"On a 30 multiple forward, with expected EPS of around 14 Rand a share, the stock is by no means cheap. It is however never cheap, I remember when the company traded at 30 Rand a share, which was when we first started buying them, the PEG ratio (PE over Growth) was at the same level as it is now. There may always be a time of consolidation, that is a great time to continue to acquire what we think is a fabulous company with great prospects."

To market, to market to buy a fat pig. Depending on what side of the divide you were sitting the market was treating you well or terribly yesterday. If you simply were owning an index, or the index, you would have said to me, three quarters of a percent gain on the day sounds like a good outcome, not so? If you were wanting resource exposure it was being gavaged to you. The term gavage normally refers to the force feeding of a goose or a duck, for the purposes of fattening up the bird so that the liver can be much larger. You know, for foie gras (fat liver).

The selling was force feeding the people stuck on the bid who have been telling you that resource stocks are cheap, unfortunately the platinum stocks have turned negative for the year, and as I look longer as a collective they are down now in the past four years consecutively and again for this year. Impala Platinum fell over 4.5 percent yesterday, Amplats fell over three percent. The collective market capitalisation of the platinum stocks listed on this local market is 167 billion Rand this morning. At the prevailing exchange rate that is equal to 14.2 billion Dollars.

Now you will recall when Citigroup in 2010 wrote about South Africa ex energy being the richest country in the world. I dredged up an old piece that I wrote back in October last year:

I often curse that Citigroup report from 2010 in which the research arm of the bank suggested that we, South Africa, were the richest country in the world ex energy. Ex energy of course means no oil, coal, uranium, any energy of any sort. And what was it made up of? 91 percent PGM's, 6 percent gold, 2 percent nickel and 1 percent iron ore. Years of production back then, 184 years

Assets in the ground at those commodity prices were a whopping 2.494 trillion Dollars. The platinum price back then? In 2010? Bearing in mind that this report said that we (South Africa) had, at current production levels of PGM's, 229 years worth of mine life. 91 percent of 2.494 trillion? 2.26 trillion Dollars. Or nearly 27 trillion Rand. The mind boggles, the number is so huge. The assets in the ground are worth so much more than the market capitalisation of the current businesses, why? I guess the market just thinks what everyone thinks currently, too expensive to get it out the ground. The same point I made last year, What happens to all the supply above ground that can be recycled?

What happens if a large component of usage, auto-catalytic convertors are redundant? How would that happen? If Tesla wins, that is how. Even if Tesla doesn't "win" the amount of platinum being used is less and less, more importantly, there is more stock above ground in older autocats than ever before. I have no idea of knowing what the eventual outcome is for the platinum miners as a whole, it looks more and more precarious with lower metal prices. The weaker platinum price in the face of a more constrained supply environment certainly tells some story and not necessarily a pretty one.

We will continue to avoid the sector entirely. Yet, the fundamentals might all be in the favour of the metal, not necessarily the producers, if you believe the following: Brighter Platinum Future as Auto Sales Cut Reserves: Commodities. I suspect that if the platinum companies become more profitable, you will start to see labour/government demanding a bigger share. I have heard from a little birdie that Impala, if Zimbabwe push ahead with the 15 percent export tax, may just want to close their business there, as it would be unprofitable. That sounds crazy, if the shafts are unprofitable as a result of costs being too high, why would it be outside the realms of possibility?

Sectors that we won't avoid are healthcare, technology, consumer related businesses. Some of the companies that are our core holdings registered incredible gains yesterday, I simply could not believe that Discovery was up nearly 6 percent. Mediclinic was up over two and a half percent. Aspen, which we will deal with now, was up nearly two and a half percent on the day.

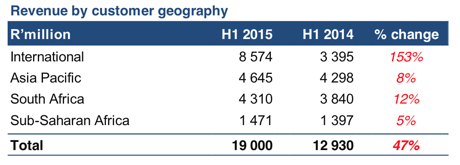

Well done Byron, last week he had a pretty forward headline in the daily message which was less than subtle, it said buy Aspen. And quite a few of you responded, this was in response to us covering the trading update, which was not favourably received by the market. They were trading at R413 that day, today we are back at R435 a share. The results themselves once again underscore why in this phase of high growth the company is tricky to value. The stock is up over 50 percent in twelve months. Why? For the half year the company grew revenues by 51 percent, thanks to all the acquisitions that the company has done. Gross profits grew by 52 percent. The strong Dollar globally has actually had quite an impact on Aspen. As much as 343 million rand for the half year or 67 cents of earnings per share can be attributed to foreign exchange losses. The Russian Rouble and the Venezuelan Bolivar performed poorly.

As a result of all these acquisitions, the funding costs have increased by a factor of three, not small. Aspen is however a very profitable business, and are able to service debt quicker than most. Net borrowings at the end of the period was 28.6 billion Rand, 34 percent of that here in South Africa, 15 percent in Asia Pacific and the balance in their "International" division. Profits after tax for the half year were 2.458 billion Rand on just over 18 billion Rand worth of revenue, this business is highly profitable. That translated to headline earnings per share of 541.7 cents, an increase of 28 percent on the half year results.

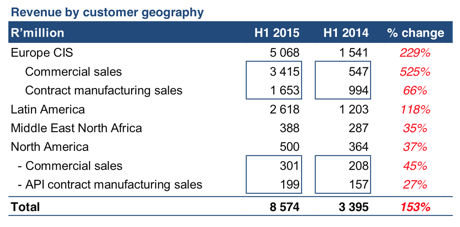

Where has most of the growth come from? In terms of revenues it is all of the acquisitions that they have made in Europe mostly, Western Europe at that and mostly commercial sale, which is all anticoagulants (which is also in Eastern Europe). The other big driver has been the infant formula in Latin American, which saw sales in that geography more than double. Here are a series of slides which explains it, taken from the presentation. First things first, revenue by geography, International is North America, Europe, Latin America and then Middle East/North Africa.

And then drilling down into the international segment (all the stuff that they have bought), reveals what we had spoken about above, the wide spread business in Europe.

The aforementioned ugly twins of Aspen's growth markets have hit the skids, when the company talks about the international segment in the prospects column: This segment is, however, also exposed to political and economic instability in Venezuela and Russia, two countries in which Aspen had been expecting material growth. Remittance of funds to pay for products supplied to Venezuela has become significantly constrained. The sharp devaluation of the Ruble in recent months has significantly diminished the value of the business undertaken in Russia. I guess until those two territories are sorted (who knows when that will be) they won't be solved. One thing is for certain, people always need pharma products.

Notwithstanding that at all, the last paragraph of the results tells you that Stephen Saad and his team are ALWAYS on the lookout for new opportunities. See: "The restructuring and consolidation which is currently prevalent in the global pharmaceutical industry is creating a number of acquisitive opportunities as businesses are re-sized and re-shaped. Aspen is well placed to participate in this process and executive management is actively engaged in assessing possibilities. The Group has a proven capability to successfully execute complex multiterritory transactions, which makes it a strong candidate for such opportunities."

They are going to nail down the recent acquisitions across Europe, which is starting to look more and more favourable. They are going to continue to sweat smaller assets harder, Stephen Saad is extremely energetic and a big personal shareholder in the business too. The risk is of course that he decides to spend more time with the Sharks rugby team or his conservation efforts, I can tell you that he never seems to lose his energy with this business. The company is not only in great hands, is growing fast, attracting new talent and new drugs and formulas, it is also a truly international one, as you could tell from the rather large currency impairment they took. Hey, it is going to happen that way if you have many international businesses.

Growth in their Asian business (which is only 4 odd percent) is key to the prospects of Aspen, they no doubt will work really hard there. Ironically their biggest sales region in their Asia division is Japan, you will recall the deal: Japan rises with GSK! See that, Japan is the second biggest pharma market in the world.

On a 30 multiple forward, with expected EPS of around 14 Rand a share, the stock is by no means cheap. It is however never cheap, I remember when the company traded at 30 Rand a share, which was when we first started buying them, the PEG ratio (PE over Growth) was at the same level as it is now. There may always be a time of consolidation, that is a great time to continue to acquire what we think is a fabulous company with great prospects. Buy.

Home again, home again, jiggety-jog. Jobs Friday. This is a favourite of the market. If we see a number above 200 thousand in total, that would signal 12 straight months. The Challenger job cuts report (that exists) from earlier in the week indicated that nearly 40 percent of all layoffs (and there were over 50 thousand in total) were directly linked to the oil price. The other main reason was company "restructuring". 40 percent of the layoffs in January were also as a result of low prices, over 34 thousand folks in total out of a job in that sector. It is another reminder that whilst the consumer might have received a windfall from lower oil prices, not everyone thinks it is a good idea. The report, if you are keen as beans to see the excitement is at 15:30 local time. The expected number is around 240 thousand. Sounds a little high, we will see!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment