"YTD the stock is actually comfortably below the rest of the market, up one and a half percent. Over the last year the stock is up 50 percent. That is why there are a lot of high expectations with regards to what expectations are. The expectations from some research reports that I have read suggest that Aspen are on track to triple their earnings from 2012 by the time 2017 rolls around"

C'mon readers, I need you, just one last time here. Many thanks to all of you who have voted in the share shootout league by retweeting that tweet of mine, I need more. Yes, like Oliver Twist. If you have not voted, it is easy. Sign up for Twitter (2 minutes) and then retweet. The retweet button is the one with the two arrows ->  . Follow the link: Put your favourite stock picker through! I need your vote to send me to the finals of @SSOLEAGUE on @cnbcafrica Vote #Bucks Simply Retweet! If only one in hundred subscribers to the newsletter do this I will win this round. Thanks in advance!

. Follow the link: Put your favourite stock picker through! I need your vote to send me to the finals of @SSOLEAGUE on @cnbcafrica Vote #Bucks Simply Retweet! If only one in hundred subscribers to the newsletter do this I will win this round. Thanks in advance!

To market, to market to buy a fat pig. Results flying in this week, many of the majors with December year end, or half years have to present their numbers inside of three months. Those are the listing requirements as far as I understand it, the JSE notifies the market if this does not happen, the share trades with some sort of a flag next to their code until they release results. It normally happens to companies that lack the resources and that find themselves going through a tough time.

Going through somewhat of a tough time this morning, having been down as much as 3 and a bit percent lower is Aspen. Here is why, there was a trading update long after the market closed last evening. The company expects normalised HEPS to be between 19 and 24 percent better, HEPS to be between 25 to 30 percent better and EPS to be 24 to 29 percent better. Obviously Mr. Market was looking for more, the stock had been going lower and lower over the last few weeks.

YTD the stock is actually comfortably below the rest of the market, up one and a half percent. Over the last year the stock is up 50 percent. That is why there are a lot of high expectations with regards to what expectations are. The expectations from some research reports that I have read suggest that Aspen are on track to triple their earnings from 2012 by the time 2017 rolls around. That is almost on a tripling of revenues too. I suspect that the company might do better than people anticipate, they have been consistently doing great deals. I was chatting with a client yesterday on the size and scale of Aspen relative to the huge listed businesses globally, Aspen has a market cap that is around one fifteenth of that of JNJ. JNJ will spend double the market cap of Aspen on R&D, in the last year. Again, that number is astonishing.

The risks of holding Aspen come around if the company does a deal that turns out badly, so far so good. Earnings forward seem to slow, the PE unwinds to the mid twenties in the next financial year, make no mistake this is a company that has to deliver earnings constantly better than anticipated. We see a great management team that will continue to grow this business quickly and bed down all the recent transactions. We view current weakness as an opportunity to acquire some more. The results themselves are expected next week on the fifth of March, we will report on those when they hit the screens.

In my mind there is no awesome secret sauce that some fund managers have and others do not, all are provided with more or less the same information. There are the good old fashioned analysts who do deep research, on the ground, phoning of suppliers and customers of the business, trying to get a feel of what it is like inside. It makes me mad when I see someone suggest that the market is wrong on this. That suggests that all the people transacting (in the opposite direction to your awesome price target) have it completely wrong and are somehow stupid. The price of a security is where it is at right now. You can either buy the business, or not.

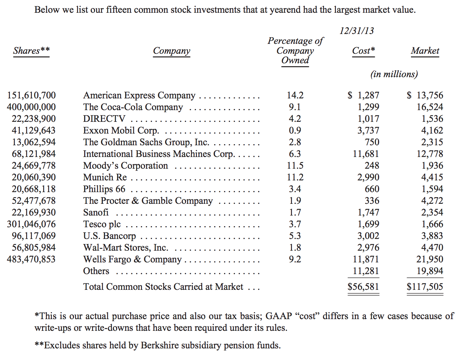

Everyone talks about Warren Buffett and his ability to pick stocks at the right time. Is Warren Buffett deep value? Perhaps not in the equities market. Their (Berkshire) insurance businesses are unlisted, Geico, BH Reinsurance and General Re. Here are the listed entities as at the end of the 2013, fast forward to last quarter and Berkshire were adding IBM and selling Exxon Mobil. Some of these shares they have owned forever, not really, but you can tell from the entry price that it is a long, long time.

In today's Friday weekly update from Eddy Elfenbein, he included a link to the BusinessInsider -> Fidelity Reviewed Which Investors Did Best And What They Found Was Hilarious in which Eddy says: "The author and investor James O'Shaughnessy tells the story of a study done by Fidelity Investments. The company wanted to find out what group of its clients did the best. As it turns out, the most successful group of Fidelity investors wasn't men or women. It wasn't young or old. It wasn't big portfolios or small investors. No. It was people had forgotten they had Fidelity accounts."

Less agonising about your investments is the way forward. The point I am trying to make is the same one I make over and over. Buy the quality at todays prices, check in every now and again and do not tinker (or think too hard) with your investments. It turns out that agonising over models this and that, percentage weightings this and that, value this and that is not the best way.

Things we are reading

Here are the two big reasons that we think MTN and Naspers are great buys - SA mobile data growth to surge 63% per year. Given that the average smartphone only uses 250MB, it is easy to see how there is huge growth down the road. Here is the second and more telling article - Less Than 40 Percent of People Worldwide Have Ever Connected to the Internet. It is scary to think that " only 32 percent of people in developing countries have Internet access".

Another Elon Musk vision is on course to change the world - Hyperloop moves closer to becoming reality

Patent numbers can be seen as an indication of innovation and moving towards doing more with less as a society - More than half the patent applications in Europe last year came from the US, China, and Japan.

Google is finding a home for a small amount of their huge cash pile - Google Is Making Its Biggest Ever Bet on Renewable Energy.

Home again, home again, jiggety-jog. The Germans vote on their portion of the revised Greek loans. Commodity producers are dragging the market lower here, the platinum producers are going lower and lower. Banks are also under pressure here today. This has been a pretty good month for equities markets, some selling before the year end. And lastly, this dress is going viral, I see different colours from my colleagues: The Science of Why No One Agrees on the Color of This Dress. More astonishing is the amazing innings from AB de Villiers today, I guess we are no longer useless. If you think market participants are fickle, look no further than sports fans.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment