Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. It was all fall down yesterday, markets across the globe sank, that nasty word contagion made an appearance again. The headlines across the publications that I read point to the great big fat Greek political impasse affecting the Mediterranean markets negatively, Spain was squarely in the sights of the government bond sellers, with the yields reaching levels not seen since late last year. And also being highlighted was the record spread between German Bunds and Spanish bonds. Indicating of course that internally in Europe, folks are happy to park their money with the Germans, and the others, well, not so much. Much needs to be done now by the European Finance ministers, who started a meeting yesterday in Brussels, more on that later.

These issues that continued to swirl around saw folks shoot (sell in this case) and ask questions later. Across the globe we saw steep sell offs, but especially in Europe, where the FTSE and DAX were down nearly two percent, with the CAC40 in France down just over two and a quarter percent. Welcome Francois Hollande. Across most of Europe stocks were clocking year lows, we were marginally helped out here by the weakening currency, that always helps out the Rand hedges and in particular the perceived defensive stocks, both SABMiller and BATS held firm, but that was not enough to prevent the Jozi all share index sinking nearly one and a half percent, down 504 points to 33533 points. Whoa, where did 34 thousand points go? Banks sank two percent, resources dropped 2.36 percent, gold miners showed their hedge properties fell three and one third of a percent, whilst industrials sold off just one percent. Retailers were off 1.7 percent. It was a horrible no good day to be long the market, but to panic, well, that is not the way to go about investing. If anything, if you have any spare funds lying around, line them up!

Right. The message from the folks in Brussels yesterday is that there is no talk about a Greek exit from the Eurozone, or what is being dubbed "The Grexit". This is propaganda they say, which I guess is at some levels weird for many. It almost smacks of crisis, what crisis? BUT, at the same time, the Europeans want solidarity. I can definitely understand why they want to stay together, any exit of any sort then opens the door for others and no doubt will spook the market. But I think that they (the collective) hear the pain that austerity is causing amongst the common folk and now see the results politically. So whilst fiscal discipline is important, well, so is political stability, even more so in a time of crisis. So perhaps the austerity measures implemented across much of Europe should have been phased in rather than rushed in, because humans do not like change of any sort, and in fact across the Atlantic, that is exactly what monetary stimulus is designed to do. To make sure that when the economy stabilizes that the spiked punch bowl is removed slowly. Because the idea is that as tax revenues rise, then the gap is closed and the short term issues abate.

Meanwhile, Moody's has downgraded 26 Italian banks. {Crickets chirping} Err, moving along. Meanwhile in GDP numbers just released, the French registered no growth for Q1, whilst Germany beat estimates and their economy grew by 0.5 percent in the first quarter. So, in the absolute worst of times, Europe's two biggest countries have not shrunk. In fact Germany embarrassingly has grown better than expected. Because I can see those folks down south saying, well it is going fine for you.

Back in Greece, the president is trying to form a unity government, of which Alexis Tsipras, the firebrand youth does not want to be a part of. From the pictures I see, he swoons around like the power broker and says things like, 70 percent of Greece voted against austerity. Yes, but just less than 17 percent of the electorate voted for your party, meaning that as far as I can tell, 83 percent of the voters did not vote for his party. But this is the key part, last evening these were comments made by Eurogroup president Jean-Claude Juncker after the meeting of the European finance ministers on talks about Greece and the Euro. To find all of the comments from this Reuters story: HIGHLIGHTS - Comments from euro zone finance ministers and officials.

- "I made it perfectly clear that nobody was mentioning an exit of Greece from the euro area. I am strongly against. We are 17 member-states being co-owners of our common currency. I don't envisage, not even for one second, Greece leaving the euro area. This is nonsense, this is propaganda.

We have to respect Greek democracy. I'm against this way of dealing with Greece, which consists in provoking the Greek public opinion and giving advice and indications to the Greek sovereign. Greece has voted, we have to take into account the result. We do hope that a government will be formed in the next coming days or weeks and then we have to deal with that government. We don't have to lecture Greece.

But the Greek public, the Greek citizens, have to know that we agreed on a programme and this programme has to be implemented. But I don't like the way of dealing with Greece, those that are threatening Greece day after day. This is not the way of dealing with partners, colleagues and friends and citizens in the European Union."

Oh! Propaganda and nonsense. I can see where he is going with all of this. I agree that for Greeks in the long run there is going to be a whole lot of pain. But that is better than reverting to the old currency. But the Greek people have spoken. I suspect that in the short term we will see commitments being made by the Greeks (once they form a government) and by the Eurozone to one another. And perhaps concessions on both sides, to admit too much austerity is not too helpful, but equally that fiscal discipline needs to be maintained in order to stay inside of the zone. That is the result that I am looking for, a concession from both sides. Oh, and meanwhile Hollande is sworn in today and his first visit is off to Berlin tonight. No guesses to what they will be talking about. France and austerity, Spain and their bond yields, Greece and errr... lots of issues, Italy and our friend Mario. All in German no doubt, Francois Hollande can speak German fluently is what a guest on CNBC Europe said this morning.

Byron's beats looks at BHP Billiton and their gas assets.

- Yesterday Sasha covered the BHP Billiton report which was titled "Technology, strategy and the growth of gas as a source of global energy." I want to touch on it again because as investors in this company it is an extremely important growth story that Billiton are investing billions of dollars in. Billions of dollars which may have been ill timed.

In fact there are rumours that they may have to write down the $17bn investment they made in both the Fayetteville and Petrohawk shale gas assets they bought last year. Why? Because, the price for shale gas has halved since this acquisition. It was unfortunate timing as a warmer than expected winter hampered demand while an improvement in technology flooded the market with supply. I would say this is one of the large factors that have hampered the Billiton price this year.

A write down will not be ideal and in the report Billiton state that they are actually holding back on gas production because the price is so low. But what may be a negative in the short term could be a big positive for the long term. Because the price is so low, gas is becoming more and more attractive as an alternative source of energy. This means that more technologies are going to be developed which is geared towards gas consumption. This will include mass consumption industries such as transport and electricity generation. Not only does it produce 1/3 of carbon that oil does but it is also in abundance in the US which will play very well into the US governments strive for independence from the volatile Middle Eastern oil producing nations.

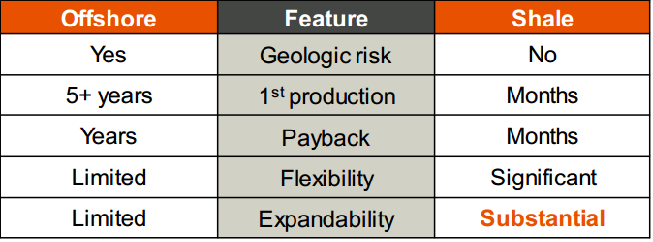

All the fundamentals are there for an increase in energy consumption globally and as the world embraces gas more than it already has, Billiton will be ideally placed to benefit. And when this happens it will happen quickly. As you can see from the graphic below which I took from the presentation, mining gas is easy, sustainable and profitable.

Yes, supply will keep the price low in the short term and the technology will only improve but as a long term play this industry is going to be massive in a country that is ideal to operate in and extremely willing to embrace alternate sources of energy. In Fact Citigroup said that the gas industry in the US could be the catalyst to the next industrial revolution which will solve all their budget issues. Why not? And mankind as a whole will benefit from cheaper cleaner energy.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks managed to more than halve losses all the way to lunch time on Wall Street, but sadly fell away in the last two hours. The same problems of course, they are global in nature, we are all hooked in. So what, does that mean protectionism is not going to work? More on that later. All three major indices sank around one percent after all was said and done, the S&P 500 is trading 80 points lower from their April the 2nd year high. One and a half months later. We are down 5.7 percent from those recent highs. Hmm... I think that it might be time, and I suspect that the Facebook IPO might well be a catalyst of sorts. We wait for the end of the week for that.

{Sarcastic alert}. Well, so much for no demand. {End Sarcastic alert} It seems that Facebook demand is so strong for their IPO, that they are set to raise the price range to 34 to 38 Dollars. Or so, that is what a source close to the company says to the WSJ. From the existing range of 28 to 35 Dollars a share. That means that the share price range could bring the market valuation to above 100 billion Dollars. There are loads of people talking about the IPO. It is of course a bit of a problem that an 11 year old wants to part with her life savings in order to pay for her college education (same WSJ article - In Facebook IPO, Frenzy, Skepticism). Well, that would mean that she was and is owning shares before Warren Buffett did. In age, not time. Judging by the headline, and I got some head nods in the office this morning when I said, that is a good sign to still see healthy scepticism from the market. Yes, this is also true.

Currencies and commodities corner. Dr. Copper is last at 358 US cents per pound, the gold price is slightly higher at 1556 Dollars per fine ounce. The platinum price has recovered a little to 1443 Dollars per fine ounce. The oil price is steady at 94.71 Dollars per barrel for WTI NYMEX. The Rand is weaker at 8.17 to the US dollar, 13.14 to the Pound Sterling and 10.50 to the Euro. We have started around half a percent higher, that German GDP data lifting all of us.

Parting shot. Good news. This time from a usual source, one of my favourite bloggers, Prof. Mark J Perry who updates a blog by the name of Carpe Diem daily. Who, crazily, I do not follow on twitter. Why? Because he mostly updates his "stuff" around midnight our time and I am ashamed to say, I am asleep then. So, I just rely on his blog posts and my RSS feeds to read his good work. And I stumbled across this one this morning: Smart Phones and Tablets Might Be Spreading Faster Than Any Technologies in Human History. And let us leave you with the amazing last paragraph:

"Smart phones, after a relatively fast start, have also outpaced nearly any comparable technology in the leap to mainstream use. It took landline telephones about 45 years to get from 5 percent to 50 percent penetration among U.S. households, and mobile phones took around seven years to reach a similar proportion of consumers. Smart phones have gone from 5 percent to 40 percent in about four years, despite a recession. In the comparison shown, the only technology that moved as quickly to the U.S. mainstream was television between 1950 and 1953."

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment