"Be Optimistic. That's it, be optimistic. Why? Because the world is full of pessimists, and that's a problem. In my line of work, there are plenty of downers, they are called stock market bears. They think it sounds clever to be worried. People like these have predicted 15 of the last three recessions. You see, despite the awful stories in the news, humanity is like a river flowing downhill, around all of the obstacles."

To market, to market to buy a fat pig. Top left to bottom right is not exactly a day that you want to see, if your time frame is one day. Which is (or is not) cricket. Cricket is played over 5 days or 5 hours, depending on the format, uses different colour balls, can take place at night, not in the rain. When you are in you are not out, when you are out you are not in, something like that. With markets, it is always best to be in, always in. In other words, never be out. If you are out of markets my experience is that you are less likely to want to get back in, you are looking for the perfect moment, which invariably never arrises. I have seen people "be cautious" or "feeling nervous" all the time. They are the same people.

Equally the optimistic folks are always ridiculed, it certainly seems better to be a pessimist, somehow you have the secret sauce, or somehow you sound smarter as the bearer of bad news. Being optimistic about human innovation is associated with head in the sky thinking. It is one thing to be optimistic, it is another to be chasing your own tail. The last category of perennial bear is not a category I ever want to fall into, if worst case scenario happens then I am pretty sure that going back to subsistence farming is not the worst outcome, your gold should be worth something. I prefer, along with my colleagues, to Be Optimistic. I have two T-shirts bought from a crowd called Best Made, that say Be Optimistic, I wear them all the time.

Paul delivered a speech at his old School, Pretoria Boys High, at his 20th reunion last year, to the boys at a school assembly, here it is, take time to read it:

Good afternoon boys, staff, guests and the class of 1984. I'm not going to let an opportunity pass me by to leave a mark on over 1500 impressionable teenage boys, so here goes. My life advice to you is this: Be Optimistic. That's it, be optimistic. Why? Because the world is full of pessimists, and that's a problem. In my line of work, there are plenty of downers, they are called stock market bears. They think it sounds clever to be worried. People like these have predicted 15 of the last three recessions. You see, despite the awful stories in the news, humanity is like a river flowing downhill, around all of the obstacles. Don't stress about the problems, laugh them off and get on with your own life. Research studies conducted by US Universities have shown that optimistic people earn more money, sleep better and live longer. One study at the University of Kentucky showed that optimists have a higher sperm count. So be upbeat about optimism. Good things will start happening around you.

OK, now that you are gee'ed up for the morning and ready to take on the world, let us pass on a little of the market news. Sadly yesterday stocks were lower here, Sasol (see below) was to blame, they changed their dividend policy, or announced a change. Resources falling over a percent and one quarter led the market to sink by over half a percent, off new record territory, albeit briefly at the beginning of the day.

Over the seas and far away the FOMC statement was all the rage, it seems that is a national pastime, predicting what the Fed is going to do next. It must have been boring over the last decade. OK, more especially, the new level was last set in December (the 16th to be specific) 2008. Since then, the Federal Funds Rate is between 0 to 0.25 percent. Ten years ago the rate was 2.5 percent. The highest that the Fed Funds rate got was 5.25 percent in June 2006. In the 1980's the Fed Funds Rate was 20 percent, much higher inflation as a result of the higher oil price and the oil embargo. Since then however, human innovations, productivity, basically sweating assets harder as a result of technological innovation has meant inflation has been kept in check, and as a result rates are and have been lower for longer.

Perhaps the new higher level is only around 2 percent, perhaps someone looking for normalisation over the long term, to an older level, is mistaken. As technological innovation means that the cost associated with production falls, farming yields rise and resource utilisation improves significantly, all this points to lower inflation. Even as populations grow, we use all the resources around us more efficiently. Just a thought.

Company corner snippets

Sasol with a fairly simple announcement that sent the share price reeling yesterday, it had recovered a little by the end, it was however not completely unexpected. The release is titled Change to dividend policy and segmental reporting and that pretty much sums it up. Why the big reaction? I mean, lots of the news was known already, the company had already released a trading statement 12 days prior. David Constable had however said the year prior, that bar for a catastrophe, the company would never pay a lower dividend. In other words they would match the dividend from the year before. I guess you could argue an oil price halving is a catastrophe. In the same release the company explains a 5 point plan to conserve capital, improving margins, further cash cost reductions, the usual response to tough times. More will be revealed at the interim results presentation on the 9th of March. The announcement precipitated a 10 percent drop in the share price, in a hurry, the share price ended the day down just under 6 percent, phew.

Discovery Holdings released a trading statement yesterday for the 6 months to end December 2014. A quick refresher, remember that the company bought the rest of the JV with Prudential in November: Discovery buying out PruHealth. The company updates, remembering that there are actuaries galore at Discovery, you need to read this trading statement carefully: "following Discovery's acquisition of the remaining 25% issued share capital of Prudential Health Holdings Limited, the holding company of PruHealth and PruProtect joint venture, from Prudential Assurance Company ("Prudential"), the accounting of the puttable non-controlling interest in respect of Prudential's put option falls away, and the difference between the current value and the purchase price of the 25% will be released to the income statement for the six months ended 31 December 2014." Of course you say, why didn't I do the math on this one, I should have known! As a result, guidance for the half just passed is as follows:

Normalised headline earnings per share undiluted range (cents) - 325.8c to 355.4c

Headline earnings per share- undiluted range (cents) - 587.7c to 617.9c

Earnings per share- basic range (cents) - 600.0c to 630.8c

Huh? From the annual report, on page 210 you see the differences in the normalised headline earnings and headline earnings per share. In this case, as per the release there are two things to consider, as per the inserted paragraph above. The share price has been on a tear lately, the stock is up 19 percent over the last six months. It is softer after this trading announcement, as usual the market is always looking for more. I suppose that we need not wait long for further clarification, the results themselves are expected on the 24th of February, which is next Tuesday.

Byron beats the streets

Yesterday we received full year results from private school operator Curro. I am intrigued by this business because I love the educational theme so I went along to the presentation. Lets first look at the breakdown of this company.

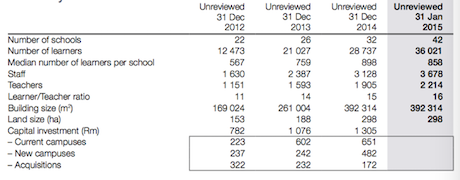

Basically Curro provides private school education from age 3 months to grade 12. They develop, acquire and manage campuses as well as own and run a teacher training institution. As we speak they have 42 campuses with 36 thousand learners. The plan is to grow by 7 campuses per annum to reach 80 schools by 2020 with 90 000 learners. They plan to get there by building schools and acquiring existing institutions.

Within the Curro group there are different types of schools. Curro branded schools are more exclusive and expensive. 75% of the groups learners attended the 23 Curro campuses around the country in 2014. Meridian which is 35% owned by Old Mutual and Curro academy target lower LSM groups but still provide quality education at an affordable price. These campuses average 3000 learners per campus. For the reported period there were 6 campuses. 4 more are in the pipeline for 2015.

Lastly we have the teachers college. This was developed so as not to poach quality teachers from the state. It turns out that training your own teachers is great for your employee supply chain and can also be a profitable operation. There is 1 campus at this stage. 2 more are in the pipeline within the next 5 years. Below is a table which shows school and learners growth.

Lets take a look at the results for 2014. Learners were up 37% to 28700, revenues crossed R1bn for the first time and EBITDA was up 68% to R192m. This all equated to headline earnings per share of 17.7c which is up 38%. Not bad when you consider that they did a rights issue last year. Trading at R33 this is not a business you should attempt to value on a fundamental basis because it is still growing so fast. Although it does tell you that the market expects a lot.

It turns out that education is a very profitable business, especially when you get your occupancy levels up. In 2014 there were 7 campuses with an occupancy rate of less than 25%. These schools had an EBITDA margin of -9%. 6 campuses had an occupancy of between 25%-50%. These schools were already in profit with EBITDA margins of 18%. 10 schools had an occupancy of of 50%-75% with an EBITA margin of 27%. 9 schools with an occupancy of 75% and above had an EBITA margin of 32%. These 9 schools brought in 59% of the groups profits.

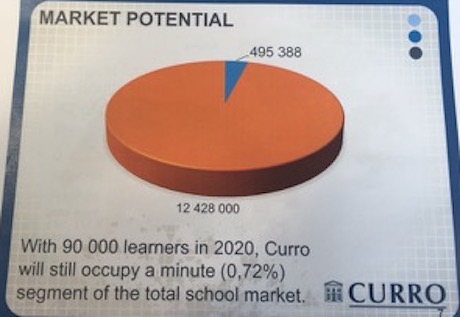

So the big question is, can Curro carry on building and acquiring schools while keeping occupancy levels up? The short answer is yes and this pie graph tells it all.

The blue sky potential within the South African market is huge. Demand will not be an issue for such an essential service. And I am very happy with the guys running the business. Dr Chris van der Merwe who runs and started the business as a teacher took the presentation. He is a teacher at heart and you can see he does this to make a difference, not just for the money. And I feel that they will make a difference for education in South Africa which is nice to know as an investor. Having PSG as 57.5% shareholder is also a great financial backing and their influence should help when making acquisitions. They plan on doing another rights issue for further acquisitions. I recommend a buy on this stock.

Things we are reading

Oil has been a talking point again - Iraq's Oil. Note the big uptick in their production over the last few months, it would seem that because of the low prices, countries are producing as much as they can to keep the revenue coming in.

Even as the oil price has been moving higher and is above $60 mark at the moment, there are forecasts for it to go back down; they have a good argument - Get Ready for $10 Oil. In summary the rig count in the US is dropping but production is still rising as people put all their efforts into the low cost fields. Add to that OPEC is loosing their power very quickly as their members (and others like Russia) fall over themselves to produce as much oil as possible.

The cherry on top is fresh out of Omaha - Buffett Ends $3.7 Billion Exxon Investment Amid Global Oil Rout

A quick look at the next generation of the internet - If you like HTTP then you'll love HTTP 2.0

Computing for the masses and hobbyists - Over 5 million Raspberry Pis have been sold. These computers sell for between $20 - $35 and can fit in the palm of your hand; WHAT IS A RASPBERRY PI?

Home again, home again, jiggety-jog. Stocks are higher at the beginning of trade today. The sun is coming up later and later. The weather is still great here, just check out Istanbul lately, yowsers. The weather is horrible.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment