"The point I am trying to make is that without Apple, where would the NASDAQ be now? Would it be around 10 percent lower or more? More actually, Apple has a market cap of 736 billion Rand as of last evening, the company in the 50th place has a market cap of less than 25 billion. In other words, back then in March 2000 when Cisco was the business that was going to 1 trillion Dollars market cap, Apple was tiny comparatively."

To market, to market to buy a fat pig. SONA this and that. There is plenty better analysis than I would ever do, seeing as I only watched part of it. Some part of it was spent reading "One Fish, Two Fish, Red Fish, Blue Fish" to my youngest, that is a fabulous story. Dr. Seuss had some good stories to tell. I will not go into it, you can read all of the analysis around. You can read the speech, in fact you can read many politicians speeches on the matter in years gone past about their brilliance and the ability to change the future. In the end it is humans that overcome human obstacles, not organisations. Charlie Munger, who is of course Warren Buffett's right hand man, has one of the best quotes on this: "I believe Costco does more for civilization than the Rockefeller Foundation. I think it's a better place. You get a bunch of very intelligent people sitting around trying to do good, I immediately get kind of suspicious and squirm in my seat."

Who is Costco? What? You don't know? They are the third largest retailer on the planet, who sell bulk goods at cheap prices. For the betterment of consumers. Yes, capitalism does that, not organisations. People with profit motives drive prices lower, the irony of it all! If the company believes that the prices are too high for their clientele, they will not stock the goods. And hence their goods will be reached by fewer people, given that Costco reach so many folks. Price controls, which the powers that be implement to protect the most vulnerable in society, never work. I cannot dictate what the price should or should not be, the market, real people decide that. That has been the case for millennia. Unfortunately we always as a collective look for guidance from someone else, not sensing that the opportunities are all ours to take and more especially to make.

That aside, our job is the job of searching for good businesses that are likely to capture market shares, likely to engineer better products at better margins than their peers. It sounds so easy. This morning the equities market is up some more. The local market is trading at an all time high. I guess the weaker currency has something to do with it, this is just another reminder that regardless of politicians, the markets evolve and companies have the ability to work inside of parameters. Fear not, the markets sort this out each and every time. For the record the nerds of NASDAQ also traded at the best levels since March 2000, that is nearly a 15 years that the earnings have taken to catch up with prices, you could argue.

Although everything in-between has been choppy, there are newer entrants in the form of the obvious ones like Facebook, Alibaba and even Google which were not even listed back then, the biggest constituent of the index (overall) Apple was a bunch of nerds selling products for nerds back then. Admittedly amazing product for nerds, the iPod and the iPhone (the iPad even), iTunes and the App store (all of which were not around when the NASDAQ was last at these levels) changed the way that we think about everything. OK, not everything, in March of 2000 Apple had a share price (adjusted) of 4.95 Dollars. Apple is up 2732 percent in the same time that the NASDAQ is down 1.16 percent, since March 24 2000.

The point I am trying to make is that without Apple, where would the NASDAQ be now? Would it be around 10 percent lower or more? More actually, Apple has a market cap of 736 billion Rand as of last evening, the company in the 50th place has a market cap of less than 25 billion. In other words, back then in March 2000 when Cisco was the business that was going to 1 trillion Dollars market cap, Apple was tiny comparatively, if you add in for the falls in the others and the growth in Apple, I am sure that it is a lot more. Nice.

One last parting shot here with regards to the market today, the companies in the JSE All Share index do not reflect the economy or the country, they are listed here. Many of the majors derive a large portion if not most of it from outside of the borders of South Africa. Do not get confused or even confuse the market and the economy and the respective prospects, they are of course two different things entirely. The bad news for consumers is that the recent move northwards in the oil price and the weakening currency (that is on the local front) means that the petrol price is going to increase significantly next month. Listen in closely to the commentary from ordinary South Africans after this, those are always entertaining.

Company corner snippets

L'Oreal reported results last evening: 2014 ANNUAL RESULTS. Remembering that these are in Euro's, the ADR price is one fifth in Dollars, i.e. the ADR price that you see (closing at 37.35 Dollars last evening) is one-fifth of the Paris price. In simplest English, for each five ADR's (American depositary receipt) that you hold, that is the equivalent of one share of L'Oreal in Pairs. Got that? First things first, this company is controlled by Lilliane Bettecourt's historic shareholding and Nestle, the Swiss giant who have the shares historically too. Recently Nestle have been a seller, they sold a stake back to the company. In fact, there are 23 million shares less in issue, shares in issue have fallen from 608 million to 585 million, average over the period, there are NOW 561 million shares. Fewer shares always equals higher earnings.

The second half of the year has boosted the full year numbers, the end of the year in the US was better, the company has grown their market share in Europe. They want to continue to take market share, this year is going to (according to the country) be a little better than last year. The CEO cited lower energy prices as being a positive for their core consumer in Europe and North America, they should have more money in their pockets, feel better about the year ahead and all in all more spending power. The consumer is in better shape across the globe.

The L'Oreal share price is trading at a 52 week high in Paris as we speak this morning, earnings of 5.34 Euros on a share price of 161.35 Euros means that the stock is hardly cheap on 30 times historic earnings. The dividend is expected to be 2.7 Euros (the French government take a whack out of that), which means that the company is pretty generous pre the tax, roughly 1.9 times cover. Why own this company then if the price is pretty aggressively priced, at face value? This is a growth company, they have been going through a pretty poor patch, the Euro moving all over the show does not help the Dollar price. The company is growing strongly in their existing markets, much faster in their emerging markets (which are smaller in terms of sales), up 13,5 percent in Asia and up a whopping 20.3 percent here in Africa and the Middle East. Both those juiced up by worse currencies relative to the Euro. Asia is going to continue to be key for the short term growth prospects, as is Latin America (less than 9 percent). Good business, luxury is a fabulous investment, richer middle income people across the globe boosted their sales, we continue to buy the business.

Byron beats the streets

On Tuesday we received full year and fourth quarter results from Cerner, one of our favoured healthcare stocks listed in New York. I have explained what these guys do before but this video clip titled What is Cerner Health does a great job. It's short and paints a good picture of what this business does. For a local example think of Discovery's Vitality product. But it goes further, it integrates all this info with doctors, nurses, chemists and medical devices. Tracking ones healthcare history, their fitness and wellness as well as their finances concerning healthcare spend. Their catch phrase "Health care is too important to stay the same" certainly inspires. The company services 18 000 facilities in 30 countries.

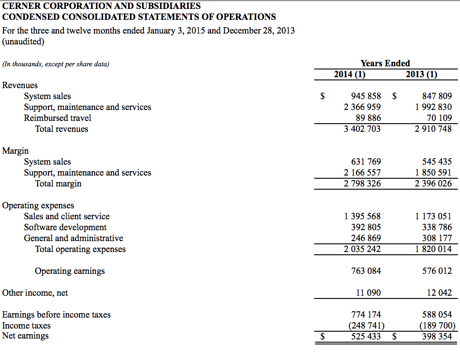

Numbers. Bookings in the fourth quarter were up 5 percent to $1.16bn. Bookings for the full year were up 13% to $4.25bn. Bookings represent the order book. Revenues for the full year came in at $3.4bn which is up 17% from 2013. Net earnings for the full year came in $576 million which equated to $1.65 per share. Below I have hacked their income statement from the presentation just to give you a feel of where the business makes and spends their money.

Earnings for 2015 are expected to come in at $2.13 which would mean growth of 29%. They did make an acquisition of Siemens health which will be earnings enhancing. More on that later. The share trades at $67.7 or 31 times 2015 earnings. It's expensive but it's growing fast. They bought that Siemens business for $1.3bn cash and have almost zero debt. You'd expect more earnings enhancing acquisitions as the sector consolidates.

The business sits in a sweet spot and I can only imagine the blue sky for selling their product globally. The potential efficiencies they can create in such a vital service is huge. And I am pretty sure governments around the world will take notice. Take the UK's NHS for example. So many publicised inefficiencies within this system could be sorted by implementing Cerners products. Locally I'd love for Mediclinic, LifeHealth and Netcare to take these products on. Filling in forms is a huge mission, imagine how difficult it is for a doctor to get hold of your history, all on paper.

The Siemens acquisition was also well received. The business focuses more on labs and imaging. This will synchronise the information gathered at the testing labs directly with the doctor who needs that info. How many lives can be saved because of a speedy response time to a diagnosis. The options are endless. We continue to add.

Things that we are reading, you should too

How big is the global financial asset base? According to Deutsche Bank it is $294 trillion - Here's what the $294 trillion market of global financial assets looks like. The number that stands out to me is the unsecured debt, which is almost as big as the global stock market capitalisation. A chunk of it will be student loans; there are definitely worse things to go into debt for.

Gold! The one commodity that everyone likes to talk about. When it comes to investing, you either love it or hate it - Gold bar and coin demand continues to slip!. Not a pretty picture from the supply and demand side of things, supply slightly up, demand is down 4%. The only people buying gold at the moment are central banks and as the global outlook improves, people are going to be less inclined to hold the "safe haven" gold.

Adapting to change is always better than fighting it - UK gives thumbs-up to driverless cars - but first come the driverless pods. Glad to see they are making provisions for driverless cars, creating more certainty around the sector which will result in more investment.

A light hearted map of what lies across the ocean - If you're on the beach, this map shows you what's across the ocean

Home again, home again, jiggety-jog. Markets are higher across the globe, a few records here and there. The Ukraine peace deal from yesterday is certainly a big deal, Greece, that situation bumbles along. Anglo American released results, they are up sharply. The Dax is through 11 thousand points for the first time ever. The World Cup starts shortly. We are up against our northern neighbours, bring your best.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment