"Byron went to the presentation, he was pretty impressed, the company brought all their company heads in an epic company presentation. The investment company has been exceptionally busy over the last year to year and a half, this period was especially busy. Having sold the Steinhoff shares, and other investments, having raised a lot of money in a convertible bond issuance, the company has proceeded to add to their Icelandic Food business, as well as bed down some of their recent big transactions."

To market to market to buy a fat pig. Markets closed better Friday, both locally and in New York. It was a mixed bag here, again at the top of the leaderboard was Tiger Brands, the follow through from their results indicating that the broader market have stuck their seal of approval on this. Elsewhere a huge bounce from Mr. Price, that stock was down sharply during the course of the week after the results, the Friday session indicated that the buyers had definitely stepped up to the plate, the stock up a whopping 8.7 percent.

The price is still comfortably off the April highs of around 280 Rand, a long road back. Still, I think that the quality of the company will prevail, that fast fashion segment is great. I might buy clothes to last and make sure that I get value for money, many view clothes as a wear for a while item, and then recycle quickly. Talking of clothes and a little off the topic, I read a Fast Company article titled: What's with all the yoga pants? Mr. Price of course has their own ath-leisure brand and have started rolling out their own sports stores. As you can see, athletic wear as a fashion item is huge, people wear sports shirts, pants, tights and so on as every day wear. Comfort for starters, more people partaking in multiple sporting events too, the size and scale of mainstream races is extraordinary.

We closed higher in the last little bit here on Friday, the Jozi all share ending the day one quarter of a percent better than where we started. Across the seas and far away in New York, New York, markets closed off their highs, still managing decent gains on the day. The Dow Jones added just over half a percent, the broader market S&P 500 added 0.38 percent by the close and the nerds of NASDAQ up 0.62 percent on the day. It has been a tough old year for stocks in general, the S&P 500 is up only one and a half percent.

Mind you, we are a world away from those August lows and the washout then, having recovered sharply (a reminder to always be in and not be out). Over five years the S&P 500 has delivered returns of 74 percent pre the dividend, and to be fair, most of the chattering classes have not given this rally much credence, being conditioned to "bad events". And now we are staring at the first rate hike in an absolute age, the anxiety seems to have evaporated a little. The Fed are raising rates as they think the timing is right, the US economy is strong enough and global risks are not as pronounced now as they were earlier in the northern hemisphere summer.

The deal on the cards this morning that will capture much of the attention (as well as the Brussels shutdown) is the news, according to the WSJ that Pfizer, Allergan Agree on Historic Merger Deal. This will make the largest drug manufacturer on the planet. 11.3 Pfizer shares for each and every Allergan share, and a small cash portion too, according to the article that always cites the loudmouth "people familiar with the situation". Most importantly however for US tax authorities, as this is a reverse take-over, the HQ will head to more tax efficient Dublin, this would represent the biggest ever tax inversion in history. I think that the US really needs to be more competitive on the corporate tax front, more and more of these mega-deals will happen and that will be to the gain of the Irish. Who are just there, they just need to turn up.

Why is this a big deal? The 150 billion Dollar deal (Allergen to essentially be acquired by Pfizer) will comfortably eclipse the AB InBev acquisition of SABMiller, that deal is 105.6 billion Dollars big. Is it really a chance for Pfizer to acquire aesthetic therapies in an area they have been lagging, or is it a chance for Pfizer to maintain their presence as numero uno, either way if the deal goes ahead it sends a clear signal that the pharma world continues to remain acquisitive. Anything relatively cheap, anything with a great product pipeline will be an acquisition target. As the article points out, the Allergen product range would become global now with the Pfizer distribution mechanisms. Either way you look at this deal, in the medium to long term it seems good for both sets of shareholders. There may be some big regulatory hurdles to clear, as they say in the classics, "a deal is not a deal until the money is in the till".

Company corner

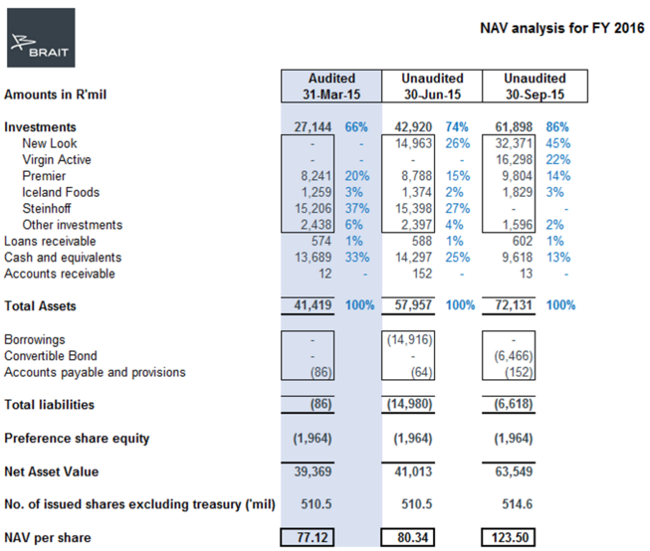

Brait released their results last week, this was for their six months to end September. Byron went to the presentation, he was pretty impressed, the company brought all their company heads in an epic company presentation. The investment company has been exceptionally busy over the last year to year and a half, this period was especially busy. Having sold the Steinhoff shares, and other investments, having raised a lot of money in a convertible bond issuance, the company has proceeded to add to their Icelandic Food business, as well as bed down some of their recent big transactions. For a quick look at how many moving parts there have been over that time, here is a snapshot of their NAV analysis for 2016, as at the end of the six month period:

You can see that quite simply, in descending order their most important assets are clothing group New Look (45 percent of NAV), health business Virgin Active (they own 78 percent) and this represents 22 percent of the overall NAV, and then their almost all of Premier Foods (management own the rest) equates to 14 percent. The rest of the NAV is made up of Icelandic Foods, 3 percent, and then cash and cash equivalents at 13 percent. The company can only report the values of these businesses when comparing them to their market peer grouping. This is not so simple, as Virgin Active has no real peer in their space.

Their biggest asset, UK based New Look however does have a peer grouping, comparable to H&M (stupid queues at lines at the recently opened Sandton store I am told), Inditex (you would know them as Zara, their flagship brand), as well as the likes of Marks & Spencers and Next. Locally the company is comparable to Mr. Price. As we mentioned, it is not easy to find a peer grouping for Virgin Active, the company is at pains to point this out. Either way, they discount both New Look and Virgin Active to their peer grouping , applying a ten percent discount to New Look and 20 percent to Virgin Active, even more on the spot prices of the listed entities, 13 to 24 percent respectively. Which may explain why the shareholders are willing to apply a premium to the reported NAV, as that is at a discount. Isn't this just the market being efficient and closing the gap?

So why would you want to own this company? The management has shown that they can certainly sniff out the best deals at the right price, sweat those for a period of time and either on-sell them or grow them into larger entities. The recent convertible bond issuance also shows a certain maturity, they have become the first company (to their knowledge) who are able to raise money in this fashion without a main listing in Europe. We recommend again that clients own this stock as a core holding, there are certainly some crossovers with Tiger and Premier, Woolies and New Look, the Virgin Active is exciting and has very little comparable, you could argue that the Discovery Vitality (and white labelling of the product) is comparable. A great business, well run, and whilst it seems like a significant premium to pay, we are comfortable based on the discounted value applied by management.

Linkfest, lap it up

If I had to ask you what was the best performing stock of the last 34 years, I doubt Home Depot would make your top guesses - The Best Performing Stock for the Past 34 Years Will Surprise You. The main thing to note is that the stock had a 71% pull back going into this millennium and then another 50% pull back in 2008, sticking to your guns over the long run is an important strategy to stick to. Sticking to your guns with a stock that is going to zero on the other hand is a problem. The hard part is to know which stock you are holding.

The group of countries that we have been grouped with, BRICs, is on its way out. Here is a look at how quickly things changed in Brazil - Brazilian waxing and waning.

When it comes to what we eat things tend to be a bit more sensitive. In the case of Salmon, the wild reserves are greatly over fished. Here is one of the solutions - U.S. clears genetically modified salmon for human consumption. Would you eat genetically modified fish? What about eating it and not knowing because it is not labeled? We already eat genetically modified fruit and vegetables and there is very little backlash from the consumer. The shift to eating GM food will probably just be another change in our food that people don't notice.

Home again, home again, jiggety-jog. The centre right folks took over in Argentina, beating the lefties. There is a long way to go to liberalise that economy, I must say that I am pleased that this is happening. The socialists did an enormous amount of damage, so much so that the Dollar is king and gets twice as much buying power in cold hard cash relative to the card swipes, that is just nuts. Brussels is in shutdown mode, this is a new world and we will have to become used to it. Expect selling on the commodities front, the oil glut is now front and centre with idle ships visible.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

I will recommend anyone looking for Business loan to Le_Meridian they helped me with Four Million USD loan to startup my Quilting business and it's was fast When obtaining a loan from them it was surprising at how easy they were to work with. They can finance up to the amount of $500,000,000.000 (Five Hundred Million Dollars) in any region of the world as long as there 1.9% ROI can be guaranteed on the projects.The process was fast and secure. It was definitely a positive experience.Avoid scammers on here and contact Le_Meridian Funding Service On. lfdsloans@lemeridianfds.com / lfdsloans@outlook.com. WhatsApp...+ 19893943740. if you looking for business loan.

ReplyDelete