"And the share price trading above the offer price tells you that if the PIC had thought that 52 was a good price, they would be included in all of this. And they are not, of course. So that tells me that perhaps Prudential and the PIC are going to say no. The PIC was very vocal in turning down the Chilean offer of over 72 odd Rand, approving that Bidvest became a bigger shareholder. It is what they call a cheeky bid. The market price is clearly telling our next door neighbour (the Bidvest back stairwell is an underhand toss away) that it should be more. At the same time the company has released results that perhaps leave a lot to be desired."

To market, to market to buy a fat pig. We thought that a deal would be done between Greece and the rest of the Eurozone, it is however not over quite just yet. The Greeks have to present a whole lot of reforms, a list today for the purposes of receiving the extension that they need. No list of reforms and then we are back at square one, to which the Greeks cannot quite afford to go, or to be at. It is pretty dramatic, the way that the FT puts it, this agreement prevented both a bank run and a sovereign default. Like the debt ceiling in the US, a last minute deal was reached. Enabling both sets of parties to walk away feeling a little better than before.

In the end the victory of a deal reached meant that equity participants around the globe could cheer, the markets opened the longest (futures included) went to record highs again. In the US the S&P 500 closed at 2110, a record, equally blue chips, the Dow Jones Industrial average closed at a record, closing at 18140, a record. The nerds of NASDAQ ended the session at 4955 points, the all time closing high was in March of 2000, 5048. The Intraday high was 5132, there is a little bit of work to be done before the technology stocks can say that the brave new world is here. Again. Do not get sucked into the vertigo and all time high discussion. Apple did not have the market cap now that it had back then. Apple had a split adjusted price of less than 5 Dollars back then. In fact, at the closing high, on that day if you had bought Apple, you would have seen a 2783 percent return. Yes, it is exactly the same, not really.

Just a thought. It was Benjamin Graham who said, "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Meaning that in the long run it is the earnings that matter more than anything else, in order for company share prices to stay at specific levels. Sometimes there are reasons why a share price either looks cheap or expensive, the earnings that the market anticipates are at the "right" levels. Sometimes the company announcement sees the "voting" (to use the above analogy) in the share price to change sharply, which leads to the folks "weighing" the price to change their mind equally.

I guess the voting part is short term movements based on sentiment whilst the weighing factors in the longer term prospects. Whilst I admire and trust the judgement of one of the greatest investors in modern history, how would Benjamin Graham know the future better than anybody else? Of course it is just about paying attention and making sure that you adjust if your ever evolving thesis changes. The collective never lie. Avatar, the movie, might not have won best movie according to the aficionados (Academy of Motion Picture Arts and Sciences), the public however voted the movie the best of all time, grossing over 2.7 billion Dollars at the box office.

It is almost like different investment philosophies, people telling you that you are wrong to buy a specific company at a specific price, their price being the right one. Sigh, the price today is the price today, the balance of the sellers and buyers present you the price, if you like a company enough to hold it for a very long time, believe that the sectors, the company, their products and services, their management team, basically their future prospects are good and the price is reasonable, buy it.

Company corner snippets

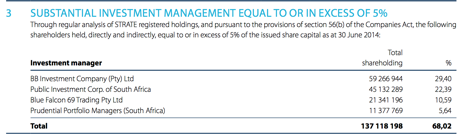

Bidvest have announced this morning that after consultation with two separate parties, Blue Falcon (10.59 percent currently) and the Bophelo Trust (3.6 percent in total), the company would buy their Adcock shares at 52 Rand apiece. These are not ordinary shares, they are linked to an empowerment deal (dividend shares), the parties above would be left with 2.571 million "dividend-acquired Adcock ordinary shares." As you can see, those shareholders above are sizeable, this then triggers an offer to minorities at the same price, 52 Rand a share. Remembering that Bidvest and CIH paid around 70 Rand in order to get a 34 odd percent controlling stake. The 52 Rand offer is a premium to the 30 day VWAP of 13 percent, not exactly a kings ransom. Who are the other main shareholders, who would have to OK any deal of any sort? Here:

And the share price trading above the offer price tells you that if the PIC had thought that 52 was a good price, they would be included in all of this. And they are not, of course. So that tells me that perhaps Prudential and the PIC are going to say no. The PIC was very vocal in turning down the Chilean offer of over 72 odd Rand, approving that Bidvest became a bigger shareholder. It is what they call a cheeky bid. The market price is clearly telling our next door neighbour (the Bidvest back stairwell is an underhand toss away) that it should be more. At the same time the company has released results that perhaps leave a lot to be desired. Revenue up one percent on a comparable basis (the company has changed their year end to match that of Bidvest), no dividend declared. Look, I think what you need to know is that Bidvest put their guy in there, they are taking an opportune moment in time to pounce.

Things we are reading

Oil is again trending at news outlets, I don't pretend to understand all the complexities of the oil market. Sweet, sour, light, heavy and the complexity in transporting, storing and hedging yourself. Here are two articles looking at the supply side of things - Supertankers Speed Up as Oil Prices Fall and this one looking at storage capacity - The Saudi project, part two. "Storage facilities in Europe and Asia are already 80-85% full. Much more and they will overflow. As it is, companies are renting tankers to keep oil in. If storage space runs out, prices could tumble again."

Low prices are also forcing companies to find cheaper ways of getting oil out of the ground - Drillers Take Second Crack at Fracking Old Wells to Cut Cost

An interesting look at where different countries stand on the internet landscape - Where the Digital Economy Is Moving the Fastest

Going back historical data tells us that there is some link between interest rates and equity returns - What Do Low Interest Rates Mean for Stock Market Returns?. The data shows a very general trend but the deviations under each scenario are so wide that you can't reliable forecast what the future may hold when interest rates change again.

We already know that the cost of renewable energy is dropping quickly, here are some graphs to show the comparison to fossil fuel power stations - The cost of wind and solar power keeps dropping all over the world. Here is a look at how some of the big corporates are embracing renewable energy - What Apple Just Did in Solar Is a Really Big Deal. As we move to renewable energy we will need more batteries, lucky battery technology is moving quickly as well.

Home again, home again, jiggety-jog. Great news! Over the weekend Byron got engaged, it is all happening here at Vestact. A hearty congratulations from all of us here, of course we knew weeks out and were sworn to secrecy. Excellent work. The market here is trading at an all time high this morning, that is good news. The FTSE has surpassed their closing high this morning, that closing high was set 30 December 1999. If you think that the nerds of NASDAQ have had a tough time, think again!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment