Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Call it a relief rally, call it whatever you want, the bulls got a chance to run out their wounds. Because let us face it, it has not exactly been an absolutely awful time over the last few weeks, we have been protected by a weakening currency. Spare a thought for those with savings in southern Europe, but at least they have savings I guess. The resources led the rally here yesterday, closing a whole 1.8 percent higher, driving the overall market higher by 1.22 percent to 33488 points, an increase of 402 points. Tiger Brands lagged the broader market, the results I guess falling short of analysts expectations. And all the while in the background the main news of the day here in South Africa was folks getting irritated about a specific painting, exposed parts, freedom of expression versus human dignity. It is a VERY difficult argument to get into, because if you think with both hats on, it is more complicated than Paris and Nicole. What am I saying, I mean Kim and Kris and the 72 day wedding. BTW, I have been married for 3651 days. Which means in two days time, Friday, it will be ten whole years of marriage! I guess I am very, very lucky.

Byron's beats looks at mining news across the globe and locally. This is your last one for a while, he is away for a bit to study, good luck!

- Yesterday Anglo America announced an agreement with Codelco to suspend legal proceedings with regards to that massive Copper asset in Chile which could mean as much as $9bn to Anglo. If you want a refresher here was the piece that Sasha wrote at the beginning of the year called Codelco and Anglo battle for copper continues. Within that refresher is another refresher you can click on for further down the line details. You see, we are quite jacked up with our archives here at Vestact.

"On 22 May, the parties have agreed to explore the possibility of negotiating an agreement in relation to Anglo American Sur. Should this prove successful, it will enable the parties to overcome their current legal dispute. Cynthia Carroll, Chief Executive of Anglo American, said: We welcome this opportunity to re-engage with Codelco and explore whether a solution may be achievable. From the outset, we have been consistently in favour of discussing commercial solution that takes into account the interests of both parties."

This is good news. Legal proceedings are expensive and often a waste of time. I can imagine that negotiations are still far apart but the fact that both parties are willing to compromise is important. Many investors were worried about Anglo's position in Chile after taking on Codelco (who are owned by the Chilean government) head on in a Chilean court. it's good to see that the Chilean legal system stayed strong and was not bias. We will have to wait and see what the outcome will be as negotiations are being done privately. I wonder if the fall in the copper price since October last year had something to do with the parties dropping their aggressive stances.

In other mining news it just seems like Impala cannot catch a break. Yesterday it was announced that there was a fire at their jointly owned Mimosa mine in Zimbabwe. There were no fatalities but production has been hampered and of course damages incurred. The extent of the damages will come out in due course.

On top of this, their flagship Rustenburg mine is still battling with their employees. But the dynamics are different this time. The battle is going on between the unions where the rival newcomer Association of Mineworkers and Construction Union (Amcu) has made headway against NUM. The clashes between workers, who are now not showing up for work, costs Impala 3000oz of Platinum per day. This equates to R36m a day lost to Impala and a big portion of that lost to the state. It seems like it is easier to start up a union than it is to start up a business. There is something very wrong with that. This Businessday article covers the story extensively.

There were results from Mediclinic, one of South Africa's big three hospital companies yesterday afternoon. In fairness, both Mediclinic and Netcare have international exposure and the only pure South African hospital group is Life Healthcare. What are Mediclinic, where do they have operations? 49 hospitals in South Africa, three in Namibia, two hospitals in Dubai and 14 private hospitals in Switzerland. 68 in total. They are a hospital group sports lovers. In the 2011 annual report, the group said that they have 7103 beds (7378 now at year end 2012) in South Africa (13588 employees), 1457 beds (1479 now) in Switzerland (5919 staffers) and 336 beds in the UAE (1676 staff). See that ratio, that basically tells me what sort of care the patients are getting. Staff to patient ratio, just less than 2-1 in South Africa, 1.9, just a little over four in Switzerland, 4.06 staffers to patients and nearly five (4.98 times) staff to patients in Dubai. These are important numbers, we will deal with them later when we do a divisional breakdown of the regions.

Revenue for the full year was 18 percent higher to 21.986 billion Rand (call it 22 billion), profits for the year were marginally higher (103 million Rand more) at 1.484 billion Rand. Headline earnings per share were six percent higher to 194.9 cents. Administrative and operating expenses grew by nearly the same amount as revenue, 21.6 percent. Not good. A 55 cent dividend has been declared, 46.75 cents net of dividend tax. At just above 37 Rand a share, the stock looks stretched. The analyst community have a fairly aggressive outlook though, suggesting a nearly 40 percent growth in earnings for the next year to March and over 20 percent the year after. So much so, that the current price trades at 11x 2014 earnings projections.

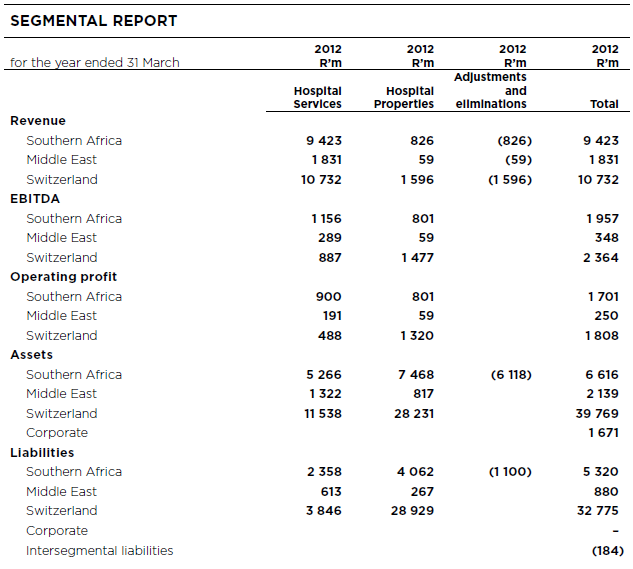

This is where I am going to make my real points, the segmental report from the release, which you can find here -> Audited results of Mediclinic international limited.

OK. First observation, revenue and operating profits of both Switzerland and South Africa are the same, more or less for the purposes of the next point. The asset base, which must include some wonderful Swiss buildings is heavily weighted towards Switzerland, by a country mile. As are the outstanding liabilities, both weighted by a factor of six in favour of Switzerland over South Africa. So, Mediclinic paid up big time for an outlandishly large asset base in Switzerland and now have to chisel away at the debt load. The weakening Rand to the Swiss Franc (which was pegged to the Euro, remember) helped the profitability and value of the Swiss assets in Rands, but equally this has the same negative with regards to the debt load.

Some of the observations about the NHI make for interesting reading. "Mediclinic is of the opinion that the NHI and indeed these initial activities to institute an NHI will not have any significant effect on the medical schemes market or the private sector industry in the immediate future." Sure, that is because it is going to take a long time to roll out, so no immediate impact.

And then there is government regulation, less so here than in Switzerland. Where, as you can see, people pay top Dollar (Franc) for medical treatments. There were changes in legislation that led to higher costs. Tariff declines, although moderate, are not always welcome. Mediclinic talks about three pieces of regulation impacting on their business, "(i) the introduction of fixed fees for inpatient services based on DRGs; (ii) a new hospital financing system which redefines the funding proportions of the cantons versus the health insurance companies; and (iii) the revision of the hospital planning that led to new hospital lists, defining those hospitals that are eligible to treat generally insured patients." The way that I read it is simple, more regulation often leads to higher costs, and whilst law makers think that their intentions are well founded, it is generally the customer, in this case the patient that suffers.

Healthcare is an emotive issue. Whilst we over here at Vestact think that it is a growing area of increased investment, you can see that there is a large amount of government meddling. In the case of a hospitals, you find yourself there because of illness and in many cases extreme illness, or for a procedure of sorts. And that is an emotive issue. So whilst I might say the same old thing, overloaded with debt, more regulation to come, Mediclinic is probably a good investment. They will continue to grow their number of beds, more people will have access to medical insurance which will mean that they can visit these healthcare facilities. More so in a South African context, although we have no idea what the NHI would mean for their business. Uncertainty. Do you think when faced with uncertainty that a business is more likely to expand their operations, or just follow a wait and see? I guess the answer is grow modestly, which they are looking to do, upgrading some facilities and adding a really modest number of beds. Not my favourite, but not the worst.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Slip sliding away. That old Paul Simon song, it was Paul Simon not so? That is what happened to markets in New York last evening, the last hour dominated proceedings again. After a really good early start, where markets were up nearly a percent, they ended about flat. There were encouraging existing home sales, which marginally beat expectations. Not just a good read, as that crazy Jim Cramer said, the size of the gains (in Dollar terms) was the best in years. Just earlier there had been a European consumer confidence read, which, although negative, had also beaten expectations. A Spanish bond auction had gone off OK, so that wasn't the reason for the late sell-off. It probably had a whole lot more to do with an informal European meeting today in Brussels. The way the WSJ see it is the beer drinkers against the wine drinkers. You know, Germany and Sweden (and co.), versus France and Italy (and co.) on the idea that austerity is the only path to follow. Angela Merkel did concede that austerity was not the only path. Oh, and Austria are siding with Germany, they might be further south, but they drink beer, not so?

The late news that crushed the rally was delivered by ex Greek Prime Minister Lucas Papademos, thanks to the Business Insider for putting this piece up: Former Greek PM Papademos Warns That Greek Exit Plans Are Under Consideration, MARKETS FREAK OUT. Don't worry about that Markets freak out, that is classic Business Insider headlines. The Dow closed down a point and two thirds of a point, barely unchanged to 12502. The broader market S&P 500 eked out a modest gain, just a little one. The nerds of NASDAQ dropped one third of a percent, Facebook still continued to take a whole lot of pain. Hmmm.... the NASDAQ and Morgan Stanley must be irritated right now. But not more than the Facebook management and the Zuck. BUT, they can say that they raised money at 38 Dollars a share. Monetise the millions on mobile, that should be the mantra.

Currencies and commodities corner. Dr. Copper is last at 346 US cents per pound. The lowest level seen in quite some time. There is a flash HSBC Chinese PMI read tomorrow, probably the most important number we have seen in a while, in terms of sensitivity for commodity prices. The gold price is lower at 1555 Dollars per fine ounce, the platinum price is also lower at 1425 Dollars per fine ounce. The light sweet crude oil WTI price as per the NYMEX quote is last at 90.92 Dollars per barrel. The Rand is weaker, Mr Risk off is visiting again and equity markets are lower around the world, last at 8.40 to the US Dollar.

Parting shot. Those European folks meet today. I saw some funny reference to meeting times of the socialist bloc and the conservative bloc, and the socialists were meeting for twice as long as the conservatives. Nice long lunches, siesta times and lots of talk. Conservatives, let us just get the job done. Do I have any great confidence that we are going to see anything else other than another solidarity pact, the Greeks are in, blah, blah? Perhaps. Or perhaps not, and the usual European way of just stumbling along and getting the job done only when it needs to. That is probably more likely. The suggestion is that a working group has been setup to deal with the prickly issue of Greece. Oh, to be a fly on the wall.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment