"On a forward basis, earnings are anticipated to clock 3.51 Renminbi for the current year, meaning that at current levels the stock trades on 38 times earnings, or a forward PEG ratio of 1.06, I guess that is slightly more than you would like for a high growth stock, not however out of the comfort zone. Revenues for the current year are anticipated to be close to 98 billion Renminbi, or 121.5 billion Hong Kong Dollars. Or, 194.4 billion Rand, if you like. Tencent on that basis trades at 10.5 times revenue. Facebook for comparisons sake trades on 17.5 times annual revenues."

To market, to market to buy a fat pig. We all know that the fox says a whole bunch of things, it almost seems like the same thing when it comes to the US Fed. The number of headlines that you see that go like this: "Stocks wait for the US Fed for next clue on interest rates" or "Markets fall as Fed could raise rates soon". As I said, it is not that I do not care, it is not as if Vestact does not care, it is however in their hands and they (the smartest academic minds in their specific field on the planet) will do what they will do. They will act according to the situation. I think that it (the worry around rates and "what to do") is not too dissimilar to a fear of flying. If you have no control over what is going to happen next, you somehow feel powerless and as such there is an anxiety associated with it.

It is the same with interest rates. Whilst the Fed, I saw on the box (it is more of a flat thing nowadays), is set to even factor in Twitter in their decision making process, the average person, professional investor, has absolutely no control of where interest rates are going next. If that means a strong Dollar, rebalancing of the economic global order, then that is what will happen. If that means that Brazil and Russia (and Venezuela) see lower prices and have to deal with inflation, uneven economic growth and political upheaval, then that is what happens as a consequence of being too reliant on a specific part of your economy to go forward. Fail to plan, plan to fail as they say in the classics.

Do not let it consume you in any way. Do not worry too much about the implications for your companies that you hold. There is no need to "reposition" yourself ahead of the Fed decision. The quality of the businesses and their ability to meet their obligations in a higher interest rate environment depends entirely on their prospects, their management team and the robustness of their consumer. And product. You can have the best business plan in the world, no plan can surely succeed if your customer is nonexistent. Anyhow, expect when the Fed release their next statement to remove a single word that apparently is going to freak everyone out, the word "patient". I kid you not, patient refers to how long the Fed are willing to wait until they raise rates. Pfff ... they must do what they must do, if that has an impact on equity prices, there is nothing you or I can do about it. We remain fully invested at all times, regardless of what any central bank does, or does not do.

Company corner snippets

Discovery go ex the rights today, meaning that the company starts trading without the rights. It is simple, on Friday was the last day in order to participate in the rights issue in the ratio of 9.38641 per 100 (at 90 Rand apiece), the share price today will trade accordingly lower, possibly around 6-7 percent lower from where it opens. The shares that you buy today include all the extra ones (55.5 million) that are going to be listed in the coming weeks. Remember, we think that you MUST follow your rights. Apply that ratio above to your current holding of Discovery shares, as per Friday's mini statement, and then multiply it by 90 Rand a share, simply make that deposit.

It is approximately 6.5 percent of your current holding, as per the close of trade Friday. That is the simpler ratio. What are the time frames? In other words, how much time do I have? You must do it, as a beloved old client of ours used to say: "immediately at once!" You basically have two weeks today to make sure that the funds are in your account. If you do not do anything, you will lose money.

TenCent fourth quarter earnings are set for release on Wednesday, expectations are for earnings of 0.66 Renminbi per share. Remember however that the company is listed in Hong Kong, where there is a different currency. The inter-webs tells me that the ratio is 1.24 Hong Kong dollars to 1 Renminbi, the expectations are therefore 0.82 Hong Kong Dollars of earnings relative to the share price of 135.5 Hong Kong Dollars. The company would earn, at that level, 2.57 Hong Kong Dollars per share. The stock would then at these levels trade on a historic price to earnings multiple of 52 times. A really lofty historical multiple by any standards of any sort. Earnings however grew by 55 percent on the prior year (if we believe these expectations) meaning that the stock trades on a PEG ratio (price to earnings over growth rate) of less than 1.

On a forward basis, earnings are anticipated to clock 3.51 Renminbi for the current year, meaning that at current levels the stock trades on 38 times earnings, or a forward PEG ratio of 1.06, I guess that is slightly more than you would like for a high growth stock, not however out of the comfort zone. Revenues for the current year are anticipated to be close to 98 billion Renminbi, or 121.5 billion Hong Kong Dollars. Or, 194.4 billion Rand, if you like. Tencent on that basis trades at 10.5 times revenue. Facebook for comparisons sake trades on 17.5 times annual revenues.

Tencent pays a dividend, not a kings ransom, 24 HKD cents. The yield is laughable, the fact is that Tencent is hugely profitable (EBITDA margins of 33 percent), continues to invest heavily in their infrastructure. They will continue to become a more important part of the every day life in China, as an entertainment, messaging, commerce business, as well as keeping up with new technology and adapting. They will also have favourable government legislation on their side, the government wants them (and their Chinese peers) to prevail over multinational competition. That is both good and bad for the average consumer in China and definitely for the companies in the long run. It is what it is, however. I am looking forward to these results as much as I am looking forward to the quarter final against Sri Lanka, it should be cracking!

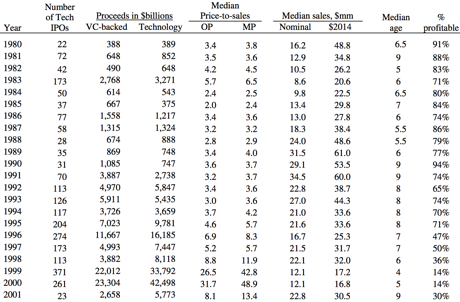

There are many comparisons between the dotcom era and now, there were 632 Tech IPO's in the US in 1999 and 2000, of which 14 percent were profitable (Yes, true story, here is the data -> Technology Company IPOs, 1980-2013), more importantly they traded at 26.5 to 31.7 times sales. Makes you think, not so? Here is the table:

Walking through the Rosebank Woolies yesterday after lunchtime got me thinking real hard, the new stores in both Sandton and Rosebank BTW are really special. I remember that Woolworths clothing offering was really not great, they were looking tired and it was not a destination for clothing. All that has changed, not only has their food offering in terms of quality and value changed markedly, their clothing offering has transformed the relative shopper. The boutiques internally (Mimco confirms that "feel") and the quality means that you attract more upmarket shoppers who are happy to spend more, margins are better, you feel that the brands then become aspirational themselves. The internal Woolworths brands. If the company can achieve here locally with their David Jones purchase, then you would guess that Woolies made a really well timed purchase. I believe that this management team have the capability to do this, the recent slump from record highs for Woolies is an opportunity in our book.

We're reading this, you should too.

This is not quite a Macbook Air and also doesn't have its price tag - Meet Google's New Chromebook Pixel

This is one of the proposals from Greece, I think the headline speaks for itself - Visiting Greece? It wants to pay you to spy on the locals

Some amazing pictures of space, the wonders of modern technology - A breathtaking photo of a constellation 4,000 light-years from Earth is the most detailed ever of that region. Having a look at the pictures it makes us feel small, I suppose we are.

The internet is disrupting many industries and the impact on the TV industry is nothing new, here are the latest stats though - Television is being nuked at all angles by Netflix, Amazon, and Hulu

Home again, home again, jiggety-jog. Oil prices off the boil sharply. Commodities are again taking heat. The rest of the market is up however as markets around Europe seek to reap the benefits of a weaker Euro and await results from the fed meeting this week.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment