Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. After starting poorly here on Friday, we rallied into the close, the Jozi all share index managed to close half a percent higher, or 168 points to close at 34038 points. Financials driving markets higher, Old Mutual continues to look much better after an interim management statement from Thursday morning from before the market opened. The last little rush up in the market was as a result of a better than anticipated consumer confidence number, as much of the day was dominated by a real howler by JP Morgan. A 2 billion Dollar trading loss. I suppose that whilst the company will still make a profit for the quarter, people are saying, that is not the point, they (JP Morgan) were the ones that sniggered at everyone else and were supposed to the kings of risk. As far as I can tell, the very word risk implies something in the first place, that "things" can happen and that "it" can go all wrong. A few employees have had pink slips already.

Lonmin have released results for the half year to end March this morning. I saw an interview with Ian Farmer, the CEO, this morning. I suggested that he looked like he had just lost his crop. He looked relegated. That look on the Bolton fans yesterday. Whilst Lonmin describe their results as solid, it is in a challenging environment. Costs in Rands up nearly 11 percent, revenue basket in Dollars down 10 percent, but the Rand basket price was only 0.5 percent lower, thanks to a weakening local unit. Platinum sales for the half basically flat at 318 thousand ounces. In the interview Farmer basically said whilst European auto catalytic convertor sales (platinum used in Diesel vehicles, of which there are many in Europe) were understandably weak, he still sees the long term fundamentals intact. I guess I would have to agree with him on that score, and even though we have dropped our platinum company exposure, we hold that view too.

It seems that whilst mining companies are still pointing fingers at safety stoppages, there is definitely a sense that both companies and the DMR are working towards a solution to reduce downtime. As they point out in the release: "Lonmin performed well in a period where unprecedented high levels of Section 54 safety stoppages, labour and community unrest impacted on our production. The impact was slightly less in Quarter Two however as we saw the benefits of our partnership approach with the DMR in tackling the safety journey start to come through. We expect production to ramp up in the second half as normal, absent any further abnormal disruptions."

The company has registered a loss for the period, so I guess no matter how much they tell us about the fundamentals and the future, this is the ugly truth. What I found quite interesting was their supply forecasts, because I am starting to read that notwithstanding the shortfalls, we might even see a surplus in the platinum market, not palladium as those crazy Russians continue to monkey with the price. But Lonmin reckon that they expect now the market to be undersupplied this year, check it out: "Platinum supply estimates have been progressively revised downwards since 2007, due to supply disruptions and constraints in South Africa. 2012 has already seen disruptions affecting over 200,000 ounces worth of production due to strikes and industry wide safety related stoppages. Some analysts are estimating that 2012 could see supply disruptions of up to 400-500,000 ounces, which would almost certainly lead to supply deficits, despite softer demand."

So how do these results make me feel? I know how Mr. Market feels, the stock is down four and a quarter percent today. This is the lowest price since December of 2008. And at 113 Rand it seems the days of 600 Rand in the middle of 2007 were a long time ago. A long, long time ago. The results make me feel like that, as South Africans we are missing an opportunity to mine these assets that we happen to find ourselves on by bickering all the time, about issues that should be easy enough to resolve. No thanks, the platinum mining companies seem to be facing too many pressures, I am still surprised that the platinum price is NOT higher than these current depressed levels.

And now they are talking about it. I suspect that the chances of Greece leaving the Euro zone have risen over the last few days, because basically the Germans have said, if you want to, then you must. It will be bad for the Euro, but it would be so much worse for Greece. It would be disastrous for Greece. And, the Germans have basically said that the Euro, whilst it would suffer, it was much better placed to deal with these issues now.

I saw an FT graphic from last year, which explained simply what happens practically when you default without support? Simple. You run out of money, because nobody is actually going to lend you anything, because your recent record is patchy. Forget the fact that Greece's record is very patchy anyhow. And then you cannot pay your civil servants. No healthcare, no teachers, no public transport, nothing works. Poor people get poorer, because at least one Euro is worth something, one Drachma will not.

What next for Greece? Well, there seems no chance of a coalition government in Greece, or little chance, so fresh elections are coming. The central bank governor of Belgium reckons that it is OK if Greece wants to make that decision. It all comes down to the money. The politicians can say that they have the peoples mandate, but I think that their (the peoples) emotions probably do not translate to wanting to exit the Euro. File that in the drawer of unintended consequences. But, austerity sucks. There were Spanish people protesting over the weekend, and Germans protesting by voting Angela Merkel's party out of power in some regional elections over the weekend. Elections on the weekend, that is how it must be done. These regional elections are important, because we can see that even the common German folk are sending a signal. But instead of voting in fringe parties, the democrats and greens in Germany are starting to make progress. So you see, even though the German government is pressing Greece and Spain hard, the truth is austerity sucks.

There is a EU Finance meeting today. Guess what is on the agenda, Greece of course. And Spain. And later, investors get to vote themselves with a bond auction for Italy today. The Italians are not too excited about being compared to the Spanish and in theory this is true, the two countries are very different economically, if not geographically. Germany, France and Spain also have debt auctions today, this has become almost as exciting as watching the various football leagues come to a conclusion. So the noisy neighbours eh? I am pleased for them, and their Italian coach, Italy is winning! And Greece is too, Olympiacos Piraeus, a basketball team from Athens won the Euro league yesterday. But, we wait for the outcome of these talks today and how much the Greek people want, or do not want the European money. Because for me, that is what it comes down to, accepting the money in return for further reforms and cutting of a bloated public sector, and just another chance to stay afloat. All of these hard decisions are not for me to decide.

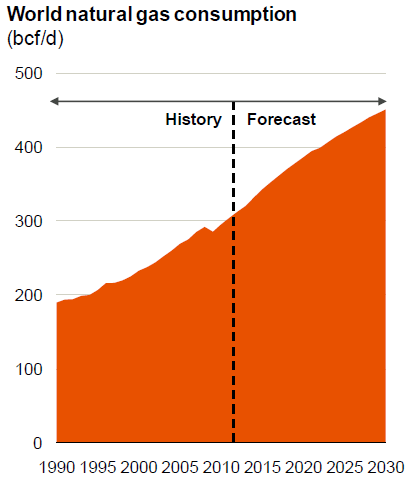

There are a whole lot of interesting slides in a BHP Billiton presentation: Technology, strategy and the growth of gas as a source of global energy. Check out the slides, because a picture of course tells ten (or is it a thousand) words. So I have gone and grabbed a whole lot of screen shots. First, world natural gas consumption shown in Billion Cubic Feet Per Day. I can't even imagine how big a billion cubic feet is, and how you can actually shrink it, but for the purposes of consumption and production, that is what it is measured in. It is much easier to imagine a barrel of oil.

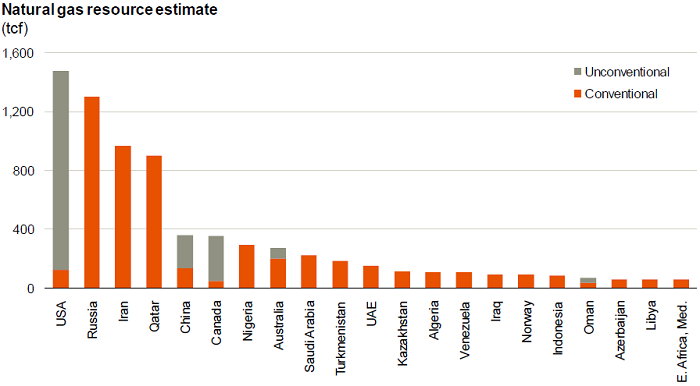

Basically, global natural gas consumption is expected to double inside of thirty years, starting in 1990. And if we believe the forecasts, then natural gas consumption should double between 2000 and 2030, keeping up that thirty year trend. The next slide points out why we have seen lower gas prices, because the improved technology has led to greater supply. In the US, the greater use of technology (fracking) has seen US production improve dramatically. Many companies in the US, either at a services level or at a production level have ramped up their exposure to natural gas, and this next visual tells us why. Natural gas resource estimate sees the US have years and years of "unconventional" gas resources.

The next few slides are specifically related to BHP's business in the US, how their operations are lower cost than their peers. And one slide which explains how 600 thousand jobs have been created by this US gas push. And how they no longer import. No wonder natural gas prices have plunged, there is now huger interest. I suspect that Americans will revolutionize gas usage plugging into the mainstream and developing new methods. We maintain our positive bias towards BHP Billiton, their gas purchases were "early". And interestingly Pat Davies (the ex Sasol CEO) was announced as a BHP Billiton non exec this morning.

Byron's beats looks at another one of the South African hospital groups.

- We had Life Healthcare releasing results on Friday and then this morning we had Netcare with 6 month interims. The big difference between these two companies is that Netcare have operations in the UK along with R26bn in net debt compared to Life's R2.2bn.

Here is a brief overview of the Netcare results. "A positive performance in South Africa (SA) was offset by weaker results in the United Kingdom (UK) primarily due to the challenging economic environment. Adjusted headline earnings per share (HEPS) increased 16.1% to 51.9 cents for the period under review. Operational efficiency and implementing business improvement plans were again key focus areas for the Group."

You can see where my message is going to go with this one. In a world of choices why would you choose a company with big exposure to a declining economy when there are better options out there? Well the difference is that Netcare understandably looks a lot cheaper. Trading at the R13.93 we get a forward PE of 13 (if we annualise this number) compared to Life's 19. Let's look at their debt situation in the UK and how their South African businesses compare. Of their R26bn debt burden, at least R21bn of that sits in the UK with their General Healthcare Group (GHG) business.

"GHG continues to meet all financial covenants on both the OpCo and property- owning companies (PropCo) debt facilities. PropCo remains focused on achieving a solution to the PropCo debt facility, which matures in October 2013. Advisors have been appointed and various options are being evaluated. The PropCo debt is ring-fenced from the OpCo and is also without recourse to Netcare`s SA operations."

See that the debt facility matures in 2013. They are going to have to arrange a new facility otherwise they may default and the hospitals could be seized. They seem to be on time with their payments so I would expect them to be able to arrange something but it is certainly a concern. Margins in the UK are decreasing as consumers shift to the lower margin NHS (state care) from the private hospitals as tougher times fall upon the wealthy. It is not an economy I would want to operate in right now and I would expect this trend in margins to continue. GHG has now become the largest private service provider to the NHS but with austerity measures being implemented one wonders how lucrative this kind of business is.

The South African Business is a similar size to Life with operating profits of R1.1bn compared to Life's R1.2bn (for the whole group) yet Life has a market cap of R27.5bn compared to Netcare's R20.9bn. In fact overall Netcare makes more money than Life with operating profits of R1.8bn. You can see that the UK business is a big portion of that (38%).From my message on Friday you know I like the fundamentals of the industry. But the UK business along with its massive debt facility puts me off this stock. I certainly feel it deserves the cheaper valuation that the market afford it.

Beijing central. 39o 54' 50" N, 116o 23' 30" E Hah! Chinese authorities have cut the reserve ratio requirement in an attempt to get the banks to lend more money. Now, depending on what your view is on China, whether you fall into the too-much-debt-and-banks-are-built-on-quicksand crowd, or whether you see the internal consumption story driving Chinese growth in the long term, as it should, you would view this triple R cut differently. Indeed I am not alone thinking along those lines, I came across this Bloomberg story (China's Stocks Drop to Three-Week Low) in which a quote suggests that "things" have to get much worse for a serious policy response. As many have suggested, interest rates need to be cut to make a real difference. But I get the sense with subdued inflation that policy makers are going to be forced to move in that direction. Stand by.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Ooops. JP Morgan came in for a whole lot of heat, I saw Jim Cramer having a big go at Jamie Dimon, who was really the attention of a lot of abuse, both on the box, but folks let rip on twitter. And the Greek connection going too, Dimon is of Greek extract and the losing investment had a connection to the name Achilles. Because a fellow by the name of Achilles Macris, ran the trading division. And now, I see from over the weekend that folks are saying no, he must go, that is a true South African line. Doesn't it come from District 9? They must go, really, they must go. Whether or not he will, well that is what the (now smaller) board must decide along with shareholders. Not for Joe Public to decide.

Currencies and commodities corner. Dr. Copper is having a really tough session, last at 359 US cents per pound. The gold price is also taking a drubbing, Mr. Giant Risk Off is visiting Mr. Markets house today. Last at 1562 Dollars per fine ounce, the platinum price is also under the same pressure, down at 1448 Dollars per fine ounce. The oil price is trading much lower at 94.15 Dollars per barrel for NYMEX WTI, 109.9 Dollars per barrel for Brent crude. As we said, Mr. Market is taking another hit today, more worries about the Greeks.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment