"The key here is that Discovery are not looking to become a bank, they make it clear that this card will continue to operate on the FirstRand banking licence (FirstRand own 25.01 percent of this venture), to learn more about their customers spending habits and customise their full suite of products accordingly. I suppose if you know (for instance) that someone spent 1000 Rand at the bottle store on Friday and then went on a drive about later in that evening, you might want to start charging them a little more for life insurance, not so? Equally, the points based system for rewards for good behaviour and a portion of your premiums back in the coming years, that is more important, don't you think? I certainly do."

To market, to market to buy a fat pig. Another day of selling for the local exchange, heavy selling actually. I have absolutely no way of knowing whether or not the Fed is, or isn't going to start the tightening cycle next meeting, or next year. I do not however think that your strategy should not change, at all.

An email question was posted to Paul last evening from an international journalist: " Just wondering if you could tell me how you are positioned ahead of a potential Fed hike. What asset classes, what regions, if you can talk about sectors you like, then maybe a couple of stock examples. And what are your time frames for these moves (next six months to two years? Etc)?"

His answer was the same one that we had been giving you over the last little while: "We don't really care about things like that. We are still buying the stocks that we like (tech, healthcare, consumer). Nothing else. I guess that we have confidence in Yellen and her team to do what they think best for that economy."

As simple as that really. Asset prices on a daily basis, most especially the ones in deep capital markets, change and reflect the mood at any one time. Whilst the short term market is highly anxious about a change in interest rates, it is important to note and reflect that is a function of an improving outlook for the US economy and not just as a result of higher interest rates. What to do? Nothing. Just watch.

The long awaited Discovery Rights issue announcement came yesterday. I suppose not too long awaited, the company only announced this on the 24th of February, for some market types that is too long ago to remember. OK, so give me the lowdown, give me the skinny! Urban dictionary will help you to understand those terms and a whole lot of others that you wished you hadn't looked at.

For every 100 shares that you hold of Discovery by the close of trade Friday, you will have the ability to acquire 9.38641 for 90 Rand a share in the rights issue. How would that work practically then? Say now that you have 250 shares, apply the above ratio and you would get to 23.466 shares at 90 Rand. Obviously there cannot be fractions of shares, it is 1 or nothing. The release does not say anything about rounding, I am pretty sure that it is either up or down. In this case then, your 23 shares at 90 Rand, in order to follow your rights, would mean that you would be in for 2112 Rand. The position right now, if you own 250 shares in our hypothetical case, at the opening price today, is worth 32000 Rand. The share price closed at 128 Rand exactly last evening.

Dates? What are those? When do you have to have the money in your account? The sooner the better as always, there is a little bit of time. The circular goes out Monday the 16th of March, the rights start trading on Friday the 27th of March, the rights issue closes the following Thursday (the 2nd of April) at noon. The following Tuesday, the 7th of April, the shares are issued against cash in your account, i.e. the cash flows out of your account and into the coffers of the company. Easy enough to understand, right? You basically have two weeks to come up with the money and our recommendation is that you must follow your rights. You must not do nothing however, the rights will have a modest price to them. Expect the share price of Discovery on Monday, which will trade ex the rights, to fall between 6-8 percent if my math is correct.

Last thing to know, and possibly the most important thing as a long term shareholder, what is it that the money is being used for? The company will be issuing 55,555,556 new shares at 90 Rand, a total of five billion Rand. 1.35 billion Rand will be used to increase their overall stake in DiscoveryCard to 74.99 percent, valuing the whole DiscoveryCard at 2.7 billion Rand. The whole business has net advances of 3.4 billion Rand as at 31 December 2014, and it recorded pre tax profits of 300 million. That means that they paid 9 times pre tax profits, Discovery has a tax rate of 28 percent. You can do the math. They only have 250 thousand card holders.

Why do they want to own this business? As they say, initially when they started in this business (in 2004) "The business model was constructed with Discovery receiving the revenue required to fund the integrated behavioural incentives and Discovery sharing in 20% of the underlying DiscoveryCard profit." And then now, "The DiscoveryCard customer base is a profitable and unique asset, and sits in the mid-income, mass affluent and affluent segment of the credit card market, which constitutes 93% of the industry's profit pool." Their 250 thousand customers are basically the most profitable, in the sweet spot.

The key here is that Discovery are not looking to become a bank, they make it clear that this card will continue to operate on the FirstRand banking licence (FirstRand own 25.01 percent of this venture), to learn more about their customers spending habits and customise their full suite of products accordingly. I suppose if you know (for instance) that someone spent 1000 Rand at the bottle store on Friday and then went on a drive about later in that evening, you might want to start charging them a little more for life insurance, not so? Equally, the points based system for rewards for good behaviour and a portion of your premiums back in the coming years, that is more important, don't you think? I certainly do. Good behaviour is rewarded rather than naughty behaviour being punished, i.e. you know when you are being bad, you however love being told you are doing well.

This is not something huge and mind-blowing. This is less than 5 percent of their market cap, including them sinking another 800 million Rand into DiscoveryCard, "which will likely be required to develop and enhance this financial services platform." So, 2 billion Rand we know where that is going to go, remembering that in the original release, the first reason for raising cash was further capital required for the "Prudential" business: In the context of the UK, the rationale behind the acquisition of The Prudential Assurance Company Limited's ("Prudential") remaining 25% shareholding in the UK joint venture was to pursue strong, profitable growth and further opportunities. In particular, VitalityLife presents a strong case for further investment, given the success of the Vitality-integrated life insurance product, the scale and reach of the distribution and wellness network, and attractive returns on new business. Historically, new business was funded through the Prudential structure. Going forward, to maintain the rate of growth, additional capital is required.

So, follow your rights, we will contact you all about the rights issue and the timing shortly. Good company that continues to make good inroads disrupting core markets, there is a strong and energetic team at the helm, we continue to also recommend this company as a buy.

Bidvest and the PIC are on the same page, when it comes to the voting of Adcock shares, a pool agreement in which the two parties collectively will have voting rights over 47.82 percent of Adcock shares. They will pool approximately 41 million shares each, and vote 82 million shares as a collective block. This comes after the PIC rejected the 52 Rand a share offer for the 48,466,905 shares that they manage on behalf of the Government Employees Pension Fund and the UIF. I guess they, the PIC will vote the extras in the same manner as the pool agreement, equally Bidvest who will have a lot more than the 41 million shares prior to the recent transaction. After taking their (Bidvest) and CIH stake up to 34.5 percent, they owned 59 266 944 shares.

With the recent purchase of the Blue Falcon (Kagiso owns 62,9% of the trust) and the Bophelo Trust shares (collectively those two parties were left post the transaction 2,571,000 Dividend acquired shares), Bidvest would own another 19,458,196 from Blue Falcon and 6,486,065 from the Bophela Trust shares. At 52 Rand. Add those two together and you get to 25,944,261. Add the above amount (59 million) and you get to 85,211,205 shares out of 201,589,011 shares in issue. Or 42.2 percent. Add in the 24 percent that the PIC controls and voila, there are only two shareholders who control the destiny of the company. This agreement just puts them on the same page essentially. Nice to have shareholders that are amicable, that is certainly very important.

Byron beats the streets, strap on your specs

Last week we received full year results from Luxottica, one of our favoured consumer stocks based in Italy but with a listing in New York. In case you forgot Luxottica, according to their website, is the leader in design, manufacture, distribution and sales of premium, luxury and sports eyewear. Trademarks include Ray-Ban, Oakley, Vogue Eyewear, Persol, Oliver Peoples, Alain Mikli and Arnette. Licensed brands include Giorgio Armani, Bulgari, Burberry, Chanel, Coach, Dolce & Gabbana, Donna Karan, Michael Kors, Paul Smith, Polo Ralph Lauren, Prada, Starck Eyes, Tiffany, Tory Burch and Versace. You get the picture. The company wholesales these products in more than 130 countries across 5 continents. Along with all of that they operate over 7000 retail stores under the Sunglass Hut brand.

They are also dominant in the prescription and vision care business around the globe. This gives them a solid healthcare element. Vision is of course imperative when it comes to healthcare and the quality of life.

Lets look at the numbers. 2014 was a record year for the group. Sales topped 7.6 billion Euro which was up 5.3% on the previous year. This equated to a 15.3% increase in operating profit to 1.18 billion Euro. Net income increased 8.9% to 687 million Euro which equated to 1.44 Euro per share. Of course there are currency complications here. As the dollar has strengthened the dollar denominated ADR we are invested in has under preformed the share in Euros. But because your shares are denominated in a strengthening currency, your buying power improves compared to every other currency. Having said that even in dollars Luxottica has a had a solid period.

The share price has improved from $47 (the shares took a dive because of ownership issues, I will explain later) in October last year to $60 a share today. In Euros the price has gone from 37 Euro a share to 57 Euro a share in the same period. When or if the dollar reaches parity with the Euro the share prices will cross over. Currencies are a funny thing. If the Euros bond buying policies work and the zone starts growing we will see flows going back to the Euro. We don't let currency movements determine our investment decisions although it is a factor we consider.

Trading at 56.4 Euro whilst making 1.44 Euro a share, the stocks trades on a historic multiple of 39. Certainly not cheap! Next year earnings are expected to come in at 1.81 Euro and 2 Euro for 2016. That puts the stock on a forward multiple of 28 with an average annual growth in earnings of 13.2% expected. Earnings growth like that, for a huge multinational with a solid and reliable customer base is almost unheard of in these markets, that is why the stock affords the multiple it does.

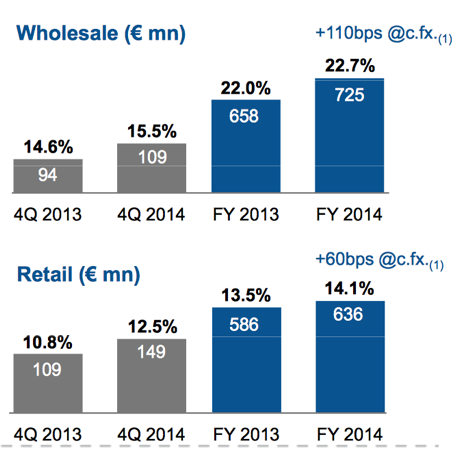

Operationally the business is split into 2 divisions, retail and wholesale. Here is how they faired (see image below). As you can see both divisions showed solid growth with earnings split fairly equally between the 2.

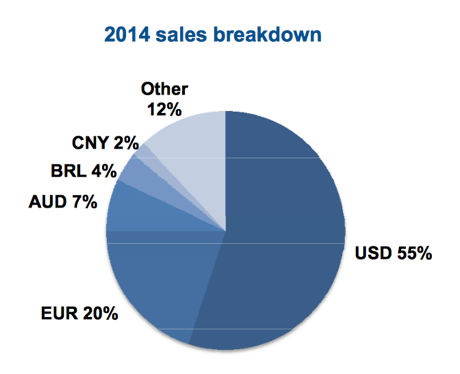

Geographically this business has huge exposure to the US as you can see from the image below. That is good for a company earning in dollars and reporting in Euros. Because of the strength in the US economy it is also their fastest growing region amongst their established regions. Emerging markets grew sales 17% wholesale and 10% retail.

The company does have a few risks. Volatile currency movements could have a short term impact but the biggest concern is the the ownership structure. We covered the debacle in details last year, click on the link Luxottica Corporate Governance Issues for all the details. In short, the situation has been dealt with and new management are in place. It is not ideal but at least your interests are heavily aligned with Del Vecchio even though he is not willing to give up power. He is certainly an exceptional man to have built the business to where it is today.

Free cash flow and net debt are almost equal, room for further capital expansion is huge. I love the theme of fashion, consumer necessity, healthcare and even sport through their active eyewear division. Even though the stock is expensive we buy shares because we believe the theme will out preform what the market predicts. This is certainly one of those themes. We continue to add.

We're reading this, you should too.

A new way to get access to all those unlisted Silicon Valley stocks - Sand Hill is the New Wall Street. This exchange would not be without its own risks and in this case your risk is the company that you are betting on and then also the risk that the exchange goes under.

Having a look at some of the crazy numbers coming out of the social media space - A Year Later, $19 Billion For WhatsApp Doesn't Sound So Crazy. The number that really stood out to me was "Instagram had around 30 million users when Facebook bought it for $1 billion. Now it has over 300 million users and Citigroup values it at $35 billion."

Having a look at the costs that can be involved in buying ETF's - Are ETFs really four times costlier than unit trusts?.

We are not fans of looking into the past to predict the future, knowing the circumstances that preceded a crash can be useful though - Hunting down the ghost of the '87 crash

Home again, home again, jiggety-jog. Commodity stocks taking some heat. Again. Sadly. Strong Dollar = weak commodity prices. The impact on inflation I guess is also likely to follow in the following months, the petrol price respite is likely to have been temporary, another 80 odd cents whacked through. Oh dear.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment