"The important take away from these results are that cost savings are going to be more aggressive, the company needs to conserve a lot going into 2017 (80 percent of the money for the ethane cracker at Lake Charles in Louisiana has been secured thus far), in what will effectively be a company transforming investment. In order for the company to take advantage of much lower gas prices in North America, as feedstock to the ethane cracker, they have to have that North American investment."

To market, to market to buy a fat pig. Oh boy, is it going to be like that? Good news should be good news. What am I talking about? Jobs, non-farm payrolls, the most widely anticipated number on the planet, as far as markets are concerned. Why? Well, if you have maximum employment in the biggest economy on the planet that is consumer driven, the better for the rest of the globe. The Federal Reserve actually has three key objectives, even though people often talk about the dual mandate. Quite simply, it is as follows: Maximum employment, stable prices, and moderate long-term interest rates. I guess the first one is the one that is possibly not open to too much interpretation, the third one is linked to the second one.

So what happened next? The markets in New York sold off aggressively. Why? Well, the actual numbers were 295 thousand new jobs created for the month of February, more importantly the unemployment rate in the US fell to 5.5 percent. Back in October 2009, a year after the firestorm broke out in the US with a 176 year old, over-leveraged investment bank being the main victim, the unemployment rate had ballooned to 10 percent. "Things" got worse before they got better. Low interest rates or ZIRP then followed. I have read countless articles on when interest rates in the US will go up next. I have no way of knowing. That was the reason for the percent and a half sell off on the Dow Jones Industrial Average, interest rates are going up sooner than anticipated is the markets best guess.

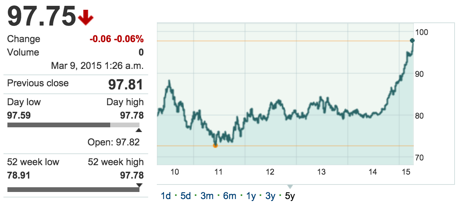

What is not in favour of interest rates going up sooner than anticipated is the stronger Dollar, dragging back company earnings, they earn the money offshore and then convert it back to Dollars. For importers it is great and is excellent for the US trade numbers. As you can see from the graph below the Dollar index has had an astonishing 6 months period. As per Wiki -> Euro (EUR), 57.6% weight, Japanese yen (JPY) 13.6% weight, Pound sterling (GBP), 11.9% weight, Canadian dollar (CAD), 9.1% weight, Swedish krona (SEK), 4.2% weight, Swiss franc (CHF) 3.6% weight. The Dollar index is at an 11 year high.

As a consequence of course the Rand weakened to the US Dollar, all major currencies weakened against the Dollar. For the Euro, which obviously is the biggest constituent of the Dollar index, this is the "worst level" since August of 2003. In November of 2000, 83 US cents could buy you a Euro. In July of 2008 the level flirted with 1.6 Dollars to the Euro. For two such enormous economies that is a pretty dramatic swing one way or another. Right now the US Fed will be mindful of a stronger Dollar, particularly as the ECB start their own bond buying program, it has just started. As in tomorrow. The US finished theirs an age ago now, in market terms at least. October last year.

Would the Fed raise rates any time soon? I guess if inflation was a problem, the strong dollar is the one reason they won't, the weaker than anticipated wage growth is another reason they will not. With Walmart raising minimum wage and many set to follow suit, this trend could change. All I am going to say and repeat, central banks will do what they have to. They will raise rates to keep prices stable. They will raise rates to cool the economy if it gets ahead of its self. Must you worry? No. We are not invested in any fixed income products of any sort. Companies adjust accordingly.

I suspect that we are for the better part of the next half of the decade still in a phase where inflation is going to be low, wage growth not as fast as anyone would like, Europe still in repair mode and as a consequence low rates. Equities will still be the most attractive option, you should pay attention, not let the Fed or any other central bank make or break your decision to own companies. If you did, you would never own anything.

Company corner snippets.

Sasol released their results for the six months to end December this morning. At face value they look OK. If you make sure that you exclude the impact of re-measurement items, earnings attributable to shareholders decreased 23 percent from the period prior. That is probably a better measure. The Rand was 9 percent weaker when measured against the corresponding period, 10.99 when compared against 10.08 Rand to the US Dollar. Reminder, this morning it is in the region of 12 to the Dollar, see above with the strong Dollar. The dividend, which was a large anxiety point after Sasol had made a supplementary SENS telling everyone about the cash conservation policy, was possibly better than expected at 7 Rand a share, 12.5 percent lower than the prior period. Not bad I guess, obviously the much weaker crude prices in the first half of their second half (partially offset by a weakening Rand) means that earnings are likely to be far lower in the second half of their financial year.

The interim dividend cover was lowered to 4.6 times from 3.8 times (in percentage terms that is over 20 percent lower), the full year dividend cover is in the region of 2.3 times. Meaning that if the analyst community are expecting around 35 Rand in earnings this year, less than 30 Rand next year (who knows where the oil price is going to next) then the stock at 410 Rand is about right. Presuming that next years number could match this years number of around 35 Rand a share, the dividend for the full year might be around 15 to 16 Rand. Meaning that forward the stock trades currently on a less than 12 times earnings, with the dividend yield of somewhere in the region of 3.6 percent before tax. That is not exactly dirt cheap, nor is it wildly expensive. The price will move as a function of the oil price in Rands, in other words, the stronger the oil price and the weaker the Rand, the better it is for Sasol's earnings prospects, the reverse is also true.

The important take away from these results are that cost savings are going to be more aggressive, the company needs to conserve a lot going into 2017 (80 percent of the money for the ethane cracker at Lake Charles in Louisiana has been secured thus far), in what will effectively be a company transforming investment. In order for the company to take advantage of much lower gas prices in North America, as feedstock to the ethane cracker, they have to have that North American investment. Equally, between now and then, the company is at the mercy of factors beyond their control, they can control capex on other projects and save costs. They are in typical Sasol style, being conservative and making sure that they can ride whatever the market throws at them. Under the circumstances, not a bad set of results, the future is a little clouded like their outlook. Of course, the future is always clouded.

Apple inc. joins the Dow Jones Industrial average. iDow is what they are calling it. AT&T gets booted out on the 18th of March this year, the telecommunications company has been a part of the Dow since November of 1999. General Electric has been part of the index since 1907, that is continuity for you. There are five other companies that have been part of the index for a lifetime, they are in chronological order (first to last) ExxonMobil (as Standard oil) from 1928, Procter & Gamble from 1932, DuPont from 1935 and United Technologies (previously United Aircraft) from 1939. The most recent entries are Nike, Goldman Sachs and Visa, all from September 2013. Apple is the sole new entrant, see the release: Apple Set to Join the Dow Jones Industrial Average.

The reason is twofold as you can see: The index change was prompted by Visa Inc.'s (NYSE:V) 4:1 stock split which is scheduled to be effective at the same time. The post-split adjusted lower price of Visa will reduce the weighting of the Information Technology sector in the index. Adding Apple to the index will help to partially offset this reduction. And As the largest corporation in the world and a leader in technology, Apple is the clear choice for the Dow Jones Industrial Average, the most recognized stock market measure. Most recognised, chosen however. The S&P 500 is a Market-value weighted index, which means that the higher your market cap, the more important you are. Even though S&P Dow Jones Indices (part of McGraw Hill Financial) may think the Dow is the most important, surely the weighting and voting machine (the broader market S&P 500) is a better measure. In the end it actually makes very little difference, it is another tick of a box I guess. You could argue that they, the folks who set the constituents, are woefully late.

We're reading this, you should too.

A question that many people have been wondering - Scientists think it's no coincidence earthquakes spike after an oil company starts fracking. There still has to be a lot more research done and make no mistake, there will be other reports that say there is no link.

Amazon are the biggest player in the cloud market at the moment but the margins are dropping as many more people enter the space - Alibaba is going head-to-head with Amazon in the cloud

An interesting look at the shifting landscape for jobs - Map: The Most Common Job In Every State.

Home again, home again, jiggety-jog. We are off sharply here to start with, I suppose the need to catch up to the sell off on Friday.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment