"My point is that the business has evolved to the point where it is a lot more mature, Google have the ability to take someone from a nearly three decade career with one of the finest financial institutions on the planet, and entice her to join a company she would not have heard of two decades ago. As one of the links in what we are reading once pointed out, the jobs that your children and grandchildren are going to be working professionally may not have been invented yet."

To market, to market to buy a fat pig. Oh dear, the cricket gods were not quite with us yesterday. Having a better side on paper in sport perhaps does not always equal the outcome. Better luck next time, no disgrace in being within a ball or two (catch or runout or two) away from the World Cup final. Such is life, you have to wait for a very long time to taste the sweetness. To make this feel a little better, know that since August of 2012, we have basically held onto the ICC test match mace, and I am pretty sure that if you ask any cricketer which form of cricket is the pinnacle, it would be test cricket. It doesn't fell better I am afraid, I feel upset. Ah well, there is always 2019.

On to matters different, market related, we saw European PMI numbers indicating that manufacturing is in its best shape for around four years. The weaker Euro helps exports and therefore makes the zone a little more competitive, relative to their international peers. Meanwhile in Athens, government authorities are scrounging for cash ahead of a potential technical default in the coming weeks. If Athens cannot pay the IMF back any of the outstanding amount, due in April, it will not have access to that portion of theirs in the fresh bailout funds.

All rather touch and go, moving at tectonic pace I guess for the Greek liking. Their new proposals are expected to be tabled on Monday, perhaps this will please the Troika a little more and they may be a little more forthcoming with the funds. Ironically whilst Greece flounders around and there is a much weaker common currency, that is not all bad news for the big exporters. Perhaps there is little irony in the pace of granting the Greeks a reprieve, although that hardly seems like a good idea for business confidence across the Eurozone. I cannot imagine that the best possible outcome for Germans is to have a Greek cloud hanging over their heads. It just looks and feels bad, it feels like a no win situation, I am sure that the Greeks do not feel that way. Ironically the only way that you can get to the point of the labour and other reforms is with the prospect of withholding money. Watch it and pay attention, do not let it consume you at all.

It is a mystery to me that so much attention is placed on airline disasters, whereas motor vehicle accidents are seen as things that just happen. I suspect that is exactly why these are sensationalised, the very fact that airplanes are NOT supposed to crash, us humans are conditioned to the idea that the one is fine and the other is not. And I guess from an air safety point of view, that is the point. I guess also the size and magnitude is something that captures people's imagination.

The WSJ has a story titled: 'Highly Unusual' Germanwings Crash Blots Period of Unprecedented Safety. If you look at the article and the associated Aviation Safety Network picture, you can see that in the 1970's, not so long ago, that there were 50 to 80 incidents per annum, or roughly one a week. Even through the 80's and 90's, there were many accidents. The casualties part I guess may have fallen further.

Yet, 2014 was the safest year on record for commercial jet aviation, in the history (around 112 years worth). You might not have thought so with two very high profile Malaysian airlines disasters, one ironically in a war zone that was recovered, the other one a year on, nowhere to be found. Perception is everything, you think it is safe to get into your motor vehicle and drive to work each and every day, yet 45 odd souls lose their lives each and every day on our roads.

In-between yesterday, when the Germanwings flight tragically crashed, and tomorrow, the same number of people would have lost their lives. Yet there is no wall to wall coverage of the time those vehicles left, when they were serviced, whether or not the drivers were capable, who the passengers were. I feel deeply for all victims of all crashes, this one is absolutely no different, my heart bleeds the same. I just think that perspective is needed, it is still far safer to step into a commercial airplane than your motor vehicle, I wish that people had the same fear of driving, perhaps the roads would be safer.

At the end of 2013 (according to the IATA safety report) there were 22500 jets and over 2000 Turboprop aircraft, that carried over 3.5 billion people. According to IATA: Every day about 100,000 flights bring people and goods to their destination. Flying is safe They are right. That does not make us feel human however, flesh and blood is what we all are.

A separate part of the conversation around technology and transport are driverless cars, whether or not as a human you would cede control to a machine to drive you around? Would you do that? I would do that immediately, Paul said he was not too sure whether, in the transition phase that it would work here in Joburg. Or in places where people were less obedient in terms of the traffic rules. How would you driverless car act at the intersection when the traffic lights are out, for instance? In Joburg there is no your turn-my turn, it is go-go-go. I am pretty sure that the driverless cars could and would adapt to all situations, it is the future. I for one would prefer to be driven home.

Company corner snippets

Oh! That is interesting, the fact that Google have managed to drag a Wall Street type across the country from New York to the Googleplex, which is in Santa Clara County for any of you that have ever been close to that part of the world. Well, do you know the way to San Jose? Ruth Porat better know the way, she has landed the job of CFO at Google, leaving the same job at Morgan Stanley. Check out the Google release: Ruth Porat to Join Google as Chief Financial Officer. The only thing that sticks out for me is that when Porat joined Morgan Stanley in 1987 (an interesting year for equity markets) Larry Page and Sergey Brin were 14. They were going through their geeky years at high school, we all remember those.

My point is that the business has evolved to the point where it is a lot more mature, Google have the ability to take someone from a nearly three decade career with one of the finest financial institutions on the planet, and entice her to join a company she would not have heard of two decades ago. As one of the links in what we are reading once pointed out, the jobs that your children and grandchildren are going to be working professionally may not have been invented yet. In fact, in all likelihood they have not been invented, it is evolving on a daily basis. It signals a clear sign that the jobs with more excitement for financial types are in technology, businesses that are evolving. I am however pretty sure that Wall Street will never lose the mojo, the allure of riches. It may not be fair in her specific case, this is as Porat describes it "a return to her roots". Her father taught in Palo Alto for 26 years. See? Good work Google, your gain is the loss of Wall Street.

Things we are reading

The underlying real economy is only now gaining some momentum, so definitely not over heated. Stock prices, I would say are fairly valued and priced for continued GDP growth - Old Age Doesn't Kill Bull Markets

What will the impact of large-scale ETF's be? Vanguard is the EFT that Buffett mentions in his will - What Happens When Vanguard Owns Everything?

Here is a look at how Apple TV could evolve in the coming years - ALL THE WAYS A NEW APPLE TV COULD DOMINATE YOUR LIVING ROOM.

One of our favorite market bloggers, Josh Brown is not convinced with some of the valuations of tech start ups - Main Street Gains Startup Bubble Exposure. Know where your money is being invested and make sure that you can sleep at night knowing that you own asset X, Y or Z.

This is contentious, worth reading however, a WSJ piece weighing in on whether or not small loans improve the lives of their users: Calls Grow for a New Microloans Model.

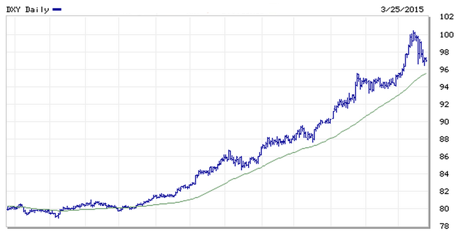

Home again, home again, jiggety-jog. Markets are off here after a Wall Street sell off in the second half of the session there. Resources falling, the Rand has strengthened as the US Dollar has been losing some heat against the rest of the basket. The Dollar Index, after having topped 100 nine sessions ago, is now below 97, which is a three percent plus swing in a short period of time. For the last year however it has been basically one way traffic. Here is a year graph via Marketwatch from the last year, so far it has looked like one way traffic:

Amazing, if you speak to all the Brazilians they will tell you how it has everything to do with their government and blame the incumbent. The same could be said here, the blame of the Rand weakness is squarely placed at the foot of the politicians, whereas in truth the stronger US economy has translated through to Dollar strength. Does it make sense? It does not mean that we cannot try a whole lot harder and make sure that our economy can fire on all cylinders, the way I view it is that we are stuck in this ideological time warp, where ideas and informative years were spent in places where it was coming to an end, communism that is. We have a wonderful country with hard working people, we need to channel that anger into productivity, not so? In the end humans make decisions for humans.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us Follow Sasha, Byron and Michael on Twitter 087 985 0939

No comments:

Post a Comment