"Currently the revenue split is 34.55 percent South Africa, 52.7 percent Switzerland and the balance, 12.76 percent the United Arab Emirates. Of course with the 30 odd percent of Spire and the pending purchase of Al Noor, that could all swing quite sharply, being a heavier weighting towards the UAE, more importantly getting a foothold in private healthcare in the UK will add another territory. In terms of operating profits, Switzerland contributes 43.3 percent, South Africa 41.6 percent and the Emirates the balance, both South Africa and the UAE are obviously more profitable for the group."

To market to market to buy a fat pig. Locally in Jozi, Jozi, we managed to squeak into the green for the day, it was a real mixed bag on the Top40, stocks like PSG, Discovery and SABMiller at the top of the leaderboard, way down and at the bottom was BHP Billiton, having slipped below the 200 Rand mark, FirstRand in some trouble, down 2 percent and Sasol right at the bottom, no thanks to sliding oil prices. What was quite unusual on the day where the market ended 0.05 percent up was that for every loser on the top 40 there was a winner, i.e. 20 up and 20 down.

Naspers stock hit an all time high, over 2100 Rand for the first time, thanks to the Tencent results being sparkling, more on that in a moment, an interaction between myself and a reader of the daily postings. Is it a blog, a daily post, or a newsletter? I suspect all of the above. We have a wonderful mature client, she calls them daily love letters, I like that! Tencent is up another one and a half percent this morning, I suspect that baring something "bad" I am guessing another good day is in store for the Naspers stock.

The Rand has taken a hammering to the Hong Kong Dollar, in part as a result of the closeness of the Dollar to the Hong Kong Dollar. How long do you think that the Hong Kong Dollar will remain as a separate currency to the Chinese Yuan? Surely it has to be one and the same at some stage, even if you travel across Europe you can use the same currency, regardless of whether you are speaking Greek, Spanish, Italian or German, French, Dutch or take your pick. What I always find interesting is that the goto language in Europe is English. I suppose it is a universal language.

Perhaps the biggest news yesterday was all about beer, Europe may not have exactly all the same languages, the people in the North love to drink beer and the people in the South love to drink wine, perhaps climate has everything to do with that! The northern beer drinkers and the southern wine drinkers possibly have a little of each. AB InBev had until the close of business yesterday to make a formal bid to the shareholders of SABMiller. Herewith the release: AB InBev announces its intention to launch a voluntary cash offer, for all of the shares and other securities giving access to voting rights in Newco.

I guess the logistics are simple, 44 Pounds a share is the offer currently. The shares and cash offer is limited to 326 million restricted shares, or 41.6 percent of the SABMiller shareholders, which roughly suggests that Altria and the Santo Domingo family will be the bulk of that, if not all of that. And there is likely to be an AB InBev listing here, an inward listing in which the locals can take stock in the biggest beer entity on the planet. I guess the discount between the current share price in London 40.77 Pounds, relative to offer price 44 Pounds is a combination of the two biggest shareholders taking cash and shares, time value of money until the deal closes (it could take 9 months, a year) and obviously the combined entity having to jump through regulatory hoops. I almost said hurdles, it would be harder to jump through hurdles, you might have to be really flexible to do that.

In the mean time, SABMiller are set to sell their North American operations. And then they released the six month results this morning: SABMiller delivers good underlying performance. I guess until the deal closes nobody will be too excited about the earnings, the SABMiller shareholders that is, the newest and most excited shareholders in town, who don't own the shares yet, AB InBev, they would be more excited about these numbers than anyone else.

Company corner

Mediclinic have released their half year results to end September this morning. Revenue up 16 percent to 19.5 billion Rand, normalised EBIDTA up 16 percent, margins stable at nearly 20 percent. Adjusted basic normalised HEPS up 19 percent to 214.1 cents, the interim dividend was 16 percent higher to 36 cents, hardly a kings ransom, the company has been growing aggressively and has just asked their shareholders to shell out serious money in order to acquire a 29.9 percent stake in Spire Healthcare (10 billion Rand rights issue), the dividend is going to be not the reason you own this stock currently.

Once they have bedded down some bigger transactions, I do not think that they are near finished, even after completing the pending Al Noor transaction, see Mediclinic and Al Noor to tie up, they may first be in a position to service debt aggressively and then become a bigger dividend payer. That deal (to buy Al Noor) is still set to be approved by both sets of shareholders, I suspect it will go through.

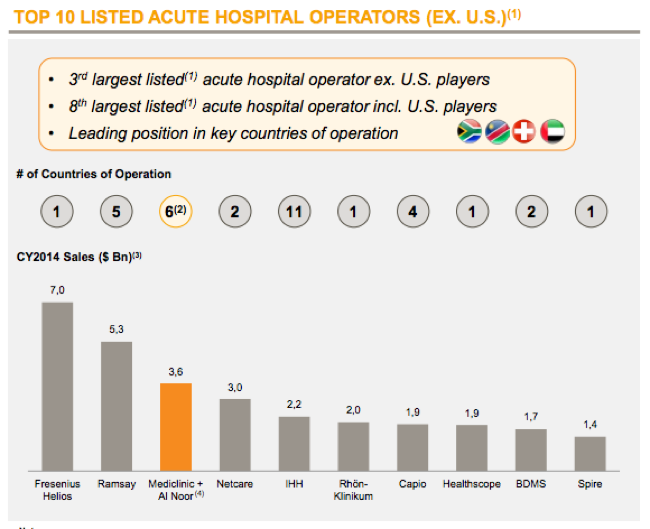

In the analyst presentation, there are two slides that sum up how the transaction with Al Noor is likely to proceed. Al Noor shareholders are likely to get 11.6 Pounds per share, which consists of a 3.28 Pound per share special dividend. What you will get as a Mediclinic investor is 0.625 Al Noor shares (in London), the company will then rename to Mediclinic International, primary listing in London, secondary listing here in Jozi. Mediclinic existing shareholders are likely to own between 84-93 percent of the combined entity, depending on how many of the existing Al Noor shareholders take cash. Outside of the United States this combined entity by sales will be much bigger than you think, true story, see one of the images from the presentation:

The deal is expected to close early 2016, according to the presentation.

Currently the revenue split is 34.55 percent South Africa, 52.7 percent Switzerland and the balance, 12.76 percent the United Arab Emirates. Of course with the 30 odd percent of Spire and the pending purchase of Al Noor, that could all swing quite sharply, being a heavier weighting towards the UAE, more importantly getting a foothold in private healthcare in the UK will add another territory. In terms of operating profits, Switzerland contributes 43.3 percent, South Africa 41.6 percent and the Emirates the balance, both South Africa and the UAE are obviously more profitable for the group. More costs in Switzerland with the smaller operations and higher cost of doing business, obviously, that territory has one of the highest standards of living in the world.

The CEO Danie Meintjes sums it up perfectly in the SENS release, ahead of the presentation at 10am this morning: "The Group continues to deliver against its key performance indicators with high levels of cash generation, growth in patient activity, stable margins and effective cost control. This is against a market backdrop of increasing demand for our services providing geographic expansion opportunities. With both a strengthened balance sheet via a successful rights issue, and capital investments made during the period, Mediclinic remains well positioned for future growth."

With Remgro as their anchor shareholder (they have even applied ), Mediclinic will continue to grow their business. They will continue to look for opportunities as and when they present themselves, as well as grow their existing businesses. Expanded healthcare is an important investment theme globally, we continue to feel that Mediclinic ticks all the boxes. We will review the results along with the presentation, and deliver exactly the same conclusion, we continue to accumulate Mediclinic.

Linkfest, lap it up

Over the short run valuation metrics mean very little. Emotions drive stock prices over the short term where fundamentals are what count many years down the line - Valuations are irrelevant to stock returns over one-year time frames. The data showed that over a 10 year period, buying a high P/E stock resulted in lower average returns but buying a high P/E stock resulted in better returns over a one year period. I suppose that over a short period of time, people can't but help buying the stock that is going up and it becomes a self fulfilling prophecy.

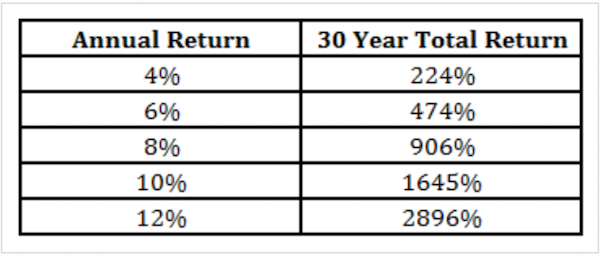

As investors sometimes we need to be reminded of the power of compound returns. It helps us keep our eye on the end goal, long term numbers - Underestimating the Power of Compound Interest

I can't say I understand the huge amounts paid for art or the likes of wine. Surely the value in the bottle lies in that it tastes better than the next? Im not sure that anything can taste so good that it costs the same amount as a car? It is an interesting investment and comes with some fascinating history - This Bunker Holds $1.5 Billion of Wine

Home again, home again, jiggety-jog. Markets have started lower here, again it looks like most of the pain being felt is across the commodities complex. Earnings season is not quite finished in the US, we are however coming to the end. Sigh, the road to the Santa Claus rally.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment