" . . . the company management suggesting that the Xstrata bid at 33 Pounds a share significantly undervalued the company, and that shareholders must reject it. With the impunity that it deserves, to borrow some trade union speak. That was 7 years ago in 2008. Yesterday the group announced a 407 million Dollar rights issue at 1 pence a share. That is right, 1 pence. So not only have you lost out on a 33 Pound a share price in 2008, you have been wiped out to a current share price of 13.25 pence. FML."

To market to market to buy a fat pig. It was a very busy day on the local front here, telecoms Monday to some extent. Telkom said that they were doing a due diligence on Cell C, for themselves of course. That share price was up over a percent. Vodacom announced numbers that were pretty decent, although growth rates are not enormous, they were pretty strong here locally, the stock ended the session one and a half percent higher.

MTN of course as we discussed yesterday dropped a bombshell, CEO Sifiso Dabengwa carrying his belongings out in a cardboard box from the company HQ. The stock closed nearly one and two-thirds of a percent higher. The resolution of the fine, interim (and long time once upon a time) CEO Phuthuma Nhleko said was hopefully to be inside of the next two weeks. I am not too sure which one I hope for first, the rain or the conclusion of this fine. On this side of the country we are really feeling the heat, maximum expected today in the City of Gold is the mid thirties. Holy smokes.

The rest of the market was peppered with green, all bar for industrial shares. Talking of which, there is of course the small matter of TenCent results today, remember that Naspers owns over one-third of the company, often the company trades almost as a proxy for the Chinese internet business. When you mention the word internet and business in the same sentence, you normally send shivers down the spine of the old guard, they will associate the internet era and its beginnings with businesses like Pets.com.

Business with little, or no revenue trading were at unreasonable multiples. Not unreasonable, rather the Tesla (Spaceballs) ludicrous mode. "They" (the Pets.com-join-the-dots-guys) throwback and apply to today. As I tweeted yesterday, there are no two moments in history that are the same, suggesting facetiously that this market looked similar to 1792. Under the Buttonwood tree at 68 Wall Street, that is where the modern day NYSE was formed. TenCent is nothing like Pets.com, although those folks who missed out on the creation of the giant Chinese business would somehow like it to be so. TenCent is an entertainment business, for modern day China.

At the bottom end of the ranking tables was Lonmin. You will recall last week when we wrote about the company management suggesting that the Xstrata bid at 33 Pounds a share significantly undervalued the company, and that shareholders must reject it. With the impunity that it deserves, to borrow some trade union speak. That was 7 years ago in 2008. Yesterday the group announced a 407 million Dollar rights issue at 1 pence a share. That is right, 1 pence. So not only have you lost out on a 33 Pound a share price in 2008, you have been wiped out to a current share price of 13.25 pence. FML.

And to rub the salt flats of Salar de Uyuni (the one in Bolivia) into it, the rights issue is in the ratio of 46 new shares to one existing (at the one pence level) must be followed. So let me get this right, if I had one Lonmin share 7 years ago, someone wanted to pay me 33 pounds for it, now, fast forward to today, if I do not follow my rights I may as well have nothing left. If you don't follow your rights, you would have lost 99.99 percent of a potential bid price.

I initially thought that the PIC was underwriting the whole thing, it turns out that I am wrong, as per the release: "The Rights Issue is being underwritten by HSBC, J.P. Morgan Cazenove and Standard Bank, save in respect of New Shares which the Directors have irrevocably undertaken to take up." I guess if you can get it for one pence, settle obligations, bring it back on an even keel and sell it for two pence inside of a couple of years, job done, not so? Marikana is essentially all of the business, 95 percent of current production. This is about as drastic a measure as I have ever seen, it makes the US banks recapitalisation kind of like Scary Movie measured against the Lonmin "The Cabinet of Dr. Caligari". Perhaps a more modern day example is "The Conjuring".

Over the seas and far away, in New York, New York stocks sank, all the major indices ended the session down about a percent. Global growth fears was the reason given (The OECD cut global growth forecasts), worries about the Fed raising interest rates was the reason given. All bets suggest a rate hike in December, rubber stamped by the strong jobs number Friday. At the end of the day, the Fed will do what they have to, interest rates will rise, perhaps at a more measured pace (every two meetings) and perhaps the Fed will pause from time to time. I suspect that the top end of the interest rate cycle will be a lower high than in cycles gone by.

Remember one thing, if the Fed hikes rates, then it means that the US economy is strong enough in order to be able to withstand a rate hike. And that is good news, it means that all the damage done through reckless lending over a decade plus ago, in the aftermath of the dot-com bubble bursting, that the cycle has closed somewhat. Of course the cycle never really closes, a new chapter always opens. Banks at a global level still need to recapitalise, to the tune of one trillion Dollars plus. Anyhow, the main story is don't get anxious about the Fed raising rates, the old mantra on Wall Street may be, "don't fight the Fed", we buy companies, not the Fed decision.

Linkfest, lap it up

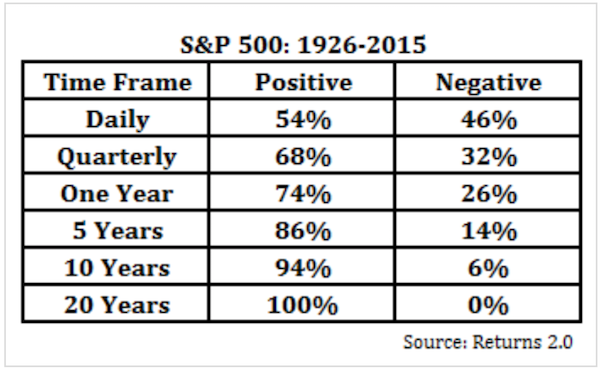

Being invested for the long term has the the benefit of lower transaction fees and a higher probability of being positive - Playing the Probabilities. Even though the market as a whole has been up over the long term, buying individual stocks might not be up over the long run. A current example is Lonmin, where as an investor you have essentially been wiped out. Here are the returns over set time frames:

Being a small nimble investor has the advantage that you can get into and out of the market quickly and that you don't have an impact on the stocks price - How you, the amateur investor, can beat the pros. Investing, as with sport, keep things simple and get the basics right will result in you having long term gains.

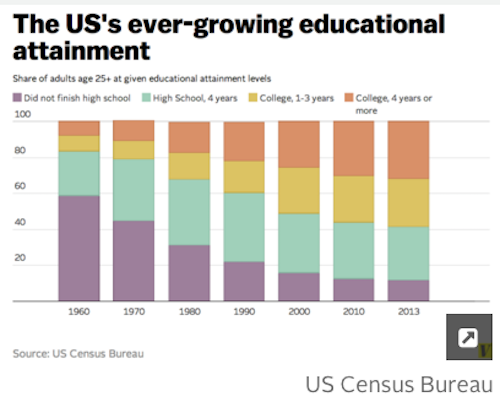

From the same guys who brought you the charts yesterday - 21 charts that explain

how the US is changing. It is always interesting to see how things change over time. Normally the change is so small we don't notice it until we can stop and compare over a longer time period.

Home again, home again, jiggety-jog. Stocks across to the East look a little worse for wear. US futures are a little better. Japanese stocks are a fraction better, that is about all the good news that I have, I am afraid. Earnings season is still happening, most of the majors seem to have reported, the other bit of good news I am seeing suggests that we are past the earnings trough, that sounds good. The Rand, sigh, that is a function of global markets and being inside of a global village. Expect equity markets to open lower today.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment