"Taxes are going up for rich people, the tax rate at the top end of the spectrum goes up 100 basis points to 41 percent. There are two ways of looking at that, if you pay the top rate in South Africa it means that you are lucky enough to have a job and be a top earner. The other way is to get upset about the higher rate."

Thanks to all of you who voted in the share shootout league by retweeting my tweet. Phew. Sounds hard. It is not, I still need your help, if you have not voted for me yet, it is easy enough. This is for me to make the finals, the more tweets the better, my chances of going through to a live show are boosted. So please, I need your help. Simply sign up for Twitter and then retweet. Remember that the retweet button is the one with the two arrows ->  . Here goes, follow and retweet: Put your favourite stock picker through! I need your vote to send me to the finals of @SSOLEAGUE on @cnbcafrica Vote #Bucks Simply Retweet!

. Here goes, follow and retweet: Put your favourite stock picker through! I need your vote to send me to the finals of @SSOLEAGUE on @cnbcafrica Vote #Bucks Simply Retweet!

To market, to market to buy a fat pig. We closed the day lower from the start, the start was excellent, in fact the all share index clocked another intraday high. An all time high. I can tell you that lots of people suffer from markets vertigo. Markets go up and down, as you will see in a piece below about the constituents of the FTSE, it is about the companies that make up the index. Beware the market soothsayer, normally they "know". Nobody knows what is going to happen next, you can predict and follow, you cannot know. What we do know is that the market here in Jozi closed lower last evening, only financials of the majors having a decent enough day.

Markets in the US slipped last evening, probably as a result of Apple falling more than the rest of the market. Blackberry (huh?) will use the Google Android software for business, "Android for work" will be available across the Blackberry platform. Free software on the Blackberry phones, I read somewhere that Blackberry's market share had fallen to 0.4 percent of the US market, this announcement coincided with a 2.56 percent fall in the Apple share price, which is around 18 billion Dollars of market capitalisation. For every (more or less) three quarters of a percent that Apple's share price moves, that is equal to the entire market cap of Blackberry.

So. (dot dot dot) Does any sort of usage of free software, on a phone that does not really seem to matter any more, justify that sort of a drop? Seems like a reason to be selling a stock that has been on a tear. There was another piece of Apple news, the company was ordered by a jury in Texas to pay 532.9 million Dollars for a patent infringement. It has to do with their iTunes business, the jury awarded the money to a business called Smartflash. Apple will appeal.

15 years is not really a long time when one talks investments, is that right? Equally it can be viewed as a very long time, industries can be changed by technological advances and some companies have neither the skills or capital to continue to evolve. Some industries themselves change so significantly that they head in the direction of the sunset. Sunset industries, I am sure that you have read the term. I was however a little surprised to read in The Guardian: More than half of companies have left FTSE since last peak. The FTSE finally clocked the best level since December the 30th 1999.

A time when we were thinking Y2K, remember that? We even had an extra day holiday, almost a global one on January 2nd 2000 just to make sure that computer systems globally had adjusted to the new date format. Remember? Mergers and acquisitions have seen more than half of the FTSE 100 companies from 1999 no longer listed as the entities they were back then. This makes the case for holding quality and paying attention even more attractive, as you can see there is a lot going on!

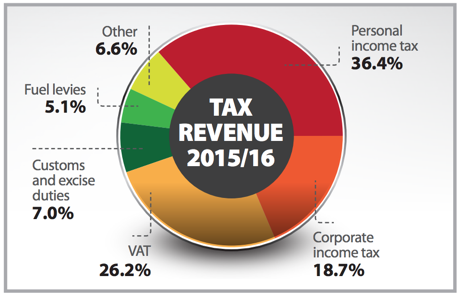

Lest we forget, the budget speech of course was yesterday, the South African finance minister put on a brave face and I think he did a pretty good job. Perhaps he could loosen up, perhaps the occasion of what most reckoned was the toughest budget in decades meant that the formal approach was needed. For the highlights, from Treasury themselves, here goes: Budget 2015 highlights. Have you always wanted to know where government collects taxes? Here goes:

There are three things here that I think are worth picking up on. Firstly, taxes are going up for rich people, the tax rate at the top end of the spectrum goes up 100 basis points to 41 percent. There are two ways of looking at that, if you pay the top rate in South Africa it means that you are lucky enough to have a job and be a top earner. The other way is to get upset about the higher rate.

The term that suggests the only constants in life are death and taxes is attributed to both Daniel Defoe (Things as certain as Death and Taxes, can be more firmly believ'd.) and Benjamin Franklin (Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.) Of course on death, where you have no say, the government taxes the estate more.

What are the other two things? The Road accident fund is woefully undercapitalised, so the government has whacked another 50 cents on the fuel price for that. The fuel levy has been put up 30.5 cents, over 1 Rand now. Minister Rob Davies said that the fuel price should really be cheaper, well, thanks for nothing. The RAF increase in unpalatable for me, this subject really peeves me, I have got one speeding fine in my life and it made me crazy. I am the quintessential driving Miss Daisy, I drive like Morgan Freeman in that movie. Not too slowly, at the speed limit however.

And then lastly, the only thing that you can change, not from the budget speech, included however in the finer print of all of it. Modernising capital flow is what it is called. From the first of April (that is in just over one month) you will be able to externalise more than the 4 million Rands per individual that you currently have been able to, that is per person. Soon, you will be able to externalise 10 million per person, per annum. That is a big change, clearly this is for wealthy people, so what the tax man takes away, the taxman does giveth back. In my mind it is always a good idea to own quality businesses offshore, if this interests you and you have done nothing about it, then you should act. No time like the present.

Company corner snippets

Let me flesh out the Discovery rights issue a little. First things first, remember that a company has various options when it comes to raising money, they can turn to the debt markets and borrow money, paying it off over time. They can borrow money from the bank, provided that the bank is willing to lend them such a large sum. The last option is to issue more equity, this is what Discovery are doing. A rights issue is simple, you as the shareholder are given the option to follow all the other shareholders in the same ratio.

The reason why you would would want to follow your rights is to be able to keep your shareholding relative to the number of share in issue at the same ratio. Company earnings are divided by the number of share in issue to get earnings per share, one of the simplest fundamental measures of share price relative cheapness. In the case of a rights issue there is a dilutionary impact, more shares in issue against the same earnings. The company is using their higher than normal share price to raise money, in this case Discovery are looking to raise between 4-5 billion Rand against their current market capitalisation of 70 billion Rand.

The price at which they are looking to raise money is 90 Rand a share. If you work backwards a little, 5 billion Rand is 1/14 to 70 billion market cap, that market cap is at 119.5 Rand a share. The money is expected to be raised at 90 Rand however, my mental arithmetic tells me that the company will look to raise money in the ratio of around 2 rights per 21 ordinary shares. My best guess. To see what you are in for, in terms of following your rights, take the current value and multiply it by around 10.5 percent. That is right, I think. More clarity before the 10th of March, in less than two weeks time we will know the quantum and more importantly what the company plans to do with the funds. We will be in touch with all the clients that are shareholders of Discovery in order to prime them for this, we continue to think that the business offers fantastic opportunities.

Things we are reading

There is long term and then there is long term - Long-Term Thinking as a Contrarian Approach. Keeping things simple and taking a long term view turned out to be the best strategy.

A look at where the wearable tech industry could be heading - The key to an $80 billion wearables market? Invisibility. This would make sense given the social reception that Google glasses received.

Alcohol comes out as the most dangerous when compared to other drugs - Marijuana is much safer than alcohol or tobacco, according to a new study. I think that going forward taxes on alcohol are going to sky rocket, which wont be good news for SAB. Take 3 min to watch the video, it has some interesting and controversial data.

A new and easy way to get a loan - This Bizarre Russian ATM Wants to Lend You Money. The interest rate on these easy loans is 2% a day which works out to 730% a year!

Home again, home again, jiggety-jog. Another whole slew of results, coming thick and fast at us here. Retailers are seeing the biggest fall off today, all the majors once again taking pain, down around 2.6 percent as a collective, dragging the index marginally lower. Resources are holding it together and keeping us up marginally. The Rand is stronger, that is good news. The Greek bailout final stamp of approval (all the European parliaments have to vote) will take place tomorrow, the Germans are the first to vote. The coalition controls around 80 percent of the seat in the German house, there are undoubtably some dissenters of course, business circles.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment