"Their platforms account for one in five minutes spent on mobile phones in the US, that means there is still scope for growth. And what is amazing is that there are only 2.5 million active advertisers on Facebook, whilst 45 million small to medium businesses have pages. Those people may start advertising a little more aggressively, once they are comfortable with spending the money in order to grow their businesses on an alternative platform. I think that there will definitely be a marked shift, younger generations are more receptive to newer platforms."

To market to market to buy a fat pig. Stocks locally rose a percent, although at one stage it was a great deal better, reaching for record territory. The ghosts of late August seem to have been exorcised, another reminder of why you should always stay the course when there is a wobble. Of course much can change with a company that you are invested in, we were checking out Lonmin and the train wreck that is unfortunately their share price yesterday. Remembering that Xstrata tried to buy this business, back in August 2008, for a monster 43 odd percent premium at 33 pounds a share, that was the offer from Xstrata. 6 August 2008. Fast forward to present day, the share price in London is 23.25 pence a share. Since August 22nd 2008 the share price is down 99.33 percent. That is an absolute shocker.

And what did the release say, back then rebuffing the Xstrata advances? Here goes, from the management of Lonmin: "Therefore, the Board has no hesitation in rejecting Xstrata's entirely unsatisfactory approach which fails to reflect a proper value for the assets and prospects of Lonmin and the synergies from which Xstrata's rather than Lonmin's shareholders would benefit. We continue to explore all options to maximise value for our shareholders." Thanks for that chaps, and your awesomeness, since then the share price has proceeded to basically lose their entire value. Everything. So much for looking to maximise the value for their shareholders. In the midst of any sort of deal, make up your own mind and of course make your own decisions based on any offer price. It is a very stark reminder of how and why you must think for yourself. The business may yet in its current form cease to exist if they do not raise the money.

MTN continued to make headway yesterday, the stock was up sharply, it is lower this morning. And again, there is an absence of any concrete news, once we know anything and have anything for clients we will communicate. In the interim, sit tight, again we want to stress that doing nothing is actually doing something. When you are doing nothing, you are not selling any shares, that counts as making a decision. As my cricket coach (he was also my headmaster) and admirer of Geoff Boycott always used to say, sometimes the best shot is no shot at all. Warren Buffet's baseball analogy would be more well suited to test cricket, of which there is heaps of on the go right now, Kagiso Rabada, a fine Joburg chap has taken his first test wicket, which is wonderful news.

US markets closed out the session lower, stocks were down around one quarter of a percent, blue chips that is, the nerds of NASDAQ closed nearly flat. The broader market ended around one quarter of a percent off. Tesla had a great session, that stock was up 11 percent. As a collective, energy stocks hit the skids, down over a percent as the oil price slid after a recent rally. The ADP jobs report looked like a marginal beat, this is the precursor to the big jobs number tomorrow. That will, as ever, be the most important release since the last one.

Company corner

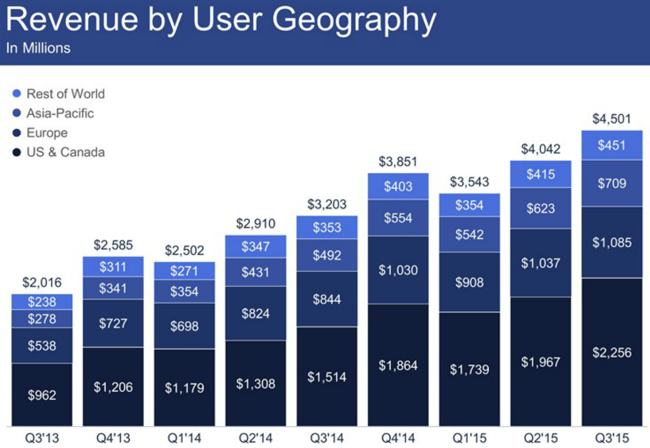

Facebook reported numbers post the market close last evening, this was for their third quarter to end September. Highlights include crossing the billion daily active user mark for the first time ever, a 17 percent increase over this time last year, of which 894 million are on their mobile phones (27 percent increase year-over-year), monthly active users are 1.545 billion (1.385 billion on their mobiles, 1 billion on Android phones). And you and I can remember a time when the chattering classes were worried about Facebook being able to monetise mobile, remember that and the "disastrous listing"? Quarterly revenues grew to 4.5 billion Dollars, a record quarter for the company, the lions share of that (4.299 billion Dollars) being advertising. Revenues across all of their geographies grew strongly, when measured against the comparative quarter, take a look at this slide from their presentation:

Having said that though, 73 percent of their revenues still come from the developed world, the US & Canada, and Europe. Potential exists across their other geographies, including Europe, where the average revenues per user (ARPUs) is one-third of that of the US. See slide number 12 of the Facebook Q3 2015 Earnings conference call and slides. Across the rest of the world ARPUs are less than one-tenth of the US. Much scope to grow still.

As well as being a record revenue quarter, it was equally a record income quarter. Non-GAAP operating income registered 2.41 billion Dollars, net income was 1.628 billion Dollars, operating margins were steady at 54 percent. Non-GAAP diluted earnings per share clocked 57 cents, again, a quarterly record. And all these quarterly records ahead of what is their best quarter, the final one in the lead into the festive season. The company continues to spend heavily, in the last quarter the company invested 780 million Dollars, compared to 1.36 billion for the whole of 2013 and 1.83 billion in 2014. In other words, what I am trying to show is that they are spending more and more on their infrastructure. And they need to keep improving their infrastructure, the number of daily video views since 6 months ago has doubled to 8 billion. That is pretty heavy, and the shift to video has been quicker than I thought it would be.

Some other interesting factoids from the Earnings Call Transcript, from Mark Zuckerberg. WhatsApp reached 900 million users, The Zuck suggested of course that it is a matter of time before they reach one billion on that platform too. Messenger, their other app has now 700 million active monthly users, 9.5 billion photos are shared monthly over that platform. Instagram, the other major platform has 400 million users and around 80 million photos are shared a day. I love Instagram, what an amazing platform.

Oculus makes progress too, the full version will be shipped next year (the Rift), the Gear VR (VR stands for virtual reality), which is a partnership mobile product with Samsung is set to be released this holiday season. Here it is, if you want to check it out: Gear VR. As the CFO said on the conference call however: "But VR is still very much in the development stage. So it would be early to be talking about large shipment volumes." Early days for virtual reality. Of course the options are endless, watching sports matches, going to the theatre, amongst many other entertaining activities.

Their platforms account for one in five minutes spent on mobile phones in the US, that means there is still scope for growth. And what is amazing is that there are only 2.5 million active advertisers on Facebook, whilst 45 million small to medium businesses have pages. Those people may start advertising a little more aggressively, once they are comfortable with spending the money in order to grow their businesses on an alternative platform. I think that there will definitely be a marked shift, younger generations are more receptive to newer platforms.

Earnings for this year are expected to be in the range of 2.10 to 2.20, and then with expectations of a 30 percent lift next year, will be in the range of 2.70 to 2.80. Remember that they IPO'ed at 38 Dollars a share back in May 2012. If you had said back then, that you could buy the shares at the IPO on 2016 earnings multiple of a mere 14 times. Yet back then, the company was overvalued, and when they could not monetise mobile (that was the perception), the share price fell to 18 Dollars three years ago. Last evening the stock traded in the aftermarket at nearly 108 Dollars. We continue to recommend the company as a buy.

Linkfest, lap it up

It is staggering to think that in the next 5 years, it is forecast that there will be 34 billion devices connected to the internet. That works out to a little more than 4 devices per person on the planet but if you consider that there are still around 4 billion people who don't have access to the internet, it would mean that most people will have 10 - 11 devices connected to the internet - The Internet of Things report 2015: Examining how the IoT will affect the world.

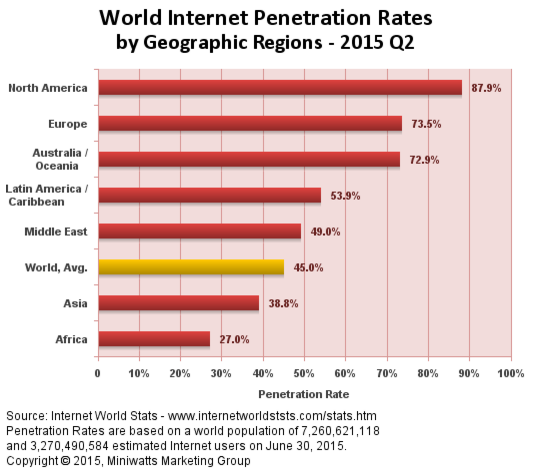

Have a look at what current internet penetration numbers look like. The biggest leveller in modern society is access to the internet and all the information that goes along with it. It is clear that Africa needs to do more to connect its' people to the internet and MTN are a big player in doing so.

The negative health impacts from sugar seem to be a big trend at the moment - Sugar has caused a global public health crisis and should be regulated like tobacco. An aspect of tobacco and sugar that is not often thought about, is the amount of farm land that those two crops take up.

It has been a good 7 years for the stock market in general, with a few bumps along the way that have created good buying opportunities - A Bull Market Built on Endless Financial Crisis Fears. The lines which stood out to me in the article were "The thing is, stocks don't rise just because the economy is getting better. They often rise just because the economy is getting better relative to expectations."

Home again, home again, jiggety-jog. Stocks are trading lower at the beginning here. Gold and platinum stocks are taking a little heat, perhaps that jobs number tomorrow will lend a hand to the metal price, as more Fed watchers decide what they think the Fed is going to do. That is not the way to go about buying shares and investing, then again, every single stock market entrant has the same objective and different time frames and styles.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment