'The only good news I suppose is that the ex CEO, a man who ran the business for nearly a decade is going to step into the breach, assuming the role of executive chairman. The company will have six months to search for a new CEO. And as the group articulates: "The engagement with the Nigerian authorities on the Nigerian Communications Commission fine is continuing and shareholders will be advised as soon as there are any material developments on this matter."'

To market to market to buy a fat pig. It was a horrible no good day down at the southern tip of Africa, things were not going well for a multitude of reasons. Firstly, as we indicated on Friday, the Richemont results looked just fine at face value, the trading conditions for October (inside of the next six months) were looking a little worse for wear. Whilst luxury will always be around, people like "nice" things, at some points in the cycle they are less affordable than at other points.

What is quite interesting for me is that the longer the company owns the Maisons, the longer that they own these brands, the more the allure becomes as the history behind the brands extend. i.e. Owning a watch that has a 200 year history is better than owning one that has 25 years. I was also checking the Cartier watches out on Friday, for the range and the price, these are very expensive items that upper middle income people can afford, they cost a lot. I am not too sure that in my personal capacity I would feel comfortable wearing those items.

So Richemont had a terrible day at the office, the stock sold off sharply. Down 6.6 percent by the end of the session. Year to date the stock has performed about inline with the market. Resources generally had an awful time, the main reason was that there was a far better than anticipated jobs number across the seas and far away, blasting expectations by around 100 thousand. So what, that sounds like good news? What it means is that the likelihood of a rate hike in December has risen, which equals stronger Dollar and by extension weaker commodity prices. Not helping commodity prices is the containing mixed Chinese data, trying to decipher that. Remembering too that a stronger US economy needs more resources too, obviously a different subset of resources, their growth is in a different cycle to that of China.

Glencore sank nearly seven and a half percent, Amplats lost five percent, Sasol lost over three and one-quarter of a percent, and then there was tragic news for the people of a town by the name of Bento Rodrigues, downstream from the jointly owned iron ore mine (not operated), Samarco. Why? What happened? One of the dams housing mining waste burst, BHP Billiton and Brazilian miner, Vale, to blame here. BHP Billiton shares sank 6.43 percent here in Johannesburg, the stock was down 5.7 percent in London. The cleanup costs could be as much as 1 billion Dollars for starters, three percent of HEPS.

The stock is currently trading at a 52 week low in Sydney this morning, kind of like the Black Caps, the Proteas, I would prefer not to talk about the superior India performance, they were great. I am wondering what the outcome of an investigation will have on BHP Billiton and whether or not the Brazilian authorities will in the aftermath of the clean up (it is going to be huge) impose any fines on the company. The possibly exists, remember that dozens are missing and presumed dead, this is a human and environmental tragedy.

Across the way in New York, New York, markets celebrated the fact that good news actually was good news. With non-farm payroll numbers beating estimates by a country mile. It is actually referred to as the Employment Situation. I suppose whilst most people look at the headline number, 271 thousand jobs created in October (it must have been a busy Halloween), the unemployment remaining unchanged at 5 percent was also a plus.

How the current administration in the White House would love a number with a four in front of it! Healthcare jobs continue to be created at a fast click, nearly half a million jobs created in that sector over the last year. The news that folks got excited about was that the average hourly earnings rose, which is better than the stagnant wage growth that has been experienced. And this all points to a Federal Reserve that will have to hike rates at the end of the year. As you know, our view is that when they do it, they will do it. If you are going to base your whole strategy on what the Fed is likely to do, i.e. pre-empting their moves, I think that you are doing it all wrong.

Company corner

The drama continues at MTN. This time the biggest of them all to fall is the CEO, who resigns this morning, a statement released by the company -> MTN - Executive Chairman appointment. As you can clearly see, Sifiso Dabengwa has resigned, it does not say with immediate effect, and means that there is a lot more that meets the eye in their Nigerian operation. That is exactly NOT what the situation needed, more uncertainty.

The only good news I suppose is that the ex CEO, a man who ran the business for nearly a decade is going to step into the breach, assuming the role of executive chairman. The company will have six months to search for a new CEO. And as the group articulates: "The engagement with the Nigerian authorities on the Nigerian Communications Commission fine is continuing and shareholders will be advised as soon as there are any material developments on this matter."

And as such we continue to recommend that you do nothing until there is clarity. Remember that if there is little to work with here, we can either presume that the outcome is going to be bad, as the CEO is resigning or we can presume that this could be a face saving outcome, an executive head rolling as they failed to abide by the Nigerian laws and a lower fine levied. Again, too little information to go on, be guided by the company. I suspect that the share price will open lower, and be under pressure, there is no good news in a CEO resigning, right?

We had an announcement from Famous Brands this morning of a new brand added to their stable - Famous Brands Savours Greek Cuisine Acquisition - Advancing the Group's Presence in Evening Casual Dining Category. The casual dinning area is something that Famous Brands have been talking about for the last 18 months, it also allows them to spend some of the the R126 million cash sitting on their balance sheet. I think you can expect more acquisitions like this going forward. Referring to the consumer this is a key line from the announcement ""Mythos's target audience is upper-LSM consumers, a market segment which has consistently proved its resilience in the current weak economic conditions. The research derived from our other premium brands illustrates that customers with robust disposable income remain enthusiastic spenders."

Byron beats the streets

On the third of November we received third quarter earnings from electric car maker Tesla. I am sure the company needs no introduction. If you have not heard of Tesla or Elon Musk you are probably living in North Korea. Over there the fat man is just about to invent cars with a sixth gear. Here in the real world, Tesla is changing the face of automobile manufacture. Lets delve into the numbers first.

Revenues came in slightly below expectations at $1.24bn. This equated to a loss of 58c per share. It's hard to value this business because it is in huge growth mode. The biggest issue for the business in fact is being able to produce enough vehicles to meet the demand. To put things into perspective, Ford has a market cap of $58bn with revenues of $35.8bn in their 3rd quarter. Tesla has a market cap of $30bn with 29 times less revenue than Ford.

The share price improved by 10% on the day of the release. That is because guidance for next quarter is to deliver between 17000-19000 vehicles. In this quarter now they delivered 13091 vehicles. Elon Musk is famous for over promising, this is how he motivates his employees to work harder than ever.

It was a big quarter for Tesla. They launched the Model X which is the first ever SUV electric vehicle. It looks incredible, check it out here from their website. MODEL X. It is beautiful, just like everything else Tesla produce. And I am not even a car person. There were delays, however. Elon Musk is a perfectionist and is not concerned with fickle short term shareholders who only care about car deliveries. He wants to deliver a near perfect product. This is their second car, the first being the Model S.

I have just come back from Europe and was fortunate enough to see a few Tesla's. I even got to sit in one at a Tesla store. I see so many similarities to Apple. One of the most powerful ones is that Tesla clients become the company's best salesmen. I met up with a family friend who lives in the US and owns a Tesla. He couldn't stop raving about the car. He explained how the software updates (Tesla describe these as updates released over the air) almost give you a new car. Without your car leaving the garage defects can be fixed, autopilot updated and even the battery life can be enhanced due to more efficient operations.

There is no combustion engine so need for services. It is simple which means less chance of anything breaking. And it is an experience, apparently the performance is incredible with unmatchable safety features. The car industry has been pretty stagnant for over half a century and finally we are witnessing a revolution. They are also at the forefront of self driving vehicles. They have the luxury of all the data coming through from existing Tesla drivers to improve the technology. Even now the car basically drives itself.

Of course there are still challenges. Competition is heating up. But if you believe, like I do, that electric cars will one day over take combustion engines, then the industry actually needs more competition. There will be no lack of demand for decades to come. Tesla have a much cheaper model in the pipeline to target the mass market.

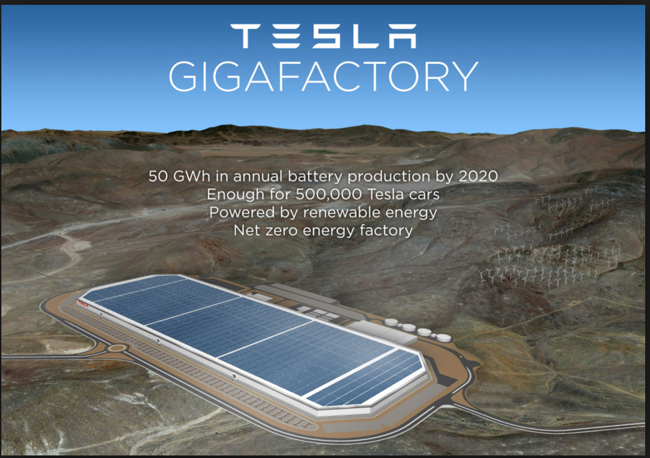

What about recharging? Tesla install a new recharge booth every 24 hours. In California you are never more than 42 miles away from a Supercharger. In Germany you are never more than 33 miles away from one. At the moment a vehicle can drive up to 300 miles (480km) without needing to charge. That is only going to improve. Tesla are pumping millions of dollars into battery technology. See the image below.

Where does the power come from? The sun of course. The Powerwall made huge waves when that was released a few months back. Being able to harness power from the sun and store it in batteries in order to power homes and cars is their main objective.

As you can see from the comparison with Ford, expectations are high. This is going to be a wild ride as Elon and his team focus on making the world a better place with the most amazing products as apposed to pleasing analysts with 1 year price targets. Our Investment strategy is about picking stocks which we feel will outpace market expectations. I believe the adoption of electric cars is underestimated. Do not underestimate the strength of scale too. Tesla's production will accelerate. Having read Elon Musks book, his ability to cut costs and produce quality products all in house at SpaceX is inspiring. In fact a lot of the technologies from SpaceX gets pushed onto Tesla, especially the aerodynamic materials which make the cars light and more efficient.

Buy the share, ignore the short term price movements and hold thumbs that Tesla comes to South Africa sooner rather than later. We have electricity issues, import loads of oil but have plenty of sunshine.

Linkfest, lap it up

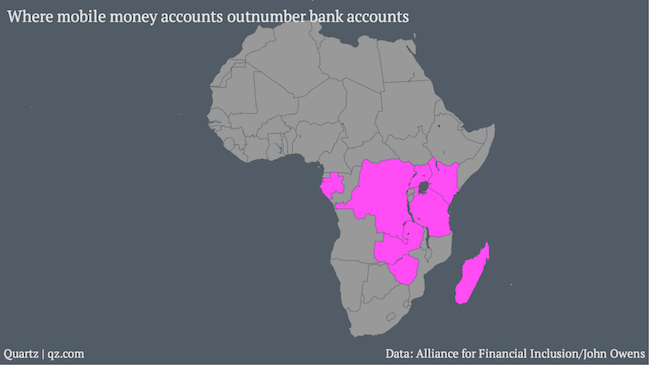

Images sometimes show us more than words can ever describe - 38 maps that explain the global economy. Below is one of the images about Africa, interesting to see how things develop when certain resources are limited.

Amazon has opened their first brick and mortar store, which is strange as they are the online guys. To ensure that the prices in the store are the same as their online platform (prices fluctuate), you need to scan the book that you want with the Amazon app - You will literally never guess how to shop at Amazon's new bookstore. I don't think the store will survive, I think this is more a marketing stunt, I might be very wrong though.

As migrants move into Europe they are helping boost the economy - Sweden Tells Refugees 'Stay in Germany' as Ikea Runs Out of Beds. Economic research has shown that having an influx of immigrants normally leaves the receiving country better off, in this case Europe is attracting young people who will help balance out their ageing population pyramids.

Home again, home again, jiggety-jog. Emerging markets are so not the flavour of the day that Goldman Sachs is considering ditching their BRIC fund, I did see that the chap who coined the phrase, Jim O'Neill suggested that the B and R get dropped. i.e. Just India and China are likely to be the global growth engines, perhaps he can throw Indonesia in to the equation. ICI? As a result of the poor flavour left in many folks mouths, and an improving outlook in the US means the flows will be in that direction.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

078 533 1063

No comments:

Post a Comment