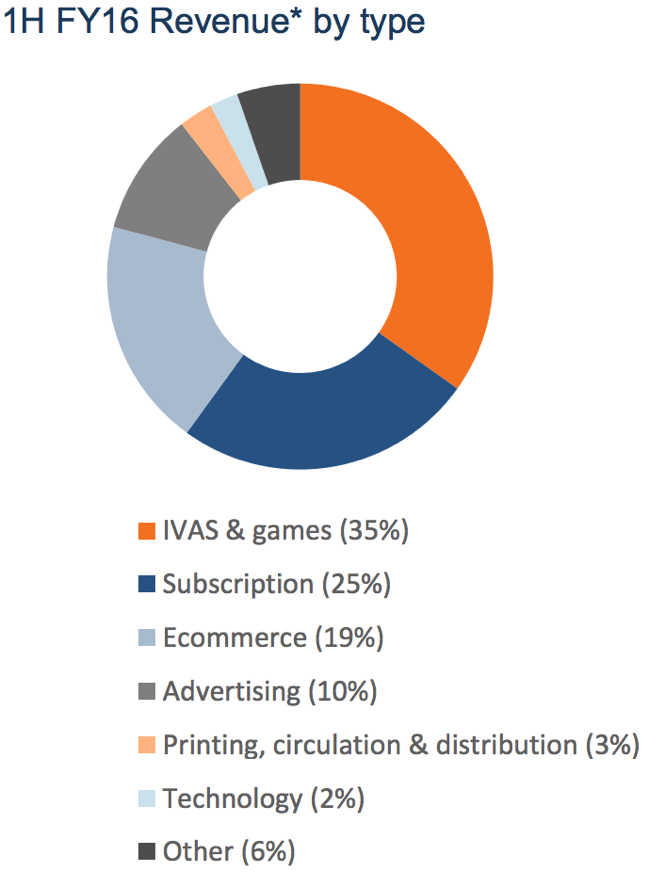

What is amazing to notice is that print has been left in the dust, it is becoming a smaller and smaller part of the overall business. It is now all internet and all video entertainment. Breaking down that even further, see the image below, you see the sticky subscription business is one quarter (your DSTV subscription is included in there).

What is IVAS and games? IVAS = internet value-added services. Which is related too your entertainment experience. Wikipedia has the value-added services as the following: "A value-added service (VAS) is a popular telecommunications industry term for non-core services, or in short, all services beyond standard voice calls and fax transmissions. However, it can be used in any service industry, for services available at little or no cost,[citation needed] to promote their primary business."

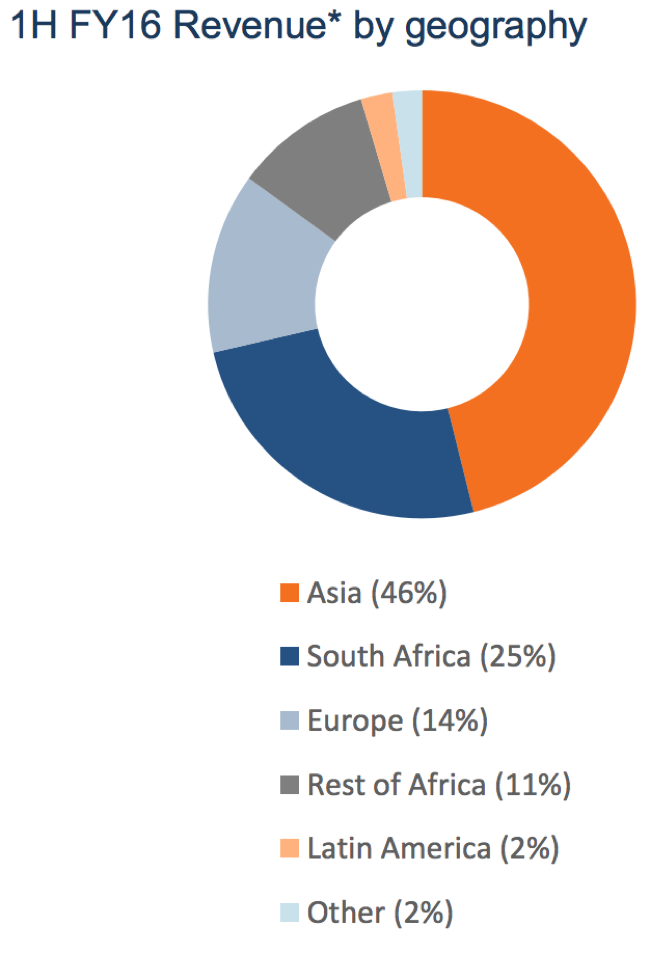

And then below, revenue by geography, obviously the picture is skewed towards Tencent, in other words Asia. And then here locally, the business is 25 percent South African. In other words, the prospects of the group will be determined by the fortunes of Tencent in the short term.

What is also very important to note is how much money the company is spending in their newer business segments that don't necessarily make money. They spend 37 percent of all development spend (3.5 billion Rand in the last half) on Etail, 31 percent of classifieds and 17 percent on other ecommerce ventures. Only three percent on print, whilst they realise that tv is changing, Michael at his new home only has Showmax. No sport. Ag shame. Video entertainment constitutes 12 percent of all development spend.

I think that the reason why the stock may have sold off on Friday, after this earnings announcement is twofold. One, the share price has obviously been on a tear since the Tencent results, as well as the trading update, both those two events were favourably received and perhaps a little wind out of the sails after the announcement. Secondly, and perhaps more of the reason, was that the company announced that they were going to be thinking about a 2.5 billion Dollar capital raise, dates as of yet unknown. In part to use for the purchase of part of Avito, 1.2 billion Dollars of that. Avito is the leading classifieds website in Russia, a bold move in itself, things are hardly "settled" there.

Why own this business? It has so many moving parts, as well as being nearly completely correlated to a single business, and that obvious share price, Tencent. I noticed the shift to the internet even over the weekend, the so called Black Friday sales in the US. Traditional old school retailer Walmart did the unthinkable, shifting discounts to their website, even before their doors had opened. We are continuing to move more and more to an online platform for entertainment, classifieds, shopping, news and all sorts and increasingly more so on our mobile phones. I think that you just have to learn to live with the volatility of the newer business segments, that continue to burn cash at heavy rates, those are going to be the businesses that compete at a global level with the likes of Amazon, just not in the english speaking world. We continue to recommend Naspers, even at these elevated levels (there will be a PE unwind in the coming years) as a core part of your portfolio.

Linkfest, lap it up

Amazon have used their newest star, Clarkson to walk us through what using drones to deliver packagers would look like - Amazon Prime Air. It would be great to have packagers delivered in under 30min, the first step though is for Amazon to get regulatory approval in the US.

For paper producers, the big shift in the industry is towards Cellulose. Cellulose Nanofiber is 5 times stronger than steel and a fraction of the weight, so you can see the huge potential for this technology. For now its first commercial use is to reduce the odour's in adult nappies - Nippon Paper Sets Nanofiber Diapers as Path to Boost Growth

If this technology works, it will be a game changer for any device using batteries. One of the biggest benefits will be to the electric car market, being able to charge your car in a fraction of the current time will make them more practical - New chip will charge your phone in under 10 minutes.

Lower oil prices means more money in the consumers pocket - Consumer Spending Rises Less Than Forecast as Americans Save. Saving hurts the retailers in the short run but it creates a stronger base for the future which should result in more spending.

Home again, home again, jiggety-jog. The week ahead holds the start of December and the start of holiday mode for most in South Africa. For the markets it jobs week, where we get the ADP number on Thursday and then the big number on Friday from the US labor department, the employment report. Will employment numbers improve or get worse? How does that effect what the FED will do in their next meeting? No doubt it will be a market moving number and expect the Rand to react.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment