Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. The Facebook listing was delayed due to some issues with regards to the NASDAQ trading systems. They (the NASDAQ) had been stress testing their systems over the days before the listing to make sure that the listing went off smoothly. A little more on that later. We were taking some more heat from the sellers, financials sold off nearly two percent, the banks sold off nearly two and a half percent, the gold miners were the only stocks that really took off, 4.38 percent better on the day. Greece of course remains a problem for the time being. Because there is a conclusion to this, and it is closer every day. Or at least that is what we are always thinking, whilst the G8 basically said they were committed to Greece staying in the Euro. And France and Britain keen for Eurobonds. Phew. And Angela Merkel is committed to Europe and the currency, more than ever.

African Bank have released results for the six months to end March 2012 this morning, as previously indicated to us. Remember a few weeks ago, we wrote up about the steer that the company gave us, African Bank trading update comes inline with expectations. We suggested that the middle of the range was 170 cents, and bang this morning we saw earnings per share clock 170.4 cents. The dividend was unchanged at 85 cents for the first half, at the top end of the dividend policy this is two times cover, perhaps not so much as in the past, but the commentary gives the following reasons: "We believe that the current cover will retain sufficient capital to support growth for the current year." AND "The group will continue to manage its dividend policy to support ABIL through the current growth phase as well as the anticipated Basel III impacts." But still, if you double the first half earnings (which you shouldn't, it is the better half) the stock trades at around 11 times forward earnings and a dividend yield (presuming unchanged for the year) of just over five percent. 5.2 percent. Sounds good to me.

OK, headline earnings increased 25 percent to 1.37 billion Rands, almost all of it from the banking unit, the furniture unit is slowly turning around. But, making progress of course. The return on equity has moved north for the last few years, to poke its head up back over 20 percent. Return on shareholders equity is defined as follows from Investopedia: "The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. ROE is expressed as a percentage and calculated as:

Return on Equity = Net Income/Shareholder's Equity

Net income is for the full fiscal year (before dividends paid to common stock holders but after dividends to preferred stock.) Shareholder's equity does not include preferred shares. Also known as "return on net worth" (RONW)." So, rising return on equity is a good thing.

Customers added for the period clocked 320 thousand and more importantly, dormant customers reactivated or rehabilitated numbered 133 thousand. Nice. This is important, listen in, 54 percent of new customers walk away with credit cards being issued. So, I guess the new customers can go and pay for school fees or additions to their new house, you will see later. AND, there are pilot programs for both funeral insurance as well as a vehicle financing division, which has extended 94 million Rand thus far.

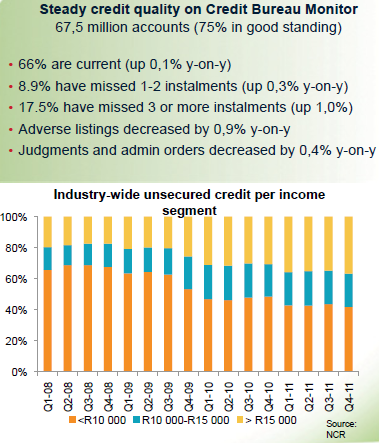

A great slide from the presentation, titled "Unsecured lending growth", you can find it here: African Bank Unaudited interim results. The graphic below is hacked just to give you an idea of who has accounts in South Africa, and how most people make sure that they look after their credit records.

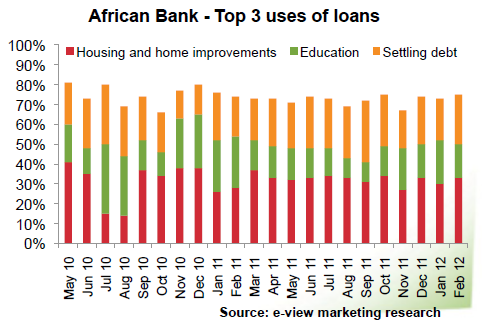

And then there is another slide, which ABIL suggests how their customers use the loans advanced. I reckon it is deserving of another slide to have a look. Most of the loans are taken for improving homes and improving lives by paying for education. I guess two things that you cannot take away in a hurry and improving the country. You might not like me saying it, but credit extension, provided that it is serviced properly improves peoples lives.

Nice. We were saying, OK, the total book is 47 billion Rand and is roughly one tenth of the size of ABSA's total book, but as Paul pointed out, ABSA has had a century and a half to build their book. ABIL was founded in 1974, but has only exploded in the last decade or so. In truth ABIL have only been a listed entity since 1998, when Theta acquired King Finance, Unity Finance and AltFin. The name change to the current one came in 1999.

That is all history. I do not care too much for the past, history was a favourite subject but I guess is only useful if you are in a profession that needs it. Think law. African Bank is a growth business and the rating that they are trading on is inline with some of the bigger more established banks, who are having problems of their own. We think they should trade on a higher multiple, but that will come in time. We have a great admiration and respect for the management team, and think that they are always in deal making mode. We suspect that a growing middle class in South Africa will continue to grow their credit profiles as they try and get ahead. We continue to maintain our buy rating on the stock.

Vodacom released results for the full year to end March 2012. HEPS were up 8.1 percent to 709 cents for the year. Dividend payouts exceeded that amount, to 710 cents. Vodafone wants the cash, they do not really care that the debt levels rise I guess, and as Paul said, with these cash flows from Vodacom, the banks won't worry too much about extending longer lines of credit. I like Pieter Uys, I think that he is a good guy, too many people think that Allan Knott-Craig is and was the business. Uys is a whole lot more humble and I think more than capable to run that business. Anyhow, I am going to have a long hard look at these results and get back to you tomorrow.

Byron's beats covers a company in a sector that we like, aspirational consumerism.

- This morning we had results from Famous Brands which came pretty much in line with the trading update they released on the 7th of May. Revenue was up 15% to R2.15bn while operating profits also increased 15% to R423mil. Headline earnings per share were up 15% to 278c while a very handsome dividend of 200c is being paid. Wow that is a cover of 1.39. With a share price of R52.46 we get a historic valuation of 18.8 and a dividend yield of 3.8%. That is a great yield for a stock that is actually quite 'expensive'.

The group has had a busy year acquiring Milky Lane and Juicy Lucy whilst opening up 146 new restaurants, 113 of them in South Africa and 33 North of our border. This is why the business grows so quick. Not only are same store sales growing but there is still so much room for new stores. And the best thing about it is that franchisers take on the risks and spot the opportunities. Their whole livelihood relies on the success of the franchise so you would imagine they are run efficiently.

There are two parts to this business. The franchising division which is responsible for R440 million of revenues (20%) and R265 million of profits (63%). And then the supply chain which is responsible for R1.7bn of revenues (80%) and R158 million in profits (37%). See the differences in margins? Well that makes perfect sense, once a franchise is sold not much costs are needed going forward other than collecting their percentage of the revenues. It's the manufacture and logistics where all the hard work is done and where Famous Brands have been so efficient. Costs have been cut and margins have increased.

But we know how this business model works, I have discussed it many times. How is the economic environment? For such good results they seem quite cautious on the economy, but most retailers are.

"Despite talk of early signs of economic recovery in the country, the period under review remained challenging for retailers. Pessimistic consumer sentiment prevailed in an environment featuring continued high levels of unemployment and indebtedness, limited real wage increases, and consumer spend pressured by rising power and fuel costs and widespread food inflation. Notwithstanding these testing conditions, Famous Brands has delivered creditable results for the year ended 29 February 2012, achieved through intensified focus and improvements in the front and back ends of the business."

I've vented my frustration about this kind of commentary before. All the retailers love blowing their own horn about good results in tough conditions but I just cannot find out who is losing allthis market share? So what about the future? I think the company is very well positioned to benefit from the African growth story. Their brands are fantastic and they have a well balanced consumer base from all ranges of incomes. I still like the long term story. I will leave you with what they say about their outlook, remember it's very fashionable to be cautious and then beat expectations.

"Consumer disposable income will remain pressured by escalating electricity tariffs, fuel costs and general food inflation. The bulk of consumers in payment arrears are middle-class earners, the traditional target market for food services operators. To entice them to resume previous levels of spending will demand intensified innovation, particularly should interest rates increase and economic uncertainty persist. Despite the negative effect which these factors will have on the industry, the Group's all-encompassing business model, exceptional personnel and best- in-class leisure brands position Famous Brands for continued growth. In this regard, the Group will undertake a range of initiatives in the period ahead aimed at unlocking further value for shareholders. This will include centralising the Group's procurement function enabling Famous Brands to become an even lower cost producer; extending the Group's presence in market segments where it currently has no representation, including identifying new joint venture partnerships; and continuing to explore opportunities to leverage the synergies afforded by Famous Brands' supply chain."

New York, New York. 40o 43' 0" N, 74o 0' 0" W. The Facebook listing was one of those memorable listings, one of those events that you have to have watched. I was not watching because it was my daughters seventh birthday party, that was a success too! But the Faceook listing did not go off as planned. A glitch of sorts by the NASDAQ saw many a investor and folks hoping for a giant pop confused and mad with the NASDAQ. But I guess on balance, perhaps Morgan Stanley and Facebook would not feel completely happy with the outcome, but the stock listed and traded. And the Zuck got married on Saturday (our Mayvis said he is too young to get married) to long time girlfriend, Priscilla Chan. Mr and Mrs. Zuck. The Zucks. Yeah, but that actually zucks, I mean sucks, the listing technology problems. The NASDAQ say that they are embarrassed by what happened. And they (the NASDAQ) are planning to repay some investors but would need SEC approval, according to the WSJ. This was a screen grab from the Zucks weekend, see, he was busy.

Next and most important question, where to for the stock? They closed JUST above the listing price, I was hopelessly wrong on Friday. Perhaps the problems in Europe, perhaps the greater offering from the vendors or the trading glitch, or the valuations. Or all these issues saw the price close just above the IPO price of 38 Dollars. There could be some short sellers stepping up the pace, there could be staggers throwing in the towel, equally the pent up demand could return to the screens. We watch as the NASDAQ continue to apologize for their mistakes.

Currencies and commodities corner. Dr. Copper is trading higher at 352 US cents per pound. The gold price is last at 1592 Dollars per fine ounce, having bounced properly on Friday. The platinum price is trading at 1464 Dollars per fine ounce. The oil price has also ticked up, 107.39 Dollars per barrel for Brent Crude, 91.86 Dollars per barrel for NYMEX WTI. The Rand is steady I guess, 8.34 to the US dollar, 13.11 to the Pound Sterling and 10.63 to the Euro. We have started a bit mixed here, a little lower.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment