Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. It seemed that the major issue was still the European elections from the weekend, but it almost seems like a foregone conclusion that the Greeks are going to have another election coming soon. Well, they better hurry. According to the last agreement, Greece had to vote through further austerity measures by the end of this month, in order to receive their next round of funding. Otherwise they are going to default. And how did their markets take to this? Well, down to the worst levels in 20 years. Whilst people might well be spooked by the fact that the anti austerity and anti Europe types got quite a large portion of the popular vote, not enough to form a government. And the Pasok party which was dragged through the brambles and nettles at the polls does not really have much of a chance of forming a government of any kind. So the Greeks, who invented democracy, will get another chance to go back to the polls. According to a Bloomberg article which I read on the serious problem of a more than a simple hung vote, more than two thirds of Greeks polled want to stay inside of the Euro zone. They are just tired of all the austerity measures.

Ironically, Gideon Rachman of the Financial Mail has weighed in saying that the Greek dilly dallying is actually a "good" thing for Angela Merkel and the German austerity push, because it leaves new French president Francois Hollande with very few options really. He might talk up some emotive issues, but really in the end the conclusion is clear. The French, faced with the choices of supporting Greece or supporting Germany inside of the Euro project are going to go with the Germans. I urge you to read it (even if you sign up for a free thirty day trial, just for this one), you must check it out: The Greek crisis will fast expose Hollande. Like I said to Paul yesterday, the idea of leaving the club (the Euro Zone) and going it alone (Greece) might have a certain romance to it, but the reality is that almost everything that you hold dear will be crushed almost immediately. Think about pension savings that would halve or more at worst, the trade benefits of the current arrangement, the fact that Greece has no natural resources of their own. It would almost be a sure recipe for anarchy.

At the same time would you believe, at the core of the Euro in Germany, the country reported a much stronger than expected industrial production number with the suggestion from the IMF that a domestic demand recovery is underway. Yeah. See that? This Euro exercise is very good for Germany. A monster construction number inside of the release (March number), but in part the suggestion was that February was terribly cold and this was a rebound plus pent up demand drove the overall number. The beer drinkers might well be suggesting, crisis? What crisis? At the same time I read a fascinating article of Sweden's colourful finance minister Anders Borg of how he led Sweden through this crisis by NOT following the mainstream. And lowering taxes for the wealthy (wildly unpopular), cutting entitlements (also unpopular) but all working in the favour of the average Swede. To such a point where Sweden has looked much better than their peers. And to such a point that he is probably the coolest finance minister in the world. Although with a good haircut (lose the pony tail) he might actually be cooler, sometimes trying to be cool can come off as way nerdy.

Briefly, the markets sank heavily in the last quarter of trade, the Jozi all share index closed at 33547 points, down 408 points for the day, resources being a big drag, down 1.52 percent. Telkom rallied to see the fixed line index up (it is only them in that index), but phew, it was just because KT Corp. was taking a stake, or that was the intention at least. Platinum miners got thrashed, down nearly three percent. Eish, not looking very good, but at some stage these miners might be attractive. Or as we often say, perhaps we are watching the same story as the gold miners from a decade ago in slow motion. The fundamentals for the metal that they mine as still great, but owning the companies sadly has not worked out well for shareholders. Sis.

Byron's beats gives us feedback on his investor day yesterday.

- Yesterday I went to Massmart's annual store visit which I must say was very interesting. They took us on four store visits as well as a look at their central distribution centre for Gauteng and the rest of Africa. We started off at the Makro in Woodmead which is their second biggest revenue spinner. The store has revenues of over R1,1bn a year and the second biggest butchery in the country. It's all about size and scale and allows the customer to get almost anything he/she needs or wants within one shop. The liquor store is also massive.

The next store we visited was the Dion Wired in Boksburg. This is one of my favourite shops and one that falls well within that aspirational consumerism theme we like so much. From iPads to affordable flat screen TV's to Nespresso machines. They have it all and although the electronics industry is highly competitive I am confident these stores will do well considering our economy.

Then we went to one of their Cambridge stores in Vosloorus, a township in the South East of Johannesburg. I was very impressed with the size and scale of this grocery super market offering very cheap goods to low end consumers. It has the feel of a massive African styled kiosk with everything from fresh meats to an array of African healing muti selections. Although it was still early, the queues were growing by the minute. There is competition for this market but I believe there is still such a high demand for such stores which is still a fairly new concept in this country.

After that, we went to their distribution centre which was back in Boksburg, nice and close to the N3 highway coming in from Durban. The warehouse was massive as we sat with an aerial view from the meeting room. As the operations manger explained how the systems worked you realised how well organised the warehousing process was. It has to be. Everything is processed electronically with a maximum of 48hrs in the warehouse before being trucked off to the relevant Game and Dion Wired stores.

South African retailers are not reinventing the wheel here, it's all been done before and on an even larger scale. That is why it is so important to have Wal-Mart guiding these guys in the right direction and avoiding mistakes they have already made and learnt from whilst building the biggest retail system the world has ever seen. Seeing the warehouse made me really appreciate the behind the scenes hard work it takes to get quality products to consumers at good prices.

Our last visit was to the Game and Foodco at Greenstone mall. Everyone knows about Game but Foodco is a fairly new concept. Basically they have taken 20% of the Game store and turned it into a grocery section. It has a very similar feel to a really nice Pick n Pay targeting the upper middleclass consumer. I was impressed and think that a lot of Game customers will be pleasantly surprised. I do feel however that they need to roll out a big marketing campaign to get the brand out there. The sector is very competitive.

All in all it was an interesting visit and I remain happy to have this company as our favoured retailer. The fact that Wal-Mart is guiding an already very highly regarded management team through the challenges of being a mass retailer in an undersupplied economy makes me believe that even though it looks expensive, as a long term hold, shareholders will be handsomely rewarded.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. The worst point of the session was reached around 11 in the morning, around the time that Europe was signing off, but markets actually rallied from that point to trim the losses. The nerds of NASDAQ was off nearly two percent at one stage, but closed off 0.39 percent in the red, a heroic recovery I guess. Some of the tech heavyweights have had a bad time over the last few weeks, Cisco is down 11 and a half percent since the beginning of April, Apple is down five and a quarter percent over the same time period, whilst the Microsoft share price is down five and a half percent since the beginning of April. Google has fared the best, down "only" 4.44 percent. But seriously, I can't wait for the Facebook listing in just under two weeks. Around then.

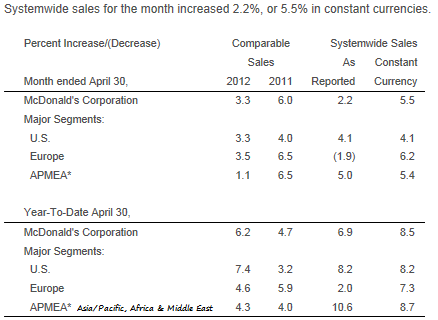

McDonald's released same store sales that really flunked, they were not bad, but for Mr. Market all he/she wants to see is that it beats expectations. And this it did not. We wondered for a little bit whether or not the stories about people starting to "eat up" in value was partly to blame for these numbers coming in with a weaker showing. Here is a quick screen grab from their press release -> McDonald's Global Comparable Sales Rise 3.3% In April.

I think that whilst analysts may have underestimated the impact of the stronger US Dollar on these sales, the constant currency sales number was quite important when trying to develop a trend view of how their sales are panning out. Looks just fine to me, but the equity participants voted with their feet, sending McDonald's over two percent lower to 93.55 Dollars. I like these prices, this is the same price as you are getting in November last year. The stock forward with estimates of 6.30 Dollars worth of earnings for the next fiscal year is trading at less than 15 times earnings. Which is a whole lot cheaper than Famous Brands, see Byron's piece from two days ago: Famous Brands trading update, still looking good. And let me be clear, I would rather own McDonald's AND Famous Brands, but if faced with only the choice of one, I would side with McDonald's. After all, McDonald's has increased their dividend EVERY year since implementing one for the first time back in 1976. Healthy sign, which is ironically the direction that their food is moving.

Currencies and commodities corner. Dr. Copper last clocked 366 US cents per pound, across the commodities complex prices are lower, the gold price is last at 1594 Dollars per fine ounce. The platinum price is also lower at 1506 Dollars per fine ounce. The oil price is lower at 96.7 Dollars per barrel for NYMEX WTI, whilst Brent is also lower at 112.42 Dollars per barrel. The Rand is weaker, most currencies that are not the Dollar and Yen are lower relative to those two, last at 7.90 to the US Dollar, 12.75 to the Pound Sterling and 10.26 to the Euro. You know how many times we say Dollar in this segment normally? 6 times, if we include the US cents as referring to Dollars. So, until commodities are priced in another currency, the Dollar will continue to be king. You could probably ask a European what the oil or gold price is, and they will quote the Dollar price. Locally the same. We are going to start higher here, but not by too much.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment