"I do not think that any investment thesis is far superior to another, I have seen many investment managers advocate that their path is the only path. As Byron and I discussed last week, the reason why a companies price trades at a certain level is that all of the buyers and sellers collectively agree on a certain price. Ultimately the buy and sell side have different time frames and objectives, some need to generate revenue for their firms at different levels. I still find it absurd that a company the size and scale of IBM corp. (to use that as an example) can trade 3.71 million shares on average on any given day, bearing in mind that there are 989 million shares in issue. What is wrong with that you say? Divide the one by the other and you get to 266 days."

To market, to market to buy a fat pig. Byron had some interesting observations yesterday, he said (sarcastically) that Woolies was empty, not a soul there as a result of finance ministers in Europe meeting on Greece's debt woes. Not true. Ordinary people care less about Greece and their debt, our TV's have enormous amounts of news about contagion, the fact that believable politicians think this could be a disaster, if Greece were to leave the Euro zone. My base case scenario is for a late deal, one that is neither favourable for either party involved, there are two stories that you can read (both subscriptions sadly) from the WSJ: Greek Financing Talks Break Down Amid Deep Divisions Over Bailout and the FT: Greece bailout talks collapse in acrimony.

If everyone sells their companies today as a result of this, you should be buying. It hardly seems to have nudged markets in either one way or another. The futures market is not in the toilet. This means that the market is indifferent to both sides and their inability to meet and compromise. I suspect that the prospects of a Greek debt tragedy evolving to an exit is something that the hyperactive market is factoring in. And seemingly people are OK with that. I suspect that saying my base case is still for the Greeks to want to continue to be in the Eurozone, Byron retweeted Ed Conway last evening, here is the link here: Greece's depression.

I guess that Germany and the UK depressions created by the war were as a result of human tragedies, the US and Greek ones were as a result of too much leverage. The US spent their way out of that depression, they had the opportunity to. There were many hardships, bank failures, life savings wiped out, soup kitchens, poverty, Hoovervilles, I am not sure, I have not been to Greece recently but does the Greece resemble those hardships? Is it the same as Germany, the UK and the US back then, or is it relative to their standard of living before? Perhaps the latter and not the former. Anyhow, like I said yesterday, we went through 53 thousand points, obviously the expectations are for the Greeks to talk tough, that is what their electorate want. The Europeans, the rest of them, want the Greeks to comply. We will see.

There is something that I have been thinking a lot about lately, the whole idea of long term investments and what that means for me or for you, for your kids or for your parents. Obviously the time horizons differ dramatically, depending on where you are in life at any given point. If you are investing for your children, then they are the ones likely to benefit hugely from the 8th wonder of the world, compounding interest. It also struck me that human nature is a major contributor to how we go about structuring our investments. I have seen people sell as a result of over information presented via all the numerous channels that we have today. The financial world never ends, we never go back to the stone age, yet the same mistakes are made, selling right at the bottom of the market. As well as chasing the pot at the end of the rainbow, chasing the small/medium cap that could be the next x or y or z. The reason why company xyz is at that size and scale is as a result of hard work and dedication from all the "stakeholders". Quality attracts quality.

Equally I do not think that any investment thesis is far superior to another, I have seen many investment managers advocate that their path is the only path. As Byron and I discussed last week, the reason why a companies price trades at a certain level is that all of the buyers and sellers collectively agree on a certain price. Ultimately the buy and sell side have different time frames and objectives, some need to generate revenue for their firms at different levels. I still find it absurd that a company the size and scale of IBM corp. (to use that as an example) can trade 3.71 million shares on average on any given day, bearing in mind that there are 989 million shares in issue. What is wrong with that you say? Divide the one by the other and you get to 266 days.

Now, according to this document -> Trading days: 2015 NYSE, there are 252 days of the year that you can buy or sell equities. How is it possible that the balance of buyers and sellers can almost trade the entire issued securities of one business, IBM (103 years old) in nearly one year? It makes the churn of prepaid customers on Vodacom Mozambique network look tame. How can so many people in one industry churn the market cap of one of the oldest blue chips? According to the International Business Machines Corporation Ownership Summary on the NASDAQ website, there are big shareholders like Berkshire Hathaway and Vanguard, collectively they hold 125 million shares, or roughly 12.6 percent of the share in issue. You would think that those shareholders are not buying and selling each and every day. They are actually owners of the business. In the case of Vanguard, the shares are held for their various index trackers. I suspect that many of the holders are either holders for a couple seconds or holders "forever".

Buffett said in the chairmans letter in the annual report in 1988, "our favourite holding period is forever", is fleshed out more with the sentences before and after: "In fact, when we own portions

of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint. Peter Lynch aptly likens such behavior to cutting the flowers and watering the weeds." I suspect that those three lines are self explanatory. Trust the business, provided you can see that the management and the industry are good.

Lastly, there are so many inventions to come that we could not possibly fathom, be adaptable. I thought about the industry of flight, how as humans we have not yet cracked supersonic flight, it would be so much more fun to get to Europe or North America or Asia from Johannesburg in four or five hours, rather than more than double or three times that currently. How will that look in 20 or 30 years? Ultimately it depends on the economics of flight, whether or not the engines will become more and more efficient and at the same time be quicker. I suspect that it will improve, to what level, your guess is as good as mine. Would that make airlines more favourable as investments? Possibly not, perhaps never, they are one of those industries that we desperately need.

I said to a friend of mine the other day, and this sounds rather counterintuitive, as an investor over a period of twenty years, you should hope that the share prices of the companies that you are buying stay as low for as long as possible. i.e. so that you can buy more and more shares of the same quality company. Of course this would not happen, in order to attract more money to equities, ironically the value of your equities need to increase more than inflation. Human nature then dictates to the investor psyche that this must be a good one. Better than every other possible investment. However, you would not continue to invest if the prices went down and down, even if you were convinced that this was a good business. This would not happen.

I think the conclusion is the same each and every time. Every investor makes mistakes. Make sure that the mistake is a learning process and that it never happens again. Even Buffett admitted that he messed up with Tesco. It happens. Find the best businesses that have are better than their peers in all regards, management, product, longevity. There are many valuation metrics; many different investment managers use different ones to suit their models. Owning quality, that is universal.

Michael's musings

Tesla, the car company that makes the best looking electric cars in the world, released their Fourth Quarter & Full Year 2014 results on Wednesday night last week. Elon Musk, the founder and CEO went to Pretoria Boys, so this company has a soft spot with us in the office, seeing as both Paul and Byron went to that fine establishment. The results were not as great as the market were expecting, they had pencilled in a profit compared to the 4Q loss of $0.13 a share, resulting in a drop around 7% in the share price.

Starting with the reason for the miss; the logistics of delivering cars. Tesla had production delays and then they struggled to get the cars to their customers due to, them being on vacation, weather and shipping. Tesla can only book the revenue and profits once a car has been delivered, in 4Q they delivered 9834 cars out of an expected 11 200. The good news is that there is a waiting list for the cars so the delayed cars were delivered int the 1Q of this year.

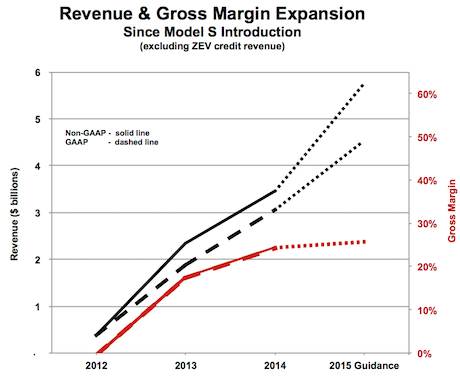

In 2014 they only produced 35 000 cars, which compared to Ford who sold 220 000 cars for December in the US alone; Tesla is still very small. For 2015 Tesla plans to deliver 55 000 cars, which is still relatively small but and increase of around 70% from 2014 figures. Along with the sales growth, Tesla is focusing on growing their margins as well, from the current 26.7% to around 30% in the 4Q in 2015. The industry average margin is the low teens, so their margin numbers are spectacular! Part of their revenue and by extension their margins is the sale of ZEV (Zero Emission Vehicle) credits. They get the credits due to their cars not having emissions and they sell them on to other car companies, who need a certain amount of credits based on the number of cars that they sell. Margins drop to 22% if you strip out the sale of credits, which you cant rely on due to regulations being able to change down the road.

Here is a look at the staggering growth they have had and the forecast growth.

Going forward they expect to launch their Model X, which is an off road vehicle, in the 3Q. There are currently 20 000 reservations for the Model X and 10 000 reservations for the Model S, no problems with demand. They are also spending a "staggering" amount of money on Capex going forward to improve their production and to add to their Supercharge network (fuel stations for Tesla's).

As far as shares go they are very expensive, they dont make a profit, so we cant use P/E. Having a look at their market cap of around $25 billion, on production of 35 000 for the last year, compared to Ford who have a market cap of $61 billion, on sales of 220 000 just for December. You can quickly see that the market has high expectations for the company. Granted Tesla is growing at a rapid pace, have super high margins and is the technology of the future, they still have a lot to live up to.

A big thing for me and something that tips the scales in Tesla's favour as an investment is their battery technology. They plan to launch a battery in the middle of this year that you could use in your house as back up power or to store solar power. A bigger battery play is through their Gigafactory, which will bring down their battery production cost by 30% and have the capacity to supply 500 000 Tesla's a year. I think the battery aspect will go further though because as the world become more green, green energy needs somewhere to put its energy until you need it. Tesla will have the technology and the production capacity to supply you with long lasting batteries. They are not just a car company.

This is a company that I really like and if you are brave, can consider adding a small position to your portfolio. There is no doubt it will be a bumpy ride until the company is mature but in the end I think it will be worth it.

Things that we are reading, you should too

Streaming is nothing new, when Apple launches Beats as a built in app it will be a milestone for the music industry - Apple's new premium music service reportedly launching by this summer. Given the number of people who are part of the Apple ecosystem and the customer experience that Apple focuses on, you would have to say that Beats will be one of the main streaming applications around.

The power of compounding and low fees - The Big Lesson From a Bet With Warren Buffett.

Home again, home again, jiggety-jog. Darn it, our lines are out again. You know where to get us, on this email or Twitter or our cell phones if you have them. It is driving us crazy! Sorry, sometimes these "things" are out of our hands, we cannot do anything about it. Markets are marginally lower here at the get go. US markets, which were closed yesterday are set to open weaker later this afternoon.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us Follow Sasha, Byron and Michael on Twitter 087 985 0939

No comments:

Post a Comment