Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We closed down around one fifth of a percent on the day, dragged lower again by the usual suspects, resource stocks once again underperformed the broader market. The Jozi all share index closed at 33086 points, that is a loss of 62 points on the day. Naspers took a clobbering yesterday, the stock was down over five percent, two factors, one the Facebook listing not going off as well as the NASDAQ the market guessed it might. But more importantly, their giant Asian holding in TenCent took some tap after an incredible run. We will have a look at that later.

Tiger Brands have released results this morning for the six months to end March. This is a business that has brands entrenched in your pantry for over generations, All Gold tomato sauce is a big hit in my house, Black Cat peanut butter is great as long as you are not allergic to the thing, Colman's mustard is my pops favourite, Fatti's & Moni's I don't buy anymore, I make my own pasta (no really), Koo is baked beans, Beacon sweets, Maynards chewy sweets are always a favourite, Ace maize meal a huge staple in South Africa, Albany bread, I use the sliced kind, Golden Cloud, I use it sometimes, Jungle oats, I should eat more of that, Tastic rice, I like it a lot, more recently Energade, which I used to drink when I ran more (I should, lazy bum me), old favourite Lucky Star, not my favourite, the baby products, Elizabeth Arden and Purity which I don't use anymore, my babies are not babies anymore. Putting a feel to the stock, something we do not do enough of.

Group turnover for the period clocked 11.6 billion Rand, an increase of just over 12 percent from H1 2011. Domestic turnover, that is you and I buying jam and peanut butter, increased only 3.4 percent, but exports and their international businesses grew turnover by 27 percent. This is largely what people have been getting excited about is my guess, bidding the stock higher. Their expansion plans into the rest of the continent, we sometimes think of ourselves as not part of Africa. Hello, Africa is the second part of our name. OK, getting distracted here again, profits increased 10.1 percent to 1.295 billion Rand. Headline earnings per share increased a paltry 5.2 percent to 787 cents per share. The interim dividend is 5 percent higher to 295 cents per share, BUT, after the 15 percent dividend tax, the dividend received by the shareholder (most) is closer to 250 cents per share.

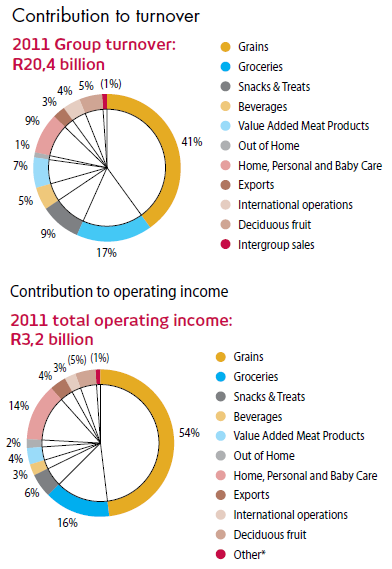

What is interesting about Tiger Brands is to know what you are dealing with, so I hacked the annual report and came up with this turnover and contribution to operating income, and you can very quickly see that it is about boring old grains. Tastic, Albany, Ace and Tiger Oats are the most profitable parts of their business. Strange to think that, but it is true. Check it out:

The last two years have been quite exciting for Tiger Brands, they certainly have expanded into the rest of the continent, sub Saharan Africa mostly. We are actually seeing interesting talks between Tiger and Dangote Industries with regards to the Dangote Flour Mills. It seems either Tiger want to buy the Industries stake from Flour Mills. Aliko Dangote is the richest fellow in Africa, according to Wikipedia he is worth over 11 billion Dollars. Dangote flour is a major producer of much of Nigeria's wheat flour, bread flour, confectionary flour and pasta semolina. Of course Tiger has bought other businesses in Nigeria, UAC Foods which is in the confectionary and drinks business as well as Deli Foods, a biscuit manufacturer. There is of course another West African business in Cameroon, Chococam, a small cocoa product business. Small as in, when Tiger bought it back in 2008, annual turnover was a mere 28 million Euros a year. Across the continent and in Kenya, Tiger have a business called Haco Industries, a much more sizeable entity selling the products we know here, as well as other products in the personal care segment.

This business is run by Peter Matlare, a fellow who once ran the hot potato SABC for a whole four years. He resigned from that role back in 2005. Peter Matlare then went to Vodacom, where he was chief strategy and business development officer. Matlare has been running Tiger Brands for over four years now, he certainly had big boots to fill in the form of Nick Dennis. Dennis fell on his sword as a result of the bread price fixing scandal which cost Tiger nearly 100 million Rand. The CFO is a relatively new appointment, from last year June, Funke Ighodaro. She is educated in the United Kingdom, worked for Primedia as well as for Kagiso's private equity fund. So it seems like she has done the time, she is older than I thought (good picture!) and seems more than capable. Talking management shuffles, the Chairman, Lex van Vught, resigned on Valentines day and Andre Parker took over. Parker is also relatively new to Tiger, having sat on the board since 2007.

We know the size and scale of the business, we know their history, we know that they have been one of the single best investments in South African corporate history. They really have, they have unbundled amongst others, Adcock, Astral Foods and Spar along the way. But at 266 Rands, is the stock priced too aggressively? It is a September year end and judging by analyst consensus it is trading on a forward multiple of 15 times and a dividend yield forward of a modest 3.3 percent. Their expansion plans are exciting, that is why I think that you are forced to pay up to these levels. Earnings are expected to grow around 14 percent per annum for the next couple of years, and the yield should also tick up accordingly, we remain buyers of the stock in our extended portfolios.

Byron's beats covers the largest and probably most important business inside of the Naspers stable. TenCent!

- We had results that slipped through the cracks the other day but I think it's fitting to cover it today seeing that Naspers dropped 5% yesterday. I'm talking about the Tencent results which were released last week which were yet again very impressive. Analysts have constantly questioned Tencents ability to maintain their fascinating growth rate off an ever increasing base but yet again they have managed to do great things. I guess it's understandable when you have nearly 1 billion users.

To put things into perspective Naspers own 34% of Tencent which at a market cap of $50bn equates to $17bn or R140bn. Naspers entire market cap as of today sits at R180bn. So, you can see why the Naspers share price follows the Tencent one so closely and why it is very important for us to follow the company as if it were our own.

So far this year Naspers is up 25% whilst Tencent has improved 35%. South African Investors are conservative and still believe Tencent is overvalued. It does trade on demanding valuations, so let's look at those numbers. The company managed to increase revenues by 52% whilst profits came in at $467 million. The stock sits on a historic PE of 31 but growth projections look good.

The business looks strong. It's like the Facebook, Google, Zynga and BBM of the western world all amalgamated into one company. Microblogging, messaging and gaming have really revelled under this massive smartphone expansion. Who would have thought? Better phones means a better experience and more consumption of data and services. In the quarter the company added 30.9 million subscribers (for the quarter!!) while their flagship QQ instant messaging service reached a total of 751 million subscribers.

The big revenue driver is the online gaming and QQ related subscription fees which grew 41%. E-commerce is also coming into the forefront which has just been introduced onto the platform. If you believe what we do about the Chinese consumer driving growth then this is going to be massive. They have the clients, now they just have to monetise them, which in the past, they have managed to do already. This is like Facebook on steroids with one third the valuation.

So those looked very encouraging. Why did Naspers drop so much yesterday? Because Tencent fell hard on the Facebook share price. I wouldn't be too worried. Many traders were banking on a big rerating in social media companies following the Facebook IPO, this is one of the reasons Tencent is up 35% this year. So yes, they have been rerated and the Facebook thesis has been correct. But the stock dropped 10% yesterday and of course that is going spur sellers in the sector. Nothing to worry about as a long term holder.

As promised yesterday we will look at the Vodacom results from yesterday, we ran short of time again. Time. Not enough of it, or perhaps I should just compromise sleep in favour of more mileage on the computer. I would probably be an almighty pain in the posterior with a lack of sleep. Making Russian bears with sore heads look more friendly than what they are. Leave that for the moment, let us focus on these numbers from the number one mobile phone company in South Africa. The shareholding in the company has undergone pretty big changes over time, at the moment the shareholder base consists of the Vodafone Group (65%), the South African government (just less than 14 percent) and the Government Employees pension fund (just less than 5.5 percent). So, comfortably over 80 percent of the company is in hands that I guess are not really sellers anytime soon.

The numbers. Quick recap, earnings of 709 cents per share, dividend of 710 cents per share. As we said yesterday, Vodafone is going to suck out as much of the cash as they can. The company increased turnover to 66.9 billion Rand, whilst headline earnings topped 10 billion Rand, 10.374 billion to be precise. Total customers increased 11 million over the year to 47.8 million. Data revenue grew 23.6 percent whilst data customers grew nearly 50 percent to 15.1 million folks. Most of those customers are in South Africa, with active data consumers here running at 12.2 million. A massive part of that has been driven by smartphones, which now top 5.1 million on the Vodacom network. Valuations, the simple metrics, the stock trades at 104.50 ZAR, roughly. So, the stock trades on an earnings multiple of 14.7 times, with a dividend yield of 6.8 percent. That is why people will pay up for the stock, the yield is amazing. But as we said, Vodafone are going to try and suck as much cash out as they can. In the presentation the company says that they will continue to payout at least 90 percent of headline earnings per share.

Data is the future, whilst it is small for now, you can see the explosion in smartphones and the strong growth that we have seen in data revenue. Although the breakneck pace will slow, I can imagine that more consumers want smartphones and to be connected and "online". Average smartphone usage has increased from 38MB to 98MB. And that is why Vodacom have invested heavily in their network, adding over 1000 sites and spending a whopping 8.66 billion Rands. That is a lot. And we continue to think that there is going to be strong growth in the data space.

But the Vodafone geographical shackles are a bit of a problem. Will Vodacom become more utility like? I suspect that the ex-growth label is not warranted, data margins, which are not as good as voice margins, are going to still grow a lot. I am not too sure what the eventual mix will be, but I suspect it is a long way before we get a fifty-fifty mix. In the US would you believe, according to this piece Verizon, AT&T dominate in global data revenues, US overall data as a percentage of ARPU is 40 percent. BUT, constitutes 85 percent of all traffic. Get that point about data margins? Still, in a world of choices, we see the rest of Africa offering greater opportunities than South Africa. And whilst that is the case, we will continue to buy MTN. BUT, if you are looking to do the same as Vodafone, look for a great yield, then Vodacom still looks cheap enough. And you are paying up for the yield.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Whoa! What a session, particularly for tech stocks which were driven higher by a massive move northwards in Apple. In part I guess folks saying, well I can pay between 40 to 100 times 2013 earnings for Facebook, or 10 times forward for Apple. Guess which one won yesterday? Six days in a row of selling saw some fatigue and some buyers comfortable at these levels. Whatever the case, the European issues will linger for some time to come, the levels of the broader market are still relatively cheap. So, if 100 Dollars plus for the S&P earnings is expected for the year, then we still see an implied 30 percent discount to the long term averages. Perhaps we deserve to see equity markets trade at these discounts to the long term average, simply because of all the issues that remain.

Currencies and commodities corner. Dr. Copper is last at 352 US cents per pound, the gold price is slightly lower at 1576 Dollars per fine ounce, the platinum price continues to take some heat, down at 1454 Dollars per fine ounce. The oil price is lower at 92.01 Dollars per barrel. The Rand is slightly firmer, 8.25 to the US Dollar, 13.02 to the Pound Sterling and 10.57 to the Euro. We are higher here, thanks to the second half rally in New York last night.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment