Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We closed lower on Friday here in Jozi, the all share slipped 0.16 percent to end the day at 32992, down 53 points. Resource stock slid nearly three quarters of a percent, looking weak as the European drag and more recently soft patch in China continues to see the prices of the underlying commodities weaker. Because China is seen to be slowing down, of course off such a big base, slowing is all relative. I love it when people talk about a hard landing, how can you land when you continue to rise and go higher. Surely the term that should be used is levelling off? Or not even that. When you are going up (hill or in the air) at a specific gradient, the landing part implies that you are going down, not so? Bath tub, U shaped, L shaped, V shaped recoveries, we can all talk the good talk, and I often get the sense that general market commentary follows the news du jour. Bleh!

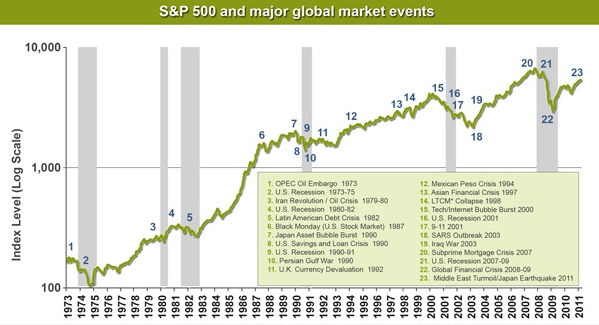

Haha, I laughed when I heard the ever friendly and passionate David Shapiro suggest to Bruce Whitfield on a Friday crossing what would dominate markets over the next week. David said, Greece Monday, Greece Tuesday, Greece Wednesday, Greece Thursday, and Greece Friday. In the short term this is true, Greece will dominate the headlines on a day to day basis, until their next elections when there would be some clarity to answer the question, "What next for Greece?" Amazingly everyone except the politicians seem to be lining themselves up for worst case scenario, but that is the human nature, or at least some humans. Born optimists and born pessimists meet somewhere in the middle. Again, the importance of the short term crisis over the long term outcome was made clear through this simple graphic that Paul found and used again on the weekend, and we used in a presentation once upon a time. In a land far, far away. First, let me show you a rather innocuous looking chart of the S&P 500 over a forty year period.

The grey (gray?) areas are periods of economic downturn in the USA, the numbers on the graph represent major global events that could and do impact on markets. But like the guy in that GOLDEX spoof (for a huge laugh, check this out -> GOLDEX--Buy Gold Now!!!) notice how the graph goes up to the right. Of course this is in the face of all these crises that were potentially crippling for both economies and countries. But, we always recover. I am guessing that we can add a new event to this graph, call it the European sovereign debt crisis. Event number 24. I think what this graph does for us here is that whilst in the midst of the event you might be consumed with thinking that "the end" is nigh, often that moment proves to be an opportunity. Which leads us to our next favourite bit, the famous war poster from the United Kingdom, and possibly our motto here in the office:

This is our favourite, and it is pretty apt that it is a war poster, because sometimes it feels like you are actually in the trenches here. But it is important to separate a couple of things, one share price is what you pay for a real company. You own the company, not the share price, even though the one is present day reflection of all the market forces as to what is the right price. The business you own, make sure that it is a good business in the first place. Sometimes a stock can look cheap for a reason, and might never return to their historic mean, because the business is in sunset mode. Think Kodak, as a recent example, forgot to keep up after having been market leaders.

OK, there are a whole lot of results this morning, and perhaps top of the pile is Illovo, who just pip Tongaat Hulett in terms of market capitalisation. Both businesses are sizeable, but not that big, Illovo is a 11.9 billion Rand business, Tongaat is at 11.5 billion Rand. So, let us start with the bigger of the two, Illovo is a business that traces its roots back to 1891, but in truth the British and their colonisation of South Africa saw them introduce the crop to the country in the 1850's. More recently the British came back, Associated British Foods bought a 51 percent stake back in 2006. The business operates in South Eastern Africa (Namibia is not a good place to grow sugar cane), with South Africa, Swaziland, Mozambique, Zambia, Tanzania and Malawi. Illovo have announced that their greenfields project in Mali has been browned out. I mean the project has been caned. I mean with regret, Illovo are not going to proceed. Meanwhile the caretaker Mali president had to fight off hundreds of folks that beat him up. Mali, hmm....

All businesses are reliant on outside factors, think TEPCO that the day before the Japanese tsunami could have seemed like a good utility company to own. But of course we all know that the weather and "mother nature" put paid to that theory. Illovo of course have been having problems in South Africa, drought conditions in their KwaZulu Natal inland regions (non irrigated I presume) that have persisted for the last two years, impacting on overall sugar production (down 7 percent), which saw sugar sales sugar fall 5 percent. But turnover for the full year grew to 9.2 billion Rand in a period marked by cost controls and a favourable market environment. Operating profits clocked 1.35 billion Rand. Check out "the country contributions were Malawi 39%, Zambia 33%, Tanzania 11%, South Africa 7%, Swaziland 6% and Mozambique 4%." Amazing to think that South Africa, that contributes the most to overall revenue, 3.129 billion Rand out of 9.173 billion Rand, but it is not very profitable. Tanzanian revenue for Illovo added up to "only" 702 million Rand, but makes more in profits than the South African business.

So, do you buy the company at 26 Rands a share? Looks expensive, HEPS clocked 132.6 cents, 18 percent higher than last year. The company pays a very modest capital distribution, 43 cents this time around, add 23 cents at the half year stage and you get to 66 cents for the year. AND, remember that the company raised money, 3 billion Rand at the current share price, around three years ago. At a discount to the share price at the time. So, basically, and I really dislike saying this, the share price has done nothing for three years. Understanding the underlying commodity is perhaps more important when making up your mind whether you should own this company. Sugar usage from traditional markets is falling, the Tim Noakes approach to staying slender, think along those lines. Usage should continue to rise in the developed world, so that should continue to support the prices. But again, there is nothing transformative about this business, I agree that their African business is well placed, or better placed from both the weather point of view and costs. But owning a business that relies heavily on the weather, no thanks, too tricky and earnings perhaps not as smooth as one would like.

The next business that we look at also relies heavily on the weather, Tongaat Hulett Limited, which also reported numbers this morning for the full year to end March 2012. Now their numbers at face value actually look a whole lot better, with sugar production up 14.3 percent, revenue up 24.8 percent to just over 12 billion Rands. Headline earnings increased by just over ten percent to 891 million Rand. On a per share basis, HEPS increased to 838 cents per share, the dividend paid out for the year totalled 290 cents per share.

On an out and out valuations basis you can quite quickly see that Tongaat is much cheaper than Illovo. The South African business as a percentage contributes a little less to Tongaat's total revenue, Zimbabwe is an important business for them. Their starch business is the main big difference between themselves and Illovo, and contributes around 20 percent to total revenue. Of course some of these products are sold to SABMiller, but not them alone, there are plenty of uses for their starch products business. And then of course there are the conversion processes of land to "active developments". This is where people get excited, the unlocking of value. Tongaat suggests that part of the business is slow, but happening.

I think that the same applies for Tongaat, as we said with Illovo. Also, the issues around the unlock of value via developing more of the land around the new airport in Durban, the King Shaka airport. But you would not want to own the business because of that, surely? I think if I had to choose between the two, Tongaat would win this battle. A little more diverse, better managed, not one (or two) shareholders looking over your shoulder all the time (ABF owns 51.5 percent and Allan Gray owns 21 percent of Illovo). Yip, Tongaat win my vote here, but I am not going to direct any funds in that direction.

Currencies and commodities corner. 347 US cents per pound is where the copper price currently trades, the gold price is a little higher at 1579 Dollars per fine ounce. The platinum price is better at 1436 Dollars per fine ounce. The oil price is higher at 91.80 Dollars per barrel. The Rand has firmed a little as Mr. Market has improved somewhat, last at 8.28 to the US Dollar and 13.06 to the Pound Sterling. We are higher here on a holiday in the US, a holiday in France.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment