"To illustrate the point about no fixed lines across our continent, look no further than Tanzania having 5.160 million data users out of the total of 11.810 million subscribers, when compared to South Africa, the ratio is about the same. The internet is empowering. Average Revenue per User (ARPU is measured per month) in the DRC, where Vodacom has nearly 11.5 million users is a paltry two dollars and seventy cents per month. Less than 10 cents per day airtime, average per consumer."

To market, to market to buy a fat pig. Wow. How did that happen? Brent Crude oil is now up 28 percent from the January lows and enjoyed a monster rally last evening. It needs to double and then some more to return to the levels last seen 12 months ago. I am not too sure we are going to see that soon, the reason for the bounce is that the supply side (generally) is showing signs of weakness. I was lucky enough to catch someone on their cell phone (in traffic) in Houston on their way to work. (insert sarcasm here) Yes, things were so much better in the old days. (sarcasm ends)

Why was I lucky enough to catch someone there? He confirmed what we have been talking about for a while now, slowing rig counts from the majors, companies laying off staff like crazy and suddenly apartments that were unavailable 6-7 months ago, there is an abundance. Let us just say that "things" move a whole lot quicker in the US than in many other places. He was hearing of lay offs of 200 here and 300 there every few days, the mood has certainly soured in a very short period of time. Energy and basic materials (resources) led the charge on Wall Street last evening, the broader market rallied hard around those two sectors. It does not make sense to me, but hey, who am I to question Mr. Market. The broader market S&P 500 closed up shop at 2050 points, up nearly one and a half percent, the nerds of NASDAQ managed only a little over a percent, the Dow Jones clocked over 300 points, which nowadays is a little over a percent and three quarters.

Listen in close here. Oil prices are up 19 percent in four trading sessions. I bet nobody saw that coming either. Falling rig counts, lower industry capex and a strike by ten percent of the oil refining capacity in the US have seen prices lift off. This is against the backdrop of what still seems like rising inventories and lower global demand. The lower global demand can be explained by more efficient consumption technologies and slowing demand. I read something that resonated well with me a couple of weeks ago, it said, an investment in commodities is a bet against human innovation and progress. Yes and no I guess, the more of us pulling in the direction of optimum consumption then I guess this holds true.

For the oil industry in the US, it is never been easy, over a decade and a half of toughing it out (mid eighties to 2000) was suddenly met with a huge period of optimism, higher prices and greater energy independence. Which is better for global consumers, ironically the successes of the US onshore oil and gas industry has been a catalyst for lower prices. Pump up the volume to the levels that you start losing your hearing, if I could use that analogy. As technologies continue to improve we (the royal we, humankind) will continue to be more efficient users, companies will push profitability boundaries. The great thing for that specific industry is that once you use oil or gas, you cannot recycle it. There is however a mindset shift afoot, check this Quora piece out: Does the Tesla Model S really save money? and then make sure that you read the comments below from Kirsten Oulton, who describes herself as a Model S owner and evangelist. Of Tesla. Whilst we are on the subject of Tesla and electric cars, Mysterious 'Apple Electric Car, Inc.' files for patent.

The local market, what happened here on the local front yesterday? Resources ruled the roost, up nearly four percent on the day. Recovering metals prices coupled with rising hopes of a Chinese stimulus as manufacturing looks weak on that side. Here is an amazing graphic, why we have all benefitted from a Chinese economic miracle. It takes some time to wrap your head around, read it carefully: Two decades of inflation and deflation. Let us take a paragraph out of the Scott Granis piece in order to emphasise what he is trying to say with the post:

For the past 20 years, and for the first time in modern history, the cost of services (labor) has been rising while the cost of "things" (durable goods) has been declining. From 1959 through 1994, durable goods prices never declined for more than a month or two. This changed starting in 1995, which was the year the Chinese yuan began to strengthen, the Chinese economy began to be liberalized, and China began turning into a manufacturing and exporting powerhouse. The net result of rising services costs and the relentless decline of the price of "things" is that the average person's standard of living has risen enormously in the past two decades. Service sector costs are up by about two-thirds, but durable goods costs have declined by almost one-third. That means that an average hour's worth of work today can buy almost two and a half more "things" than it could just 20 years ago.

Amazing hey? It really is. We closed a fraction below 52 thousand points, having crested that level during the course of the day. Well done all and sundry, I suspect that if the firming Rand does not hold us back a little today, then we might well test the best levels ever for the index. In Rand terms that is.

Company corner snippets

Yech. ArcelorMittal released a trading statement that their results are likely to look less bad. A whole lot less bad when compared to a period in which they took a charge related to the closure of the Thabazimbi mine. Earnings for the full year to end December are expected to show that the company made a loss per share of 33 to 43 cents. At the moment it seems to be incredibly tough to get enthusiastic about this company, their CFO resigned in the middle of January, their CEO resigned in December 2013, local demand looks sloppy with rising costs, the export market looks average, the power situation looks average. The market however values the company at a much lower level than the replacement cost of the steel mills. Yip, it is hard to feel the faith here, if you fall into the camp of searching for value, this must look like a screamer. However, if you factor in all the headwinds, you could argue that Mr. Market has it right here.

Vodacom have released quarterly numbers this morning, they look pretty average. That is to be expected I guess. Local revenues getting squeezed, CEO Shameel Joosub had this to say in the commentary: There was a significant impact from the 50% decline in mobile termination rates in South Africa, increased competition and we're seeing increased pressure on consumer spending. Data spend continues to be the only bright spot in these numbers, data traffic grew a whopping 62 percent here and an astonishing (off a low base) almost threefold in their international operations. Active smartphones and tablets across the network here in South Africa is 9.5 million devices. Forget about broadband, the people have spoken, the continued investment in 3G and LTE networks will continue to see customers view the mobile networks as their goto for data.

And if the Neotel transaction goes ahead, the plan is to connect 1 million businesses and households with fibre. PLEASE!!! To illustrate the point about no fixed lines across our continent, look no further than Tanzania having 5.160 million data users out of the total of 11.810 million subscribers, when compared to South Africa, the ratio is about the same. The internet is empowering. Average Revenue per User (ARPU is measured per month) in the DRC, where Vodacom has nearly 11.5 million users is a paltry two dollars and seventy cents per month. Less than 10 cents per day airtime, average per consumer. Phew. In that lies a giant opportunity, the provisor is that the DRC "gets its stuff together". Major potential, a soft spot for the company currently. The stock is down over three percent to begin with.

You will recall the commentary on Standard Bank yesterday titled Standard Bank update (how original), how the Chinese investment in Dollar terms was still a long way behind from October 2007. Not good. There was a comment that an avid reader and friend of Vestact sent that is certainly worth sharing: While what you say about Chinese businessmen and apples may be true, it is appalling that Standard Bank can give a client $75m credit without checking with the other creditors of the business that the assets have not been ceded to them as well. Talk about Banking 101. One wonders what other assets of the bank will turn out to be irrecoverable. It is a a point worth making and has been a major reason for our reluctance to own financials.

This is not great news for Tiger Brands. Having said that, the stock crested 400 Rand for the first time ever yesterday. Today the company finds its shares trading down two and a half percent. Not good. What was in these results? Here goes, as per the Tiger Brands website, seeing as these are merely quarterly results from their Nigerian subsidiary, it is a matter of lots of tables and muted commentary: DFM Quarterly Results - December 2014. The company metrics all point in the right direction, however, they are still making an operating loss. Not helping matters are the domestic issues plaguing Nigeria, which appears in the brief commentary part: "pricing competition remains intense notwithstanding the impact of the recent currency devaluation and the ongoing volatility and constrained liquidity in the foreign exchange market, which has resulted in a significant increase in the cost of raw materials. The volatility is expected to remain for the balance of the year, due to the collapse of the oil price and the political uncertainty in the build up to the general election in February, and a further devaluation of the Naira will impact negatively on the outlook for the current financial year." It is certainly going to take a little longer than anticipated to turn this around, a hat tip (bitter one at that) to Aliko Dangote for having sold much of this business to Tiger.

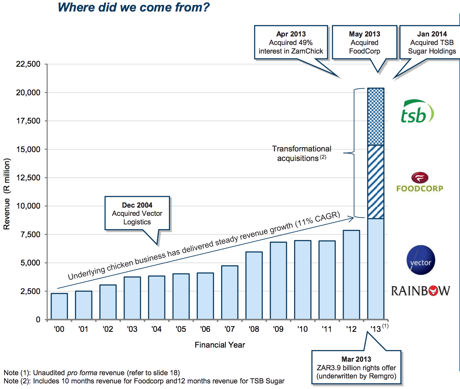

RCL foods share price spiked over six and a half percent yesterday after a trading update was favourably received by Mr. Market. The results themselves are expected to be in two weeks today, the impact of having acquired several businesses and diversified along the way. It does not really make sense when you are comparing to a period where there has been a rapid increase in the number of shares in issue. The shares in issue has increased as shareholders have been asked to come up with money in order to diversify into TSB (I can't say that the sugar business excites me) and Foodcorp, which is a far better business. In June of 2012, there were 294.9 million shares in issue, as at June last year, there was an astonishing 858 million shares, 564 million extra shares. Turnover in that time has nearly tripled, we should get a fair idea of what the newer more profitable business is likely to look like. Expectations are for 60 to 80 cents for the half, or 70 cents in the middle of the range = 610 million Rand of earnings for the half. Wow, now this makes the company vault up the ranking tables. Methinks that majority shareholder Remgro had lots to do with all of this. If you are confused, then all you have to do is look at this slide from the Road Show last year:

Life Healthcare released a trading statement as the market closed last evening. It does not look that good at face value, mostly as a result of being compared to the company having divested from Joint Medical Holdings Limited in the prior financial year. This is for the six months to end March this year, the company is expected to earn 75 to 110 cents per share. Obviously the wide range is given as a result of being quite far away from where we are now, another 50 days plus left in this half. I wonder why the company felt compelled to do a long dated trading update? Not sure.

Michaels Musings

Amazon released their 4Q and full year results on Thursday last week, Amazon.com Announces Fourth Quarter Sales up 15% to $29.33 Billion. The company's stock was up 14% after the announcement because they made a small profit. Their EPS for the quarter was 45c compared to the 95c loss in the previous quarter.

If you follow Amazon at all you will know that they are all sales and no profit; too much (if that is possible) investment in growth and very thin margins. Here are the numbers. Revenue for the 4th quarter was $29.33 billion, up 15% from the comparable quarter, full year revenue is at $88.99 billion up 20% from a year earlier. To put that into perspective, Google had revenue of $66 billion for the full year. So the revenue number is great but they still made a loss for the full year. The Net loss of the full year was $241 million compared to a profit of 274 million a year earlier.

Growth for the current quarter is expected to be between 6 and 16% but they are likely to make a loss due to stock based compensation and amortisation of a few assets. Basically same old storey more top line growth and no bottom line growth. If you believe that Amazon (Jeff Bezos) is building a company that will be the king of retail in the next decade then it is not a problem. If they don't get big enough, quick enough and allow other online retailers to get a solid foothold in the e-commerce market, then as an investor you have a problem. To ensure that they put daylight between them and competitors they spent $5 billion dollars on growing and investing on their systems and website. Doing a very basic calc, your P/E ratio sits in the mid 30s if you add back their invested billions.

The "moat" that Amazon are building around their business is through their Prime subscription. Being a Prime member gives you free shipping, access to their online media and the ability to use their cloud storage for free. Being a Prime member costs $99 a year which is not nothing but the benefits definitely outweigh the costs. Their prime membership grew by 53% over the last year to an unknown number. Analysts estimate the number of Prime members sit at around 40 million.

On average a Prime member spends around 2 and 3 times more on Amazon than an average user! So in other words you have 40 million very loyal customers and that number is growing at a rapid rate.

Other big innovations include being able to get delivery in under an hour in some parts of New York. With a delivery time like that brick and mortar shopping does not sound as appealing. Sales for North America were up 22% compared to International sales which were up only 3%. There is still huge potential for the international devotion of their business and as internet speeds improve and courier companies become more reliable, we will see sales grow there as well.

The goal for Amazon is to be the "everything shop" and that is where Bezos is driving them. I think that they will be the size of Walmart in the next decade which will be great for their investors. Between now and then it will be a very bumpy ride! (Assuming that day arrives)

Things that we are reading, you should too

Only one link today and it makes up for the lack of others - Warren Buffett adds to his lead in $1 million hedge-fund bet. The bet highlights how less is sometimes more!

Home again, home again, jiggety-jog. Markets are lower here after having been higher earlier in the day. Not my best guess at the beginning of this article. My hero Jim O'Neill is on the box as I finish this piece off. He is always optimistic, I guess that has served him well in the past and will continue to serve him well into the future.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment