"If you apply a PEG ratio (Price to earnings over growth rates), then the stock trades on 1.09 times PEG next year, and 0.9 times 2017. And by that metric the stock is still cheap, the high PE (not so high any more) justified as a result of the growth rates. We maintain our buy on Tencent, the only way being through Naspers locally. Given the discount applied by us geniuses here (we are obviously smarter than Hong Kong investors), it provides an opportunity to accumulate the stock. Our house view is that Naspers still has plenty of scope to reward shareholders in the coming years."

To market to market to buy a fat pig. Stocks made a sharp comeback in New York, the broader market was down over four-tenths at one point, and managed to close marginally (about one-eighth) in the green by the close. Basic materials dragged stocks lower, technology shares were also weaker. Why? Some reports, a specific one in fact done by Credit Suisse on the Apple supply chains that saw weakness in orders in the coming quarter.

The analyst from that firm cut his iPhone target by around ten percent, the market was not kind to the stock, down over three percent in the ordinary session and lower after-hours again to settle a little above 116 Dollars a share. The stock is up nearly 6 percent this year, and although disappointing (off the 134 Dollar highs from February), the stock has outperformed the broader market. Roughly 31 cents of each Dollar market cap is cash only, even if the Credit Suisse analyst suggested 9.8 Dollars of earnings for next year, the stock trades (minus the cash) on less than 10 times forward earnings. For a company that has the ability to grow their market share, release new consumer must have products, this still sounds very cheap to me!

On the local front Lonmin was beaten to a pulp again. Having seen the massive dilution pending, perhaps shareholders who hung in there hoping for a turnaround have thrown in the towel. And this would be after having gone fifty rounds with a tag team consisting of Ali, Foreman and Tyson. No more, white flag time. With the rights issue priced at one pence, the stock in London was crushed to 10.3 pence, locally we fared worse in percentage terms, the stock was down an unbelievable 33.44 percent to 217 ZA cents. It is difficult to believe that the 52 week high is around 35 Rand a share.

It wasn't only Lonmin, someone quipped on the wireless that Anglo American in Dollar terms fell to their lowest levels since the 1970's. Since the stock listed in London in the middle of 1999 it is down 37.6 percent. Giants fall, just ask Jack (from the beanstalk story), the stock now occupies 14th on the ranking tables, just above Barclays Africa and Aspen, who are not really that far away for overtaking the company by market value.

And the other evening, in the Hot Stocks show, Paul had guest Wayne McCurrie, from Momentum Asset Management, and they were all cold on the diversified miners. Scrambling on all fronts, the iron ore price still seen sinking, platinum could be sorted for Anglo if Lonmin fell by the wayside. Although you would think that the political will to keep Lonmin up and running (and 30 odd thousand jobs intact) is stronger than the smell of mothballs. And diamonds may still be a girls best friend, they may not be an investors best friend, demand has waned a little, prices have fallen. Avoid them all, still at these depressed levels.

The local market was weighed on heavily by the resource stocks, which closed as a collective down 3 and one quarter of a percent, the whole market was down one and a half percent by the time the bell rang. Coronation had results that looked good at face value, the dividend paid out was nearly 100 percent of earnings, going ahead the company committed to pay out roughly 75 percent of earnings by way of a dividend. Perhaps this is peak earnings for the time being, the market has clawed back their expectations of the company and justifiably so, it was revealed in a muted outlook commentary. Still, they manage 610 billion Rand, and will continue to attract inflows from all quarters, the provisor is that performance remains.

Company corner

Tencent reported numbers yesterday. So what, why should we care? Well, last I checked, the Naspers ownership of Tencent was 33.85 percent. Which is a lot, to own of any company. Under the guidance of Koos Bekker, the company got involved in the early stages of Tencent's development. Naspers actually turned 100 years old this year, it is a far cry from the company that it once was, with the legacy print businesses a thing of the past. They really are, what the attraction is? I can’t seem to see it, when last did you see anyone under the age of 25 reading anything other than on their mobile phone? Yip, me neither, and those are the consumers of tomorrow.

Quick Tencent calc, as to see how much the value is worth to Naspers. Tencent market cap is currently 1.46 trillion Hong Kong Dollars, Naspers share is 33.85, multiply the two by one another and you get to roughly 494 billion Hong Kong Dollars. The inter-webs, or more specifically, Google, tells me that one Hong Kong Dollar is equal to 1.84 Rand this morning. Multiply the Hong Kong Dollar market cap by the exchange rate (back to Rand) and you get a smidgen over 907 billion Rand. Ummmm. . . why is the Naspers market cap this morning, on opening just under 880 billion Rand? This implies that the local market gives Naspers a discount relative to the rest of their holdings and the rest of their assets, which includes a growing satellite TV business that is still growing strongly. Perhaps the best and cheapest way to own Tencent is through Naspers.

Let us quickly look at the Tencent results, for their third quarter. As we often point out, they may report in Renminbi, the stock however trades in Hong Kong Dollars, not too dissimilar to Richemont I guess, which reports in Euros, yet the stock trades in Swiss Francs. Group revenues increased 24 percent, to 4.18 billion Dollars (26.5 billion RMB), profits for the period were 1.192 billion Dollars. A quarter, that is right! This machine that is Tencent, makes in profits more than 1 billion Dollars a quarter, and grew profits by 34 percent. Basic earnings were 0.8 RMB, which converts to 0.97 Hong Kong Dollars.

So what multiple do you pay for a company that is growing profits by 30 odd percent? Let us get to that in a second, first things first, how did the business do? Online revenues doubled in a single year. Astonishing. There are now 200 million credit cards linked to their mobile payment systems via the QQ Wallet and Weixin Pay services. Online gaming revenues increased 27 percent, mostly as a result of strong mobile gaming. That is right, you wondered if people were reading the news on their smartphones, wrong, they were engaged and engrossed in Candy Crush, or Angry Birds (I am a little out of date here, bear with me). Astonishing number of users, I guess China is that big. Monthly Active User accounts (is that different from individual users?) clocked 860 million, I guess that reaches a ceiling at some stage. Of those, 639 million connected through their mobile phones. Do you see the similarities here with Facebook?

OK, let us answer that question, what are they likely to earn for the full year this year, and what are they likely to earn next year? Consensus for this year is around 4.2 Hong Kong Dollars, and next year it is 5.6 Dong Kong Dollars, looking towards 2017 the far out there analysts have penciled around 7.3 Hong Kong Dollars in earnings. So currently the stock at 153 Hong Kong Dollars (up two percent plus this morning) trades on a multiple of 36.4 times Current Year estimates, 27.3 times next years earnings and checking the clock two years out at 20.9 times. Almost anything could happen between now and then of course, I just wanted to show the growth rates that the analysts have penciled in sees a quick "PE unwind".

If you apply a PEG ratio (Price to earnings over growth rates), then the stock trades on 1.09 times PEG next year, and 0.9 times 2017. And by that metric the stock is still cheap, the high PE (not so high any more) justified as a result of the growth rates. We maintain our buy on Tencent, the only way being through Naspers locally. Given the discount applied by us geniuses here (we are obviously smarter than Hong Kong investors), it provides an opportunity to accumulate the stock. Our house view is that Naspers still has plenty of scope to reward shareholders in the coming years.

Priceline.com had results the other evening, the market was far from kind to the stock, sending it down by around 9 percent in a single session. It certainly was not as if the results themselves were bad, they were not. First, before we being reviewing those results, what is Priceline and what do they do? Quite simply, through their operating and ownership of brands you know such as Booking.com, priceline.com itself, agoda.com, KAYAK, OpenTable (book your restaurant table) and rentalcars.com they are the biggest provider of online travel and services on the planet.

That is right, the company has a market capitalisation of 66 billion Dollars, quarterly sales in excess of 3.1 billion Dollars, have served 1 billion guests since the inception of the business in 1998. They represent 820 thousand unique properties, which in turn have 21 million bookable rooms, last year alone 285 million people booked through their platforms. And as they point out, 70 percent of the properties that you can book are beyond the "traditional hotel". They can tell what patterns their customers follow, most booked boat holidays are for instance in Sweden, for bed and breakfasts it is Italy, Spain for guest houses, the United Kingdom unsurprisingly for hostel and inn bookings, whilst the US has the highest percentage of vanilla hotel bookings.

That said about the percentage of bookable properties, of the 21 million odd bookable beds, 14.4 million still fit in the hotel rooms category, with vacation home rooms covering 1.8 million. Other unique places to stay fall into 4.8 million "rooms", which includes, as the company points out rustic tents in South Africa (we get a mention), igloos in Lapland, a treehouse in Costa Rica and caves in Turkey. Fancy yourself as a globetrotter? Through the platforms you can find hotels in 214 countries, vacation rentals in 197 and "other types" (including caves, treehouses, tents and igloos) in 208 countries. Interesting that their bookings reveal that self-catering and unique properties continue to grow in popularity, meaning people are looking off the traditional and beaten track. Immersing themselves in experiences rather than physical and material "things".

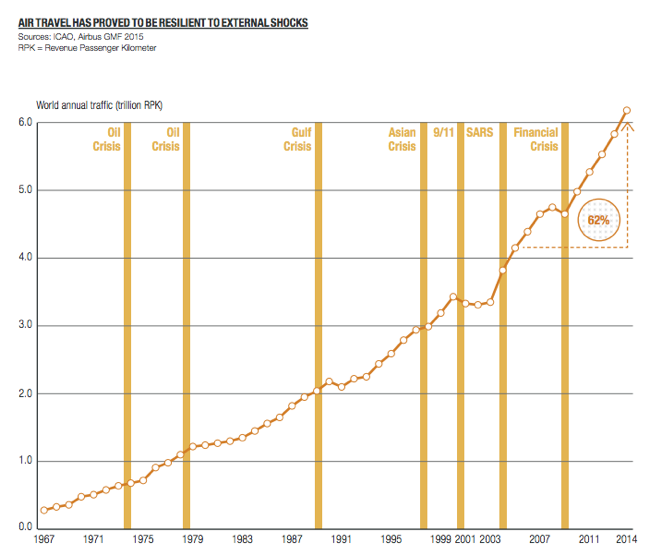

There were 3.2 billion bums on aircraft seats last year (2014), for both business and tourism purposes, both Airbus and Boeing have pretty aggressive forecasts for plane numbers over the next twenty years. There are some stronger zones than others, for instance the number of Chinese flying to the US in-between 2009 to 2012 increased threefold. Easier to travel, richer consumers looking for different experiences. With populations set to grow to 9.5 billion by 2050, and with two-thirds of them living in urban areas, the scope for richer consumers travelling more is heightened. Airbus predict that air traffic will double in the next 15 years, more air travel means more places needed to stay on the other side. Equally, check out from this Airbus on how robust air travel is in the face of some pretty horrid events over the last 45 odd years:

I think that the best thing about the platforms is that real guests can review the place after the stay, during the stay and that helps establishments keep up their standards and equally attract more guests over time. If you are searching by stars, you get the best possible option for the price that you are willing to pay. The company earns its money via a commission structure whilst they facilitate the reservations (from cruises, to cars, to accommodation), as well as for other services of flights, holiday packages and rental cars. They are the platform and the facilitator, hence they are the people who keep a small slice of the pie when there are transaction fees.

It is a very competitive space, competition includes the likes of Expedia (Hotels.com and Travelocity are the brands you will be familiar with), Orbitz (which is about to be owned by Expedia), Airbnb, HomeAway, TripAdvisor (they have a partnership with them), and then of course the traditional and older models of providers. Lets not forget the good old fashioned travel agent who does all the booking for you. These platforms I am afraid are replacing all the traditional platforms, new jobs and more efficient jobs.

Q3 numbers were pretty good, gross bookings swelled to 14.8 billion Dollars, up 22 percent, that was without dollar headwinds. Including the stronger Dollar, a less impressive 6.9 percent growth year over year. Earnings for the quarter were 25.35 Dollars per share (the share price is at 1323 Dollars a share), the main disappointment was that guidance for the next quarter was weak. Total bookings in Dollar terms set to be up only 1 to 8 percent (in constant currencies it is 13-20 percent), you can see how the currencies are weighing on earnings. Of course that changes in time. Earnings for the full year is expected to be in the region of 49 Dollars, and next year the analyst community is modelling as much as 63 Dollars a share, I have seen estimates as high as 69 Dollars. Which means that for a growth company the stock trades on a very undemanding multiple, relative of course to the growth. In fact, the PEG ratio is less than 1. We initiate Priceline with a buy, this is great business with great growth prospects.

Linkfest, lap it up

We get calls and emails (thankfully not many) from clients who are worried that the stock market is going to halve from here, there is obviously loads of information on the internet designed to hook you and pull you in. As this piece points out, it is more likely to double, most likely to do something in-between however. There's only a 4% chance we're in a stock market bubble. Your investing mantra should be, keep adding and accumulating.

As technology evolves and the sharing economy rises there will be winners and loses. The rise of Airbnb means that hotels are starting to feel the pinch but other industries have popped up to support Airbnb, like key swapping services - The Rise of Airbnb's Full-Time Landlords. Now that Airbnb makes it cheaper to travel, it means that more people will be traveling which is great for local tourist industries.

Moving from one disrupt technology to another. Uber and Wesbank are moving to help Uber drivers branch out and be their own boss - Uber, Wesbank in R200m car rental deal

The reason that Uber and Airbnb are doing so well and are so disruptive to the old way of doing things is that they have found ways to harness idle resources. In the case of Airbnb, your idle resource is your spare room. The more efficient we are, the cheaper things become and humanity at a macro level is better off. Here is a way to harness your cell phones computing power while it is idle - Your smartphone could contribute to cancer research while you sleep. This is a great idea!

It is singles day in China today(11/11 - all the singles) it is basically an anti-valentines day with huge online specials - Alibaba's Singles' Day generates $3.9 billion in GMV in first hour. One of the best US shows in China is House of Cards, so Frank Underwood the main character got in on the action - Watch Frank Underwood tell Chinese shoppers to buy burner phones in this "Singles Day" ad

Home again, home again, jiggety-jog. Markets are marginally better today, just ever so much. Poor singles, sitting online and shopping, eating chocolate ice cream and wishing that you had a boyfriend/girlfriend/wife/husband. Whilst you are getting there, of course you can reward yourself! Chinese retail sales reported this morning showed an 11 percent growth, not bad for a slowing China.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment