"What is important to note is that the phone is huge, the business is still the phone. Not the Macbook, not the iPad and for now, not the watch. These are just early stage entry into wearables. Not everyone will want one, Apple fans will have to get used to new functionality, different tapping and scrolling"

To market, to market to buy a fat pig. A rout of sorts for the local market, commodity stocks were hammered. Perhaps the 7 percent hangover in China and the US better than anticipated jobs situation. Most importantly the stronger Dollar is as a result of the Fed possibly to raise rates sooner, rather than later. Personally I do not care, the Fed and the ECB will do what they need to in order to meet their respective mandates. What can I or you do about it? Nothing. There are some things worth getting excited about in life, the ones that you have no control over, like how the Proteas, Bafana or the Boks go about their business are high energy and high emotion, in the end the result has no bearing on how hard you shout at the TV. The Fed will raise rates when they think it is appropriate. It does not make any of the companies that you own any worse or better if interest rates go up, obviously the more indebted that they are, the higher their interest costs.

Those commodity stocks, yowsers, down over 2 percent as a collective on the day. Gold shares were down over 5 percent, my word, a stronger Dollar is certainly not very good for gold. I still cannot work out why you would want to hold the metal as an investment. It is never going to pay you a dividend. Even a property, which I do not think is the best investment (with all the added and unseen costs) pays you a rental income. The only reason you buy a gold coin or a gold tracking instrument is that you think the price is going up. There is absolutely no cash flow associated with a gold coin. When faced with a choice of buying a bond with a negative yield right now, or a gold coin, you can almost be sure that the one will yield an income in the coming years, the other one never. Anyhow, my prejudices aside, the industry is still very important in South Africa. After all was said and done, the overall market had sunk 1.37 percent. Which is around 700 odd points nowadays.

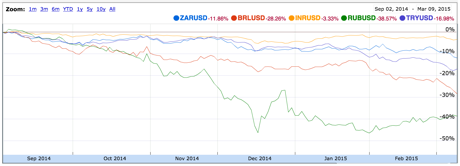

Over the seas and far away markets recovered a little off their heavy handed sell off Friday, the Dow Jones comfortably outperformed the rest of the other indices, up nearly four-fifths of a percent, the broader market S&P 500 and the nerds of NASDAQ added 0.39 and 0.31 percent respectively. Energy slumping again as prices continue to wax and wane in a new area for the oil and gas producers. As I look across Asia, the markets there are in the red, around two-thirds of a percent lower across the board. The emerging market currency rout is spread across the globe. Be thankful that in the last six months you are not Brazilian or Russian. Or Turkish. Or earning money in that area and buying goods in Dollars. Or the inflation outlook which must be worsening. This is a graph that tells the story from September the 2nd to present, courtesy of Google finance.

It doesn't tell the whole story, I have enlarged the portion above (a bit fuzzy) to show you how terrible it has been, we have been relatively shielded against the stronger Dollar, down 11 percent, spare a thought for the users of the Brazilian Real buying stuff in Dollars, equally ordinary Russians and Turks. Slammed:

Obviously each country has a different story, Dilma Rousseff has her back to the wall, check this FT story about Brazil and their woes: Brazilian real falls to 11-year low over risk to austerity plan. Socialism, bribes, pals, it turns out that eventually it comes back to bite you in the bum when politicians try and manage the economy, it does not work. The only reason why I point this out is that many people are "thinking insular", meaning that they view the weakness of the Rand as a result of the local economy rather than Dollar strength. Make no mistake, "things" could be a lot better here, we are however not Turkey, not Brazil and not Russia.

Apple fleshed out the watch last evening and for us Mac lovers (the electronic kind) released what looks like an amazing new sleek model, in the air category. I switched over to the business channel whilst Tim Cook was delivering his piece and my eldest daughter expressed a desire to get one. In her world the company makes excellent products, they are better than anything else she knows. In the same way for her search is associated with Google and online videos are associated with YouTube. I am not too sure how powerful that is, I am guessing that if I was paying more attention when I was growing up I would have associated pictures with the Kodak brand, we all know how that turned out.

OK, check out the watch and let me know whether or not this device is for you: Watch gallery. Which one would you get? Is it good or bad that there are loads of choices? Stainless Steel casing all the way through to 18 Karat Gold casing in more classic designs. Pricing? That varies substantially, all the way from a 38mm silver aluminium case for the sports edition at 349 Dollars, to the 42mm stainless steel case at 599 Dollars, to the 38mm 18 Karat Rose Gold case for a whopping 17 thousand Dollars.

Check that one out, the most expensive one: 38mm 18-Karat Rose Gold Case with Rose Gray Modern Buckle. Is that the kind of thing that you order online? I guess it is. There are of course multiple bands and accessories, a magnetic charging cable costs 29-39 Dollars, that itself is the cost of a cheap phone. Personally, this is my choice: 42mm Stainless Steel Case with Light Brown Leather Loop. Not too much, functional and classic looking.

So what does the new watch do? Battery life is around 18 hours. Your timeless piece, the classic kind (I tell you, a Cartier classic gold watch is around 43 thousand Dollars) last all day and all year and all decade. How long does the watch take to charge, if there are 18 hours of charge in it? That is a key questions I guess. Here is a piece from Scott Stein at Cnet: Apple Watch hands-on. Gene Munster, one of the most recognisable Apple analysts and perhaps a rockstar analyst as a result of his "correct" calls on the company was suggesting that even if 10 percent of iPhone owners get the device it moves the needle a little (4 percent to numbers is his best guess), check out this video: Apple Smartwatch Is Priced in 'Sweet Spot': Munster. Worth a watch, that Bloomberg video.

What is important to note is that the phone is huge, the business is still the phone. Not the Macbook, not the iPad and for now, not the watch. These are just early stage entry into wearables. Not everyone will want one, Apple fans will have to get used to new functionality, different tapping and scrolling. I suspect that it will be a hit, the middle end range watches, for sports folks it might be a nice way of integrating with multiple Apple devices. The health function I think has amazing prospects, think of all the positive reinforcements on diet and exercise. Siri can tell you how well or how badly you are doing.

We're reading this, you should too.

The hardest thing in investing is knowing when to stick to your guns and when to move on - Why It's So Hard to Change Your Mind About the Markets

Here is a look at some of the reasons that you should stick to your guns - 6 bad reasons to make changes to your portfolio. When you have a long term view, all of the reasons listed are not applicable, the hard part is remembering to keep focussed on the long term.

Here are a few graphs showing how household debt in the US is shifting - Household Debt and Post-Recession Auto Lending. Increased debt is good over the short run because it increases consumption.

Home again, home again, jiggety-jog. Another wicked commodities sell off, the gold shares have turned negative for the year after being up 30 percent in January. It is almost like deja vu (sans the accents), the same happened last year. Spare a thought for the construction shares down over twenty percent this year, down 20 percent last year. Down 3 percent the year prior. They almost have to double just to get back to the same levels that they were in 2012. Since the World Cup euphoria peak in October 2007, the construction index had gone from 93 points to 27 points, down nearly 70 percent in that time. Investing in cyclical industries I guess is not for sissies. Wow.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment