"As mentioned above, this business is a disrupter in a very old industry. They have realised that as an insurer their interests are aligned with their clients. So they have created incredible products to incentivise their clients to alter their behaviour. And it turns out that clients actually want to be healthy and actually want to avoid car accidents if you give them the right platform to take it seriously."

To market, to market to buy a fat pig. Yech, my least favourite thing, the Fed chair being quizzed by politicians. Why, what, who, when, why? There are many examples of nonsensical questions from the powers that be, you can, if needs be, read the prepared comments of Fed chair Janet Yellen: Semiannual Monetary Policy Report to the Congress Short in stature, a giant in markets. I really like her, her accent, her demeanour and her general ability to be able to deal with the pressure of being the most important person out there at some points in time. Whether or not you like it, interest rate fixation is something that we have to live with. What will the Fed do next is as much a fixation as to what your favourite designer or actor will do next. Or the next song from Rihanna, Beyonce or Taylor Swift. Taylor Swift is clearly not quite there yet, Riri and Beyonce are famous enough to be known by their first names. As in when you say Sachin.

We are getting off track here, something that unfortunately I do a lot, it makes for entertainment though, if you wanted the boring what is happening in the market, you would find that elsewhere. What we aim to do here is to educate and simplify and entertain. Talking of which, I need your help here. I really do, I know who you are. The crunch time for the Share shootout league came last evening, I was in the semi final and need your votes to go through to the final. In the end the cash prize goes to charity and of course I get to be in the final, you can help me simply by retweeting my status from last evening. I am going to relent for the whole week, do it now (for me, pretty please). Finals here we come baby. So here goes, follow link -> and retweet. Put your favourite stock picker through! I need your vote to send me to the finals of @SSOLEAGUE on @cnbcafrica Vote #Bucks Simply Retweet! Remember, I know who you are if you don't vote for me.

The reaction to Janet Yellen's testimony and subsequent Q&A segment sent the US markets to fresh highs. And those suffering from market vertigo would be feeling that they need to sit down. Why? Interest rate rising have been pushed out further, and perhaps further than most folks anticipated. I suspect that we may well be living in a world with lower interest rates as a result of human innovation and the cheapness of doing business, as well as much more competitively priced (as a result of technological innovation) services and products. You can buy power tools for half the price you bought them 15 years ago, and that is in Rand terms. Granted many other things have become more expensive, the charts below showed in the things we are reading (94 percent of the global population lived in poverty in 1820) shows that we are making rapid progress as a species.

The one line isolated in the Janet Yellen testimony (above is the link) that possibly had the impact on markets is as follows: "The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings." At the same time, if you are interested in the Fed and interest rates, the Business Insider found a piece from: Here's a chart of interest rates since 3000 BC. The broader market S&P 500 added nearly 6 points to 2115 and a half, the Dow Jones added half a percent to 18209 and the nerds of NASDAQ added just a little to be less than a percent away from 5000 points. Although just a number, it always has a nice ring to it. The only excitement was a potential tie up between First Solar and SunPower, those stocks both soared.

I wanted to show that all companies rely on their people. Even those that may be seen as the most greedy, even if that is a perception that exists amongst broader society. This via an email subscription service titled Goldman Sachs says "People are People" which points out the obvious, the "disclosure" is new as Footnoted points out:

Notwithstanding the proliferation of technology and technology-based risk and control systems, our businesses ultimately rely on human beings as our greatest resource, and from time-to-time, they make mistakes that are not always caught immediately by our technological processes or by our other procedures which are intended to prevent and detect such errors. These can include calculation errors, mistakes in addressing emails, errors in software development or implementation, or simple errors in judgment. We strive to eliminate such human errors through training, supervision, technology and by redundant processes and controls. Human errors, even if promptly discovered and remediated, can result in material losses and liabilities for the firm.

Even the most sophisticated business with the best systems on the planet are in a position where they absolutely have to rely on humans. Humans make mistakes, even in programming software or designing hardware, computers are told what to do. People make companies. Unless of course you are Amazon.

Byron beats the streets

Yesterday we received 6 month results for the period ending 31 December 2014 from Discovery. This is our only recommended stock that falls within the financial services sector. Although there is a big healthcare element to this business which they have targeted as a disrupter in the industry. More on that later, lets first look at the financials.

Total new business for the period increased 17% to R6.6bn. Normalised headline earnings were up 20% to R1.98bn. This equated to headline earnings per share of R3.40. If we simply annualise this number to R6.80 we get a forward 2015 PE of 17, currently trading at R116. I wouldn't call that expensive considering the growth of this business. But there are other ways to value insurance businesses.

Embedded value was up 14% to R45.5bn. Embedded value is an actuarial term which equates to the sum of the adjusted net asset value and the present value of future profits of the company. This can be fairly accurately calculated because once an insurance company locks in a client they know what premiums they will receive on an annual basis. The actuarial estimations comes from the claims expected to be paid out. Discovery's market cap of 67.5bn sits on a 48% premium to the embedded value. Again I wouldn't be concerned. We feel that Discovery, with their superior product will steal market share faster than what the market expects. We also feel that their health initiatives will decrease claims faster than what the market expects.

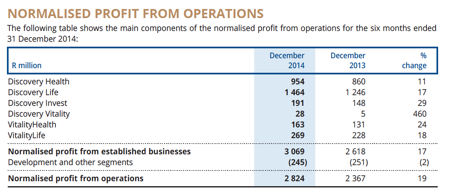

Lets look at the operations of the business. Here is a table from the presentation which shows the different divisions and how much money they make.

As you can see the South African Life insurance business is by far the biggest profit driver. But of course this links to the health business which incentivises clients to be healthier, stay alive longer and of course pay those life insurance premiums for longer without claiming. These 2 big profit drivers are the core of the business and should benefit from a growing market share amongst a growing middle class.

It's nice to see Vitality making a profit. This initiative was originally expected to break even whilst improving the product. They of course cover the difference of all those gym, flights and food discounts. It turns out that they have built such an incredible product that they are able to franchise it out to other insurers and even corporates around the globe.

VitalityHealth and VitalityLife are the rebranded UK businesses after they bought the remaining 25% stake from Prudential. These businesses are showing solid growth. Apparently the participation rate of the Vitality initiatives in the UK are brilliant and people are really embracing and enjoying the product. I expect this business to become more and more significant and the geographic diversification into a developed market is also a great plus.

Ping An Health, their stake in the Chinese insurer still has plenty of potential. But the stake is small and the money flows are not significant enough to make the table. We back management to turn this opportunity into a great business.

The short term insurance has also not made the table of profits because it in fact made a loss. They are pushing this business hard and spending a lot on improving the product. New business actually grew 57% to R403 million. Discovery Invest has seen solid inflows as they leverage off their great brand and huge client base.

As mentioned above, this business is a disrupter in a very old industry. They have realised that as an insurer their interests are aligned with their clients. So they have created incredible products to incentivise their clients to alter their behaviour. And it turns out that clients actually want to be healthy and actually want to avoid car accidents if you give them the right platform to take it seriously.

This is not the last we will hear from Adrian Gore and his team. They have announced a rights issue to raise up to R5bn in order to fund the UK acquisition as well as an opportunity they have earmarked in SA which they have not yet disclosed. More on that when we have further details. I am very pleased with these results. We will continue to add and we will advise clients to follow their rights which will be at a juicy discount, R90 a share.

Company corner snippets

Results from Shoprite yesterday were less than favourably received by the market. The share price was sold off heavily (down 5.6 percent), I guess when you are primed for perfection you have to keep delivering above market results. Their announcement along with the results I guess is aptly titled: Shoprite defies economy to grow jobs and turnover. A couple of things caught our eye here. They are the 107th biggest retailer in the world, 71 percent of all South Africans shop at their outlets. Why say 107th unless your objective is to get comfortably inside of the top 50 or so, that would be a clear objective, not so?

Whilst a 12.5 percent growth in top line (to 57.5 billion Rand) is hardly awesome (trading profits increased 11.6 percent), this is comfortably ahead of the market. Trading margins decreased slightly. Diluted HEPS came in at 370.2 cents per share, the dividend is 143 cents, both increasing by just over 8 percent. Again, that is hardly exciting, the company is ahead of the market. This company, to borrow a phrase from Charlie Munger, does more for society than any other charitable organisation. explain? By keeping prices low and generating (as a percentage) more cash in customers pockets. The customers that definitely need it. It is no secret that government have done a great job in social security in South Africa, Shoprite have definitely been a benefactor of the government grant system. Equally, Shoprite have helped government keep the inflation rate low with their better systems. And of course created many jobs along the way, the company employs 130 thousand people.

The reason for the sell off might have a lot to do with the outlook segment, which is cautious to say the least. Here, let us copy paste: There is every indication that the present economic climate will continue, while consumers' lack of disposable income, coupled with sluggish economic growth and climbing unemployment, will continue to inhibit trading. However, the biggest concern centres on Eskom's erratic load-shedding. It is not only influencing shopping patterns, but is also forcing businesses into substantial additional costs to provide their own back-up power systems. We believe that we are better equipped than most to deal with the crisis because of our forward planning and the extent and depth of our infrastructure and management team.

Coupled with the fact that in the presentation the company reveals some startling facts about the state of active credit consumers in South Africa, it is not a pretty picture as they say in the classics: Only 55.3% (Q2 2014 - 55%) of the 22.5m active credit customers are in good standing. Still, I suspect that lower rates for longer will eventually lead to this ugly period in South African credit history leading to a painful learning experience for all concerned.

What now? What do you do if you own the shares and are expecting to see earnings grow slowly over the next two to three years? 30 months out from now the analyst forecasts are for a little above ten Rand a share in earnings per share, hardly breakneck speed. Equally they (Shoprite) pay out half of their earnings, two times cover. At 170 odd Rand the stock looks expensive, it is for me however one of the very few companies of scale that are primed to grow aggressively across the continent. If you are looking for a company that will execute properly, this is the one for you. The statistic that Shoprite uses to explain the rise of the African consumer is Guinness (the brown beer), where they sell 60 times more of that product in Nigeria in their 11 liquor stores than they do in 136 stores in South Africa. It is a bit of a cherry pick, seeing as Guinness Nigeria is listed and secondly the reason being is that this (Nigeria) is one of their biggest markets. Although much smaller and with a select customer base, Woolworths is our top retail pick.

Things we are reading

This presentation shows the huge impact that modernising of the agriculture industry has had on global poverty - Visualising the History of Decreasing World Hunger and Improving Food Provision. I have seen most of these stats before, the one stat that I have not seen before is the following, as our population grows we will probably use less land for farming due to technology advances. Meaning food consumption will be more environmentally friendly.

Wealth brings with it many benefits, this presentation shows how world wealth levels have changed over the last 200 years - The Story of Increasing Prosperity, Declining Poverty, and Decreasing World Income Inequality. It is scary to think that in 1820 94% of the worlds population lived in poverty!

Here is a look at how our internet compares to the rest of Africa - What 1GB of mobile data in SA can buy you elsewhere. Our prices might not be as low as they could be, we feature well on the value for money index due to our quicker internet speeds. Cell C is struggling on the list and MTN Nigeria is still on the expensive side as MTN spend money to grow their network there.

The Oscars were on Sunday night and the usage data is in - The Oscars flops: TV audience drops 16%, tweets fall 47%. There wasn't a selfie this year that went viral, which skews numbers a bit, but there was a defiant shift to Facebook, up 86%! Great news as a Facebook shareholder.

Home again, home again, jiggety-jog. Oh, the Chinese PMI figure is at a four month high. The year of the sheep (Wei) is on us now, Chinese superstitions suggest that being a sheep is not exactly the best outcome. I am a Dragon. Yes. Only by zodiac sign, everyone had a dragon teacher at some stage, am I right or wrong? I can remember a specific headmistress who was "not nice". OK, talking of not nice, we are bombarded with analysis of the budget speech. That is apparently a must watch, we will of course pay attention and see if there are any implications that will impact you. Don't forget to vote for me if you want me to live on in the competition. Use your best Schwarzenegger accent there.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment