"Bidvest almost never looks cheap. There were moments in time when the stock was cheap, so was the market. If you are in the business of owning quality and looking for superior returns over time, this is a business that you have to own. Sometimes steady is the way forward. I am looking for 2 numbers soon, one is 200 billion Rand in turnover and 10 billion Rand worth of trading profit, they might get really close on the second one this financial year. An achievement that the board and company (nearly 150 thousand employees) can be proud of."

To market, to market to buy a fat pig. I think I can, I think I can. We managed to just push through on Friday in the local markets, if we had been the Proteas captain we would have closed up 20 percent on the day, that guy is incredible. What is nicest about him however is that he just goes out there and does the business in a way that would have seemed impossible a mere two decades ago. In the same way that the rest of life evolves, so does sport, in front of our eyes. Impressive, as ever, let us try not get ahead of ourselves here. Back to the stuff that matters in these newsletters, as we well know sport takes place in a stadium between two teams and 50 thousand experts watching live with millions of experts on TV who all think that the ref is rubbish if the decision goes against them. One eyed fans.

Bidvest results today. I guess that it is not a coincidence that Brian Joffe of Bidvest and Warren Buffett of Berkshire report on and around the first weekend of March, that is the nature of the reporting cycles. I am pretty sure that Joffe would be humbled with the comparison, he is after all only human (both of them) and being compared to the best allocator of capital over time is flattering. Joffe is however one of the greatest allocators of capital that this country has ever seen, taking the business in 1988 with the acquisition of Chipkins (when he was 41 years old) to a business with an annual turnover that might just top 200 billion Rand for the first time this financial year. Astonishing what one can achieve in a relatively short period of time when you put your mind to it.

For Bidvest these are the half year results, they include a fair value impairment of 118.1 million Rand on Adcock (the mark to market price) and a reversal of a previous Comair impairment of 33.3 million Rand. When you own listed companies as part of your investments, you have to accept the market price at the end of the reporting period. Comair, all things being equal should benefit from lower oil prices for longer, Adcock seems to be in turnaround mode.

The Foodservices business which is reported as a collective is more than half the business. It truly is an international business, the South African business is less than half of the whole thing put together now. The South African business however accounts for more than half the profits which means that the margins are better here in part and the costs associated with expanding internationally. The company continues to grow in all the right regions with the right services and products for the markets, of most interest (to me) is their Chinese and Latin American businesses, those are both high growth regions.

These results have been received a little negatively, Mr. Market not really impressed so much. That is always an opportunity for me. There are few businesses that can or could be viewed as bulletproof (I use that term sparingly), this is one of them. Bidvest almost never looks cheap. There were moments in time when the stock was cheap, so was the market. If you are in the business of owning quality and looking for superior returns over time, this is a business that you have to own. Sometimes steady is the way forward. I am looking for 2 numbers soon, one is 200 billion Rand in turnover and 10 billion Rand worth of trading profit, they might get really close on the second one this financial year. An achievement that the board and company (nearly 150 thousand employees) can be proud of.

OK, sport-lovers. We were trying to make the point about how the structure of Berkshire Hathaway had changed over the years. The fact that they had moved away from looking for value in the market to looking to be more private equity like. Look no further than the 50th anniversary of Charlie and Warren working together and possibly the most eagerly awaited piece the financial world has to offer, the letter from the Chairman, Warren Buffett:

In our early decades, the relationship between book value and intrinsic value was much closer than it is now. That was true because Berkshire's assets were then largely securities whose values were continuously restated to reflect their current market prices. In Wall Street parlance, most of the assets involved in the calculation of book value were "marked to market."

Today, our emphasis has shifted in a major way to owning and operating large businesses. Many of these are worth far more than their cost-based carrying value. But that amount is never revalued upward no matter how much the value of these companies has increased. Consequently, the gap between Berkshire's intrinsic value and its book value has materially widened.

I want to try and explain, eloquently, what that means. Or what I think that means. As Buffett himself is the best explainer of these things, why interpret it? I think many try and use the Buffett model in the market, in the equities market, I suspect that this is trying to replicate the past. The best place to find misplaced businesses is no longer in the market, which is far more crowded than in the days of Benjamin Graham and the early days of Warren Buffett. The best place is basically buying unlisted businesses. Private transactions, and of course Buffett has been finding solid partners like that 3G Capital crowd. Charlie Munger remains his friend and advisor, a 56 year relationship in which they have never had a fight. Choose your business partners wisely.

Whilst many try and replicate the returns of the favourite billionaire next door (he has lived in the same house since 1958, he reckons a home is for living, not speculating), many do not have the patience to be in the market. We live in a society that has credit card returns mentality, I bought the shares, I need them to go up by a factor of two, and I want that yesterday.

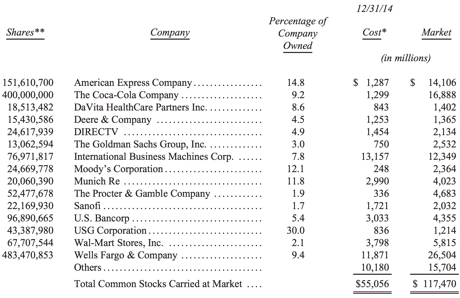

My point about Buffett and Berkshire being away from the market is given further vooma by him suggesting that their core insurance businesses, their powerhouse five delivered X (not listed), as well as the big 4 listed assets Coke, Wells Fargo, American Express and IBM which are the cornerstone. They did add to their listed entities by not increasing their stakes, but rather with buybacks of their own shares. The only one they added to was IBM. As you can see from the updated version (we have the new letter of course), IBM is the only company of their listed assets where they are in the red:

What is missing on this list is the option to buy Bank of America by 2021, it would effectively be the fourth largest holding. Who knows, he is only human and might actually be wrong on IBM in the long run. He makes mistakes, admits them, moves on. I suspect a business as large as IBM will take a little time to adapt and evolve. In fact Buffett even says that he is embarrassed to say that he dawdled on Tesco: Attentive readers will notice that Tesco, which last year appeared in the list of our largest common stock investments, is now absent. An attentive investor, I'm embarrassed to report, would have sold Tesco shares earlier. I made a big mistake with this investment by dawdling

We all make mistakes, it is the manner in which we approach them that is important. He said that he had soured to the management. Lastly, a number of juicy Warren quotes, I am pretty sure they are going to be all over the media today and in the coming days with his multiple interviews: "For the great majority of investors, however, who can – and should – invest with a multi-decade horizon, quotational declines are unimportant. Their focus should remain fixed on attaining significant gains in purchasing power over their investing lifetime. For them, a diversified equity portfolio, bought over time, will prove far less risky than dollar-based securities. If the investor, instead, fears price volatility, erroneously viewing it as a measure of risk, he may, ironically, end up doing some very risky things."

Lastly, and this sits well with me: Investors, of course, can, by their own behavior, make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit: Anything can happen anytime in markets. And no advisor, economist, or TV commentator – and definitely not Charlie nor I – can tell you when chaos will occur. Market forecasters will fill your ear but will never fill your wallet.

Ha ha, thanks Warren, market forecasters will fill your ear but never fill your wallet! The AGM this year has been planned already, a huge affair starting on the 2nd of May. Michael wanted to go I recall, he has settled for his honeymoon instead. Which makes far better sense really, the Berkshire AGM will always be there, on honeymoon (the first) we hope it will be the one and only one.

Things we are reading

A reminder that it does not always go your own way, it certainly is not one way traffic. Mxit: the rise and collapse of 'Africa's largest social network'

Along the same theme as last week, doing nothing can result in the best performance - The Problem With Intuitive Investing. Our approach is to be "actively passive", which has worked well for our clients. Keeping our eye on the long term.

Following the Buffett frenzy at the moment - Berkshire Hathaway's Willingness to Kill. Allocation of capital is a key component of Buffetts success. I am reading his chairman letters starting in 1965 and the first bold move was to move out of their textile business and into the insurance business.

Changing the way the music industry works will hopefully lead to more money for artists not at the pinnacle - Google's latest, fascinating bet on the future of music is called Kobalt. Google have their fingers in many pies at the moment, hoping that down the line they will start to have significant earnings.

Home again, home again, jiggety-jog. Thanks to all of you for voting for me for a crack through to the finals of Share Shootout, I will find out a little later today whether or not I made it. And then I shall advise as to what next from there, the finals are live and are tomorrow night. That is where I am really going to need your help, live tweeting during the show will be the best way to go about it. First things first, let me advise about the finals! Thanks again sports lovers I really appreciate your votes.

On a sad note, the actor that played Spock in Star Wars passed away on the weekend, he had a good innings. Less so (in years) the former AIG CEO, Bob Benmosche also passed away. Benmosche is the guy who moved the company from a point where nobody knew anything to a period where the business was profitable and stable. He trashed around half a trillion dollars in assets and slimmed down the workforce aggressively, by around 40 percent.

The market is flat here heading towards midday. The shooting dead of the opposition leader in Russia is certainly no accident and a reminder that whilst we think the political debate here is robust and we can say all sorts of things about parliament, at least this doesn't happen. Sigh.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment