"The Germans are clear that it is a compliance thing. Wolfgang Schauble, the German finance minister rebuffed the Greek finance minister Yanis Varoufakis pointing out that the third largest political party in Greece is a Nazi one, saying that Greek must do more. And made an offer again to send 500 German tax collectors to help the Greeks collect taxes from wealthy individuals. The Greeks feel they are getting trodden on, the Germans feel that the Greeks are dodgy."

To market, to market to buy a fat pig. Shloaded. It is the word I made up for load shedding. I saw the suggestion that hopes the sun stays up longer. No, that is not it, rather, the suggestion has been made that the country be split into various time zones in order to accommodate different parts of the population with electricity during peak demand times. If I check on the weather app on my phone, the suggestion is that the sun comes up at 5:46 and does down at 6:48, that is here in Joburg. In Cape Town, the same app says that the sun comes up at 6:12 and goes down at 7:48. For Durban, the same app says that the sun comes up at 5:29 and goes down at 6:51.

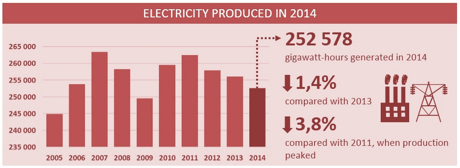

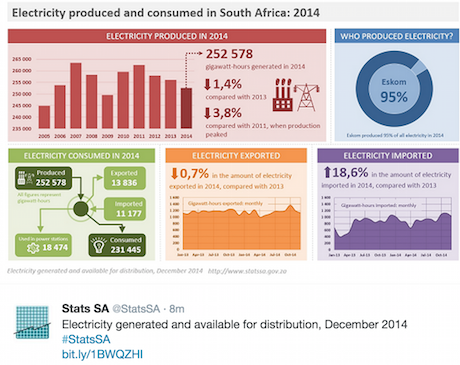

It is pretty obvious then that Durban needs to start earlier and end earlier, Cape Town needs to start later and end later. And of course all the surrounding towns and province. It is also true that we are producing less electricity, it is far less about where people live than the ability of an ageing infrastructure to meet the demand. According to StatsSA, this piece: Electricity produced and consumed in South Africa: 2014.

I have no doubt that humans will solve personal problems to them. In other words, the problems that impact you most, you will find a way around it. Rich people have the necessary resources in order to be able to do this, install more gas, get more solar equipment, install generators, the list goes on to what you can do in order to meet your needs. If you do not have the resources, unfortunately you are going to have find other alternatives, they are both more dangerous and unfortunately have a health warning. The cost is high, to all of us, whilst we may think that it is a case of rock bottom, perhaps we are only nearing that part. People will respond accordingly. The problem lies with those without the resources. Those are the folks that I feel worst for.

The upshot of it all means more time spent in traffic too, there is a huge economic cost associated with wasted time. Mind you, I always wonder why people speed to the coast, is it to get there 45 minutes earlier in order to lie on the couch in that time? On a risk/reward basis, the time "saved" relative to the potential risks incurred and the subsequent usage of that time almost never makes sense to me. That is just me I guess.

Right, on to other matters that impact us in our daily lives, the equities markets and the fact that Greece remains on the radar. That same old chart has been dredged up indicating that Greece has been technically bankrupt more than half the time in the last 190 years, with failures to repay debt and default numbering 6 times. Yesterday the new Greek finance minister and the veteran politician, German finance minister, were next to one another at a press conference. Thorsten Beck writes an interesting and aptly titled article: Groundhog Day in Greece. It is superbly written, without a stunning conclusion however.

One gets the sense that the Greeks will continue to meander, without growth there is no prospect of ever paying back the money. Ever. You can forget about it in the short term. In the medium term, provided there is inflation and the economy stabilises somewhat, the road ahead will be long, hard and full of obstacles. It probably could be done in thirty years, who wants to hang around in a vacuum for that long. Hey, if I were Greece, you could adopt the Ireland approach to lower corporate tax rates, where do you think that multinationals would rather have their offices, in Athens and the surrounds, or in Dublin. Dublin is probably awesome, Athens has far better weather.

The Germans are clear that it is a compliance thing. Wolfgang Schauble, the German finance minister rebuffed the Greek finance minister Yanis Varoufakis pointing out that the third largest political party in Greece is a Nazi one, saying that Greek must do more. And made an offer again to send 500 German tax collectors to help the Greeks collect taxes from wealthy individuals. The Greeks feel they are getting trodden on, the Germans feel that the Greeks are dodgy. This article in the New Yorker, written by John Cassidy titled Why Greece and Europe can still reach a deal, has the best conclusion. Another write down on harder reforms, which seems acceptable. However, tell the left wing that there must be less government, they will tell you that they just want the dodgers to not dodge. Complicated. Watch, do not let it consume you.

Favourite thing today

This is a critique by Cullen Roche of an FT column written by a chap by the name of Seth Klarman on the 12 things that he had learnt from Warren Buffett. Follow the link and take some time to read it: Critiquing Klarman. I particularly enjoyed the piece on how real value investing is actually very hard and quality mattering above almost everything else. As well as not trying to be overly diversified for the sake of being overly diversified. And of course patience. We live in a credit card world where if you want something, you can get it, the consequences are of having to deal with that down the line. The last point where Cullen disagrees with Seth is pretty interesting. I would love the feedback from you in which Cullen disagrees with the Do what you love, rather he says: "don't do what you love. Do something other people will love you for doing. Good capitalists serve themselves best by serving others." Agree or disagree?

Companies corner snippets

Did you see the news that Google and Twitter were combining forces? Or so the rumour mill was suggesting -> Twitter Reaches Deal to Show Tweets in Google Search Results. I am not too sure what that tells me either about the search function on Twitter, or more importantly whether Google has conceded that Twitter is already what we know it is, the fastest source of news. In other words, the best place to search for news immediately in Twitter and perhaps Twitter is saying that Google has better search functionality. I suppose the respective leaders in search and immediate news should tie up in this way. What it does however confirm is that Google is not ready any time soon to reel Twitter in totally, i.e. buy the business.

Talking of Twitter. Did you see the results? Via the Investor relations website, Twitter Reports Fourth Quarter and Fiscal Year 2014 Results. The metrics are all moving in the right direction, other than average monthly users, which is starting to slow. The revenues from those same said users is starting to grow at a fair click, guidance looks fairly aggressive too, the company expects to grow revenue from 664 million in 2013, 1.403 billion in 2014 just past to a whopping 2.35 billion Dollars at the top end of the range.

Huge capex spend on a relative basis, spending around 25 percent of projected revenues for the current year. Michael and I have one big reservation however, stock based compensation expense in the current financial year is expected to be as much as 750 million Dollars, which is more than the capex guidance and more than the EBIDTA guidance of 575 million at the TOP end of the range. My user experience is OK, it certainly is not amazing, surely keeping the talent does not need that much? Twitter has a market cap of 25.5 billion Dollars, that amounts to an almost three percent dilution this year alone. Pfff..... perhaps we are being too precious about it. The long and the short of it all is that this company is investing aggressively in their staff, in their business and the profits are non existent for now. They need to improve the experience, grow the base and catch more users and more especially more advertisers. Twitter is a customisable news feed, as long as you get people who are interested in news and current affairs (and everything in-between), the advertising platform will continue to grow. The stock bounced 9 percent in the aftermarket, reaching levels last seen in October.

There are new features in order to improve that user experience, group direct messages (perhaps we can use that here at Vestact, we do have a WhatsApp group), Vine is OK, I guess. for now there are 6000 tweets a minute, half a billion users come to Twitter and never sign up, they just "use" the service. I suspect that Twitter will go from strength to strength, judging the future profitability of the business is the trickiest part. Very hard. If you want to own them, then just buy them at current levels.

Things that we are reading, you should too

What does America's wealth look like ? This blog piece has a look at financial trends since the late 80s and there are some scary trends. The one point they make that I don't agree with is that average incomes have not grown. Incomes may not have grown in real terms but the cost of buying goods and technology has dropped dramatically, which means you are wealthier because you can buy more "stuff" - For Many U.S. Families, Financial Disaster Is Just One Setback Away. Not saving would also be a big reason why the rich (who save and invest) get richer and the rest don't.

Drones are on the horizon for online retailers. Alibaba recently did some testing where they delivered tea using drones. Has the U.S. Lost Its Edge on Drones to China?, a point raised by the journalist is that regulation in the US may result in funding and technology going elsewhere.

Some fun facts that I found on Twitter (the graphic from the link at the top).

A bit of fun to end this week. The digital revolution has changed many aspects of life and as you will know Newspapers are on the way out - Watch R.E.M's ex-bassist rap about the death of newspapers

Home again, home again, jiggety-jog. Load shed again. The market is flat here. Non-farm payrolls here today. That is always exciting.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment