"I am not too sure what to say about the platinum producers, whether or not they actually make investment grade, do you think that they have been too discounted for all these factors? Possibly. Whether or not the industry is going to be as profitable as in the past, remember all the special dividends 10 odd years ago, remains to be seen. Perhaps, who knows. Too many question marks."

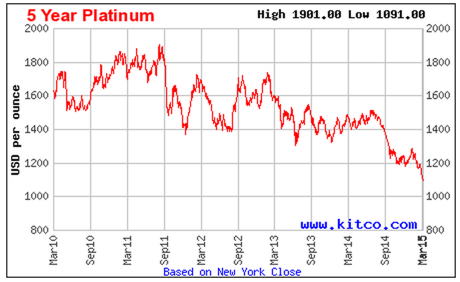

To market, to market to buy a fat pig. A day for the resource stocks yesterday, which was kind of bizarre, as the prices of the underlying commodities were slipping badly. That has continued through until this morning, the platinum price has slipped below 1100 Dollars per fine ounce. This looks like comfortably the lowest price for platinum in years. Check out this graph from Kitco, the platinum price over the last five years:

This is clearly terrible news for the local producers, in the face of a very strong Dollar (at least that translates to a weaker Rand), management and a workforce that clearly are miles apart, disruptive power supply, the list goes on. What is clear about the oil and gas markets in North America is that there is a whole lot of extra supply, it is easier to get this out of the ground with improved technologies. Technology has improved equally for the consumer too, motor vehicles have become better in terms of their usage, commuters more aware of their habits. People going green. No inflation, I remember a speech from James Bullard (a Fed voting member) in August of 2013 in which he warned how it could become a big problem. Boom, the market expected the Fed to raise rates, that wasn't necessarily good for commodities.

I would have anticipated that the platinum price would have been higher, recovering European vehicle demand, higher emission control standards and generally all around improvement in the global economy (and tight supply) would have been factors that would have been favourable. Not to be. Even the platinum execs are confused, I share that with them, whilst the investment side winds in their necks, surely the prospects look better for the price of the metal? If not of course for the producers, all the aforementioned factors plaguing them are unlikely to go away. Sigh. Remember that when investing in immovable assets, the law of the territory that those immovable assets are exactly that.

In other words, what I am trying to say is, if the platinum assets from the Great Dyke of Zimbabwe were in Switzerland, would they be cheaper or easier to mine? I don't know the mining laws of Switzerland (if there are any), I would however think that the Swiss government would be more agreeable than say the government in Zimbabwe has been. Maybe, how am I to know how hypothetically the Swiss government would act if there were large platinum deposits underground and they viewed this as a national asset? What I do know is that for historical reasons, the Swiss have more resources to call on, be they government or private.

They (the Swiss) welcome companies, you could argue too easily (along with their secret banking system of years gone by). It does not matter to ask the question, it is what it is. I envisage a world where there is no more need for the Orinoco oil sands (Venezuela), they essentially become useless economically, like whale fat. As they say in the classics, the rocks did not run out when the stone age ended. If anything, they (the rocks) become more useful for building material, it is still an asset after all.

I am not too sure what to say about the platinum producers, whether or not they actually make investment grade, do you think that they have been too discounted for all these factors? Possibly. Whether or not the industry is going to be as profitable as in the past, remember all the special dividends 10 odd years ago, remains to be seen. Perhaps, who knows. Too many question marks. Having said that, Citi is comfortable enough to upgrade Lonmin to a buy, they are probably right! Ben Moolman has been appointed there, Ben Magara the CEO says he is thrilled on that!

Today the Fed are expected to remove "patient" from their statement. Or not. There are so many armchair Fed experts that the subject of guessing must (like the sporting fans) be left to the masses. If the masses had their way on their favourite sporting teams, the team would have absolutely no continuity. The same goes for guessing over and over again as to when the Fed are going to raise rates, or hint that they are going to raise rates. If you think that the Fed doesn't actually fulfil the function that you think it should, then read Cullen Roche's piece today, very good: A World Without the Federal Reserve:

"In the 60 years between 1853-1913 when the Fed was created the US experienced TEN different banking panics. It was an unstable system because it was comprised of private entities who would lock up during panics. Similar to 2008, the private banks would stop doing business with one another for fear of counterparty risk. The private clearinghouses improved the system by creating joint liabilities, but this did not halt the panics."

So, before the Fed was created just over 100 years ago in 1913, there was basically a banking crisis every six years. That does little for either the business cycle, or for your trust of the financial system. So forgive me for thinking that intervention is better than failure and lurching from crisis to crisis. Also, one last point to add to this, many in the market (and this is the sense that I get) are waiting for another market Armageddon type situation soon.

As Eddy Elfenbein pointed out a couple of weeks ago however, in his March 6 2015 piece, CWS Market Review - March 6, 2015: Nearly six years ago, on March 9, 2009, the S&P 500 closed at 676.53. The day before, the index had reached a beastly low of 666.79. Consider how painful that was. The market was still less than half of what it had been nine years before. Adjusted for inflation, the Dow was where it was in 1966. Think of that! Forty-three years of no real gains. If you are waiting for another 1966 inflation adjusted market drawdown, missing everything in-between, perhaps (in a crude way) you are doing all of this wrong.

Company corner snippets

Oh wow. We knew that this was coming, the logistics of it was not quite something that people could get their heads around. Facebook payments are going to be a reality between two parties using the Messenger option. Check it out: Send Money to Friends in Messenger. It seems really simple and of course, as we have been saying all along, the payments systems will be the traditional ones, you need a Visa or MasterCard debit card.

See: "The first time you send or receive money in Messenger, you'll need to add a Visa or MasterCard debit card issued by a US bank to your account. Once you add a debit card, you can create a PIN to provide additional security the next time you send money. On iOS devices you can also enable Touch ID. As always, you can add another layer of authentication to your account at any time."

It is not a new payment system, Facebook already handles more than one million transactions a day, for those who are fans of all the distractions that go along with it, as well as the advertisers. Same system, different audience. Expect the system, once rolled out across iOS and Android (and desktop) to be spread further and wider across the globe. I am pretty sure that all and sundry will adopt this, this is what you call a cash killer for the smaller transactions. Couldn't happen sooner.

Apple with loads of news over the last few days, the TV announcements are pretty big. Again, sadly for consumers here in South Africa that means very little, at least for the time being. In terms of laws around different programming (inside of specific territories) it is likely to remain that way. I know that Netflix have similar laws around which territories you can, or can't stream in. Michael is simply asking the question, via a Bloomberg video: Apple changed the music industry with iTunes, they are now looking to do the same with television - What Would Apple's New TV Service Offer? Perhaps, I have a Apple TV (I have had for a while), the problem is bandwidth, that is shocking in my area, sadly.

We're reading this, you should too.

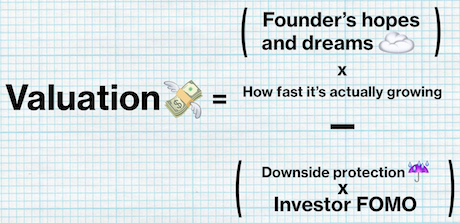

Some big numbers being thrown at disruptive start-ups, here is a rough way to see how the numbers are obtained - The Fuzzy, Insane Math That's Creating So Many Billion-Dollar Tech Companies

Pinterest valued at $11B after latest round of funding

There is a push for increased digital security, remembering passwords is a major weakness in the current model - Alibaba's Jack Ma shows off new 'pay with a selfie' technology

Am interesting experiment from Google on generating alternate power - Google will fly a crazy, plane-like, 84-foot wind turbine next month

Home again, home again, jiggety-jog. OK. Finally. I saw the monkey off our backs running across the hallowed turf of the Sydney Cricket Ground, young Quinny de Kock and the old man of the side, Imraan Tahir saw to that. And JP Duminy took a hat-trick. Wow, what a day, those memories of 1999 and 1992 still hurt. This feels good. Markets are about flat, apparently "investors" are waiting for the Fed. Ignore that part, pay attention to what the Fed chair says, do not amen to everything.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment