"As you can see, most economists are bleating, the primary sector of the economy experienced the worst of times recently. The more advanced your economy, the more reliant on technological innovations to drive your primary sector, more industrialised machinery doing the logging, the harvesting, the planting, the maintenance (fertilisers and pesticides) and so on. There may be fewer people doing work in that segment of the economy, that does not mean it is not as important to the rest of the economy."

To market to market to buy a fat pig. It's complicated. More complicated than Ross, Joey, Chandler, Phoebe, Monica and Rachel, all sitting on a couch in their favourite coffee shop, trying to figure what life is all about. That show. In the Middle East it is so complicated that when I tried in my simple way to explain, using history going back, I found myself being spun right round. Like, why exactly is Bashar al-Assad and his dictatorship, friends with the Russians? Equally, why do the Iranians support Bashar al-Assad? How did the Daesh (Islamic State - IS) form and take control over multiple territories and millions of people?

If you read about the precursor to the IS, the leader fought against the Russians in Afghanistan. The history goes a little further back than you think. So why did the Turks down a Russian plane yesterday? The Turks suggested that the Russian plane had violated their airspace, multiple warnings were given. The Russians deny they were in Turkey, they were in Syria, which of course is by "invitation". It is very complicated and very tense, the Russians, NATO, Turkey themselves, the French looking for allies in the area, the involvement of the US in that region for decades, the history goes a little further back, thousands of years. Yip, it truly is complicated.

Markets took a swoon as the news started appearing on the screens, futures fell and the decent enough European GDP numbers (albeit still weak), evaporated along the way. Then later on in the day US GDP numbers were a comfortable beat, revised higher for the third quarter on beefed up inventories. Whilst markets in New York, New York opened much lower, stocks clawed their way back and managed to close marginally in the green on the day. Spurred on by the energy stocks, tensions in the Middle East and geopolitical tensions in general lead to higher energy prices.

On the local front, again it was a mixed bag for stocks, we never got the lift at the end from an improving US session and closed down nearly three-quarters of a percent, most of the day was spent wallowing in the red. Richemont continues to slide, the company no doubt suffering from the strains of cancelled bookings to the city of lights, Paris. There was also a gloomier outlook from Tiffany & Co. in a global world all the stocks I guess are impacted by the same factors. You cannot have it both ways.

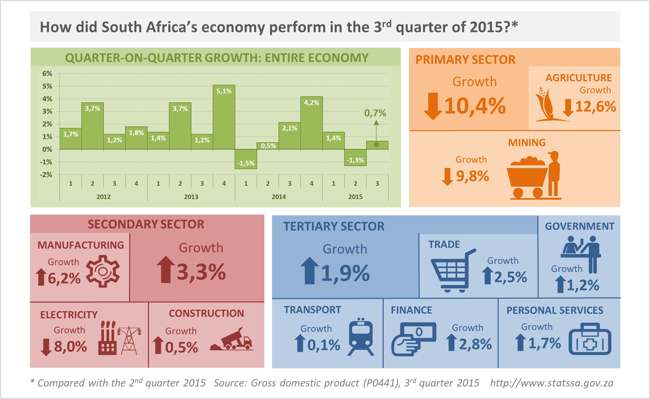

Talking of not the best outlook, the local GDP number disappointed yesterday, although as Stats SA pointed out, in nominal terms this is the first time that the number has topped 1 trillion Rand for a quarter. And barring a disaster, I suspect that the next quarter will be better. Bright spots included food and beverages, wood and paper, as segments of the economy. There was obviously pain felt in the agricultural sector, the weather is always something that you cannot control, the mining sector was understandably lower too, with commodity prices having shrunk drastically over the last twelve months and the demand side looking floppy (equally too much supply), the sector might remain muted for some time. In fact, Omnia who operates in that space suggested as much yesterday. There was a nice graphic from Stats SA that is worth sharing.

As you can see, most economists are bleating, the primary sector of the economy experienced the worst of times recently. The more advanced your economy, the more reliant on technological innovations to drive your primary sector, more industrialised machinery doing the logging, the harvesting, the planting, the maintenance (fertilisers and pesticides) and so on. There may be fewer people doing work in that segment of the economy, that does not mean it is not as important to the rest of the economy.

Anyhow, as the divergent US and our local economic numbers, which resemble more European looking number, suggest, we are in a tough patch here. What does help, in my little opinion, is the president telling the far left that the capitalists set the price of bread and oil (it is the market ultimately), and then ask the private sector to invest. I shall reserve judgement and avoid this sensitive area, I have found that in the past there are too many divergent opinions, which is what makes South Africa great, many divergent views. Imagine the level of agreement in Scandinavia relative to here, no wonder they all have similar looking flags.

Linkfest, lap it up

Commercial space travel is now one step closer with the team at Blue Origin managing to land a rocket - The reusable space rocket is nearly here with Blue Origin's first successful landing. You might have not hear of Blue Origin before, it is the space company headed by another pioneer Jeff Bezos.

One of the most influential people of the last decade is Ben Bernanke. His knowledge of economic history helped to avert another great depression - Ben Bernanke on bubbles, bitcoin, and why he's not a Republican anymore. The interview gives a brief insight into his thoughts on politics, monetary policy and fiscal policy.

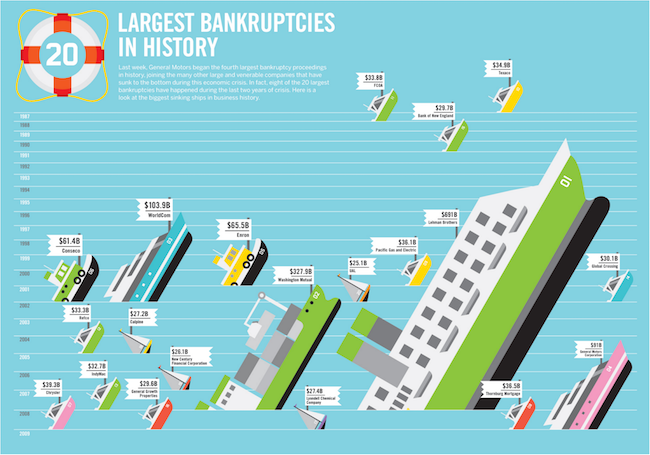

Here is a look at the largest bankruptcies in history. Lehman makes Enron look like child's play. It is a reminder that things do go wrong and it can happen to huge, very old companies - Largest Bankruptcies in history (Click on the link for a clearer view of the image)

One advantage of having a super computer is that it can process vast amounts of data and pick up patterns - IBM wants to predict earthquakes and volcanoes with Watson. To give perspective of how much data needs to be crunched to better understand the what is going on below the surface of the earth: "Were you somehow able to run this model on a regular home computer, it'd take you three years to get a sense of what's going on under the Earth's surface. The Sequoia can do it in a day."

Home again, home again, jiggety-jog. Stocks across Asia are a mixed bunch, mostly lower other than the Shanghai markets, that has a mind of its own. Although as Byron tweeted the other day, and it is worth looking at almost every single day, the US markets are so colossal, relative to the rest of the world. See here, a tweet from BI Markets: This map shows how some US corporations are worth more than the entire stock markets of other countries. JP Morgan Chase is marginally smaller than the whole of our market. JNJ is worth more than India. As long as we beat India over the next five days, I am happy! What is pretty amazing is that Google and Amazon collectively are bigger than the entire Chinese market. Makes you think about the anxiety of the recent Chinese stock market swoon, not so? Perspective as ever.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment