"We would rather own Holdsport, Nike, Under Armour, businesses that are working to make you healthier, equally Discovery, rather than producers of products that global bodies are trying to reduce your intake thereof. Make sense? British American Tobacco also falls within the no go category for us. So far we have been wrong on that but it will come."

To market to market to buy a fat pig. There and back yesterday on the Jozi all share, the biggest stories of the day were undoubtably the climate talks in Paris. And at exactly the same time, as the FT pointed out in an article I read, giant smog clouds descended over the capital cities of the two most populous countries on the planet, namely China and India. Those two countries desperately need to uplift their respective populations, their energy needs and mix will be vastly different to those of the developed world.

In the developed world there are more reasons to worry about climate control, your infrastructure is built and your intensive industries have developed to a point where the laws and rules for environmental controls are stricter. For instance, with all due respect to the countries involved, the environmental laws will undoubtably be stricter in Denmark than the DRC, Japan than in Java, it is not to say that these issues shouldn't be taken more seriously in all territories.

How can you tell India to be stricter on emissions controls when around 30 percent of the population lives below the poverty line, a number not too dissimilar to here in South Africa? There are bigger social problems to overcome, full tummies, jobs, shelter, access to basic services seem a whole lot more important than clean air, perhaps that is a basic human right, access to clean resources. Ironically the consequences of climate change often impact those that are marginalised, so we have to care more, a two pronged approach.

We should all try a little harder, be more energy efficient, recycle more, I think that is happening. Resources ironically need to become more scarce, i.e. the economics need to dictate to us. In other words, like we are seeing with solar panels, their conversion, adoption, battery storage capacity, etc. The costs are falling at a rate of knots, relative to the mainstream technologies. Our preferred investments in this space, and they certainly are out there, is SolarCity and Tesla, ironically both companies are associated with Elon Musk, who might have been schooled in these parts (and we call him our own), Charlize is really more South African. Although she picked up some funny accent along the way, what happened there?

There was of course other news, there was a name and version change for Steinhoff, it is effectively an inward listing now. What does that mean? Here is your refresher, we wrote about this back when the company released their FY numbers, here goes: " ... the company announced that they had got the necessary votes to proceed with the offshore listing in Frankfurt. Logistically speaking, what happens next is that a business called Genesis N.V. will acquire all the shares of Steinhoff, in exchange for each Steinhoff listed share on the Frankfurt stock exchange, there will no doubt be a version change. You will basically be an investor, owning a global depositary receipt of a business listed in Frankfurt and domiciled in the Netherlands. Got it? Easy, not so?"

The share code has now changed from SHF to SNH, which stands for Steinhoff International Holdings N.V. The N.V. part stands for naamloze vennootschap, which translates to public company, and according to Wikipedia is used only in the Netherlands (obviously), Belgium, Aruba, Curacao (accent left off the second c, apologies), Suriname, St. Maarten, and Indonesia. The stock actually flew up the charts, up four and a half percent, last week was not a particularly good week for the company, perhaps the ebbs and flows of it all, or perhaps out of certain indices and into others created natural sellers and natural buyers.

In other company news there was Illovo who pointed to the poor weather as something that has really impacted on their business, they are of course not alone. I would not own the business, their core product is one that most diets agree should not be included, it is not good for you, obviously there are still many studies to be done. Some would argue that everything in moderation is ok.

Earlier this year the World Health Organisation (WHO) urged people to reduce their sugar intake, check it out: WHO calls on countries to reduce sugars intake among adults and children. Isn't that a bit of a dumb headline? Adults and children, are you not one or the other? Just recently too the WHO released this: Q&A on the carcinogenicity of the consumption of red meat and processed meat. We would rather own Holdsport, Nike, Under Armour, businesses that are working to make you healthier, equally Discovery, rather than producers of products that global bodies are trying to reduce your intake thereof. Make sense? British American Tobacco also falls within the no go category for us. So far we have been wrong on that but it will come.

And then lastly on the company front, perhaps a story that was underreported and more important than almost anything else going on globally was that the Brazilian government were mulling fining BHP Billiton and Vale (the Brazilian Iron Ore giant) 5.2 billion Dollars for the Samarco operation dam burst. Someone needs to fit the bill for cleaning up a huge environmental disaster. What is astonishing for me is that the size of the fine is about the same as the one levied on MTN for not disconnecting sim cards.

When the fine fits the punishment I have no problem, in this case the burst dam has seen a loss of life and a significant displacement of hundreds of people, the longer term environmental impact is yet to be felt. In BHP's defence, they deny that the tailings had heavy metals and toxic chemicals in them, suggesting that they had checked. The BHP Billiton share price in London fell to a 10 year low. Against of course the backdrop of a complete rout of commodity stocks. We continue to avoid all of these businesses.

Over the seas and far away in New York, New York, stocks started the last day of the second last month on a better footing, unfortunately slipping away after mid afternoon. That Fed meeting and the pending hike will no doubt capture the imagination of market participants for the better part of two weeks. First however is the small matter of the most hyped, most highly anticipated event in equity markets across the world, the release of the non-farm payrolls, officially known as the Employment Situation. A stronger than anticipated number would definitely lead to 100 percent stamp of surety that the Fed are going to hike rates in mid December. The meeting of the Federal Open Market Committee (FOMC) ends on the 16 of December, a holiday here in South Africa. And the local currency has been obliterated relative to the US Dollar, so have many currencies across the globe. Year-to-date the Rand is 8.7 percent weaker to the Euro, over 20 percent to the US Dollar.

Other noteworthy news, and the Euro being the obvious loser was the inclusion of the Chinese Renminbi into the SDR basket. Huh? SDR stands for Special Drawing Right, and according to the inter-webs (that will explain these things better than me): "The Special Drawing Right (SDR) is an international reserve asset, created by the IMF in 1969 to supplement the existing official reserves of member countries. The SDR is neither a currency, nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members." The official IMF release is here: IMF's Executive Board Completes Review of SDR Basket, Includes Chinese Renminbi.

All this means is that the IMF have recognised the Chinese currency as a reserve, a decade after the real Chinese growth started to ramp up. Admittedly this only changes every five or so years, herewith the "new" formula:

U.S. dollar 41.73 percent (compared with 41.9 percent at the 2010 Review)

Euro 30.93 percent (compared with 37.4 percent at the 2010 Review)

Chinese renminbi 10.92 percent

Japanese yen 8.33 percent (compared with 9.4 percent at the 2010 Review)

Pound sterling 8.09 percent (compared with 11.3 percent at the 2010 Review)

I for one still don't understand how the Chinese currency trades, whilst it floats and is supposedly free, it is certainly managed by the central bank, the People's Bank of China. Quite right, the direct translation of Renminbi is the people's currency. As apposed to? Fun to watch, nice to be part of that history, until the Dollar changes significantly it will still be the currency that is most widely accepted worldwide. Even in the heart of the cold war, what did people want behind the iron curtain? Dollars. Capitalism wins every single time, and with the liberalisations in the Chinese economy, this is being recognised by the IMF, the International Monetary Fund. A question that should be asked is, how would Chairman Mao Zedong feel about all of this, he is after all the face of the Yuan notes?

Linkfest, lap it up

With wealth comes the ability to take bigger risks. In this case it is taking bigger risks to try push us forward in our consumption of energy, to consume clean energy - Bill Gates, Jeff Bezos and other tech titans form the Breakthrough Energy Coalition to invest in zero-carbon energy technologies. The one thing that Gates says which I feel is very important is: "Our primary goal with the Coalition is as much to accelerate progress on clean energy as it is to make a profit.". Being profitable will make the project sustainable and will also make it possible to attract more talented people to the project.

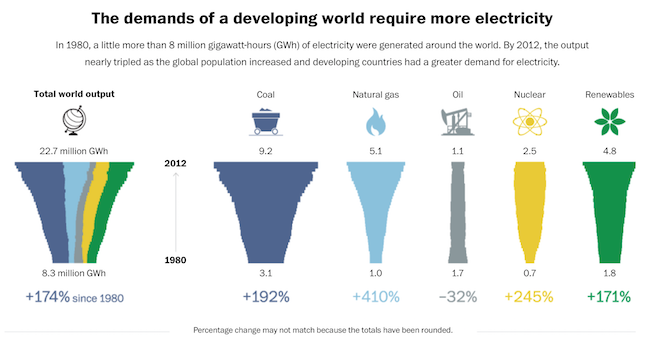

Here is a look at what global energy supply looks like and the carbon emissions that come with them. It is amazing to see how much more power we consume - As appetite for electricity soars, the world keeps turning to coal. The one thing to remember about electric cars is that at the moment most of them are essentially powered by coal and with a single charge equating to around a months power use of your fridge at home, they have a high electricity demand. As the likes of Bill Gates invests in renewable energy production and as scale makes it cheaper than coal, electric cars will become cleaner.

Josh Brown points out the phenomenon of momentum in asset prices. The basics are that when something is hot or doing well, it gets an extra boost as people all run towards it - The Trouble With Chasing Hot Strategies. It seems to be a phycological trait where we want to get in on the hot action and get out of the things that are doing poorly. The problem is that what normally happens is we buy a stock/strategy at the top and sell a stock/ strategy at the bottom. The cure is to stay calm and patient, short term noise always passes.

Home again, home again, jiggety-jog. Stocks across Asia are higher across the board, some December cheer. US futures are up sharply. The reason given is apparently Asian cheer of the regions prominence, the Asian economic Tiger has clearly arrived. I am not too sure what the Indians think of all of this. India have Ravichandran Ashwin, who is now the second best bowler in the world. China as far as I know have no cricketers of prominence, although the left arm leg spinners googly is known as a chinaman. Stick that in your pipe and smoke it.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron and Paul on Twitter

078 533 1063

No comments:

Post a Comment