"Word on the street (the streets of London) say that 3G Capital (the Brazilian Private Equity crowd) and another consortium of investors, including Anheuser-Busch InBev are involved. The rumoured price is 75 billion Pounds, which is a full 20 billion Pounds above the current market capitalisation. That is a fair bit higher and sounds like too much. Perhaps as massive a premium (excuse the pun) would be the only thing that would entice SABMiller shareholders, remembering that Altria (through their sale of their Miller stake) are the biggest shareholder."

To market, to market to buy a fat pig. Another ripping day higher for oil, a huge gap has opened up between Brent and WTI, nearly 9 Dollars a barrel. Friday was a little more about "hope" for a Greek deal, today the finance ministers meet again. Let me be clear here, surveys amongst Greek people indicate that they DO NOT want to leave the Eurozone. Read that line over and over again. Once you are out of the Eurozone, all the benefits associated with free trade and labour movement are gone. As well as access to capital at lower rates, that is the theory at least. The rest of the Europeans might not be as excited about the Greeks wanting more and more favourable terms, in fact an objection was raised over the weekend on Ireland's behalf. Ireland coincidentally (that is all of Ireland, not just the European part) beat the West Indies this morning in the sprawling metropolis of Nelson, the "middle" of New Zealand this morning. Nowhere near middle earth.

OK, the Greeks will resolve their problems. Perhaps the loan will be interest free, or closer to current rates and be extended over a longer time frame. In the end the Greeks need growth, their own people need to trust the banking system, reforms of all sorts need to take place to become more competitive. I think that all the solutions "offered" by people with nothing to lose or gain should be ignored. These problems are for Greek people. With growth this all changes, Ireland attracted business with lower tax rates and ease of doing business, there might be a completely different language in Greece, it is however not stable.

Hey, we popped above the 53 thousand mark here for the first time. Thanks to a relatively sharp move northwards in the SABMiller price this morning. Word on the street (the streets of London) say that 3G Capital (the Brazilian Private Equity crowd) and another consortium of investors, including Anheuser-Busch InBev are involved. The rumoured price is 75 billion Pounds, which is a full 20 billion Pounds above the current market capitalisation. That is a fair bit higher and sounds like too much. Perhaps as massive a premium (excuse the pun) would be the only thing that would entice SABMiller shareholders, remembering that Altria (through their sale of their Miller stake) are the biggest shareholder.

They (Altria) have a (according to Wikipedia): "28.7% economic and voting interest" in SABMiller. I looked inside of the last annual report under Substantial Shareholders (page 87) and it says that Altria have 430 million shares, or 26.99 percent of shares in issue. The next biggest shareholder is BevCo, who own 14 percent of the business. Those folks are represented by the Santo Domingo family, the richest people in South America through their Bavaria business, which they sold in 2005 to SABMiller. The other assets of that business are media interests, this is possibly their most valuable asset. So whilst you and I might think that this is a preposterous idea, a monster premium over the current share price, it only matters to the shareholders of size and scale. Anyhow, I just think that it is an old story resurfacing, the share price is up in London less than 2 percent.

Company corner snippets

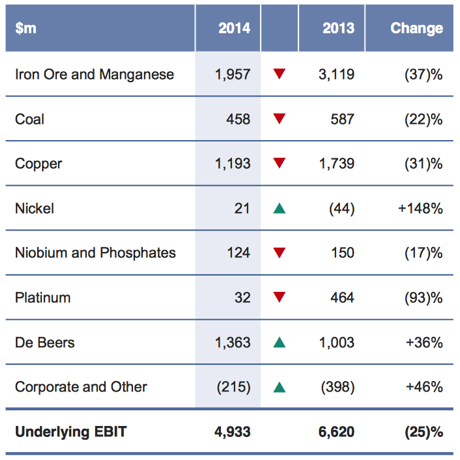

Anglo American released their results on Friday. Iron Ore, predictably falling sharply, still very profitable for the group however, diamonds were an investors best friend, De Beers being the most profitable unit for the commodities company. I guess I could have used the word giant, perhaps Anglo once were the biggest and most talked about company here in South Africa, that bias definitely still exists. With a market capitalisation of 305 billion Rand, it is still a huge company by South African standards, in London the market cap is 16.69 billion Pound Sterling. It is enough to make the FTSE 100, in terms of market capitalisation however it has a weighting of about 1.1 percent. They are currently in 32nd place, BHP Billiton Plc are twice the size (add in the other Ltd. and then it is roughly four), Rio Tinto are two and three quarter times bigger, Glencore Xstrata are a little over two times bigger. The mighty, which once was a contemporary of the others and in most cases superior to the others has slipped in size and scale. Management? Bad decisions associated with management? Assets relative to their peers? Perhaps all of those things. Here is a quick snapshot of their underlying EBIT

If you download the results presentation and the associated graph next to this table above. You will see that in the last year, according to Anglo, their mix was a lot better. My observations are simple, if you like diamonds as your favourite commodity, it is far easier and the margins are better to own a manufacturer of jewellery (who uses the raw products) than to own the people that mine it. For the time being. That may change, for me however it seems that if you are buying Anglo to benefit from a later consumer cycle, I think that there are far better consumer businesses to buy. If you are looking for a commodities business, equally I think that there are better businesses to own, two of them locally here. I suspect that there is locally a need that you MUST look at the company as an investment for historic reasons. I wish the company only the best, what they do is very hard, Mark Cutifani has done a good job so far in repair work, let us hope that him and his team are right about their commodity price predictions, which look very bullish.

Things that we are reading, you should too

Bill Gates is an editor on The Verg for this month, so he is getting a good amount of media time - Bill Gates: how online courses can radically improve education by 2030. As education levels the playing field and opens doors for people, so economies will grow and companies customer base gets bigger.

A look at where education may be heading. Given the explosion in population numbers and new technology available to us, education is in need of a shake up - Degrees don't matter anymore, skills do

I think Uber is a great company and adds value to any city that they come to - I drove for Uber for a week, and here's what it was like. There are many great points made by the blogger, the one that sums up Uber the best: "There is a good reason why Uber does not have a problem with harassment, while taxis do. The reason is the app...This creates a very safe system, and is in my view the reason why there's been almost zero incidents with 150,000 drivers. This system is far better than any permit system and is the secret sauce behind the great experience that is Uber."

Interesting look at what commodity prices did in general since 2005 - The Periodic Table of Commodity Returns Interesting to note is how gold miners have performed worse than the gold price. The price of gold is up 270% in the period, where AngloGold through their ADR in dollar terms is down 75% and Gold Fields, also through their ADR, is down 63%.

Home again, home again, jiggety-jog. We are down slightly today as short termers keep their eyes fixed on Greece. Many of our stocks hitting solid highs. Seems like people are still buying Woolies groceries despite the Greek negotiations.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment