"Nein. Nein no blink. That did not seem to matter too much for markets, other than the Greek market. So, there you go. Around 11 - 12 hours ago however, as I write this, the Greek Prime minister in his English Twitter feed (replicated from the Greek one, the pictures look the same) tweeted that he had gotten off talks with both the French and the German leaders, talks had been good. That hardly sounds like a chap looking for money from Russians, Chinese or Venezuelans, even though we know that two of those three have no spare cash right now."

To market, to market to buy a fat pig. Ha ha, I myself was being optimistic yesterday. The only person to have spotted a glaring mistake on my part was Paul's wife. She said, hold on a second, if he devilled his 20 year reunion speech last year, then he would be ten years younger than he is now. In fact, it was my bad, it was his 30th reunion. And not 20. As I said, I was being optimistic and perhaps underestimated my own age. Age is certainly great from a memory point of view (and also not), provided that you can remember all the information that you have accumulated over time. More importantly, use it!

OK, that aside, what happened yesterday and why should it matter to you? Information is to a large degree power, knowledge is power. So to know that the Germans rejected the Greek letter for an extension, is marginally important. Nein. Nein no blink. That did not seem to matter too much for markets, other than the Greek market. So, there you go. Around 11 - 12 hours ago however, as I write this, the Greek Prime minister in his English Twitter feed (replicated from the Greek one, the pictures look the same) tweeted that he had gotten off talks with both the French and the German leaders, talks had been good. That hardly sounds like a chap looking for money from Russians, Chinese or Venezuelans, even though we know that two of those three have no spare cash right now. Here are the two tweets, screen grabbed from his Twitter feed and sized for the message:

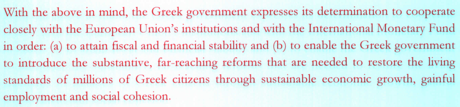

I am not too sure about you, that hardly sounds like a man that is hell bent on getting out of the Eurozone as soon as possible now, does it? Read the FT story, aptly titled: Germans rebuff Greek 'Trojan horse'. Read the letter from the Hellenic Republic to the Eurogroup: Dear President of the Eurogroup. There are seven points when requesting an extension. The last paragraph shows you that the Greeks are committed to the Eurozone:

That is the way that I interpret it anyhow, everyone is entitled to their opinion. And that I guess is mine, that Greece will stay in the Eurozone.

The other piece of good news was the US weekly jobless claims, which were far better than anticipated. Oil prices were trounced, it seems (Michael included them in the links segment yesterday) that everyone is pumping volumes, seeing as that is the only way to catch up to falling prices. As you all know however, more supply means lower prices, winning consumers. Lower prices ultimately means marginal production disappears. It is amazing that we see predictions of even 10 Dollars a barrel, when a year ago we would never have seen something that preposterous.

Markets down South at the bottom of Africa, which happens to be the second biggest and second most populous continent, closed the day half a percent better (and a little more), led by industrials. And not commodity businesses, we spoke about that above. Across the seas and far away in the US, the Dow Jones was lower, dragged lower by a few key constituents, Walmart too, most in the oil space however. Chevron, Exxon Mobil and Caterpillar all falling heavily with Walmart, dragging the rest of blue chips lower. The nerds of NASDAQ are on a tear.

Company corner snippets

MTN released a trading update yesterday afternoon that the market received well, the company has unfortunately been impacted by something outside of their control, the falling oil price. MTN does not produce oil, two of their major operations happen to fall in countries that do produce oil however, with government spend expected to be far lower than in prior years and in many cases the government is a big employer. Markets can respond to markets, governments are less nimble, they have different agendas. Back to the trading update, which looked ahead of market consensus: MTN expects an increase of between 5% and 15% (equating to a range of between 1482 cents and 1623 cents) in headline earnings per share ("HEPS") and an increase of between 15% and 25% (equating to a range of between 1679 cents and 1825 cents) in attributable earnings per a share ("EPS")

Why the variance? EPS for the 2014 financial year was positively impacted by the transaction whereby the MTN Nigeria's passive infrastructure was transferred to an associate. MTN Group has retained a 51% interest in the newly created entity and MTN Nigeria will lease-back the towers for its operations. Results themselves will be released for the full year to end December on the 4th of March, which is not next Wednesday, rather the Wednesday after that. Two weeks. In the middle of that range, HEPS is anticipated to be 1552.

What? The SABMiller CFO resigned, for personal reasons. Perhaps as a Scotsman he had been taking too much heat for working at a beer company. Our favourite Scotsman here in the markets in South Africa is Chris Gilmour. He drinks beer and in fact is an expert on this company. Perhaps the two are linked? Not likely. As the release, short and sharp and to the point says: Jamie Wilson, has tendered his resignation for personal reasons. He steps down immediately. Taking over from Wilson will be Domenic De Lorenzo, who is currently Director of Group Strategy. This is pretty strange, of a group of that size and scale. Wilson is only 55, has been with the company since 1996. He forfeits all share options and share awards, including 35,726 SABMiller shares due to be awarded in equal tranches at the end of June this year and the next.

Yesterday we saw Unaudited Group interim report for the 26 weeks ended 28 December 2014 for Truworths. The results weren't great but the market was expecting worse, given the 5% rise in the share price. Taking into account inflation, their sales were down, gross margins were down 1% point, operating margins were down 2% points and HEPS were down 0.4%. In the period they managed to open 33 new stores and their acceptance rate for new accounts improved from 26% to 31% (this is either because they have better quality applicants or application requirements have dropped). All in all, not shooting the lights out which is reflected in the stock "only" trading on a 13 P/E.

Walmart reported results yesterday. There was some fellow on the box talking about Walmart and whether they were still relevant, as if the company was in the same shape as RadioShack. The business services 245 million customers a week and employs 2.2 million people. I beg your pardon, associates. Annual revenue in 2014 was an astonishing 473 billion Dollars. I would say that this company is definitely relevant. Walmart opened their first store in 1962. They have over 11 thousand now. If there was a company able to adapt and move towards purely distribution, I suspect that they would be able (with a bit of pain) move towards an online experience in a hurry and compete against the likes of Amazon, who are light years ahead. The stock fell over three percent, a miss on revenue for the quarter and another cautious outlook. This is still an amazing business, I love that Charlie Munger quote on Costco (also a low cost retailer) which suggested that discounted retailers do more for humanity than any charitable organisation. Low prices consistently = low inflation. Inflation eats into the spending power of the poor more than the rich. Keep it up Walmart please. Walmart also agreed to raise the hourly wage of all of their associates to 10 Dollars an hour, I presume that they only mean in the US.

Things we are reading

Since 2008 people in the US have consumed less meat, the trend seems to be changing back to increased consumption - Why that steak might cost less in a few years. Meat could be considered a luxury and its consumption numbers could be used as a proxy for what is happening at the ground level of the economy.

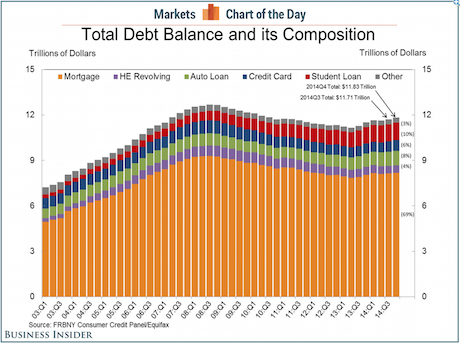

Having a look at the debt levels and trends in the US - This is what $11.83 trillion worth of household debt looks like. This was the Business Insiders "Chart of the Day" on Tuesday:

Two observations from the graph, the first is that debt levels are still lower than they were in 2008 (since then they have added $3 trillion onto their economy). The second observation is how student debt grew during the down turn, indicating that people used the hard job conditions to upscale themselves.

A weak currency promotes tourism, in Russia's case they are getting "petrol tourism" - Finland: Cheap petrol propels motorists to Russia

Another reason to buy Starbucks, coffee is good for you - Coffee's Great, U.S. Panel Says in Official Diet Recommendations

Home again, home again, jiggety-jog. The Greek market is up this morning. Does it matter? The entire size of the Greek equities market is equal to roughly a 0.3 percent move in the S&P 500, so perhaps it does not matter that much. At all.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment