"Voice is still a large part of revenue. If you were looking from the US you may scratch your head. Obviously lots has to do with the quality of the subscriber and the quality of the handsets that the subscribers have. MTN spend over 7.5 billion Rand a year on superior handsets, subsidising them so that their users and customers can pay more and more over time for a "better" phone. We not only want to be richer and better looking, we want a better handset for faster internet speeds."

To market, to market to buy a fat pig. That value thing yesterday seems to have captured some of you, the conversation never has a conclusion and I suspect that if you buy good companies at what seem to be stretched valuations at that point in history, in 6 odd years nobody remembers, provided that the company management have executed properly. That depends on what consumers want at any point in time, you can have the best business systems (and plans) in the world, the best management and the best execution, if consumers do not want to use your service or buy your product, you are dead in the water.

An old friend of the newsletter had this to say in response to yesterday's message: "I think you have put your finger on the dilemma in investing - how to evaluate value at a point in time. There are any number of systems touted around, some ostensibly more successful than others. But in the end it still comes down to "buy cheap and sell dear". The trick seems to be able to evaluate cheap and dear at any given moment." I have no secret sauce and I believe that not many investors have the perfect formula.

Even some of the most impressive money managers in the world have made mistakes from time to time. Tesco and Buffett. Bill Ackman and JC Penney. You cannot get it right. We have had our fair share too, we have been wrong and we will be wrong in the future. As long as you can be consistently less wrong than the market, as well as pick the better businesses, you are always going to do better. Companies are bought, they diversify, they unbundle, they go bankrupt, their products are replaced with newer technologies, it just all changes at a snails pace in front of your eyes. In the case of Moores law, technology changes a little quicker. And that is where I guess you must pay a little more attention.

Stop it. Immediately. At once. Be careful either as a young professional or advising your children when they get their first job and then think that they "deserve" a brand new fancy motor vehicle. The costs of that, having heard and caught the end of an interview with Niel Fourie, from the Actuarial Society of South Africa with Bruce Whitfield on the Money Show on 702. Those of you not from 702land will be familiar with Cape Talk 567, the same platform. I am not too sure that down in KZN you get 702, other than on the DSTV platforms. I guess that is available, who wants to listen to the radio on your TV though?

Anyhow, the long and the short of it all is that based on a five year replacement cycle (that is probably conservative) over a 40 year period, folks will spend 9 million Rand on that shiny new car with an awesome smell. 9 million rand over 40 years. That obviously factors in inflation, I am presuming running costs and insurance. The more expensive the motor vehicle, the more expensive the insurance, particularly for your professionals. The younger you are, the greater the likelihood of you being an insurance risk. I did eventually find the press release from the actuarial society of South Africa, you can read through it here: How your choice of first car can make or break your retirement.

The argument could however be taken further. If you are prepared to rebuff your colleagues and own something very modest (to get you to and from work) and more importantly save that money. I bought a second hand Polo Vivo that gets me to and from work for a little over 110 thousand Rand. It has a radio, an aircon, as well as a heater for winter. The services are cheap. It is good on fuel. If someone thinks that I am not doing well based on my motor vehicle, it is time to have your reality updated.

OK, so let us presume that you keep your first cheap car and then save 5500 Rand a month in a fund to buy a 125,000 Rand car, that would take 22 months. You then buy that car cash, and then you save the 10 thousand Rand a month in a spread portfolio that delivers around 12 percent per annum, avoiding unit trusts as they suggest, too expensive and in fact the compounding effect of the 3-5 percent drawdown leaves you comfortably behind. Let us presume that you make monthly contributions of 10 thousand Rand for ten years and then repeat the cycle.

Using this simple calculator - > Compound Interest Calculator, I end up at 2,35 million Rand after ten years. Based on a dividend yield of 2.5 percent per annum, you can draw down on 62 thousand Rand after tax. You can then continue along your merry way, another 15 years later (25 in total) with the same 12 percent per annum returns you get to nearly 18 million Rand. A 2.5 percent yield will be 450 thousand Rand a year, more than enough to buy a motor vehicle every year on an inflation adjusted basis (6 percent).

The thing that you have to prime yourself to do is be patient and be prepared to be modest. You will be far richer than your big spending colleagues. And the argument that if the world ended tomorrow? Your world? I guess then you leave the earth with more assets and less debt for those left behind to deal with. If you push to 40 years, the returns (assuming you still only contribute 120 thousand Rand a year) are 12 percent per annum, you end up with over 103 million Rand. Tell that to your friend with the swanky car.

You will recall that we introduced the MTN results yesterday, just to recap a little with the numbers that are most important, we wrote this in the message yesterday:

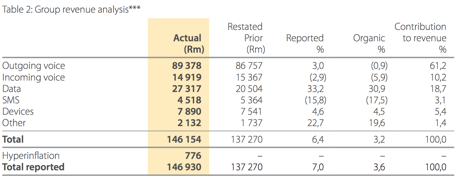

Revenue for the full year is up only 6.4 percent to 146 billion Rand, EBITDA margins increased by 150 basis points, EBITDA increased by 10.2 percent to 65.5 billion Rand. Astonishing. HEPS clocked 1536 cents, up 8.9 percent. The dividend was a record 1245 cents for the year, 800 cents in the second half. Subject of course to a 15 percent withholding tax, that is 680 cents. For the full year that amounts to 1058 cents per share. At a current share price of 211.74 Rand the company trades on 13.78 times price to earnings multiple with a post tax dividend yield of 5 percent. Or just shy, 4.99 percent. We will flesh these out over the coming days.

So the company looks cheap? Is that as a result of declining revenues in their home market South Africa? Or is it that the company is continuing to see pressures on their voice revenues, a price war has seen a race to the bottom. There have been casualties in this, word on the street is that Cell C are creaking, the ship is taking some serious water. A plan is underway to determine what can be done there, whether or not the business is for sale. Not in a good way.

Data is definitely growing like gangbusters. Here is the opening paragraph across all of their networks across all of their countries: Data services remain the key driver of the Group's revenue growth and increased their contribution by 3,8 percentage points to 18,7% of total revenue in 2014. In the year, the number of data users increased by 22,8% to 101,2 million as we expanded our 3G and LTE networks and stimulated the adoption and usage of data-enabled devices and smartphones. At the end of December, we had 51,9 million 3G-enabled devices on our network, an increase of 30,4% on the previous year.

There are a few interesting things from this table of revenue contributors across the group. First of all, what is an SMS? Kidding, I SMS my wife a lot, WhatsApp does not always work if you do not have a reliable and steady connection. Plus sometimes you are stuck in groups that you may (or may not) want to be on. Here goes:

Voice is still a large part of revenue. If you were looking from the US you may scratch your head. Obviously lots has to do with the quality of the subscriber and the quality of the handsets that the subscribers have. MTN spend over 7.5 billion Rand a year on superior handsets, subsidising them so that their users and customers can pay more and more over time for a "better" phone. We not only want to be richer and better looking, we want a better handset for faster internet speeds.

The growth segments (if you look in the AT&T 2013 Annual report) in the US are the same as here, data. Yet data represents an astonishing 83 percent of revenues, MTN have a long, long way to go before they are remotely close to maturing. More importantly, if you believe that growth in Sub Saharan Africa will improve at a much faster pace than before, this company is for you. We continue to recommend this company as a buy.

Things we are reading

When I saw this I really could not believe it. How is that possible? The headline says it all: In January, spending at bars and restaurants topped grocery stores for the first time.

Do we secretly all want to be hipsters? Beards, style, retro goods, flat white drinkers and generally far away from mainstream. Could this be a sign of peak hipster however, Etsy, the online crafts marketplace filed for IPO, the story from the WSJ.

Instagram is the fastest growing social network on the planet. Guess what, Facebook owns it. A picture tells 1000 words (or more), if you are looking to market your goods on the platform, then read this article: 4 Key Advantages for Video Marketing on Instagram vs. Vine.

Buffett has been investing heavily in his energy business as well as his railway business, giving him an unexpected favourable "problem" to deal with, this article via the FT: The $62bn secret of Warren Buffett's success.

Whoa! This company has seen their share price eaten by termites in a hurry. It is also a reminder that good old fashioned snooping can lead to both a government enquiry, as well as profiteering for many short sellers: How a 25-Year-Old Sparked Lumber Liquidators' Stock Plunge

Home again, home again, jiggety-jog. Lots of results locally here this morning. And generally pretty good. Sanlam, Standard Bank and RMI reminding us that financial services in South Africa as well as the rest of the continent is still lucrative. MTN and Discovery are again surging, commodity stocks still taking a beating.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment