Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Not good, or at least not looking good at all. My hero Jim O'Neill, who is chairman of Goldman Sachs Asset management and therefore should know a thing or two, said that he had recently been in the US on a whirlwind tour and the only thing that everyone wanted to know about was Greece. He said that he had seen encouraging signs in the US, but his clients concerns was on something on the other side of the ocean. But let us put this into perspective. The Greek economy is two percent of the size of the US. Meaning, quite simply if the US grows at a very anaemic two percent this year, that would have added the entire Greek economy. So, how can something that small (in the bigger picture) really drag down the rest of the world? Even more telling is that Greece is 1.72 percent of the entire European Union. How could one country of that size bring down an entire bloc? I guess confidence in the zone has been dented, the countries are more interconnected than ever before. So this is possibly the one and only event that is keeping us back. That Mad guy Jim Cramer reckons (on his Tuesday evening show) that we would be close if not at all time highs if it was not for Greece. Amazing.

Resource stocks took another hammering, down 2.4 percent, and are now nine and a half percent collectively this year. Versus an index that is up just shy of three percent. The Jozi all share index sank 1.79 percent, or 600 points to 32887. There was little place for anyone to hide yesterday, we were all "greased up" (Greece'd) and sliding downhill. Full of olive oil and wrestling a slippery slide downhill with our hands tied behind our backs. You know what, when everyone gets scared and runs, shooting first and asking questions later, eventually the sellers are fatigued in the same way that the buyers are. We are long term accumulators of quality stocks, so if you have free cash lined up for investing, get cracking.

Mussels in Brussels. Mussels are always on the menu when you visit Belgium, I have only ever spent a few hours there, so I can't comment. It turns out the European leaders might as well have gathered for a friendly meal at the European headquarters yesterday, because after all was said and done, nothing really happened. At least at a headline level, the Germans said no to the Euro bonds that the French had been pushing for (not a new thing, because Nicolas Sarkozy wanted this too), and all the leaders said that they would like to see the Greeks stay in the Euro zone. So, at face value, the meeting was a waste of time. But I have always maintained that the only way to move to fiscal integration in Europe is to actually do it, and nothing like a good old fashioned crisis to get everyone on the same page.

Angela Merkel said that she wanted Greece to stay in the Euro zone, but they must keep the promises that they made. In other words, this upstart Tsipras (that the opinion polls suggests has one in four people on his side) that is saying that this austerity is not the right way, and the terms posed are crippling Greece, you must stick to your side of the deal. In the mean time the suggestion is that Europe is making contingency plans for a Greek exit. A Grexit. I am pretty sure that the Greeks know very well that a vote on the 17th of June is basically a referendum. Elect the lefties and let them form a government, and you are out. Auf Wiedersehen. I think that is right, my German friends can help me with that.

I think that there must be a roadmap for fiscal integration (there probably is amongst the reams of paper stored in Brussels), I suspect that Berlin will only want this once government accounts are in order. And that might take a few more years of pain for the southern states before Germany agrees to proceed. But I guess that point, the issuance of Euro bonds would be the real moment and would see us closer to fiscal integration. I guess either it comes, in a normal European kind of a way, slow and bureaucratic, or the zone really does risk spinning off the weaker members.

Back to that Jim O'Neill guy who said that he had already seen a change in attitude of the Germans since the Hollande election. And this was the example that he cited, one of the biggest labour unions in Germany, around 800 thousand metal workers had won a 4.3 percent pay rise. This comes after finance minister Wolfgang Schaeuble said it was time that wages rose in Germany to reduce economic imbalances in Europe. You must be thinking, 4.3 percent, that does not sound like too much. BUT. This is the biggest increase in twenty years. And German civil servants managed to get a 6.3 percent pay increase, this is for two years. SO, what Jim is saying is that Germany has made a concerted effort to move towards stronger consumption internally in German. Sneaky hey? Even sneakier is that German government (meaning high end folks) increased their own salaries by 5.7 percent. But, the German have basically said that they have done all the reforms, so they can do this. Austerity could actually be a thing of the past in Germany. Perhaps the Hollande election thing is coincidence, the timing.

SABMiller have released results this morning for the 12 month period to end March 2012. Really strong numbers for Latin America and the rest of Africa (as well as South Africa) more than offset pretty stodgy numbers from Europe and North America. Asia Pacific, although still relatively small from a profit contribution point of view, grew strongly. It is actually quite a diverse business (30 countries in total) with an extraordinary number of brands across all their geographies.

In the US there are 30 brands, including Coors, Miller and Blue Moon, 11 brands in South Africa, with well known brands such as Carling Black Label, Castle and Hansa, Latin America has 30 brands, including Pilsen and Aguila, Europe (think emerging Europe mostly) has 60 brands including Pilsner Urquell, Peroni and Grolsch whilst the SABMiller rest of Africa business has 36 brands, including 2M and Laurentina, just over the border to the East of us. And then there is the Asia Pacific, which has 73 brands in total, including a whopping 58 in Australia. Brands such as Snow in China, Fosters in India and VB in Australia. So, add those up and you get to 240 brands in 30 geographies, an average of 8 per country, not bad I guess, Aussie pulls the average up a lot. In Vietnam they have a single brand, Zorok and in Lesotho a single one too, Maluti Premium Lager. I am a very limited drinker of alcohol, of the above brands I have tasted four. And that is because they are all here in South Africa.

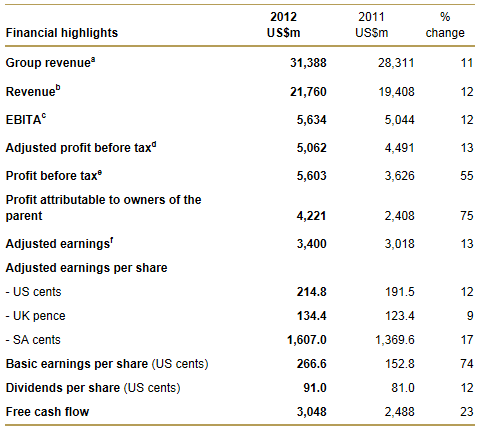

The results themselves, well, a picture tells you what many more words would, so I did a hack job from this place: F12 full year results: SABMiller drives strong results in developing markets. First, financial highlights:

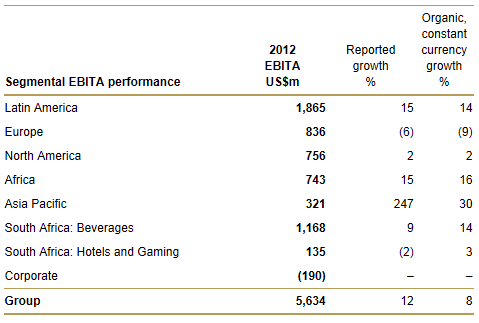

All those numbers look very decent, then you get to the segmental report and you can see how strong the Latin America market is for SABMiller. Well timed purchase, credit must be given where it is due, 7.8 billion Dollars was the purchase price in July 2005 (for roughly three quarters of the overall business), that business now makes 1.865 billion Dollars EBITA. One third (33.1 percent) of EBIDTA comes from Latin America, 20.73 percent from South Africa, 13.19 percent from the rest of Africa and only 5.7 percent from the Asia Pacific region. So it is safe to say that it is an emerging market business with 72.72 percent of EBITA coming from these regions. I guess you could also add in the 2.4 percent hotels and gaming stake contribution from South Africa. This is now from a 36.87 holding in Tsogo Sun Holdings. That contributes 135 million Dollars in EBITA. Wow. Here goes, the breakdown:

See the quite large fall off in Europe. And remember that they only have operations in the old Western Europe in the Netherlands and Italy. All the other countries in Europe are the old traditional ones, the ones in Eastern Europe including the Czech Republic, Poland and Romania, as well as Slovakia and Hungary. The only other country included in that cluster are the Canary Islands. Which is closer to West Africa than to Europe, but is a Spanish protectorate.

OK, so what are the attractions of owning a business like SABMiller? Well, it is consumer oriented business that is well placed and in some cases the market leader in some fast growing developing markets. Sure, they have tricky operating environments in the developed market businesses, but those are manageable. As you can see from the above, all the regions that contribute to earnings growth are the developing world, so tick that box, emerging market consumer based stock! Next, does the price look right? Well, that is trickier, let us work that out in Pounds. The stock trades at just over 24 pounds, or in Dollar terms 37.7 Dollars. The company reported adjusted EPS of 214.8 US cents, so the stock trades on a historical multiple of 17.55 times. And a dividend yield of 2.4 percent with a 91 US cents per share for an annual dividend. You would hardly say cheap, but you would hardly say overly expensive. Somewhere in the middle and I suspect that is what the shareholders who have driven it to these levels say to themselves, growing developing world, stodgy old world, need to pay up a little.

Paul said the other evening on Hot Stoxx (watch it daily at 20:00 on CNBC Africa, channel 410 on the DSTv bouquet) that he thought that the business is not really in a transformative industry. So it is not going to change the way that the world works, we are talking about beer here. Make no mistake, they seem to execute really well, some deals have been great. We worry too about the regulatory environment, there has been quite a lot of talk about increased taxation on alcohol products. Let me be clear, do governments of the world want a workforce that drinks less or more? Pretty simple to answer that one. It has done amazingly well, in ten years in Pound terms the stock is up 320 percent versus the FTSE that is up only 2.27 percent. Heineken is DOWN 10 and a half percent over the same time period. Time to give a big up to the smart folks there. But we wouldn't buy any over here at Vestact.

Beijing central. 39o 54' 50" N, 116o 23' 30" E Eeekkk. The HSBC flash PMI data release, which is always a little earlier than the state official one (and very often looks worse) has come in lower than expected. These flash numbers are also ahead of the final numbers from the same release, to coincide with the official ones. The number was 48.7, which indicates weakness. In part the Chinese put the brakes on themselves, they engineered this slowdown. Inflation is slowing, that is what they wanted to do. Time for some more policy response as we indicated a little earlier in the month, the triple R has been cut, it is possibly a matter of weeks before we see w full blown interest rate cut.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks staged a heroic bounce ending flat to 0.4 percent higher in the case of the NASDAQ. Buyers. Starting to sniff a bargain when they see one I guess, and perhaps that dumb line that I used earlier, sellers fatigue. Metal fatigue is understandable, but other types of fatigue, especially when trying to give the collective market human characteristics, that is just plain strange. That is why I always tongue in cheek refer to this as Mr. Market. I think the actual term is Anthropomorphism. Collective buyers and sellers are involved, not all of them human, perhaps there is a human element to assigning a human emotion to the collective. Like I said yesterday, I see the market as quite cheap. But that is just me. Many are anxious about Europe. That will pass.

Currencies and commodities corner. Dr. Copper is last at 346 US cents per pound, the gold price is slightly lower at 1557 Dollars per fine ounce. The platinum price is weaker at 1419 Dollars per fine ounce. The oil price is slightly higher at 90.46 Dollars per barrel for WTI NYMEX. The Rand is 8.37 to the US Dollar and 13.13 to the Pound Sterling. The market has started marginally better, but some average European data has weighed us down a little.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment