Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We were trading at a record high, and then we slipped after the ECB decided to keep rates on hold. Not the actual event, but rather the press conference where the ECB basically said that governments should follow a pro-growth path, and that the central bank would not be intervening to boost economic growth. In other words, no more stimulus from them, or extraordinary measures other than the ones in place right now. What ECB governor Mario Draghi did say however is that credit was not given to the various governments for their extraordinary work that they have done thus far. Draghi said that they had done more in two years than in the last twenty. Like I have often said, nothing like a good old fashioned crisis to crystallize the thought process. I am not like the mainstream thought out there, but rather side with some of the more sensible insiders in Europe. Europe will solve European problems in their own way, if that means bumbling along for a while, then so be it. But I am confident that in a decade, there will be more members of the union and not fewer. And I still can't understand how Mario Draghi looks so good for a 64 year old.

The after effect of no more extraordinary measures from the ECB weighed on commodity prices from that point on in the day, and that weighed on the global producers of the underlying metals. There was also at the same time the sense that we are closer to some sort of resolution as far as Iran is concerned, I saw yesterday that India was no longer buying big quantities of Iranian crude. So crude started to slide, alongside the gold and platinum price, but the copper price remained steady. So we slipped, the gold stocks slipped just over two percent, and are now down 23 percent year to date! What? Resources slipped 1.3 percent, the overall market was down only 0.31 percent, or 107 points to 34376 points. Banks were up over two percent. What? AND, are now up 20 percent for the year, that is amazing. Short gold, long banks, who would have thought?

Mondi gave a trading update for the first three months of their financial year, to end March. This is their weakest quarter, or that is what I can establish anyhow. They made 120 million Euros in the first quarter, which is both less in the last quarter and the corresponding quarter last year. But they do make some interesting observations: "Pleasingly, following the low levels of demand seen towards the end of the previous quarter and into the early part of 2012, there was a clear trend of improving demand through the period under review, such that, on average, sales volumes were higher than the previous quarter across all paper grades."

Nice, so I am guessing out loud here, but "things" are improving a little, not so? And that is also in March I guess, I would think that since the Greek debt restructuring that confidence is slightly higher in Europe than before the event. And as such I suspect that Mondi will register a much better second quarter. BUT, do I want to own a paper and packaging producer? No. No thanks.

Byron's beats looks at one of our most widely held stocks that has been in the news.

- MTN are in the news again for the wrong reasons. This time there is news that Nigerian authorities are threatening to impose sanctions on the service provider over alleged poor service to subscribers. The Nigerian Communications Commission (NCC) issued a warning to the company today.

Apparently subscribers experienced problems with connecting over the last few days without MTN communicating reasons why to either its subscribers or the regulator which are required.

To put things into perspective MTN have 42 million subscribers in Nigeria which is about 50% of the market share. That gives them massive control of the market. There are pros and cons to this. The negative is perhaps an arrogance over so much market control hence bad services which lead to allegations like this. The lack of competition may cause them to fall asleep at the wheel. I don't believe this is the case however. MTN have a great reputation for thorough efficiency and wouldn't let such an important market slide.

But because they have such a big market share I doubt the regulators would sanction a service that keeps 42 million people connected. That would be a disaster. This gives MTN a lot of bargaining power. So I wouldn't be too worried about such threats. MTN have 24 hours to respond but have not released any statements as yet. But according to this article from a website called allAfrica.com, MTN suffered a fire on Tuesday which was of course a public holiday. It's not that the service was down which seems to be the issue, it's the communication of the incident which was the problem. They seem to have a good relationship in Nigeria and I am sure they will deal with the regulators accordingly.

Although they are dealing with big issues in Iran they should not let this kind of things slide. The company has a fantastic reputation which is being tested. I'm sure unhappy subscribers in Nigeria feel the same.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks slipped and closed at the worst point of the day. There was a pleasing reduction in the weekly jobless claims, which had gone back up after having fallen to a four year low in March. Pleasing to see on the way down, hopefully the nonfarm payrolls is a surprise too. That number is set for release mid afternoon. That will dictate how the day ends up for everybody that is open around the world.

Undoubtedly the biggest news yesterday was the Facebook announcement that they would be aiming at the top end of the range to have a valuation of as high as 96 billion Dollars. Some folks are worried that some of the original shareholders, even the Zuck himself (around 6 percent of his stake), are looking to take money off the table when the company IPO's. Which is not what has been happening much at some of the other recent social media listings, the owners have been hanging onto all their stock on listing. Like Paul said, if they want to sell, why not do so on the first day? Or perhaps the size of it, the company is set to be the most valuable US technology company on listing, perhaps that is the reason. When Google listed in 2004, the company was worth one quarter of what Facebook is hoping to be, that 96 billion. The first day of trade will be 18 May, the price will have been determined probably the day before, my eldest daughter's birthday. She is turning 7, Facebook is 8. I can't believe that!

At the top end of the range Facebook are looking to raise as much as 13.6 billion Dollars, the offering is between 28 and 35 Dollars per share. Like we said above, 96 billion Dollars. Time for a road show, you can check it out here -> Facebook Video roadshow. If you have the time, go and have a look over the weekend. The Zuck talks about a better world, because people understand each other better. I have always said that the internet has done more to demystify one another from each other. They talk about their product, timeline (which was not very well received) and news feed. I have been using Facebook a whole lot more lately, because I want to understand THEIR angles, how they (Facebook) see their product changing the world. They talk about 125 billion friendships on Facebook (900 million monthly users and 525 million daily users) and 300 million photos uploaded each and every day. Whoa! And 2 billion "likes" a day. 1 billion comments a day. It is of course easier to "like" something than it is to write a comment.

Facebook says that the mobile phone means that people will become linked more heavily with their product, they currently have 488 million mobile users, Facebook is the number one most downloaded application on all mobile phones in the US. The road show video is a really good production. 100 million people were choosing Farmville and the like for extreme time wasting entertainment inside of 1 year of their launch. WOW.

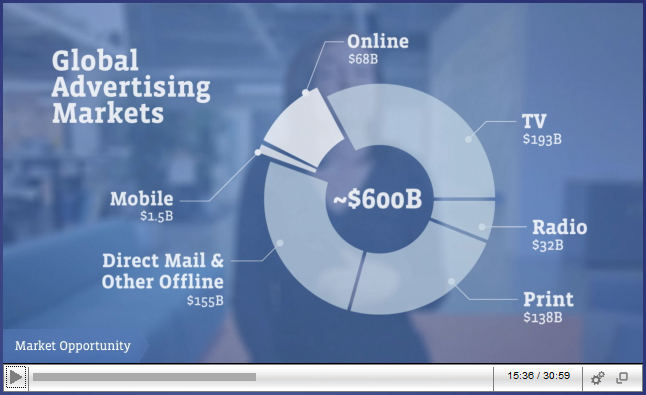

And then the most important "thing", advertising. Zuck said he did not start Facebook as a business. Adverts. In keeping Facebook free, advertisers will have to be able to reach you and I. Ben and Jerry's (the best ice cream in the world according to my wife) has over three million fans. Thanks to Facebook. And in fact, Ben and Jerry's say that for every one Dollar they spend on Facebook, they get three Dollars in sales back. This is where Sheryl Sandberg comes in, and she weighs in with this slide:

And why should advertisers send more of their money towards Facebook and not in the traditional places? In fact Sandberg suggests that advertisers are soon going to shift strongly towards an online presence, you see how skew it is still to the "old" media. I am pretty sure that a pie graph 50 years ago showed how TV was starting to impact on print. These are their compelling reasons to advertise with them.

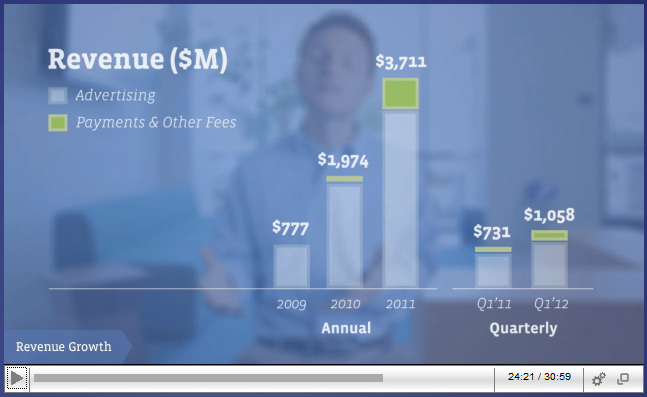

There is a much higher accuracy, because Facebook knows who you are and what you "like". In fact Facebook knows more about you than any other advertiser. This is true. That makes sense that Facebook should have the most important data to deliver to advertisers. Next, their financials, the part that EVERYONE struggles with, why would you pay so much for this business. Here is a screen grab from their video, revenue.

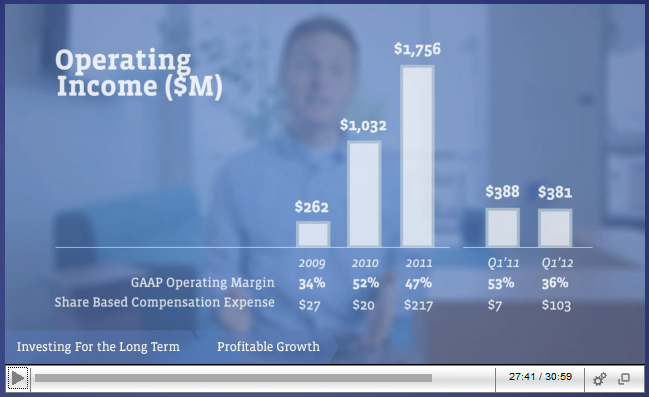

And then I guess from a valuations point of view, here is operating income, and how it has grown.

As the CFO points out, high margins whilst they are still spending heavily in investing in their business. New staff, new developers, new products. The future part, a short one and a half minute piece from the Zuck is quite moving, talking about how all web based information will be plugged into Facebook. And Facebook will be your first port of call. I am sold on the company, what I am not so sure on are the valuations. But I believe that the power for advertisers is enormous. Bigger than any other platform. And there are a lot more young people who have lived the experience, even though the age gap between myself and the Zuck is not that big (9 years), I did not grow up with the internet, I had to learn how to use it as a young adult. I suspect that like a Google, or Microsoft, this is a company that is going to be integrated into peoples lives. And worth a lot more than it is today.

OK, so what now? Byron and Paul are of the opinion that the reason that Facebook are doing it this way, pricing the stock a little cheaper (the stock has traded in the OTC market as high as 40 Dollars) is that they WANT a pop on the first day. Because I can assure you that stock will be hard to get. If not impossible. Unless you are inside of the inner circle.

Currencies and commodities corner. Dr. Copper last traded a little lower to 376 US cents per pound, the gold price is also lower at 1631 Dollars per fine ounce. The platinum price is last at 1530 Dollars per fine ounce. The oil price, well NYMEX WTI was last at 101.64 Dollars per barrel, the Brent crude oil price was last at 115.30 Dollars per barrel. The Rand is last at 7.73 to the US Dollar, 12.51 to the Pound Sterling and 10.16 to the Euro. It is all about nonfarm payrolls, that number will hit our screens at 14:30.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment